Understanding Payday Loan Contract Terms: What You Need to Know

Understanding the terms of a payday loan contract is crucial for anyone considering this type of financial assistance. These contracts can be tricky, and knowing what to look for can save you from unexpected surprises. Let’s dive into the key elements that make up payday loan contract terms.

- Interest Rates: Payday loans often come with high-interest rates. Make sure to check how much you’ll owe in total.

- Repayment Schedule: Understand when and how you need to repay the loan. Missing a payment can lead to additional fees.

- Fees and Charges: Look for any hidden fees that might apply. These can add up quickly and increase your total cost.

The Payday Loan Application Process

Before you sign anything, familiarize yourself with the payday loan application process. This usually involves providing personal information and proof of income. Knowing what to expect can help you feel more confident and prepared. Always read the contract carefully before agreeing to the terms.

Need cash fast? AdvanceCash offers quick payday loans to help you cover your expenses!

Key Components of a Payday Loan Contract: A Breakdown

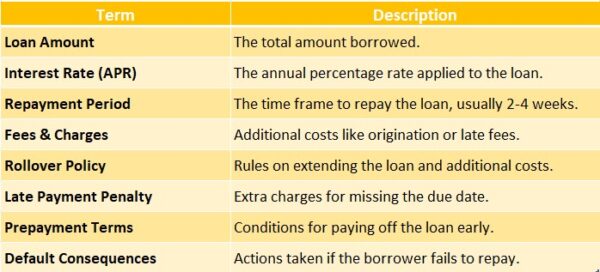

Understanding payday loan contract terms is essential for anyone considering this type of loan. These terms can significantly impact your finances, so knowing what to look for can help you avoid unexpected surprises. Here’s a breakdown of the key components of a payday loan contract to guide you through the payday loan application process confidently.

When reviewing a payday loan contract, focus on these critical elements:

- Loan Amount: Ensure the total amount borrowed meets your needs without exceeding them.

- Interest Rate: This determines how much extra you will repay. Higher rates can lead to larger repayments, so scrutinize this closely.

- Repayment Terms: Know when and how to repay the loan to avoid late fees.

Additional Considerations

- Fees: Be aware of any hidden fees that could accumulate quickly.

- Default Terms: Understand the consequences of not repaying on time, as this can impact your credit score and future borrowing ability.

By familiarizing yourself with these payday loan contract terms, you can make informed choices and steer clear of potential pitfalls.

Are Payday Loan Contract Terms Transparent?

Understanding payday loan contract terms is crucial for anyone considering this type of loan. These terms can significantly impact your financial situation, so knowing what to look for is essential. Let’s dive into whether payday loan contract terms are transparent and what that means for you.

When you apply for a payday loan, it’s important to read the contract carefully. Here are some key points to consider:

- Interest Rates: Payday loans often come with high-interest rates. Make sure you know what you’re agreeing to!

- Repayment Terms: Understand when and how you need to repay the loan. Missing a payment can lead to extra fees.

- Hidden Fees: Some lenders may include fees that aren’t immediately obvious.

Always ask questions if something seems unclear. By being aware of these aspects, you can navigate the payday loan application process more confidently. Transparency in these terms helps you make informed decisions and avoid potential pitfalls.

If you’re facing unexpected bills, AdvanceCash can provide you with the funds you need instantly!

The Importance of Interest Rates in Payday Loan Agreements

When exploring payday loans, grasping the contract terms is vital, especially the interest rates. These rates significantly impact your total repayment amount, making it essential to understand them before signing any agreement.

Why Interest Rates Matter

Interest rates in payday loan contracts can be alarmingly high, determining how much extra you owe beyond the original loan. If not managed carefully, this can trap you in a cycle of debt.

Key Points to Remember

- High Rates: Payday loans can have interest rates exceeding 400% annually.

- Short-Term Loans: Due on your next payday, interest accumulates rapidly.

- Read the Fine Print: Always review the contract for specific interest rate details before proceeding with the payday loan application process.

Understanding these terms empowers you to make informed choices, helping you avoid pitfalls and select a loan that suits your financial needs. Remember, being informed is the first step toward financial freedom!

Also Read: What Is the Payday Loan Application Process?

What Happens if You Default on a Payday Loan?

Understanding payday loan contract terms is crucial for anyone considering this type of borrowing. These terms outline your responsibilities and the lender’s expectations. Knowing what happens if you default can save you from unexpected troubles down the road.

When you default on a payday loan, several things can occur. First, the lender may charge you additional fees, making your debt grow larger. Also, they might contact you repeatedly to collect the money owed, which can be stressful.

Key Consequences of Defaulting:

- Credit Score Impact: Defaulting can hurt your credit score, making future loans harder to get.

- Legal Action: In some cases, lenders may take legal action to recover their money.

- Debt Collection: Your debt could be handed over to a collection agency, leading to more aggressive collection tactics.

