When you’re in a tight spot financially, knowing which payday loans accept Netspend accounts can be a lifesaver. Netspend accounts are popular for their convenience, especially for those who may not have traditional bank accounts. Understanding your options can help you secure the funds you need quickly and easily.

Why Choose Payday Loans with Netspend?

Payday loans that accept Netspend accounts offer a quick solution for urgent cash needs. They are designed for people who might not qualify for traditional loans due to credit issues. Plus, using a Netspend account means you can receive your funds faster, often on the same day!

Loan Approval & Credit Requirements

Most payday lenders have lenient credit requirements, making it easier for you to get approved. Here are some key points to consider:

- Quick Approval: Many lenders can approve your loan within minutes.

- Minimal Documentation: You usually only need to provide basic information, like your income and identification.

- Flexible Terms: Some lenders offer repayment plans that fit your budget, making it easier to manage your loan.

By knowing which payday loans accept Netspend accounts, you can make informed decisions and get the help you need without the hassle.

Need cash fast? AdvanceCash offers quick payday loans to help you cover your expenses!

What Are Netspend Accounts and How Do They Work?

When you’re in a tight spot financially, knowing which payday loans accept Netspend accounts can be a lifesaver. These loans can provide quick cash, especially if you don’t have a traditional bank account. But first, let’s understand what Netspend accounts are and how they work.

Netspend accounts are prepaid debit accounts that allow you to load money onto a card. They work like a regular bank account but without the need for credit checks. This makes them a popular choice for people who may not qualify for traditional banking services.

Key Features of Netspend Accounts:

- Easy Access: You can use your Netspend card anywhere debit cards are accepted.

- No Credit Check: This means you can get a payday loan without worrying about your credit score.

- Direct Deposit: You can receive your paycheck directly onto your Netspend account, making it convenient for managing funds.

When looking for payday loans that accept Netspend accounts, it’s essential to check the loan approval and credit requirements. Many lenders understand that not everyone has a perfect credit history, so they may offer flexible options for those using Netspend.

Top Features of Payday Loans That Accept Netspend Accounts

When you’re facing financial difficulties, knowing which payday loans accept Netspend accounts can be crucial. These loans offer quick cash for unexpected expenses, but finding the right option is essential. Let’s dive into the top features of payday loans that accept Netspend accounts.

Easy Access to Funds

One major benefit is the ease of access. You can apply online with just a few clicks and get approved quickly. This allows you to have cash in your account within hours, helping you manage urgent bills or emergencies without delay.

Flexible Loan Approval & Credit Requirements

Another advantage is the flexible loan approval and credit requirements. Many lenders consider your income and Netspend account activity rather than just your credit score. This opens up opportunities for more people to qualify for loans, even with less-than-perfect credit histories.

Quick Application Process

The application process is straightforward. You simply fill out an online form with basic information like your name, income, and Netspend account details. This convenience means you can apply anytime, anywhere!

Instant Approval Decisions

Many lenders provide instant approval decisions, so you won’t have to wait long to find out if you’re approved. Once approved, funds can be deposited directly into your Netspend account, giving you immediate access to your money.

No Hidden Fees

Transparency is vital in payday loans. Reputable lenders clearly outline their fees and interest rates upfront, allowing you to make informed decisions without worrying about hidden costs.

If you’re facing unexpected bills, AdvanceCash can provide you with the funds you need instantly!

How to Apply for Payday Loans Using Your Netspend Account?

When you’re in a financial pinch, knowing which payday loans accept Netspend accounts can be a lifesaver. Many people rely on Netspend for its convenience, especially if they don’t have a traditional bank account. Understanding how to apply for these loans can help you get the cash you need quickly and easily.

Applying for payday loans that accept Netspend accounts is straightforward. Here’s how you can do it:

- Research Lenders: Start by looking for lenders that specifically mention they accept Netspend accounts. This is crucial to ensure your application is considered.

- Check Loan Approval & Credit Requirements: Each lender has different criteria. Some may not require a credit check, while others might. Make sure you understand what’s needed before applying.

- Gather Your Information: You’ll typically need to provide your Netspend account details, proof of income, and identification. Having these ready will speed up the process.

- Complete the Application: Fill out the online application form. Be honest and accurate with your information to avoid delays.

- Receive Your Funds: If approved, the funds can be deposited directly into your Netspend account, often within a day! This makes it easy to access your money when you need it most.

Also Read: Loan Approval & Credit Requirements for Payday Loans

Are There Any Risks Involved with Payday Loans on Netspend?

When considering payday loans that accept Netspend accounts, it’s essential to understand the potential risks involved. While these loans can provide quick cash, they often come with high fees and interest rates. This can lead to a cycle of debt if not managed carefully. Let’s explore the risks further.

