Understanding Payday Loan FAQs is essential for anyone considering this type of financial assistance. Many people have questions about how payday loans work, their benefits, and the application process. By addressing these common concerns, we can help you make informed decisions and navigate the world of payday loans with confidence.

Need cash fast? AdvanceCash offers quick payday loans to help you cover your expenses!

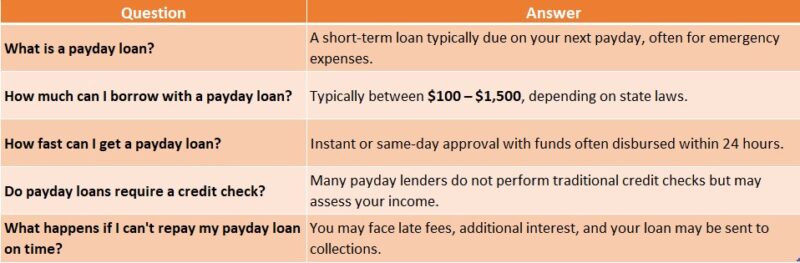

Common Questions About Payday Loans

What is a Payday Loan?

A payday loan is a short-term borrowing option designed to cover urgent expenses until your next paycheck. These loans are typically small amounts and are meant to be repaid quickly, often within a few weeks.

How Does the Payday Loan Application Process Work?

The payday loan application process is usually straightforward. Here’s what you can expect:

- Find a Lender: Research and choose a reputable lender.

- Fill Out an Application: Provide your personal information, income details, and banking information.

- Receive Approval: Many lenders offer quick approvals, sometimes within minutes.

- Get Your Funds: Once approved, the money is often deposited directly into your bank account.

Are Payday Loans Safe?

While payday loans can be helpful, it’s important to borrow responsibly. Make sure to read the terms and conditions carefully and understand the repayment schedule to avoid falling into a cycle of debt.

Are Payday Loans Right for You? Key Considerations

When considering a payday loan, it’s important to determine if it’s the right choice for you. Understanding the Payday Loan FAQs can help clarify your doubts. While payday loans may seem like a quick fix for financial emergencies, weighing the pros and cons is crucial before proceeding.

Key Considerations for Payday Loans

- Interest Rates: Be aware that payday loans often come with high-interest rates. Know what you’ll be paying back.

- Repayment Terms: Understand the repayment terms. Can you pay it back on time? Missing payments can lead to additional fees.

- Financial Situation: Assess your current financial status and explore other options that may be available.

The Payday Loan Application Process

The Payday Loan Application Process is typically straightforward. You fill out an application, provide personal information, and wait for approval. However, this simplicity can lead to rushed decisions, so take your time to read the terms carefully.

Alternatives to Consider

Before choosing a payday loan, consider alternatives like personal loans or borrowing from friends and family, which may offer better terms and lower interest rates.

Final Thoughts

In conclusion, payday loans can be beneficial in emergencies but come with risks. Always read the Payday Loan FAQs and understand the implications to make informed decisions that protect your financial future.

If you’re facing unexpected bills, AdvanceCash can provide you with the funds you need instantly!

How Do Payday Loans Work? A Step-by-Step Guide

Understanding how payday loans work is crucial for anyone considering this option. In our Payday Loan FAQs, we aim to clarify common questions and provide insights into the payday loan application process. Knowing what to expect can help you make informed decisions and avoid surprises.

Step 1: Research Lenders

Before applying, take time to research different lenders. Look for reputable companies with good reviews. This step is essential to ensure you choose a trustworthy lender that fits your needs.

Step 2: Complete the Application

Once you’ve chosen a lender, it’s time to fill out the payday loan application. This process is usually quick and can often be done online. You’ll need to provide basic information like your income, employment details, and bank account information.

Step 3: Review the Terms

After submitting your application, the lender will review it. If approved, they’ll present you with the loan terms. Make sure to read these carefully! Understand the interest rates, repayment period, and any fees involved before agreeing.

Step 4: Receive Your Funds

If you accept the terms, the lender will deposit the funds directly into your bank account. This usually happens within one business day, giving you quick access to cash when you need it most.

Step 5: Repayment

Finally, be prepared to repay the loan on the agreed date. Most lenders will automatically withdraw the amount from your account, so ensure you have sufficient funds to avoid extra fees.

Also Read: What Is the Payday Loan Application Process?

What Are the Costs Associated with Payday Loans?

When considering a payday loan, understanding the associated costs is crucial. This section of our Payday Loan FAQs: Answers to Common Questions highlights what you can expect. Knowing these costs helps you make informed decisions and avoid surprises later on.

Payday loans can come with several costs, including:

- Interest Rates: Often ranging from 300% to 500% APR, meaning you could pay back much more than you borrowed!

- Fees: Many lenders charge additional processing fees that can add up quickly, so be sure to read the fine print.

