Understanding payday loan interest rates is crucial for anyone considering this type of borrowing. These rates can significantly impact how much you end up paying back. So, let’s break it down in a way that’s easy to understand!

What Are Payday Loan Interest Rates?

Payday loan interest rates are the fees charged by lenders for borrowing money. They can be quite high compared to traditional loans. Typically, these rates are expressed as a percentage of the loan amount, and they can vary widely depending on the lender and your location.

Why Do Interest Rates Matter?

Understanding payday loan interest rates is important because it helps you know how much you’ll owe. Here are some key points to consider:

- High Costs: Interest rates can range from 200% to 600% APR!

- Short-Term Loans: These loans are usually due on your next payday, which means you need to pay back quickly.

- Potential Debt Cycle: High interest can lead to borrowing more to pay off the first loan, creating a cycle of debt.

Tips for Managing Interest Rates

To manage payday loan interest rates effectively, consider these tips:

- Shop Around: Compare rates from different lenders.

- Read the Fine Print: Always check the terms and conditions.

- Consider Alternatives: Look for other options like credit unions or personal loans with lower rates.

By understanding payday loan interest rates, you can make informed decisions and avoid falling into financial traps.

Need cash fast? AdvanceCash offers quick payday loans to help you cover your expenses!

How Are Payday Loan Interest Rates Calculated?

Understanding how payday loan interest rates are calculated is essential for anyone considering this type of loan. Knowing the factors that influence these rates can save you money and prevent unexpected surprises when it’s time to pay back your loan.

Factors Influencing Interest Rates

Several key elements determine payday loan interest rates:

- Loan Amount: Larger loans may have different rates than smaller ones.

- Repayment Period: Shorter repayment periods often lead to higher rates.

- State Regulations: Each state has its own laws affecting interest rates.

- Credit History: Your credit score can influence the rate you receive, even for payday loans.

Why It Matters

Understanding these factors is crucial. Knowing how payday loan interest rates are calculated allows you to compare offers from different lenders. This knowledge empowers you to choose a loan that fits your budget and needs, helping you avoid falling into a cycle of debt.

How Interest Rates Are Expressed

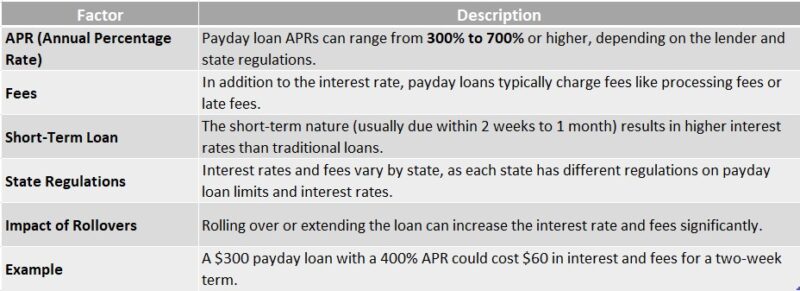

Payday loan interest rates are often expressed as a percentage of the loan amount, known as the Annual Percentage Rate (APR). However, since payday loans are typically short-term, the effective interest rate can be much higher than traditional loans.

Importance of Comparing Rates

When looking for a payday loan, always compare rates from different lenders. Some may offer lower fees or better terms, allowing you to find a loan that minimizes your costs and fits your financial situation better.

If you’re facing unexpected bills, AdvanceCash can provide you with the funds you need instantly!

What Factors Influence Payday Loan Interest Rates?

Understanding payday loan interest rates is crucial for anyone considering this option. These rates can vary widely, impacting how much you ultimately pay back. So, let’s dive into what factors influence payday loan interest rates and why it matters for your financial decisions.

Several elements play a role in determining payday loan interest rates. Here are the main ones to consider:

- State Regulations: Each state has different laws governing payday loans. Some states cap interest rates, while others allow lenders to charge higher fees.

- Loan Amount: The size of the loan can affect the interest rate. Smaller loans might have higher rates compared to larger ones, as lenders often charge more for the risk involved.

- Credit Score: Although payday loans are often available without a credit check, your credit history can still influence rates. A better score might help you secure a lower rate, even in this market.

- Lender Policies: Different lenders have their own policies and risk assessments. Some may offer competitive rates, while others might charge more based on their business model.

Also Read: What Is the Payday Loan Application Process?