Understanding the Risks of Payday Loans on Netspend

Payday loans can be tempting, especially when you need money fast. However, here are some risks to keep in mind:

- High Interest Rates: Many payday loans have exorbitant interest rates, making repayment challenging.

- Loan Approval & Credit Requirements: While some lenders may not check your credit score, they often have strict approval criteria that can lead to disappointment if you don’t meet them.

- Debt Cycle: If you can’t repay on time, you might need to take out another loan, leading to more debt.

Making Informed Decisions

Before applying for a payday loan, consider these tips:

- Read the Fine Print: Always understand the terms and conditions.

- Budget Wisely: Ensure you can repay the loan without falling into a debt trap.

- Explore Alternatives: Look for other options like personal loans or community assistance programs.

By being aware of these risks, you can make a more informed decision about using payday loans that accept Netspend accounts.

Comparing Interest Rates: Netspend-Compatible Payday Loans

When you’re in a tight spot and need quick cash, knowing which payday loans accept Netspend accounts can be a game changer. Netspend accounts are popular for their convenience, especially for those who may not have traditional bank accounts. But how do you find payday loans that accept them? Let’s dive in!

Understanding Interest Rates

Interest rates can vary widely among payday loans. If you have a Netspend account, it’s essential to compare these rates. Some lenders may offer lower rates for borrowers with a steady income, while others might charge higher fees. Always read the fine print!

Loan Approval & Credit Requirements

- Quick Approval: Many payday loans that accept Netspend accounts offer fast approval processes, often within hours.

- Flexible Credit Requirements: Unlike traditional loans, payday lenders typically have more lenient credit requirements. This means even if your credit isn’t perfect, you might still qualify!

Key Takeaways

- Always compare interest rates before choosing a lender.

- Look for lenders that specifically mention they accept Netspend accounts.

- Ensure you understand the loan terms to avoid surprises later on.

How AdvanceCash Can Help You Find the Right Payday Loan

Finding the right payday loan can feel overwhelming, especially if you have a NetSpend account. Many people rely on these accounts for their daily expenses, so knowing which payday loans accept NetSpend accounts is crucial. This knowledge can help you secure the funds you need without unnecessary hassle.

At AdvanceCash, we understand the importance of quick access to cash. That’s why we’ve compiled a list of payday loans that accept NetSpend accounts. This way, you can easily find lenders who are willing to work with your financial situation.

Benefits of Using NetSpend for Payday Loans

- Quick Access: Funds can be deposited directly into your NetSpend account.

- Convenience: You can manage your money easily without needing a traditional bank account.

- Flexible Options: Many lenders offer various loan amounts and repayment terms to suit your needs.

When searching for payday loans, it’s also essential to consider loan approval and credit requirements. Some lenders may have more lenient criteria, making it easier for you to get approved. At AdvanceCash, we provide insights into these requirements, helping you make informed decisions. Remember, understanding your options can lead to a smoother borrowing experience.

FAQs

💳 Can I get a payday loan with a Netspend account?

Yes, some payday lenders and cash advance services accept Netspend prepaid debit cards for depositing loan funds. However, not all lenders support prepaid accounts, so it’s important to verify before applying.

🏦 How do I receive a loan on my Netspend card?

If a lender accepts Netspend, you can enter your Netspend routing and account number during the loan application. Once approved, the funds may be directly deposited to your Netspend account, sometimes within hours.

📋 What are the requirements for a payday loan using Netspend?

To qualify, you’ll typically need:

-

A valid Netspend account

-

Proof of income (e.g., paystubs or bank deposits)

-

A government-issued ID

-

A working phone and email address

Lenders may also require your account to be active and in good standing.

⚠️ Are there any risks using a Netspend card for payday loans?

Yes. As with all payday loans, using a Netspend card may come with high interest rates and fees. Always review the repayment terms and ensure you can repay on time to avoid penalties.

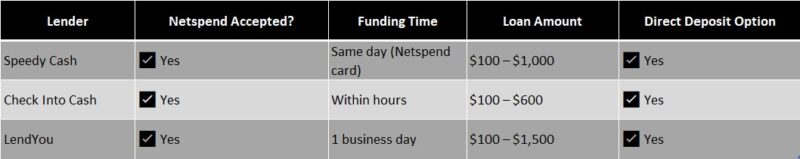

🔍 Which lenders accept Netspend cards?

Some lenders and platforms reported to accept Netspend include:

-

Check `n Go

-

Allied Cash Advance

-

Net Pay Advance

Availability may vary by state, so it’s best to check directly with the lender or use a comparison site that allows filtering by payment method.

Don’t let financial stress hold you back. AdvanceCash is here to help you secure your payday loan today!

🔗At ExpressCash, we’re here to help guide you through the process and find the right financial solution for your specific situation.