When you’re in a financial pinch, understanding your options is crucial. Many people wonder, is Balance Credit a payday loan? This question matters because it helps you make informed decisions about borrowing money and managing your finances effectively.

What is Balance Credit?

Balance Credit is a type of short-term loan that can help you cover unexpected expenses. Unlike traditional payday loans, which often come with high fees and interest rates, Balance Credit offers a more flexible repayment plan. This can make it a better option for those in need.

Key Differences Between Balance Credit and Payday Loans

- Repayment Terms: Balance Credit typically allows for longer repayment periods compared to payday loans.

- Interest Rates: While both can have high rates, Balance Credit often provides clearer terms.

- Application Process: You can easily apply for Balance Credit through the ACE Cash Express online application, making it accessible for many borrowers.

In summary, while Balance Credit shares some similarities with payday loans, it offers more flexibility and transparency. This makes it a viable option for those seeking quick financial relief without the pitfalls of traditional payday loans.

Need cash fast? AdvanceCash offers quick payday loans to help you cover your expenses!

The Mechanics of Balance Credit Explained

When considering financial options, many people wonder, is balance credit a payday loan? Understanding this distinction is crucial for making informed decisions about borrowing money. Balance credit can seem similar to payday loans, but they have different mechanics and implications for your finances.

The Basics of Balance Credit

Balance credit is a type of short-term borrowing that allows you to access funds quickly. Unlike traditional payday loans, which often come with high fees and interest rates, balance credit may offer more flexible repayment options. This can make it a more manageable choice for some borrowers.

Key Differences

- Repayment Terms: Balance credit usually has longer repayment terms compared to payday loans.

- Interest Rates: Interest rates on balance credit can be lower, making it less costly in the long run.

- Application Process: You can easily start the process with an ace cash express online application, which is user-friendly and efficient. Understanding these differences can help you choose the right financial product for your needs.

Key Differences Between Balance Credit and Traditional Payday Loans

When considering financial options, many people wonder, “Is Balance Credit a payday loan?” Understanding the differences between Balance Credit and traditional payday loans is crucial for making informed decisions. Let’s dive into what sets them apart!

Loan Amounts

- Balance Credit: Offers flexible amounts based on your needs.

- Payday Loans: Typically provide smaller amounts, often just enough to cover immediate expenses.

Repayment Terms

- Balance Credit: Allows longer repayment periods, giving you more time to pay back.

- Payday Loans: Usually require repayment by your next payday, which can be stressful.

Application Process

- Balance Credit: The process is straightforward, often with options like the ACE Cash Express online application.

- Payday Loans: Generally involve a quick application but can come with hidden fees.

In summary, while both options can help in a pinch, Balance Credit offers more flexibility and better repayment terms. This makes it a more manageable choice for many people, especially when considering the question, “Is Balance Credit a payday loan?”

If you’re facing unexpected bills, AdvanceCash can provide you with the funds you need instantly!

Are There Risks Associated with Balance Credit?

When considering financial options, many people wonder, “Is Balance Credit considered a payday loan?” Understanding this distinction is crucial because it helps you make informed decisions about borrowing money. Balance Credit offers quick access to funds, but it’s essential to know the risks involved.

Potential High Costs

- Interest Rates: Balance Credit may have higher interest rates compared to traditional loans. This can lead to significant costs if not managed properly.

- Fees: Just like payday loans, there might be hidden fees that can add up quickly. Always read the fine print before signing anything.

Short Repayment Terms

- Quick Payback: Balance Credit often requires repayment within a short period. This can be challenging if you’re not prepared, leading to potential financial strain.

- Risk of Debt Cycle: If you can’t pay back on time, you might need to borrow again, creating a cycle of debt similar to payday loans.

In conclusion, while Balance Credit can provide quick cash, it’s essential to weigh these risks carefully. If you’re considering applying, you might also want to check out the ACE Cash Express online application for comparison.

Also Read: How Do I Apply for Ace Cash Express Online?

How Does Balance Credit Affect Your Credit Score?

When considering financial options, many people wonder, “Is Balance Credit considered a payday loan?” This question is important because it helps you understand how these loans work and their impact on your financial health. Knowing the difference can save you from potential pitfalls.

Understanding Balance Credit

Balance Credit is often confused with payday loans due to its quick approval process. However, it typically offers more flexible repayment terms. Unlike payday loans, which can trap borrowers in a cycle of debt, Balance Credit aims to provide a more manageable solution.

Key Points to Consider:

- Impact on Credit Score: Using Balance Credit responsibly can improve your credit score. Making timely payments shows lenders you are reliable.

- Application Process: If you’re curious about applying, check out the ACE Cash Express online application for a straightforward process.

In summary, while Balance Credit may share some characteristics with payday loans, it offers a different approach to borrowing. Understanding these differences can empower you to make better financial decisions.

What Are the Alternatives to Balance Credit?

Understanding whether Balance Credit is considered a payday loan is crucial for anyone seeking quick financial help. Many people find themselves in tight spots and need fast cash. However, knowing your options can save you from high-interest traps.

