Understanding payday loans is essential, especially if you find yourself in a financial pinch. Many people wonder, “Are payday loans no checking account required?” This question matters because it opens up options for those who may not have traditional banking services. Let’s explore this topic further!

What Are Payday Loans?

Payday loans are short-term loans designed to help you cover unexpected expenses until your next paycheck. They are usually easy to apply for and can provide quick cash. However, you might be wondering about the requirements, especially regarding bank accounts.

Loan Approval & Credit Requirements

- No Checking Account Needed: Some lenders offer payday loans no checking account required. This means you can still get a loan even if you don’t have a bank account.

- Credit Requirements: Most payday lenders do not require a high credit score. They focus more on your income and ability to repay the loan rather than your credit history.

- Quick Approval: The application process is often fast, allowing you to receive funds quickly, which is great for emergencies.

Understanding these aspects can help you make informed decisions when considering payday loans.

Need cash fast? AdvanceCash offers quick payday loans to help you cover your expenses!

Are Payday Loans Available With No Checking Account Required?

When unexpected expenses arise, many people wonder, “Are payday loans available with no checking account required?” This question is important because not everyone has a traditional bank account. Understanding your options can help you make informed financial decisions during tough times.

Yes, some lenders offer payday loans no checking account required. This means you can still access funds even if you don’t have a checking account. However, it’s crucial to research lenders carefully to ensure they are reputable and transparent about their terms.

Key Considerations:

- Loan Approval & Credit Requirements: Many payday lenders focus more on your income than your credit score. This can be beneficial if you have a low credit score.

- Alternative Options: If you don’t have a checking account, consider options like prepaid debit cards or cash advances from credit cards.

These can sometimes be easier to obtain. In conclusion, while payday loans without a checking account are available, always read the fine print and understand the repayment terms. This way, you can avoid falling into a cycle of debt.

The Pros and Cons of No-Checking-Account Payday Loans

When unexpected expenses arise, many people wonder, “Are payday loans available with no checking account required?” This question is crucial because having a checking account can be a barrier for some individuals seeking quick financial help. Understanding the pros and cons of these loans can help you make an informed decision.

Pros

- Accessibility: These loans are available to those without a checking account, making them more inclusive.

- Quick Approval: Loan approval & credit requirements are often less stringent, allowing for faster access to cash.

Cons

- Higher Fees: Without a checking account, you might face higher fees or interest rates.

- Limited Options: Fewer lenders offer these loans, which can limit your choices and flexibility.

In conclusion, while payday loans no checking account required can provide immediate relief, they come with their own set of challenges. Weighing the pros and cons is essential to ensure you choose the best financial path for your situation. Always consider your ability to repay the loan to avoid falling into a cycle of debt.

If you’re facing unexpected bills, AdvanceCash can provide you with the funds you need instantly!

How to Qualify for Payday Loans Without a Checking Account

When unexpected expenses arise, many people wonder, “Are payday loans available with no checking account required?” This question is crucial because not everyone has a traditional bank account. Understanding how to qualify for payday loans without a checking account can open doors for those in need of quick cash.

Alternative Documentation

Many lenders offer payday loans no checking account required. Instead of a bank account, you might need to provide alternative documentation. This can include:

- Proof of income (like pay stubs)

- A valid ID

- A working phone number

Loan Approval & Credit Requirements

While payday loans often have lenient credit requirements, approval can still depend on your income and ability to repay. Lenders want to ensure you can pay back the loan on time, so having a steady job is beneficial. Remember, even without a checking account, your financial stability matters! In summary, qualifying for payday loans without a checking account is possible. By providing alternative documentation and demonstrating your ability to repay, you can access the funds you need. Just be sure to read the terms carefully and choose a reputable lender to avoid any surprises.

Also Read: Loan Approval & Credit Requirements for Payday Loans

Alternative Options for Quick Cash Without a Checking Account

When life throws unexpected expenses your way, finding quick cash can be a challenge, especially if you don’t have a checking account. Many people wonder, “Are payday loans available with no checking account required?” This question is crucial because it opens up options for those who might feel stuck financially.

Exploring Your Choices

If you’re in a pinch, there are alternatives to payday loans no checking account required. Here are some options to consider:

- Prepaid Debit Cards: Some lenders allow you to receive funds on a prepaid debit card, making it easier to access cash without a traditional bank account.

- Title Loans: If you own a vehicle, title loans can provide quick cash using your car as collateral. Just remember, this comes with risks!

Loan Approval & Credit Requirements

When seeking quick cash, understanding loan approval & credit requirements is essential. Many lenders focus more on your income than your credit score, making it easier for those without a checking account to qualify. Always read the fine print and ensure you can repay the loan to avoid further financial stress.

What to Expect When Applying for Payday Loans No Checking Account Required

When life throws unexpected expenses your way, payday loans can be a quick solution. But what if you don’t have a checking account? Many people wonder, “Are payday loans available with no checking account required?” Understanding this can help you navigate your financial options more easily.

