Understanding the limits of payday loan interest rates is crucial for anyone considering this option. Each state has its own rules, which can significantly affect how much you pay back. Knowing these caps can help you avoid falling into a cycle of debt.

When you look at payday loan interest rates explained, it’s clear that they vary widely. Some states have strict caps, while others allow lenders to charge much higher rates. This means that what might be a reasonable loan in one state could be a financial trap in another.

Key Points to Remember:

- State Variations: Each state sets its own limits on how much interest can be charged.

- Consumer Protection: Caps are designed to protect borrowers from excessive fees.

- Research is Key: Always check your state’s laws before taking out a payday loan.

By understanding payday loan interest rate caps by state, you can make informed decisions and choose the best options for your financial situation.

Need cash fast? AdvanceCash offers quick payday loans to help you cover your expenses!

What Are the Average Interest Rates for Payday Loans?

Understanding the average interest rates for payday loans is crucial for anyone considering this type of borrowing. Each state has its own rules, which means the costs can vary widely. Knowing the Payday Loan Interest Rate Caps by State can help you avoid falling into a debt trap.

Payday loan interest rates can be confusing. Here’s a simple breakdown:

- State Variations: Some states cap interest rates at 15%, while others can go as high as 400%.

- Typical Rates: On average, payday loan interest rates hover around 300% annually. This means if you borrow $300, you could owe $900 in a year!

- Short-Term Costs: Most payday loans are due within two weeks, so the short-term costs can be steep.

Always check your state’s caps to understand what you might pay. By being informed about Payday Loan Interest Rates Explained, you can make better financial decisions. Always read the fine print and know your limits before borrowing.

How Do State Regulations Impact Borrowers?

Understanding state regulations is essential for payday loan borrowers. Each state has unique rules, particularly regarding Payday Loan Interest Rate Caps by State. These caps can greatly affect repayment amounts, making it crucial to know your state’s limits.

What Are Interest Rate Caps?

Interest rate caps represent the maximum rates lenders can charge for payday loans. For instance, some states cap rates at 15%, while others may allow rates as high as 400%. Lower caps mean borrowers pay less interest, making loans easier to manage.

Why Do These Caps Matter?

Familiarity with Payday Loan Interest Rates Explained helps borrowers avoid debt traps. High-interest rates can lead to a cycle of borrowing, where new loans are taken to pay off old ones. Knowing your state’s limits enables informed financial decisions and protects your finances.

The Impact of State Regulations

State regulations set not only interest rate caps but also loan terms and fees. Some states offer longer repayment periods or lower fees, easing the burden on borrowers. Understanding these variations can help you select the best loan option.

The Bottom Line

In conclusion, being aware of the Payday Loan Interest Rate Caps by State is crucial for borrowers. It prepares you for what to expect and aids in repayment planning. Always research and stay informed to safeguard against high-interest loans.

If you’re facing unexpected bills, AdvanceCash can provide you with the funds you need instantly!

Comparing Payday Loan Interest Rate Caps Across the U.S.

Understanding Payday Loan Interest Rate Caps by State is crucial for anyone considering a payday loan. These caps help protect borrowers from exorbitant interest rates that can lead to a cycle of debt. Knowing the limits in your state can save you money and stress.

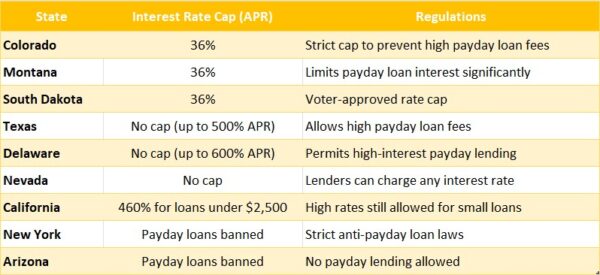

Each state has different rules regarding payday loans. Here’s a quick look at how interest rates vary:

- Texas: Up to 660% APR

- California: 460% APR

- New York: 25% APR (with strict regulations)

- Ohio: 28% APR These differences can significantly impact how much you pay back.

For example, a loan in Texas can cost you much more than one in New York. So, it’s essential to check the Payday Loan Interest Rates Explained in your state before borrowing. In conclusion, knowing your state’s payday loan interest rate caps can empower you to make informed financial decisions. Always read the fine print and consider alternatives if the rates seem too high. Your financial health is worth it!

Also Read: Payday Loan Interest Rates Explained: What to Know

What Happens When You Exceed the Interest Rate Cap?

Understanding the limits of payday loan interest rates is crucial for borrowers. Each state has its own rules, and exceeding these caps can lead to serious financial consequences. Knowing the payday loan interest rate caps by state can help you avoid falling into a debt trap.

When lenders charge more than the allowed interest rate, it can create a cycle of debt. Here’s what you should know:

Legal Consequences

- Fines and Penalties: Lenders may face hefty fines for violating state laws. This can lead to increased scrutiny and potential legal action.

