Understanding how to get approved for savings account payday loans is crucial for anyone in need of quick cash. These loans can be a lifeline during emergencies, but knowing the requirements can make the process smoother and less stressful. Let’s dive into what you need to know!

What Are Savings Account Payday Loans?

Savings account payday loans are short-term loans that allow you to borrow against your savings. They are designed for quick access to funds, often with fewer requirements than traditional loans. However, understanding the Loan Approval & Credit Requirements is key to getting approved.

Key Requirements for Approval

To improve your chances of getting approved, consider these factors:

- Savings Account: You usually need an active savings account with a certain balance.

- Income Verification: Lenders may ask for proof of income to ensure you can repay the loan.

- Credit Score: While some lenders are flexible, a decent credit score can help.

- Age and Residency: You must be at least 18 years old and a resident of the state where you apply.

By keeping these requirements in mind, you can navigate the application process more effectively and increase your chances of approval.

Need cash fast? AdvanceCash offers quick payday loans to help you cover your expenses!

Are You Eligible? Key Criteria for Approval

When you find yourself in a tight spot financially, knowing how to get approved for savings account payday loans can be a game-changer. These loans can provide quick cash to cover unexpected expenses, but understanding the eligibility criteria is crucial. Let’s dive into what you need to know!

Basic Requirements

To qualify for savings account payday loans, lenders typically look for a few key factors. Here’s what you should have:

- Age: You must be at least 18 years old.

- Income: A steady source of income is essential.

- Bank Account: Having a savings account is usually required.

Loan Approval & Credit Requirements

While payday loans are often easier to get than traditional loans, lenders still check your credit history. Here’s what they consider:

- Credit Score: A higher score increases your chances of approval.

- Debt-to-Income Ratio: Lenders want to see that you can manage your debts.

Understanding these criteria can help you prepare better and improve your chances of getting that much-needed loan. Remember, each lender may have different requirements, so it’s wise to shop around!

How to Improve Your Chances of Getting Approved

Getting approved for savings account payday loans can be challenging, especially if you’re unclear about what lenders seek. Understanding loan approval and credit requirements is essential, as it boosts your confidence and enhances your chances of securing funds.

Know Your Credit Score

Your credit score significantly impacts loan approval. Lenders check this score to evaluate your creditworthiness. If your score is low, work on improving it by paying off debts and making timely payments.

Maintain a Steady Income

A stable income is crucial for loan approval. Lenders want assurance that you can repay the loan. Highlight your job or consistent income source in your application to demonstrate responsibility.

Prepare Your Documentation

Gather necessary documents like proof of income, identification, and bank statements before applying. Being organized can expedite the approval process, as lenders appreciate prepared applicants.

Understand Loan Terms

Familiarize yourself with the terms of savings account payday loans, including interest rates and repayment periods. This knowledge helps you make informed decisions and shows lenders you are serious about borrowing responsibly.

Build a Relationship with Your Bank

If you have a savings account, discuss your loan needs with your bank. Existing relationships can improve approval chances, as banks prefer lending to familiar customers.

Avoid Multiple Applications

Submitting multiple applications can negatively impact your credit score. Instead, focus on one or two lenders to present your best case and protect your score.

If you’re facing unexpected bills, AdvanceCash can provide you with the funds you need instantly!

The Application Process: Step-by-Step Guide

Getting approved for savings account payday loans can be a game-changer when you need quick cash. Understanding the application process is crucial, as it helps you navigate the requirements and increases your chances of loan approval. Let’s break it down step-by-step!

Step 1: Gather Your Documents

Before you apply, make sure you have all necessary documents ready. This typically includes:

- A valid ID (like a driver’s license)

- Proof of income (pay stubs or bank statements)

- Your savings account details

Having these on hand will speed up the process!

Step 2: Check Loan Approval & Credit Requirements

Different lenders have various criteria for savings account payday loans. Generally, they look at:

- Your credit score

- Your income stability

- Your savings account balance

Understanding these factors can help you prepare better and improve your chances of getting approved!

Step 3: Fill Out the Application

Once you have your documents, it’s time to fill out the application. Be honest and accurate with your information. Many lenders allow you to apply online, making it convenient and quick!

