Understanding What Happens If You Don’t Repay a Payday Loan

Understanding payday loans is essential, especially during financial emergencies. These short-term loans help cover unexpected expenses until your next paycheck, typically ranging from a few hundred to a thousand dollars, with repayment due on your next payday. However, the terms can be complicated, and failing to repay a payday loan can lead to serious consequences.

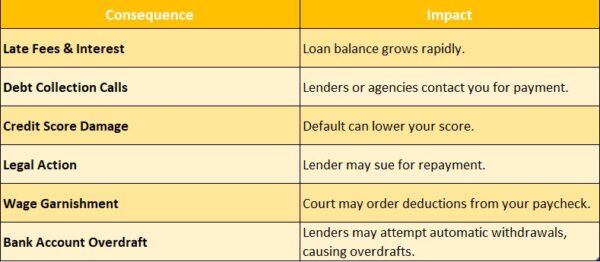

Missing a payment can result in hefty late fees that quickly increase your debt. Lenders may also attempt to withdraw the owed amount directly from your bank account, potentially causing overdraft fees if funds are insufficient. In severe cases, your debt might be sold to a collection agency, negatively affecting your credit score and adding to your financial stress. To avoid these issues, keep these tips in mind:

- Read the loan agreement thoroughly to understand the terms.

- Communicate with your lender if you foresee trouble making a payment.

- Consider alternatives to payday loans, like personal loans or credit unions, which often provide better terms.

By staying informed and proactive, you can better manage payday loans and mitigate the risks associated with non-repayment.

Need cash fast? AdvanceCash offers quick payday loans to help you cover your expenses!

Consequences of Not Repaying a Payday Loan

Taking out a payday loan may seem like a quick solution to financial problems, but failing to repay it on time can lead to serious consequences. Lenders typically impose late fees that accumulate rapidly, potentially trapping borrowers in a cycle of debt where they must take out additional loans just to cover the original amount. This situation can be challenging to escape.

Additionally, not repaying a payday loan can significantly affect your credit score. Although payday lenders may not report to credit bureaus right away, they often sell unpaid debts to collection agencies, resulting in negative marks on your credit report. Many are surprised to learn that even one missed payment can linger on their credit report for up to seven years, complicating future borrowing opportunities. To mitigate these risks, consider these steps:

- Communicate with your lender: If you anticipate difficulty in making a payment, contact them to discuss possible payment plans or extensions.

- Explore alternatives: Research other borrowing options with lower interest rates or more flexible terms.

- Budget wisely: Develop a budget to better manage your finances and reduce reliance on payday loans.

Understanding how payday loans function and their repayment consequences can empower you to make informed financial choices.

Impact on Your Credit Score After Defaulting

Taking out a payday loan may seem like a quick solution to your financial problems, but failing to repay it can lead to serious consequences. One of the most immediate effects is a significant drop in your credit score. Defaulting on a payday loan signals to lenders that you are a high-risk borrower, making it more difficult to secure future loans or credit cards. Consider these key points about your credit score after defaulting on a payday loan:

- Late Payments: Missing your repayment deadline can result in the lender reporting this to credit bureaus, negatively impacting your score.

- Collections: Unpaid loans may be sent to collections, further harming your credit.

- Long-Term Effects: A default can remain on your credit report for up to seven years, affecting your ability to obtain favorable loan terms later on.

For instance, if you take out a payday loan of five hundred dollars and miss the payment, you could face late fees and a credit score drop of up to 100 points. This could lead to higher interest rates or even denial of credit in the future. Therefore, while payday loans might seem convenient, the long-term repercussions of not repaying them can be detrimental to your financial health.

If you’re facing unexpected bills, AdvanceCash can provide you with the funds you need instantly!

Legal Actions Taken by Lenders for Non-Payment

Taking out a payday loan may seem like a quick fix for financial issues, but failing to repay it on time can lead to serious consequences. Lenders have various legal actions they can pursue to recover their money, so understanding these can help you manage the situation and reduce stress.

Payday loans are intended as short-term solutions. If you miss a payment, lenders will likely contact you to discuss options. However, if the loan remains unpaid, they may escalate their efforts. Here are some common actions lenders might take:

- Collection Calls: You can expect frequent calls from the lender or a collection agency.

- Negative Credit Reporting: Your credit score may suffer, complicating future borrowing.

- Legal Action: Lenders might file a lawsuit to recover the owed amount.

- Wage Garnishment: If they win a judgment, they could garnish your wages.

Ignoring the issue won’t help. It’s advisable to reach out to your lender to discuss your situation, as many are willing to work on a repayment plan. Being proactive can help you avoid legal actions and find a solution that benefits both parties. Understanding how payday loans work can empower you to make informed financial decisions.

Also Read: How Do Payday Loans Work for Emergency Expenses?

Exploring Debt Collection Practices for Unpaid Loans

Taking out a payday loan offers quick cash for immediate expenses, but failing to repay it on time can lead to serious consequences. The landscape of debt collection for unpaid loans can be daunting, with lenders imposing hefty fees and using aggressive tactics that may impact your credit score and financial stability. Here are some key insights into what happens if you don’t repay a payday loan:

- Increased Fees: Missing payments can lead to escalating fees, increasing the total amount owed.

- Debt Collection Calls: Lenders may frequently contact you, and if the debt remains unpaid, they could transfer it to a collection agency.

- Impact on Credit Score: While payday loans may not directly affect your credit score, unpaid debts can result in negative reports that harm your credit history.

- Legal Action: In severe cases, lenders might pursue legal action to recover the debt, potentially leading to wage garnishment or bank levies.

