Understanding short-term business loans for entrepreneurs can significantly impact their operations. These loans offer quick access to capital, making them ideal for those needing to seize immediate opportunities or address unexpected expenses. Unlike traditional loans that may take weeks to process, short-term loans feature a streamlined application process, allowing entrepreneurs to secure funds within days, which is crucial for maintaining competitiveness. Benefits of short-term business loans include:

- Quick Access to Funds: Perfect for urgent needs like inventory purchases or emergency repairs.

- Flexible Use: Funds can be allocated for various purposes, including marketing campaigns or hiring staff.

- Easier Qualification: These loans typically have less stringent requirements than long-term loans, making them accessible for newer businesses.

However, entrepreneurs should be mindful of the associated costs, as interest rates can be higher than traditional financing. For those seeking alternatives, payday loan alternatives may offer a more manageable solution without excessive fees. Overall, when used wisely, short-term business loans can be a valuable financial tool for entrepreneurs.

Need cash fast? AdvanceCash offers quick payday loans to help you cover your expenses!

Benefits of Short-Term Business Loans for Startups

Launching a startup often presents the challenge of securing adequate funding. Short-term business loans for entrepreneurs can be an effective solution, providing quick access to cash when needed. With repayment periods ranging from a few months to a year, these loans are ideal for those requiring immediate capital to seize opportunities or manage unexpected expenses. Here are some key benefits of short-term business loans for startups:

- Quick Access to Funds: Approval can often occur within days, unlike traditional loans that may take weeks or months, allowing entrepreneurs to act swiftly.

- Flexible Use of Funds: These loans can be used for various purposes, such as purchasing inventory, covering payroll, or investing in marketing.

- Building Credit: Repaying a short-term loan can enhance your business credit score, facilitating access to larger loans in the future.

- Less Stringent Requirements: Many lenders have fewer requirements than traditional financing, making these loans accessible for new businesses without extensive credit histories.

For instance, a small coffee shop needing equipment quickly can use a short-term loan to capitalize on rising demand, demonstrating how these loans can be a lifeline for startups in a competitive landscape.

How Short-Term Business Loans Can Boost Cash Flow

Cash flow is essential for managing a business, and for entrepreneurs, short-term business loans can be transformative. These loans offer quick access to funds, helping to bridge the gap between expenses and income. Typically designed for repayment within a year, they provide immediate financial support without the long-term commitment of traditional loans. One major advantage of short-term business loans is their speed. Many lenders can approve applications and disburse funds within days, which is crucial for entrepreneurs facing unexpected expenses. For example, a local bakery needing new equipment to meet a sudden demand can secure a short-term loan quickly, ensuring they do not miss out on business opportunities. Key benefits of short-term business loans include:

- Quick Access to Funds: Perfect for urgent needs.

- Flexible Repayment Terms: Easier to manage than long-term loans.

- Boosts Cash Flow: Helps maintain operations during tough times.

- Builds Credit: Responsible repayment can enhance your credit score.

In conclusion, short-term business loans are a valuable resource for entrepreneurs, providing a structured alternative to payday loans and enhancing cash flow.

Key Considerations Before Applying for Short-Term Loans

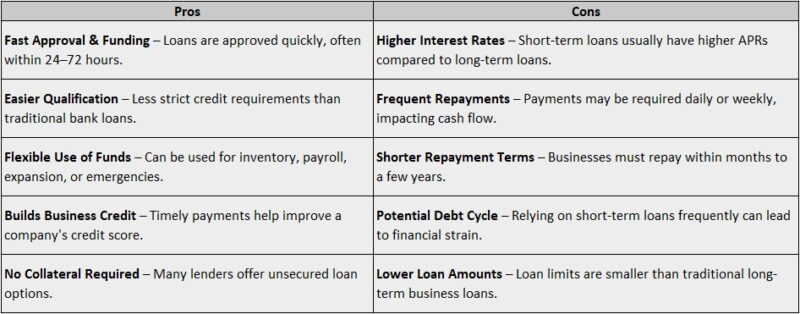

When considering short-term business loans, entrepreneurs must evaluate several key factors. These loans offer quick access to capital, which is vital for seizing immediate opportunities or addressing urgent cash flow needs. However, they typically come with higher interest rates than traditional loans, making it essential to assess whether the benefits justify the costs. Here are some important considerations before applying for short-term loans:

- Purpose of the Loan: Clearly define the intended use of the funds, whether for inventory, equipment, or marketing. This clarity helps determine if a short-term loan is suitable.

