Understanding the Benefits of Payday Loans: A Quick Overview

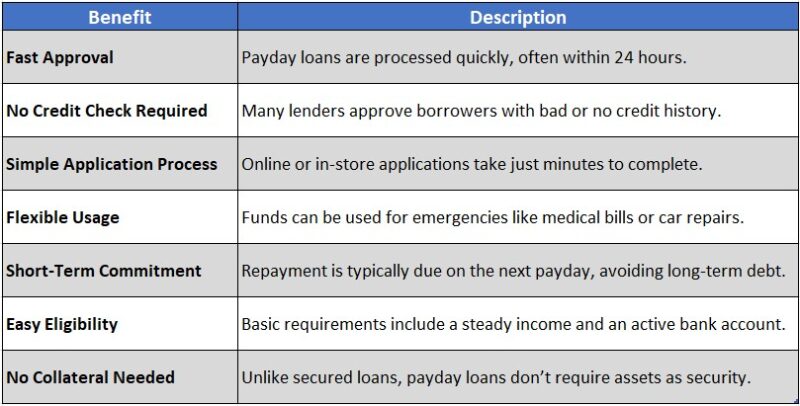

When unexpected expenses arise, understanding the benefits of payday loans can be a lifesaver. These short-term loans offer quick access to cash, making them an appealing option for those in need. But what exactly are the benefits of payday loans? Let’s dive in!

Payday loans are designed for emergencies. You can often receive funds within 24 hours, which is faster than traditional loans. This speed can be crucial when facing urgent bills or unexpected expenses.

Simple Application Process

The payday loan application process is straightforward. Most lenders require minimal documentation, making it easy for anyone to apply. You can often complete the process online, saving you time and hassle.

Flexible Repayment Options

Many payday lenders offer flexible repayment plans. This means you can choose a repayment schedule that fits your budget, helping you avoid additional financial stress.

Need cash fast? AdvanceCash offers quick payday loans to help you cover your expenses!

When unexpected expenses arise, many people find themselves in a tight spot financially. Understanding the benefits of payday loans can help you make informed decisions during these challenging times. These loans can provide immediate financial relief, making them a popular choice for those in need.

Quick Access to Cash

Payday loans are designed to be fast. Once you complete the payday loan application process, you can often receive funds within a day. This speed is crucial when bills are due or emergencies arise.

Simple Application Process

The payday loan application process is straightforward. You typically need to provide proof of income and identification. This simplicity means you can get help without a lengthy wait, allowing you to tackle your financial issues head-on.

Flexible Loan Amounts

Another benefit of payday loans is their flexibility. You can borrow a small amount to cover immediate needs, making it easier to manage your finances without taking on more debt than necessary. This tailored approach can be a lifesaver in tough situations.

Are Payday Loans a Viable Option for Emergency Expenses?

When unexpected expenses arise, many people wonder about their options. One popular choice is payday loans. Understanding the benefits of payday loans can help you decide if they are the right solution for your emergency expenses. Let’s explore why these loans might be a viable option for you.

Quick Access to Cash

One of the biggest benefits of payday loans is the speed at which you can get cash. Unlike traditional loans, which can take days or weeks, payday loans often provide funds within hours. This quick access can be crucial when you need to cover urgent bills or unexpected costs.

Simple Application Process

The payday loan application process is usually straightforward. Most lenders require minimal paperwork, and you can often apply online. This simplicity makes it easier for people to get the help they need without a lot of hassle. Just remember to borrow responsibly!

If you’re facing unexpected bills, AdvanceCash can provide you with the funds you need instantly!

The Accessibility of Payday Loans: No Credit Check Required

When unexpected expenses arise, many people wonder about their options. One popular choice is payday loans. Understanding the benefits of payday loans can help you make informed decisions when you need quick cash. They offer a fast solution, especially when traditional loans seem out of reach.

Quick and Easy Approval

Payday loans are known for their simple application process. Unlike banks, they often don’t require a credit check. This means that even if you have a low credit score, you can still get the money you need quickly.

Fast Cash When You Need It

- Immediate Access: Once approved, funds can be available within hours.

- Flexible Use: You can use the money for anything, from bills to emergencies.