- Late Payment Fees: Missing your payment date can lead to extra charges, making your loan even more expensive.

Understanding the Payday Loan Application Process is also essential. It’s typically quick and straightforward, but be aware of the costs before applying. Always compare different lenders to find the best deal.

Why Are These Costs Important?

Knowing the costs helps you avoid financial pitfalls and potential debt cycles. Understanding these expenses allows for better budgeting and financial choices.

Tips for Managing Costs

To manage costs effectively, consider these tips:

- Read the Fine Print: Always check terms and conditions before signing.

- Borrow Only What You Need: Take out only what you can afford to repay.

- Plan for Repayment: Create a repayment plan to avoid late fees and additional interest.

Common Misconceptions About Payday Loans Explained

Understanding the truth about payday loans is crucial for anyone considering them. Many people have questions, and that’s where our Payday Loan FAQs come in. By addressing common misconceptions, we can help you make informed decisions about the payday loan application process and avoid pitfalls.

They’re Only for Emergencies

One common myth is that payday loans are only for emergencies. While they can help in urgent situations, many people use them for planned expenses, like car repairs or medical bills. It’s essential to understand when and how to use them responsibly.

They’re Always High-Interest

Another misconception is that all payday loans come with sky-high interest rates. While some do, many lenders offer competitive rates. Always compare options and read the fine print before applying. This way, you can find a loan that suits your needs without breaking the bank.

The Application Process is Complicated

Many believe the payday loan application process is lengthy and confusing. In reality, it’s often straightforward. Most lenders provide online applications that can be completed in minutes. Just gather your information, and you’re ready to go!

How Can AdvanceCash Help You Navigate Payday Loan FAQs?

Navigating payday loans can be overwhelming, but understanding Payday Loan FAQs: Answers to Common Questions is crucial. Having clear answers helps you make informed decisions and avoid potential pitfalls.

At AdvanceCash, we simplify the payday loan application process by providing straightforward answers to your pressing questions. Here’s how we assist you:

Key Insights:

- Understanding Terms: We break down complex terms into easy language.

- Step-by-Step Guidance: Our FAQs guide you through the payday loan application process, ensuring you know what to expect.

- Avoiding Common Mistakes: Learn about common pitfalls and how to avoid them, saving you time and money.

With our resources, you’ll feel more confident exploring payday loans. We support you every step of the way, making the process less daunting.

Benefits of Using AdvanceCash for Your Payday Loan Questions:

- Comprehensive Information: We cover a wide range of payday loan topics, ensuring you have all the information in one place.

- User-Friendly Format: Our FAQs are easy to navigate, so you can quickly find the answers you need.

- Expert Insights: Our experts regularly update content, providing the latest information and trends in the payday loan industry.

By utilizing AdvanceCash, you can approach payday loans with confidence, empowering you to navigate the application process smoothly.

What Alternatives to Payday Loans Should You Consider?

When exploring Payday Loan FAQs, it’s essential to consider alternatives that might be better suited for your financial needs. Understanding these options can help you avoid high-interest rates and fees associated with payday loans. Let’s dive into some alternatives that can provide relief without the stress.

Personal Loans

Personal loans are a great option if you need a larger sum of money. They usually have lower interest rates than payday loans and can be paid back over a longer period. Just remember to check the payday loan application process for personal loans, as it may require more documentation.

Credit Unions

Credit unions often offer small loans with better terms than payday lenders. If you’re a member, you might qualify for a low-interest loan. Plus, they usually have friendly staff who can help you understand your options.

Payment Plans

If you’re facing a temporary financial crunch, consider talking to your creditors about payment plans. Many companies are willing to work with you to create a manageable repayment schedule, which can save you from the payday loan trap.

Borrowing from Friends or Family

Lastly, don’t underestimate the power of asking friends or family for help. They might be willing to lend you money without the high interest, making it a win-win situation for everyone involved.

FAQs

-

What is a payday loan?

A payday loan is a short-term, high-interest loan designed to provide quick cash, usually repaid on the borrower’s next payday. -

Who is eligible for a payday loan?

Most lenders require applicants to be at least 18 years old, have a steady income, and provide a valid bank account for repayment. -

How much can I borrow with a payday loan?

Loan amounts vary by lender and state regulations, typically ranging from $100 to $1,500, depending on income and borrowing history. -

What are the risks of taking a payday loan?

Payday loans come with high interest rates and fees, which can lead to a debt cycle if not repaid on time. Borrowers should consider alternatives if possible. -

Are payday loans available with bad credit?

Yes, many payday lenders approve loans for borrowers with poor credit, as they focus more on income and ability to repay rather than credit history.

Don’t let financial stress hold you back. AdvanceCash is here to help you secure your payday loan today!

🔗At ExpressCash, we’re here to help guide you through the process and find the right financial solution for your specific situation.