Understanding Payday Loan Legal Regulations: An Overview

Understanding the payday loan legal regulations surrounding is crucial for borrowers. These rules help protect consumers from unfair practices and ensure transparency in the payday loan application process. Knowing your rights can empower you to make informed financial decisions.

Key Legal Regulations to Know

- Interest Rate Limits: Many states cap the interest rates lenders can charge, preventing exorbitant fees.

- Loan Amounts: Regulations often dictate the maximum amount you can borrow, ensuring loans are manageable.

- Repayment Terms: Laws may require lenders to offer clear repayment terms, helping borrowers understand their obligations.

Why These Regulations Matter

These payday loan legal regulations are designed to safeguard you from predatory lending. By understanding them, you can avoid falling into a cycle of debt and make better choices when seeking financial help. Always read the fine print and ask questions during the payday loan application process to ensure you’re fully informed.

Need cash fast? AdvanceCash offers quick payday loans to help you cover your expenses!

What Are the Key Laws Governing Payday Loans?

Understanding the legal regulations surrounding payday loans is crucial for anyone considering this type of borrowing. These laws protect consumers from predatory lending practices and ensure that the payday loan application process is fair and transparent. Let’s dive into the key laws that govern payday loans and what they mean for you.

Key Laws Governing Payday Loans

- State Regulations: Each state has its own rules about payday loans. Some states have strict limits on interest rates, while others allow higher fees. Knowing your state’s laws can help you avoid costly mistakes.

- Federal Regulations: The Truth in Lending Act requires lenders to disclose the terms of the loan clearly. This means you should know how much you’ll pay back and when before signing anything.

Why It Matters

Understanding these regulations can save you money and stress. By being informed, you can make better decisions about borrowing and avoid falling into a cycle of debt. Always read the fine print and ask questions during the payday loan application process to ensure you know what you’re getting into.

How Do State Regulations Differ on Payday Loans?

Understanding the legal regulations surrounding payday loans is crucial for anyone considering this type of borrowing. These regulations can significantly impact the payday loan application process, determining how much you can borrow and the fees involved. Let’s dive into how state regulations differ and what that means for you.

Each state has its own set of

payday loan legal regulations. For instance, some states allow high-interest rates, while others impose strict caps. Here are a few key differences:

- Interest Rates: Some states limit rates to 15%, while others may allow up to 400%.

- Loan Amounts: The maximum loan amount can vary, with some states capping it at $500 and others allowing more.

- Repayment Terms: States differ on how long you have to repay the loan, ranging from a few weeks to several months.

This variation can affect your financial planning. Understanding these differences can help you make informed decisions and avoid potential pitfalls when applying for a payday loan. Always check your state’s regulations before proceeding!

If you’re facing unexpected bills, AdvanceCash can provide you with the funds you need instantly!

The Impact of Federal Regulations on Payday Lending Practices

Understanding the legal regulations surrounding payday loans is crucial for borrowers. These laws help protect consumers from unfair lending practices and ensure that the payday loan application process is transparent and fair. Knowing your rights can empower you to make informed financial decisions.

Key Federal Regulations

- Truth in Lending Act (TILA): This law requires lenders to disclose the terms and costs of loans clearly.

- Consumer Financial Protection Bureau (CFPB): This agency oversees payday lending practices to ensure they are fair and transparent.

These regulations aim to prevent predatory lending and ensure that borrowers understand what they are getting into before signing any agreements.

Why It Matters

Payday loan legal regulations are designed to protect you from high-interest rates and hidden fees. By understanding these rules, you can navigate the payday loan application process with confidence, knowing that there are safeguards in place to protect your financial well-being. This knowledge can help you avoid falling into a cycle of debt.

Also Read: What Is the Payday Loan Application Process?

Are There Caps on Interest Rates for Payday Loans?

Understanding the legal regulations surrounding payday loans is crucial for anyone considering this option. These laws can protect borrowers from excessive fees and interest rates, ensuring that the payday loan application process is fair and transparent. Knowing these regulations helps you make informed decisions and avoid potential pitfalls.

Many states have implemented caps on interest rates for payday loans to protect consumers. Here are some key points to consider:

- State Variations: Each state has different laws. Some states cap interest rates at 15%, while others may allow rates as high as 400%.

- Loan Amounts: The maximum amount you can borrow often varies by state, affecting how much interest you might pay.

- Repayment Terms: Regulations also dictate how long you have to repay the loan, which can influence the total cost of borrowing.

By understanding these payday loan legal regulations, you can better navigate your options and avoid falling into a cycle of debt. Always check your state’s specific laws before applying!

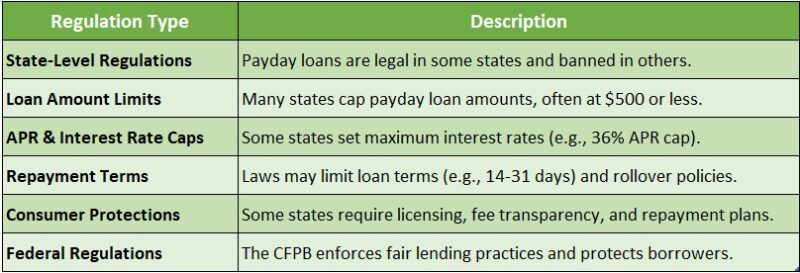

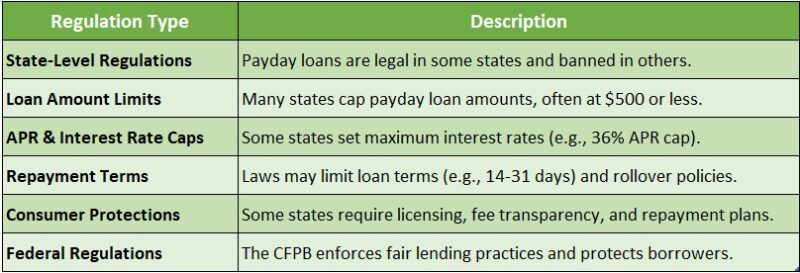

Payday Loan Legal Regulations in the U.S.