Applying for payday loans no checking account required can be straightforward. Here’s what you need to know:

Loan Approval & Credit Requirements

- Minimal Documentation: Most lenders don’t require extensive paperwork, making it easier for you to apply.

- Alternative Accounts: You can use savings accounts or prepaid debit cards instead of a checking account.

- Credit Score: While some lenders may check your credit, many focus more on your income and ability to repay the loan.

Benefits of No Checking Account Loans

- Quick Access to Cash: You can get funds quickly without needing a checking account.

- Flexible Options: Different lenders offer various terms, so you can find one that suits your needs.

The Role of Online Lenders in Providing No-Checking-Account Loans

When unexpected expenses arise, many people wonder, “Are payday loans available with no checking account required?” This question is crucial for those who may not have a traditional bank account but still need quick cash. Thankfully, online lenders have stepped in to provide solutions for these individuals.

Online lenders have become a popular option for those seeking payday loans no checking account required. They offer a convenient way to apply for loans without the need for a bank account. This flexibility is especially helpful for people who may not have access to traditional banking services.

Benefits of Online Lenders

- Quick Approval: Many online lenders provide fast loan approval, often within minutes.

- Flexible Requirements: They often have more lenient credit requirements compared to banks.

- Easy Application Process: You can apply from the comfort of your home, making it simple and stress-free.

In summary, online lenders play a vital role in offering payday loans without requiring a checking account. This makes it easier for those in need to access funds quickly, even if they face challenges with traditional banking.

Tips for Managing Payday Loans Responsibly

When it comes to payday loans, many people wonder, “Are payday loans available with no checking account required?” This question is crucial because it opens up options for those who may not have a traditional bank account. Understanding this can help you make informed financial decisions and avoid unnecessary pitfalls.

Know Your Loan Approval & Credit Requirements

Before applying for payday loans no checking account required, it’s essential to understand the loan approval and credit requirements. Many lenders focus on your income rather than your credit score, making it easier for those with less-than-perfect credit to qualify. However, always check the terms to avoid surprises!

Create a Repayment Plan

Once you secure a payday loan, create a repayment plan. This plan should outline how and when you’ll pay back the loan. Stick to your schedule to avoid late fees and additional interest. Remember, payday loans can be helpful, but managing them responsibly is key to avoiding a cycle of debt.

How AdvanceCash Can Help You Find the Right Loan Solutions

Finding a payday loan without a checking account can feel like searching for a needle in a haystack. Many lenders require a checking account for approval, which can be a hurdle for some. However, understanding your options is key to securing the funds you need quickly and easily.

At AdvanceCash, we specialize in connecting you with lenders who offer payday loans no checking account required. This means you can get the cash you need without the stress of having a checking account. Our platform simplifies the process, making it easier for you to find the right loan solutions that fit your needs.

Benefits of Using AdvanceCash

- Quick Access: Get connected with lenders who understand your situation.

- Flexible Options: Explore various loan amounts and terms that suit your financial needs.

- Loan Approval & Credit Requirements: We help you understand what lenders look for, making it easier to get approved even without a checking account.

FAQs

🏦 Can I get a payday loan without a checking account?

Yes, some lenders allow you to get a payday loan using a savings account, prepaid debit card, or even offer in-store cash pickup options, though it may limit your loan choices.

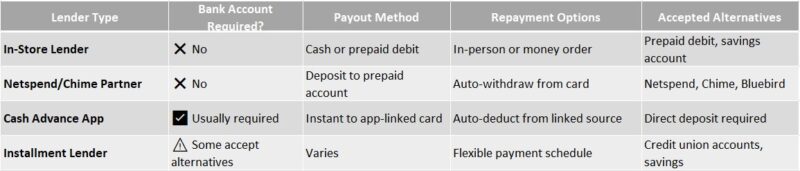

💳 What alternatives do lenders accept instead of checking accounts?

Lenders may accept a savings account, Netspend or prepaid debit cards, or provide cash in person at physical locations depending on their policies and your location.

📋 What are the requirements for payday loans without a checking account?

You’ll typically need proof of income, valid ID, a working phone number, and an alternative deposit method like a savings account or prepaid card.

⚠️ Are no-checking-account payday loans more expensive?

They can be. Lenders may charge higher fees or interest rates to offset the increased risk or alternative disbursement methods, so always review the loan terms carefully.

🔍 Where can I find payday loans that don’t require a checking account?

Look for lenders that specialize in alternative payday lending, such as Check Into Cash, Speedy Cash, or local storefront lenders that offer in-person services and flexible payout methods.

Don’t let financial stress hold you back. AdvanceCash is here to help you secure your payday loan today!

🔗At ExpressCash, we’re here to help guide you through the process and find the right financial solution for your specific situation.