- Loan Cancellation: In some states, exceeding the interest rate cap can result in the loan being declared void, meaning you owe nothing.

Financial Impact

- Increased Debt: Higher interest rates mean you’ll pay back much more than you borrowed, making it harder to escape the cycle of payday loans.

- Credit Score Damage: Defaulting on loans due to high interest can hurt your credit score, affecting future borrowing opportunities.

By understanding payday loan interest rates explained, you can make informed decisions and protect your financial health.

How to Find the Best Payday Loan Options in Your State

Finding the best payday loan options in your state can feel overwhelming, especially with varying Payday Loan Interest Rate Caps by State. Knowing these limits is crucial because they protect you from sky-high interest rates that can trap you in a cycle of debt. Let’s break it down simply!

Understanding Your State’s Caps

Each state has its own rules regarding payday loans. Some states have strict caps on interest rates, while others allow lenders to charge more. Here’s how to navigate this:

- Research Your State: Start by looking up the interest rate caps in your state. This information is usually available on state government websites.

- Compare Lenders: Not all lenders charge the same rates. Compare different options to find the best deal that fits your needs.

Tips for Choosing the Right Loan

When considering payday loans, keep these tips in mind:

- Read the Fine Print: Always check the terms and conditions. Look for hidden fees that could increase your total cost.

- Ask Questions: Don’t hesitate to ask lenders about their rates and fees. Understanding Payday Loan Interest Rates Explained can help you make informed decisions.

- Consider Alternatives: Sometimes, other options like personal loans or credit unions might offer better rates. Always explore all your choices before committing.

Why Knowing Your State’s Limits is Crucial for Borrowers

Understanding payday loan interest rate limits is essential for borrowers. Each state has unique rules that can greatly impact repayment amounts. By knowing these caps, you can avoid falling into a debt cycle and make informed financial choices.

Interest rates for payday loans can vary significantly. Here’s why knowing your state’s caps is important:

Key Reasons to Know Your Limits:

- Avoid Overpaying: Some states impose high caps, resulting in hefty repayments. Being aware of your limit can save you money.

- Stay Informed: Understanding payday loan interest rates helps you navigate your options effectively.

- Protect Yourself: Knowing your state’s regulations can shield you from predatory lending practices.

Understanding Your Rights:

Being aware of your state’s payday loan interest rate caps empowers you as a borrower. This knowledge can help you negotiate better terms and avoid unfair practices. It’s your money, and you deserve clarity on what you owe!

The Importance of Research:

Before taking out a payday loan, research your state’s specific caps and regulations. This knowledge protects you and helps you choose the best lender. Remember, informed borrowers are empowered borrowers!

Consequences of Ignorance:

Ignoring your state’s limits can lead to unexpected financial burdens. High-interest rates can trap you in debt, making it difficult to escape. Knowing the caps allows you to make smarter choices and avoid this trap.

How AdvanceCash Can Help You Navigate Payday Loan Interest Rates

Understanding payday loan interest rate caps by state is essential for anyone considering a payday loan. These caps protect borrowers from excessive fees, ensuring loans remain manageable. Being aware of these limits can help you avoid falling into a debt cycle, making it vital to stay informed.

At AdvanceCash, we simplify the complex world of payday loan interest rates. We provide clear, up-to-date information on interest rate caps in your state, allowing you to make informed decisions without feeling overwhelmed.

Key Benefits of Using AdvanceCash

- State-Specific Information: We break down payday loan interest rate caps by state, so you know what to expect.

- Easy-to-Understand Guides: Our resources are straightforward, making it easy for anyone to grasp the essentials.

- Helpful Tools: Use our calculators and comparison tools to find the best loan options for your needs.

Stay Informed

Staying informed about payday loan interest rates empowers you. Our resources help you track changes and understand their impact on your finances.

Personalized Assistance

Need help? Our team is here to answer your questions and guide you in finding the right payday loan.

FAQs

-

What are payday loan interest rate caps?

Interest rate caps are state-imposed limits on the maximum annual percentage rate (APR) that payday lenders can charge borrowers. Some states have strict limits, while others allow high-interest payday loans. -

Which states have the lowest payday loan interest rate caps?

States like New York, North Carolina, and Montana have strict caps around 36% APR, effectively banning high-cost payday loans. The District of Columbia also enforces a 36% cap. -

Which states allow the highest payday loan interest rates?

States such as Texas, Nevada, and Idaho have little to no interest rate caps, allowing payday loan APRs to exceed 500% in some cases. -

How do interest rate caps protect borrowers?

Caps prevent predatory lending practices by limiting excessive fees and interest rates, reducing the risk of borrowers falling into debt cycles. -

Where can I check payday loan regulations in my state?

You can visit your state’s financial regulatory agency or the Consumer Financial Protection Bureau (CFPB) website to find updated payday loan laws and interest rate limits.

Don’t let financial stress hold you back. AdvanceCash is here to help you secure your payday loan today!

🔗At ExpressCash, we’re here to help guide you through the process and find the right financial solution for your specific situation.