- Repayment Terms: Understand the repayment schedule, as these loans usually require repayment within a year. Ensure your business can manage the cash flow demands.

- Alternatives Available: Look into payday loan alternatives that may offer better terms or lower interest rates. Options like a line of credit or a business credit card might be more advantageous.

- Impact on Credit Score: Recognize that taking on debt can influence your credit score. Ensure you can manage repayments to avoid negative consequences.

In summary, while short-term business loans can be beneficial, a clear strategy and understanding of your financial situation are crucial.

If you’re facing unexpected bills, AdvanceCash can provide you with the funds you need instantly!

Comparing Short-Term Business Loans to Traditional Financing

Entrepreneurs often weigh the pros and cons of short-term business loans versus traditional financing. Short-term business loans can be a quick and flexible solution, especially during tight cash flow periods or unexpected expenses. Unlike traditional loans, which may take weeks or months to secure, short-term loans typically offer faster approval times, allowing business owners to access funds when needed. Here are some key benefits of short-term business loans:

- Speed: Approval and funding can occur in as little as 24 hours, ideal for urgent needs.

- Flexibility: These loans can be used for various purposes, from inventory purchases to marketing campaigns.

- Less Documentation: Short-term loans often require less paperwork, simplifying the application process.

However, potential downsides exist. Short-term loans usually come with higher interest rates, which can accumulate quickly if not managed properly. Entrepreneurs should assess their ability to repay the loan within the short timeframe, as missed payments can lead to financial strain. In contrast, traditional financing may offer lower rates and longer repayment terms, making it a more sustainable option for some businesses. Ultimately, the choice depends on the entrepreneur’s specific needs and circumstances.

Also Read: What Are the Best Payday Loan Alternatives?

Common Misconceptions About Short-Term Business Loans

Many entrepreneurs are often misled by misconceptions surrounding short-term business loans. A prevalent belief is that these loans are only for businesses facing financial crises. In truth, short-term business loans for entrepreneurs can serve as a strategic growth tool, offering quick access to capital for opportunities like expanding inventory or launching marketing campaigns, ultimately boosting revenue. Another common myth is that short-term loans come with exorbitant interest rates. While they may have higher rates than traditional loans, the speed and flexibility they provide can justify the costs.

For example, a small business owner might take a short-term loan to capitalize on a limited-time supplier discount, potentially saving more than the interest incurred. This strategic borrowing can be transformative. Lastly, some entrepreneurs equate short-term loans with payday loan alternatives, which often have predatory terms. However, reputable lenders offer transparent terms and flexible repayment options. Consider these benefits of short-term business loans:

- Quick access to funds when needed

- Flexible repayment terms that align with cash flow

- Ability to seize immediate business opportunities

By dispelling these misconceptions, entrepreneurs can better assess if short-term business loans are suitable for their needs.

The Application Process for Short-Term Business Loans Explained

Understanding the application process for short-term business loans is essential for entrepreneurs. While it may seem overwhelming, breaking it down into steps simplifies the journey. Start by gathering key documents like your business plan, financial statements, and tax returns, as lenders need a clear view of your financial health before approving a loan. Next, research potential lenders since terms can vary significantly. Focus on those that specialize in short-term business loans for entrepreneurs, as they often provide tailored options. Once you identify a suitable lender, complete the application, which typically requires personal and business information along with the loan amount you seek.

After submitting your application, the lender will review your details and may request additional documentation. Being organized at this stage is beneficial. If approved, you can expect quick access to funds, often within days. This rapid turnaround is a major advantage of short-term loans compared to payday loan alternatives, which usually come with higher interest rates and less favorable terms. Understanding this process empowers you to make informed business decisions.