Are Payday Loan Interest Rates Regulated?

Understanding payday loan interest rates is crucial for anyone considering this type of borrowing. These rates can significantly impact how much you end up paying back. So, let’s dive into whether payday loan interest rates are regulated and what that means for you.

Payday loan interest rates vary widely, and this can be confusing. In many states, there are no strict regulations on how much lenders can charge. This means some lenders might charge extremely high rates, making it hard for borrowers to repay their loans. Here are some key points to consider:

- State Regulations: Some states have laws limiting interest rates, while others do not. It’s essential to check your state’s regulations before taking out a payday loan.

- Annual Percentage Rate (APR): Payday loans often have high APRs, sometimes exceeding 400%. This means if you borrow $500, you could end up paying back much more than you borrowed.

- Consumer Protection: Organizations are working to protect consumers from predatory lending practices. Always research your lender and understand the terms before signing anything.

In conclusion, knowing whether payday loan interest rates are regulated can help you make informed decisions. Always read the fine print and consider alternatives if the rates seem too high.

Comparing Payday Loan Interest Rates with Other Loan Types

When it comes to borrowing money, understanding the costs involved is crucial. That’s why knowing about Payday Loan Interest Rates Explained is so important. These rates can significantly impact how much you end up paying back, especially when compared to other loan types.

What Are Payday Loan Interest Rates?

Payday loans often come with high interest rates, sometimes exceeding 400% APR! This means if you borrow $500, you could owe over $2,000 if you don’t pay it back quickly. It’s essential to grasp these rates to avoid financial pitfalls.

How Do They Stack Up?

When you compare payday loans to other types of loans, the differences are striking:

- Personal Loans: Typically range from 6% to 36% APR.

- Credit Cards: Average around 15% to 25% APR.

- Auto Loans: Usually between 3% and 10% APR.

As you can see, payday loans are much more expensive. Understanding these differences helps you make better financial decisions.

Why It Matters

Choosing the right loan type can save you money. If you need quick cash, consider alternatives like personal loans or credit cards, which usually have lower interest rates. Always weigh your options carefully before deciding!

How Can AdvanceCash Help You Navigate Payday Loan Interest Rates?

Understanding payday loan interest rates is crucial for anyone considering this type of borrowing. These rates can significantly impact how much you end up paying back. So, knowing the ins and outs of payday loan interest rates explained can help you make informed decisions and avoid financial pitfalls.

At AdvanceCash, we simplify the complex world of payday loans. Our goal is to empower you with the knowledge you need. Here’s how we can assist you:

Key Insights:

- Clear Definitions: We break down terms and concepts related to payday loan interest rates, making them easy to understand.

- Comparative Analysis: Our tools allow you to compare rates from different lenders, ensuring you find the best deal.

- Expert Advice: Our articles provide tips on how to manage and negotiate interest rates effectively.

By using our resources, you can confidently navigate the payday loan landscape. We aim to equip you with the information necessary to make smart financial choices, ultimately saving you money and stress.

Understanding Your Options:

We help you explore various payday loan options available in your area. Knowing your choices can lead to better decisions and lower interest rates.

Real-Life Examples:

Our website shares real-life stories and examples of how others have successfully managed payday loans. These insights can guide you in your journey.

Frequently Asked Questions:

-

How are payday loan interest rates calculated?

Payday loans typically have high interest rates, often expressed as a fee per $100 borrowed. This can translate into an Annual Percentage Rate (APR) of 300% or higher. -

Why are payday loan interest rates so high?

Lenders charge high rates due to the short repayment terms, high default risks, and lack of collateral or credit checks. -

What is the average interest rate on a payday loan?

The rate varies by state, but payday loans often charge $10 to $30 per $100 borrowed, leading to APR rates between 200% and 600%. -

Are there regulations on payday loan interest rates?

Yes, many U.S. states have laws capping payday loan interest rates, while others allow lenders to charge high fees with fewer restrictions. -

How can I reduce payday loan interest costs?

Paying off the loan early, borrowing only what’s necessary, and exploring lower-interest alternatives (such as personal loans or credit unions) can help reduce costs.

Don’t let financial stress hold you back. AdvanceCash is here to help you secure your payday loan today!

🔗At ExpressCash, we’re here to help guide you through the process and find the right financial solution for your specific situation.