Step 4: Review and Submit

Before hitting that submit button, double-check your application. Ensure everything is correct to avoid delays. After submission, you may receive a decision within minutes or a few hours. Keep an eye on your email or phone for updates!

Also Read: Loan Approval & Credit Requirements for Payday Loans

Common Mistakes to Avoid When Applying for Loans

When it comes to getting approved for savings account payday loans, understanding the process is crucial. Many people make simple mistakes that can delay or even prevent their loan approval. Knowing what to avoid can save you time and stress, making your financial journey smoother.

- Ignoring Loan Approval & Credit Requirements

Many applicants overlook the importance of their credit score. Lenders often check your credit history to determine your eligibility. A low score can lead to rejection, so it’s wise to check your credit report beforehand. - Not Comparing Lenders

Another common mistake is applying with the first lender you find. Different lenders have varying terms and interest rates. Take the time to compare options to find the best deal for your savings account payday loans. - Providing Inaccurate Information

Always ensure that the information you provide is accurate and up-to-date. Mistakes in your application can raise red flags for lenders, leading to delays or denials. Double-check your details before submitting your application. - Neglecting to Read the Fine Print

Lastly, many applicants skip reading the terms and conditions. Understanding the loan’s terms can help you avoid hidden fees and unfavorable conditions. Always read the fine print to ensure you know what you’re signing up for.

By avoiding these common pitfalls, you can improve your chances of getting approved for savings account payday loans. Remember, preparation is key!

How AdvanceCash Can Help You Secure Your Loan

Getting approved for savings account payday loans can feel like a daunting task, especially if you’re unsure about the requirements. Understanding how to navigate the loan approval process is crucial. It can help you secure the funds you need without unnecessary stress. That’s where AdvanceCash comes in to guide you through the steps!

Understanding Loan Approval & Credit Requirements

To get started, it’s essential to know what lenders look for. Generally, they check your credit score and income stability. Here are some key points to consider:

- Credit Score: A higher score increases your chances of approval.

- Income Verification: Steady income reassures lenders of your repayment ability.

- Savings Account: Having a savings account can demonstrate financial responsibility.

How AdvanceCash Can Assist You

At AdvanceCash, we simplify the process of applying for savings account payday loans. We provide resources and tips to help you meet the loan approval and credit requirements. Our user-friendly platform allows you to:

- Compare Lenders: Find the best rates and terms.

- Access Educational Resources: Learn about improving your credit score.

- Get Personalized Support: Our team is here to answer your questions and guide you through the application process.

Frequently Asked Questions About Savings Account Payday Loans

🏦 Can I get a payday loan with a savings account?

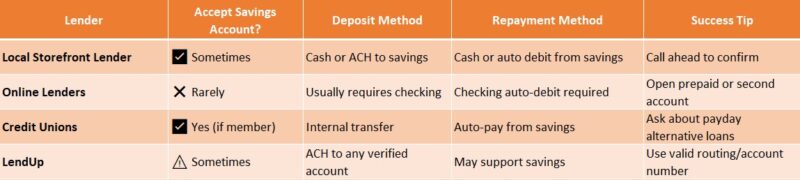

Yes, some lenders allow payday loan deposits and repayments through a savings account, though it’s less common than using a checking account.

💳 Why do most payday lenders prefer checking accounts over savings?

Checking accounts allow for easier withdrawals and ACH transactions, making it more convenient for lenders to receive repayments automatically.

📄 What do I need to apply for a payday loan using a savings account?

You’ll need a valid ID, proof of income, and your savings account number and routing number. Some lenders may also request recent bank statements.

🔍 Are there lenders that specialize in savings account payday loans?

Yes, a few online lenders and local payday stores cater to borrowers with only savings accounts, but you may need to contact them directly to confirm eligibility.

⚠️ Are savings account payday loans more risky or limited?

They can be slightly more limited due to fewer lender options and possible delays in repayment processing. It’s important to confirm that your bank allows payday loan ACH withdrawals from a savings account.

Don’t let financial stress hold you back. AdvanceCash is here to help you secure your payday loan today!

🔗At ExpressCash, we’re here to help guide you through the process and find the right financial solution for your specific situation.