Understanding the Basics of Repayment Terms for Payday Loans

When considering a payday loan, understanding the repayment terms for payday loans is crucial. These terms dictate how and when you need to pay back the money you borrowed. Knowing this can help you avoid surprises and manage your finances better. Let’s dive into the basics!

- Short Duration: Typically, payday loans are due on your next payday, which can be just a few weeks away.

- Fixed Amount: You’ll usually repay the exact amount borrowed plus a fee, making it straightforward to understand your total obligation.

- Automatic Withdrawal: Many lenders will automatically withdraw the repayment from your bank account, so it’s essential to ensure you have enough funds available.

Why It Matters

Understanding the repayment terms for payday loans can help you make informed decisions. If you miss a payment, it could lead to additional fees or even a cycle of debt. Therefore, being aware of the payday loan application process and its terms can empower you to borrow responsibly.

Need cash fast? AdvanceCash offers quick payday loans to help you cover your expenses!

What Factors Influence Repayment Terms for Payday Loans?

Understanding the repayment terms for payday loans is crucial for anyone considering this option. These terms can significantly impact your financial situation, especially if you’re in a tight spot. Knowing what to expect helps you plan better and avoid surprises when it’s time to pay back the loan.

Several factors can affect the repayment terms for payday loans. Here are some key points to consider:

- Loan Amount: The size of the loan often dictates how long you have to repay it. Larger loans may come with longer repayment periods.

- Lender Policies: Different lenders have varying policies. Some may offer flexible terms, while others stick to strict deadlines.

- State Regulations: Laws governing payday loans differ by state, influencing repayment terms. Always check your local regulations before applying.

- Your Financial Situation: Lenders may consider your income and credit history during the payday loan application process, which can affect the terms offered.

How Long Do You Have to Repay a Payday Loan?

When considering a payday loan, understanding the repayment terms is crucial. These terms dictate how long you have to pay back the money you borrowed, which can significantly impact your finances. Knowing what to expect can help you avoid falling into a cycle of debt.

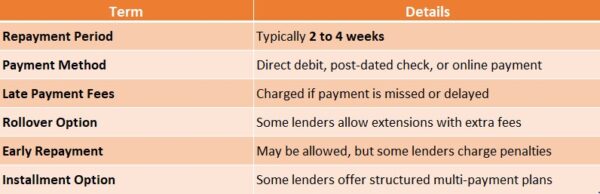

Typically, repayment terms for payday loans range from two weeks to a month. This short timeframe aligns with your next payday, hence the name. However, it’s essential to check the specific terms outlined in your payday loan application process, as they can vary by lender.

Key Points to Remember:

- Repayment Duration: Usually between 14 to 30 days.

- Payment Methods: Most lenders will automatically deduct the repayment from your bank account on the due date.

- Extensions: Some lenders may offer extensions, but this often comes with additional fees.

Are There Different Types of Repayment Plans for Payday Loans?

Understanding repayment terms for payday loans is essential for anyone considering this type of borrowing. These loans can provide quick financial relief, but knowing how and when to repay them is key to avoiding debt traps.

Typically, payday loans are due on your next payday, but some lenders offer flexible repayment options. Here are a few common plans:

- Single Payment Plan: Repay the full loan amount plus fees on your next payday. This is the simplest option.

- Installment Plan: Some lenders allow repayment in smaller installments over several pay periods, making it easier on your budget.

- Rollovers: If you can’t repay on time, some lenders may permit an extension for a fee, but this can lead to accumulating debt.

Understanding these repayment terms can help you navigate the payday loan application process more effectively. Always read the fine print and ask questions to find the best option for your needs.

If you’re facing unexpected bills, AdvanceCash can provide you with the funds you need instantly!

What Happens If You Miss a Payment on a Payday Loan?

When you take out a payday loan, understanding the repayment terms is crucial. Missing a payment can lead to serious consequences, so it’s essential to know what to expect. Let’s explore what happens if you miss a payment on a payday loan.

Late Fees and Penalties

Missing a payment often results in late fees, which can accumulate quickly and increase your total debt. Therefore, it’s vital to read the repayment terms for payday loans to understand these potential costs.

Impact on Credit Score

A missed payment can negatively affect your credit score. Lenders may report this to credit bureaus, making it more challenging to secure loans in the future. Staying informed during the payday loan application process is key.

Options to Consider

If you think you might miss a payment, reach out to your lender. They may provide options like extending your loan or creating a payment plan. Being proactive can help you avoid penalties and maintain your financial health.

Also Read: What Is the Payday Loan Application Process?

Can You Extend the Repayment Terms for Payday Loans?

When considering a payday loan, understanding the repayment terms is crucial. These terms dictate how long you have to pay back the loan and the total amount you’ll owe. Knowing this can help you avoid falling into a cycle of debt, which is a common concern for many borrowers.

Yes, But It Depends!