Real-Life Success Stories of Entrepreneurs Using Short-Term Loans

Financing a business can be challenging for many entrepreneurs, but short-term business loans offer a practical solution for those looking to seize immediate opportunities. For example, a bakery owner in Chicago faced a surge in demand during the holiday season. By securing a short-term loan, she purchased additional inventory and hired temporary staff, resulting in a 30 percent sales increase compared to the previous year. Similarly, a tech startup needed quick funding for a product launch. They used a short-term loan to cover marketing and production costs, leading to a successful launch that attracted long-term investors. These success stories demonstrate how short-term loans can provide the necessary boost to capitalize on fleeting opportunities.

Key benefits of short-term business loans include:

- Quick access to funds, often within days

- Flexible repayment terms

- Ability to address immediate cash flow needs

- Opportunity to invest in growth without long-term commitment

For entrepreneurs considering their options, short-term loans can be a strategic choice, especially compared to payday loan alternatives that often come with higher interest rates.

Potential Risks of Short-Term Business Loans for Entrepreneurs

When considering short-term business loans for entrepreneurs, it’s crucial to evaluate both the risks and benefits. These loans offer quick cash access but often come with higher interest rates and shorter repayment periods, which can lead to a debt cycle if not managed wisely. For example, an entrepreneur might secure a short-term loan for unexpected expenses, but if revenue doesn’t rise as expected, they may struggle to repay it. Key risks include:

- High Interest Rates: Short-term loans usually have higher rates than traditional loans, increasing the total repayment amount.

- Short Repayment Terms: With terms often lasting a few months to a year, entrepreneurs may feel pressured to generate revenue quickly, potentially leading to rushed decisions.

- Potential for Debt Cycle: Frequent reliance on short-term loans can trap business owners in a borrowing cycle, akin to the issues seen with payday loan alternatives.

To reduce these risks, entrepreneurs should evaluate their cash flow and ensure they can realistically repay the loan on time. Consulting financial advisors or exploring alternative funding options can also help.

Tips for Choosing the Right Short-Term Business Loan

When considering short-term business loans, entrepreneurs often face important decisions. These loans can provide quick access to capital, essential for seizing opportunities or managing cash flow. However, choosing wisely is crucial to ensure the loan aligns with your business goals. Here are some tips to help you navigate your options. First, evaluate your business needs. Are you seeking funds for unexpected expenses or to invest in growth? Understanding your purpose will guide you in selecting the right loan.

Next, compare interest rates and terms from various lenders. Some may offer lower rates but have hidden fees, while others might provide flexible repayment options. Look for lenders that specialize in short-term business loans for entrepreneurs, as they understand the unique challenges you face. Finally, consider alternatives to payday loans. While they may seem appealing due to quick approval, they often come with high interest rates. Instead, explore options like peer-to-peer lending or credit unions, which can offer more favorable terms. By researching and comparing your options, you can find a short-term loan that meets your immediate needs and supports long-term success.

FAQs

-

What are short-term business loans?

Short-term business loans provide quick funding for entrepreneurs to cover immediate expenses, cash flow gaps, or business growth needs, typically with repayment terms of a few months to a few years. -

Who qualifies for a short-term business loan?

Eligibility depends on credit score, business revenue, time in operation, and ability to repay. Some lenders may offer options for startups or businesses with lower credit scores. -

What are the benefits of short-term business loans?

They offer fast approval, flexible use of funds, and quick access to cash, making them ideal for covering emergency expenses or short-term investment opportunities. -

What are the risks of short-term business loans?

These loans often come with higher interest rates and frequent repayment schedules, which can strain business finances if not managed properly. -

Where can entrepreneurs find short-term business loans?

Entrepreneurs can apply through banks, online lenders, credit unions, and alternative lenders, depending on their business needs and financial situation.

Don’t let financial stress hold you back. AdvanceCash is here to help you secure your payday loan today!

🔗At ExpressCash, we’re here to help guide you through the process and find the right financial solution for your specific situation.