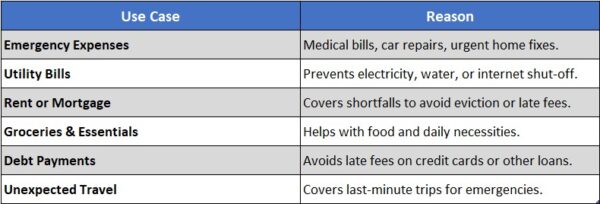

Understanding Common Uses for Payday Loans

- Emergency Expenses: When life throws a curveball, such as a sudden medical emergency or car breakdown, payday loans can help bridge the gap until your next paycheck.

- Utility Bills: If you are short on cash and facing a looming utility bill, a payday loan can help you avoid late fees or service interruptions.

- Unexpected Travel: Sometimes, you may need to travel unexpectedly for family emergencies or job opportunities.

- Research Lenders: Look for reputable payday loan providers with good reviews.

- Fill Out the Application: Provide necessary information such as your income, employment details, and bank account information.

- Receive Approval: Many lenders offer quick approvals, often within minutes.

- Get Your Funds: Once approved, the funds are usually deposited directly into your bank account, often on the same day.

Need cash fast? AdvanceCash offers quick payday loans to help you cover your expenses!

- Medical Expenses: An unexpected trip to the emergency room can lead to hefty bills. A payday loan can help you manage these costs until your insurance kicks in.

- Car Repairs: If your vehicle needs urgent repairs to keep you on the road, a payday loan can provide the necessary funds quickly.

- Utility Bills: Sometimes, utility bills arrive at inconvenient times. A payday loan can help you avoid late fees and service interruptions.

How Payday Loans Help Cover Unexpected Expenses

- Emergency car repairs: If your vehicle breaks down unexpectedly, a payday loan can help you cover the repair costs without delay.

- Medical expenses: Unforeseen medical bills can be daunting. A payday loan can help you manage these costs until you can settle them with your insurance or savings.

- Utility bills: When utility bills come due and your paycheck is still a few days away, a payday loan can help you avoid late fees and service interruptions.

If you’re facing unexpected bills, AdvanceCash can provide you with the funds you need instantly!

Using Payday Loans for Medical Bills and Healthcare Costs

- Quick Access to Funds: The application process is usually fast and straightforward, allowing you to receive money within hours or by the next day.

- No Credit Check: Many lenders do not require a credit check, making it easier for those with less-than-perfect credit to obtain funds.

- Flexible Use: These loans can cover a range of medical expenses, from emergency visits to routine check-ups.

- Short-Term Commitment: Payday loans are designed for quick repayment, making them suitable for those needing immediate assistance without long-term obligations.

- Research Lenders: Find reputable payday lenders online or locally.

- Gather Documentation: Collect necessary documents like proof of income.

- Complete the Application: Fill out the application accurately.

- Review Terms: Understand the loan terms before signing.

- Receive Funds: Once approved, funds will be deposited into your account, ready to address your medical bills.

Also Read: What Is the Payday Loan Application Process?

Payday Loans as a Solution for Utility Bills

- Quick access to funds: Obtain the money you need almost immediately.

- Minimal application process: Most lenders require little documentation.

- Flexibility: Use the funds for any utility bill, including electricity, water, or gas.

- Research lenders: Find reputable payday loan providers in your area.

- Gather necessary documents: Typically, proof of income and identification are required.

- Complete the application: This can often be done online or in person.

- Receive funds: Once approved, the money is usually deposited directly into your bank account.

Managing Rent Payments with Payday Loans

- Researching lenders: Find reputable payday loan providers.

- Gathering documentation: Most lenders require proof of income and identification.

- Submitting your application: This can often be done online for convenience.

- Receiving funds: Once approved, money is usually deposited directly into your bank account quickly, which is essential when rent is due soon.

- Quick access to cash: Ideal for urgent situations.

- Simple application process: Minimal paperwork is usually required.

- Flexible use: Can cover various expenses, including rent.

Payday Loans for Car Repairs and Maintenance

- Quick Access to Funds: Most loans can be processed within a day, allowing you to tackle urgent repairs immediately.

- Minimal Documentation: The application process is straightforward, requiring basic income and employment information.

- Flexibility: Funds can be used for any repair, from routine maintenance to unexpected breakdowns.

- No Collateral Needed: Unlike traditional loans, payday loans do not require collateral, making them more accessible.

- Research Lenders: Find reputable payday lenders in your area or online.

- Gather Documentation: Prepare your ID, proof of income, and bank details.

- Complete the Application: Fill out the form accurately to avoid delays.

- Review Terms: Read the terms and conditions carefully before accepting the loan.

- Receive Funds: Once approved, funds are typically deposited directly into your bank account for immediate use.

The Role of Payday Loans in Bridging Income Gaps

- Research Lenders: Find reputable payday loan providers.

- Gather Documentation: Prepare your income proof and ID.

- Complete the Application: Fill out the application form online or in-person.

- Receive Approval: Many lenders offer quick approvals, sometimes within minutes.

- Get Your Funds: Approved funds are usually deposited into your bank account within a day or two.

- Medical Expenses: Covering unexpected bills.

- Car Repairs: Keeping your vehicle operational.

- Utility Bills: Avoiding service interruptions.

- Groceries: Managing food expenses during tight times.

FAQs

⭐ What are payday loans typically used for?

Payday loans are often used for emergency expenses, such as medical bills, car repairs, rent, or utility bills, when borrowers need quick cash before their next paycheck.

⭐ Can I use a payday loan to pay off other debts?

While some people use payday loans to cover credit card bills or other loans, this can lead to a cycle of debt due to high interest rates. Consider alternatives like debt consolidation loans instead.

⭐ Are payday loans used for everyday expenses?

Some borrowers use payday loans for groceries, gas, or other daily expenses if they run out of funds before payday. However, frequent use can become costly.

⭐ Can I use a payday loan for business expenses?

Payday loans are generally not ideal for business expenses due to high fees. Small business loans or lines of credit are better options.

⭐ Are payday loans a good choice for vacations or luxury purchases?

No, payday loans should be reserved for urgent financial needs. Using them for non-essential expenses can lead to long-term financial strain.

Don’t let financial stress hold you back. AdvanceCash is here to help you secure your payday loan today!🔗At ExpressCash, we’re here to help guide you through the process and find the right financial solution for your specific situation.