Understanding the payday loan application process can help you avoid defaulting. Always read the contract terms carefully before signing to ensure you know what you’re getting into.

How to Compare Different Payday Loan Contract Terms

Understanding payday loan contract terms is essential when considering a loan. These terms outline repayment amounts, due dates, and any associated fees. Being informed helps you avoid surprises during the payday loan application process.

To compare payday loan contract terms effectively, focus on these key aspects:

- Interest Rates: Check the annual percentage rate (APR); a lower APR means less money paid back.

- Repayment Period: Review how long you have to repay the loan. Shorter terms may lead to higher payments but less interest overall.

- Fees: Watch for additional fees like origination or late payment penalties, as they can accumulate quickly!

Key Insights

- Always read the fine print to uncover hidden fees.

- Don’t hesitate to ask questions; reputable lenders will clarify any confusing terms.

By understanding and comparing payday loan contract terms, you can make informed financial choices and find a loan that suits your needs without overspending. Knowledge is your best asset in navigating the payday loan landscape!

Can You Negotiate Your Payday Loan Contract?

When it comes to payday loans, understanding the contract terms is crucial. These terms dictate how much you owe, when payments are due, and the interest rates involved. Knowing these details can help you avoid surprises and make informed decisions during the payday loan application process.

Absolutely! Many people don’t realize that payday loan contract terms can be negotiable. Here are some key points to consider:

- Interest Rates: Sometimes, lenders may be willing to lower the interest rate if you ask.

- Payment Plans: You can discuss extending your repayment period to make payments more manageable.

- Fees: Don’t hesitate to inquire about any fees. Some lenders may waive certain charges if you negotiate.

Negotiating can lead to better terms that fit your financial situation, so it’s worth a try! In conclusion, understanding and negotiating your payday loan contract terms can significantly impact your financial health. Always read the fine print and don’t be afraid to ask questions. Remember, the payday loan application process is not just about getting money; it’s about ensuring you can repay it comfortably.

The Role of State Regulations in Payday Loan Contracts

Understanding payday loan contract terms is crucial for anyone considering this type of loan. These contracts can be tricky, and knowing what to look for can save you from unexpected surprises. State regulations play a big role in shaping these terms, so let’s dive into how they affect you.

Each state has its own rules about payday loans. This means that the payday loan contract terms can vary widely depending on where you live. For example, some states limit the amount you can borrow or the fees lenders can charge. This is important because it helps protect borrowers from predatory lending practices.

Key Points to Remember

- Interest Rates: States often cap interest rates, which can help you avoid sky-high fees.

- Loan Amounts: Regulations may limit how much you can borrow, ensuring you don’t take on more debt than you can handle.

- Repayment Terms: Some states require longer repayment periods, giving you more time to pay back the loan without penalties.

Understanding these aspects can make the payday loan application process smoother and less stressful. Always read your contract carefully and know your rights!

How AdvanceCash Can Help You Navigate Payday Loan Contract Terms

Understanding payday loan contract terms is crucial for anyone considering a payday loan. These terms can affect your finances significantly, so knowing what to look for can save you from unexpected pitfalls. At AdvanceCash, we aim to simplify this process for you, ensuring you make informed decisions.

When you apply for a payday loan, the contract outlines your responsibilities and the lender’s obligations. Here’s what you should keep in mind:

- Interest Rates: Always check the interest rates. They can vary widely and affect how much you repay.

- Repayment Terms: Understand when and how you need to repay the loan. Missing payments can lead to extra fees.

- Fees: Look for any hidden fees that might not be obvious at first glance. These can add up quickly!

By using AdvanceCash, you can easily navigate the payday loan application process. We provide resources that break down the contract terms into simple language. This way, you can focus on what matters most—making the best financial choice for your situation. Remember, knowledge is power!

FAQs

⭐ What should I look for in a payday loan contract?

Review the loan amount, interest rate (APR), repayment terms, fees, and penalties. Ensure there are no hidden charges.

⭐ Can I cancel a payday loan after signing the contract?

Some states allow a cooling-off period, usually 24–48 hours, where you can cancel the loan without penalties. Check your lender’s policy.

⭐ What happens if I miss a payment on my payday loan?

Missing a payment can result in late fees, increased interest, collection efforts, or legal action. Some lenders may allow an extension, but this can lead to higher costs.

⭐ Are payday loan contracts legally binding?

Yes, once signed, payday loan contracts are legally binding agreements. Always read and understand the terms before signing.

⭐ Can payday loan terms be negotiated?

Some lenders may offer flexible repayment options or lower fees if you ask. It’s best to discuss terms before signing the contract.

Don’t let financial stress hold you back. AdvanceCash is here to help you secure your payday loan today!

🔗At ExpressCash, we’re here to help guide you through the process and find the right financial solution for your specific situation.