In some cases, you can extend the repayment terms for payday loans. This often involves contacting your lender before the due date. They may offer options like a payment plan or a rollover, but be cautious! These options can lead to higher fees and interest.

Key Points to Remember:

- Contact Your Lender Early: Reach out before your payment is due.

- Understand the Fees: Extensions may come with extra costs.

- Consider Alternatives: If you can, explore other options like personal loans or credit unions.

By knowing the repayment terms for payday loans and your options for extensions, you can make informed decisions during the payday loan application process.

The Impact of Interest Rates on Repayment Terms for Payday Loans

Understanding the repayment terms for payday loans is crucial for anyone considering this type of borrowing. These loans can be a quick fix for financial emergencies, but the terms can be tricky. Knowing how interest rates affect repayment can help you make informed decisions and avoid pitfalls.

When you apply for a payday loan, the interest rate plays a significant role in determining how much you will owe. Higher interest rates mean larger repayments, which can lead to a cycle of debt if not managed carefully. Here’s what to keep in mind:

Key Insights on Interest Rates and Repayment Terms

- Short Loan Duration: Payday loans typically have a short repayment period, often due on your next payday.

- High Interest Rates: Interest rates can be steep, sometimes exceeding 400% APR.

- Total Cost: Always calculate the total amount you’ll repay, including interest, to avoid surprises.

Understanding these factors can help you navigate the payday loan application process with confidence and make choices that suit your financial situation.

How to Choose the Right Repayment Plan for Your Payday Loan

When considering a payday loan, understanding the repayment terms is crucial. These terms dictate how and when you need to pay back the money you borrow. Knowing this helps you avoid unexpected fees and ensures you can manage your finances effectively. Let’s dive into how to choose the right repayment plan for your payday loan.

Understand the Basics

Repayment terms for payday loans typically range from a few weeks to a month. It’s essential to know the due date and the total amount you’ll owe. This way, you can plan your budget accordingly and avoid falling behind.

Key Considerations

- Interest Rates: Check how much interest you’ll pay. Higher rates can make repayment tougher.

- Payment Options: Some lenders offer flexible payment plans. Ask about these during the payday loan application process.

- Penalties: Be aware of any late fees or penalties if you miss a payment. This knowledge can save you from added stress later on.

What Resources Are Available to Help You Manage Payday Loan Repayment?

Understanding the repayment terms for payday loans is crucial for anyone considering this type of borrowing. These loans can be a quick fix for financial emergencies, but knowing how to manage repayment can save you from falling into a cycle of debt. Let’s explore some resources that can help you navigate this process effectively.

Financial Counseling Services

Many organizations offer free or low-cost financial counseling. These services can help you understand your repayment terms for payday loans and create a budget to manage your finances better. They can also assist with the payday loan application process if you decide to pursue a loan.

Online Tools and Calculators

There are various online tools available that can help you calculate your total repayment amount. These calculators can show you how much interest you’ll pay and help you plan your payments. Using these tools can make the repayment process clearer and less stressful.

How AdvanceCash Can Assist You with Your Payday Loan Repayment Needs

Understanding the repayment terms for payday loans is essential for anyone considering this borrowing option. These terms outline how and when you need to repay the borrowed money, helping you avoid unnecessary fees and stress. At AdvanceCash, we strive to simplify this process for you.

When applying for a payday loan, knowing the repayment terms is crucial. Typically, these loans are due on your next payday, often within two weeks. However, some lenders may offer flexible repayment options. Here’s how we can assist you:

- Clear Information: We provide detailed insights into repayment terms, ensuring you know what to expect.

- Guidance: Our team can help you navigate the payday loan application process, assisting you in selecting a loan that aligns with your repayment capabilities.

By understanding these terms, you can make informed decisions and avoid falling into a cycle of debt. At AdvanceCash, we’re dedicated to supporting you throughout your payday loan journey, ensuring a smooth and manageable experience.

FAQs

⭐ How long do I have to repay a payday loan?

Payday loans are usually due on your next payday, typically within two to four weeks. Some lenders offer extended repayment terms.

⭐ Can I make installment payments on a payday loan?

Some states and lenders allow installment repayment plans, but traditional payday loans are usually due in a single lump sum.

⭐ What happens if I can’t repay my payday loan on time?

If you miss the due date, you may face late fees, additional interest, and potential collection actions. Some states require lenders to offer extended payment plans.

⭐ Can I repay my payday loan early?

Yes, many lenders allow early repayment without penalties, but check your loan agreement for specific terms.

⭐ Do payday loan repayment terms vary by state?

Yes, state laws regulate loan terms, extensions, and fees, so repayment options depend on where you borrow.

Don’t let financial stress hold you back. AdvanceCash is here to help you secure your payday loan today!

🔗At ExpressCash, we’re here to help guide you through the process and find the right financial solution for your specific situation.