Understanding how payday loans work is essential for navigating these challenges. They are intended as short-term solutions, but failing to repay can trap you in a cycle of debt. If you find yourself in this situation, communicate with your lender and consider options like payment plans or extensions to avoid aggressive debt collection.

Alternatives to Consider Before Defaulting on a Payday Loan

If you’re unable to repay a payday loan, it’s essential to consider your options before defaulting. While payday loans may seem like a quick solution for financial emergencies, they often come with high interest rates and fees. Defaulting can lead to serious consequences, such as damage to your credit score and potential legal action. So, what alternatives do you have? Here are some options to explore:

- Negotiate with your lender: Open communication can lead to extensions or payment plans that make repayment more manageable.

- Seek financial counseling: Professional guidance can help you understand your financial situation and develop a workable budget. Many non-profit organizations offer these services for free.

- Explore other loan options: Consider personal loans from banks or credit unions, which usually have lower interest rates. Borrowing from friends or family can also be a viable option.

- Utilize community resources: Local charities and organizations may provide assistance for those in financial distress, offering temporary relief without the burden of debt.

By taking these proactive steps, you can avoid the pitfalls of defaulting on a payday loan and find a more sustainable financial solution.

How to Negotiate with Lenders for Repayment

Facing the inability to repay a payday loan can be daunting, but understanding how

payday loans work is crucial. Missing a payment can lead to significant fees and interest, trapping you in a cycle of debt. However, you can negotiate with your lender to find a mutually beneficial solution.

Here are some effective steps for negotiating repayment:

- Communicate Early: Contact your lender as soon as you anticipate a missed payment. Early communication can lead to better terms.

- Be Honest: Clearly explain your financial situation. Lenders value honesty and may be more flexible if they understand your circumstances.

- Request a Payment Plan: Inquire about setting up a manageable payment plan that aligns with your budget. Many lenders prefer restructuring payments over risking default.

Real-life examples highlight successful negotiations. One borrower shared their financial struggles and extended their repayment period without extra fees, while another secured a lower interest rate, easing their payment burden. The key is to approach negotiations positively and with a willingness to collaborate. This proactive approach can reduce stress and help you regain control of your finances.

Seeking Financial Assistance After Loan Default

Facing the inability to repay a payday loan can be overwhelming, often leading borrowers into a cycle of debt. Missing a payment may result in additional fees, causing your debt to escalate rapidly. Additionally, your credit score could suffer, making it challenging to secure future loans. So, what should you do if you find yourself in this predicament? Seeking financial assistance after a loan default is vital. Here are some steps to regain control of your finances:

- Communicate with your lender: Discuss your situation; some lenders may offer extensions or alternative payment plans.

- Explore local resources: Many communities have non-profit organizations that provide financial counseling and assistance.

- Consider debt consolidation: This can help combine multiple debts into a single payment, often at a lower interest rate.

- Seek legal advice: Consulting with a financial advisor or attorney can clarify your options if you feel overwhelmed.

- Create a budget: Understanding your income and expenses can help prioritize payments and prevent future defaults.

While payday loans can provide quick cash, they often come with high fees and interest rates. Understanding how payday loans work is crucial to avoid falling into a debt trap. If you’re struggling, seek help; proactive steps can lead to a more stable financial future.

Preventing Future Payday Loan Issues and Debt

Taking out a payday loan may seem like a quick solution to financial problems, but failing to repay it on time can lead to serious consequences. Many borrowers end up in a cycle of debt, where the initial loan amount increases rapidly due to high interest rates and fees. This can result in various financial issues, including damaged credit scores and heightened stress. So,

what happens if you don’t repay a payday loan? Missing a payment often leads to hefty late fees, and your loan may be rolled over into a new one, increasing your debt. Here are some potential outcomes of not repaying your payday loan:

- Increased Debt: Delaying payment results in accumulating interest.

- Collection Calls: Lenders may contact you for repayment, causing stress.

- Legal Action: Some lenders may pursue legal action, leading to court costs.

- Credit Score Impact: Non-repayment can severely damage your credit score, complicating future borrowing.

To avoid future payday loan issues, consider these proactive steps:

- Create a Budget: Monitor your income and expenses.

- Explore Alternatives: Investigate other borrowing options with lower interest rates.

- Build an Emergency Fund: Save monthly to prevent reliance on payday loans.

Understanding payday loans and their consequences can help you make informed financial decisions.

FAQs

⭐ What are the immediate consequences of not repaying a payday loan?

If you miss a payment, the lender may charge late fees and interest, making the loan more expensive. Your account could also be sent to collections.

⭐ Can a lender take legal action if I don’t repay?

Yes, but they cannot have you arrested. Lenders can sue you in civil court to collect the debt, which may result in wage garnishment or a court-ordered repayment plan.

⭐ Will defaulting on a payday loan affect my credit score?

Yes. If the lender reports missed payments to credit bureaus, it can significantly lower your credit score, making it harder to get future loans.

⭐ Can a lender withdraw money from my bank account?

If you authorized automatic payments, the lender may attempt multiple withdrawals. If you don’t have enough funds, this could lead to overdraft fees from your bank.

⭐ What should I do if I can’t repay my payday loan?

-

Contact the lender to discuss a payment plan

-

Look into payday loan consolidation or settlement options

-

Seek assistance from credit counseling services to manage your debt

Don’t let financial stress hold you back. AdvanceCash is here to help you secure your payday loan today!

🔗At

ExpressCash, we’re here to help guide you through the process and find the right financial solution for your specific situation.