What Consumer Protections Exist in Payday Loan Legal Regulations?

Understanding the legal regulations surrounding payday loans is crucial for consumers. These laws are designed to protect borrowers from predatory lending practices and ensure fair treatment throughout the payday loan application process. Knowing your rights can help you make informed decisions and avoid falling into a cycle of debt.

Key Protections:

- Interest Rate Caps: Many states impose limits on the interest rates that lenders can charge, preventing exorbitant fees.

- Clear Disclosure: Lenders must provide clear information about the loan terms, including fees and repayment schedules, so borrowers know what to expect.

- Repayment Plans: Some regulations require lenders to offer repayment plans, allowing borrowers to pay back their loans in manageable installments rather than one lump sum.

These protections aim to create a safer borrowing environment. By understanding these regulations, you can navigate the payday loan landscape more confidently and avoid potential pitfalls.

How to Identify Legitimate Payday Lenders: A Legal Perspective

Understanding the legal regulations surrounding payday loans is crucial for anyone considering this type of borrowing. These laws are designed to protect consumers from predatory lending practices and ensure that lenders operate fairly. Knowing these regulations can help you identify legitimate payday lenders and avoid scams.

Key Legal Regulations to Consider

- Licensing: Legitimate payday lenders must be licensed in your state. Check your state’s financial regulatory agency to verify their credentials.

- Interest Rate Limits: Many states impose caps on interest rates for payday loans. Familiarize yourself with these limits to avoid excessive fees.

- Loan Terms: Regulations often dictate the maximum loan amount and repayment terms. Ensure the lender adheres to these guidelines to protect yourself.

The Payday Loan Application Process

When applying for a payday loan, ensure the lender provides clear information about the terms and conditions. A reputable lender will explain the fees, repayment schedule, and any potential penalties. Always read the fine print before signing anything!

What Happens When Payday Loan Regulations Are Violated?

When it comes to payday loans, understanding the legal regulations is crucial. These rules are designed to protect borrowers from unfair practices. But what happens when these regulations are violated? Let’s dive into the consequences and why they matter.

Legal Consequences

If lenders break payday loan legal regulations, they can face serious penalties. This might include hefty fines or even losing their license to operate. It’s important for borrowers to know their rights during the payday loan application process.

Borrower Protections

When regulations are ignored, borrowers can suffer too. They might be charged excessive fees or interest rates. This can lead to a cycle of debt that’s hard to escape. Knowing the rules helps borrowers avoid these pitfalls and make informed decisions.

How Can AdvanceCash Help You Navigate Payday Loan Legal Regulations?

Understanding the legal regulations surrounding payday loans is crucial for anyone considering this type of financial assistance. These regulations help protect consumers from predatory lending practices and ensure that the payday loan application process is fair and transparent. Knowing your rights can empower you to make informed decisions.

At

AdvanceCash, we simplify the complex world of payday loan legal regulations. Our expert resources guide you through the maze of rules, ensuring you understand what to expect during the payday loan application process. Here’s how we can assist you:

- Clear Information: We provide straightforward explanations of the laws governing payday loans in your state.

- Step-by-Step Guidance: Our easy-to-follow guides help you navigate the application process without confusion.

- Consumer Rights: Learn about your rights as a borrower, so you can avoid scams and unfair practices.

Future Trends: What Changes Are Expected in Payday Loan Regulations?

Understanding the legal regulations for payday loans is crucial for borrowers. These laws protect consumers from unfair practices and ensure transparency in the payday loan application process. As the financial landscape evolves, so do the rules governing these loans, making it essential to stay informed about future changes.

Stricter Lending Practices

Many experts predict that regulations will tighten, leading to stricter lending practices. This means lenders may have to provide clearer information about fees and repayment terms, helping borrowers make better decisions.

Enhanced Consumer Protections

Another trend is the push for enhanced consumer protections. This could include limits on interest rates and more robust guidelines for the payday loan application process, ensuring that borrowers are not trapped in a cycle of debt.

FAQs

⭐ Are payday loans legal in all states?

No, payday loans are regulated at the state level, and some states have banned them completely, while others impose strict regulations on interest rates and loan terms.

⭐ What is the maximum interest rate allowed on payday loans?

Interest rate caps vary by state. Some states have strict APR limits, while others allow lenders to charge high fees. Always check your state’s regulations.

⭐ Are payday lenders required to be licensed?

Yes, most states require payday lenders to be licensed and comply with local lending laws to operate legally.

⭐ Can payday lenders take legal action for non-payment?

While lenders cannot threaten criminal charges, they may take legal action through civil lawsuits to recover unpaid debts.

⭐ What protections do borrowers have against payday loan abuse?

Federal and state laws, such as the Truth in Lending Act (TILA), require lenders to disclose all loan terms upfront, including interest rates, fees, and repayment conditions.

Don’t let financial stress hold you back. AdvanceCash is here to help you secure your payday loan today!

🔗At

ExpressCash, we’re here to help guide you through the process and find the right financial solution for your specific situation.