When exploring alternatives to Balance Credit, consider these options:

Personal Loans

- Credit Unions: They often offer lower interest rates than payday loans. You can apply for a personal loan with a simple online application.

- Banks: Traditional banks may provide personal loans with better terms. Check their requirements to see if you qualify.

Installment Loans

- ACE Cash Express: They offer an online application for installment loans, which can be more manageable than payday loans. You pay back in smaller amounts over time, making it easier on your budget.

Borrowing from Friends or Family

- Sometimes, asking a friend or family member for help can be a better option. They might lend you money without charging interest! By exploring these alternatives, you can avoid the pitfalls of high-interest payday loans and find a solution that works for you.

Customer Experiences: Is Balance Credit a Good Option?

When considering financial options, many people wonder, “Is Balance Credit a payday loan?” This question is crucial because understanding the type of loan you’re dealing with can help you make informed decisions about your finances. Balance Credit offers a different approach compared to traditional payday loans, which often come with high fees and short repayment terms.

Customer Experiences with Balance Credit

Many customers have shared their experiences with Balance Credit, and here’s what they say:

- Flexible Terms: Unlike typical payday loans, Balance Credit provides more flexible repayment options, making it easier for borrowers to manage their payments.

- Quick Access: The ace cash express online application allows users to apply quickly and receive funds in a timely manner, which is a significant advantage for those in need of immediate cash.

Is Balance Credit Right for You?

While Balance Credit may not be classified as a payday loan, it’s essential to consider your financial situation. If you need a short-term solution without the hefty fees associated with payday loans, Balance Credit could be a good option. Always read the terms carefully and ensure it fits your needs before proceeding.

How AdvanceCash Can Help You Navigate Balance Credit

Understanding whether Balance Credit is considered a payday loan is important for anyone seeking quick financial solutions. Many people find themselves in situations where they need cash fast, and knowing the differences can help you make informed decisions about your finances.

What is Balance Credit?

Balance Credit offers short-term loans that can be used for various expenses. However, it’s crucial to understand that these loans can sometimes resemble payday loans, which are known for their high fees and short repayment terms.

Key Differences

- Loan Amounts: Balance Credit may offer larger amounts than typical payday loans.

- Repayment Terms: Unlike payday loans, which are often due on your next payday, Balance Credit may provide more flexible repayment options.

If you’re considering applying for a loan, the ACE Cash Express online application is a straightforward way to get started. It’s user-friendly and can help you understand your options better.

Final Thoughts: Making Informed Decisions About Balance Credit

When considering financial options, many people wonder, “Is Balance Credit a payday loan?” Understanding this distinction is crucial because it helps you make informed choices about borrowing money. Balance Credit offers a different approach compared to traditional payday loans, which often come with high fees and short repayment terms.

What Sets Balance Credit Apart?

- Flexible Terms: Unlike payday loans, Balance Credit provides longer repayment periods, making it easier to manage payments.

- Lower Fees: Balance Credit typically has lower fees than payday loans, which can save you money in the long run.

- Application Process: You can easily apply for Balance Credit through the ACE Cash Express online application, simplifying the borrowing process.

In conclusion, while Balance Credit may seem similar to payday loans, it offers more flexibility and lower costs. Always remember to read the terms carefully and choose the option that best fits your financial situation. Making informed decisions can lead to better financial health!

FAQs

💳 Is Balance Credit considered a payday loan lender?

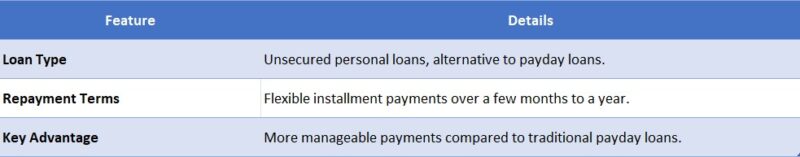

No, Balance Credit does not offer traditional payday loans. Instead, they provide personal installment loans, which have longer repayment terms and are typically paid off in fixed monthly payments.

🏦 How is a Balance Credit loan different from a payday loan?

Unlike payday loans, which are usually due in a lump sum on your next payday, Balance Credit loans are installment-based, meaning you can repay them over several months with consistent payments.

📄 What are the typical loan terms offered by Balance Credit?

Balance Credit offers loan amounts and terms that vary by state but generally range from a few hundred to several thousand dollars, with repayment periods from 6 to 36 months.

⚖️ Does Balance Credit charge high interest rates like payday lenders?

While Balance Credit may charge higher interest rates than traditional banks, their rates are typically lower than those of payday loans, and their installment structure makes repayment more manageable.

🛡️ Is Balance Credit a safe and regulated lender?

Yes, Balance Credit is a licensed and regulated lender in the states where it operates. However, it’s still important to review all loan terms and conditions before borrowing.

Don’t let financial stress hold you back. AdvanceCash is here to help you secure your payday loan today!

🔗At ExpressCash, we’re here to help guide you through the process and find the right financial solution for your specific situation.