This accessibility makes payday loans a go-to option for many individuals facing financial challenges. The payday loan application process is designed to be straightforward, allowing you to focus on solving your immediate financial needs rather than worrying about lengthy approvals.

Also Read: What Is the Payday Loan Application Process?

Exploring the Flexibility of Payday Loan Repayment Plans

When considering financial options, understanding the benefits of payday loans can be crucial. These loans can provide quick cash when you need it most, helping you manage unexpected expenses. But what makes them particularly appealing is their flexible repayment plans, which can ease the burden of repayment.

Quick Access to Funds

Payday loans often have a simple application process, allowing you to get money fast. This quick access can be a lifesaver during emergencies, like car repairs or medical bills. You can apply online, and many lenders approve applications almost instantly.

Tailored Repayment Options

One of the standout benefits of payday loans is their flexible repayment plans. Unlike traditional loans, you can often choose a repayment schedule that fits your financial situation. This means you can pay back the loan in a way that feels manageable, reducing stress during tough times.

What Makes Payday Loans a Convenient Choice for Borrowers?

When unexpected expenses arise, many people find themselves in a tight spot. Understanding the benefits of payday loans can help you make informed decisions during these challenging times. They offer quick access to cash, making them a popular choice for borrowers who need funds fast.

Quick Access to Funds

One of the biggest benefits of payday loans is the speed at which you can get money. Unlike traditional loans, the payday loan application process is straightforward and often completed online. This means you can have cash in hand within a day or even hours!

Easy Application Process

The payday loan application process is designed to be simple. You typically need to provide basic information like your income and bank details. This ease of access is perfect for those who may not have time for lengthy paperwork or credit checks.

Flexible Repayment Options

Payday loans often come with flexible repayment terms. Borrowers can choose to pay back the loan on their next payday or set up a plan that works better for their budget. This flexibility helps ease the financial burden during tough times.

The Role of Payday Loans in Building Credit History

When discussing the benefits of payday loans, one important aspect to consider is their role in building credit history. Many people may not realize that responsibly using a payday loan can actually help improve your credit score. This is crucial because a good credit score opens doors to better financial opportunities in the future.

Understanding the Payday Loan Application Process

The payday loan application process is typically quick and straightforward. You fill out an application, provide necessary documents, and, if approved, receive funds almost immediately. This speed can be beneficial for those facing unexpected expenses, allowing them to manage their finances effectively while also establishing a positive credit history.

Key Benefits of Payday Loans for Credit Building

- Timely Payments: Making on-time payments can positively impact your credit score.

- Credit Mix: Adding a payday loan to your credit profile can diversify your credit mix, which is favorable for your score.

- Financial Responsibility: Successfully managing a payday loan demonstrates your ability to handle credit responsibly, which lenders appreciate.

How AdvanceCash Can Help You Navigate Payday Loan Options

Understanding the benefits of payday loans can be a game-changer for those facing unexpected expenses. These short-term loans can provide quick cash when you need it most, making them a popular choice for many. But how can you navigate this process effectively? That’s where AdvanceCash comes in!

At

AdvanceCash, we simplify the payday loan application process. Here’s how we can assist you:

- Quick Access to Funds: Payday loans are designed for urgent needs, allowing you to access cash quickly.

- Flexible Terms: Many lenders offer various repayment options, making it easier to find a plan that suits your budget.

- No Credit Check: Most payday loans don’t require a credit check, which is great for those with less-than-perfect credit histories.

With our guidance, you can confidently explore the benefits of payday loans. We provide resources and tips to help you make informed decisions, ensuring you choose the right loan for your situation. Let AdvanceCash be your trusted partner in navigating the world of payday loans!

Weighing the Pros and Cons: Are the Benefits of Payday Loans Worth It?

When considering financial options, understanding the benefits of payday loans is crucial. These loans can provide quick cash in emergencies, making them a popular choice for many. But are they really worth it? Let’s explore the pros and cons together.

Quick Access to Funds

One of the main

benefits of payday loans is their speed. Unlike traditional loans, the payday loan application process is often straightforward and can be completed online. This means you can get money in your account within a day, helping you tackle urgent expenses like bills or car repairs.

No Credit Check Required

Another advantage is that payday loans typically don’t require a credit check. This makes them accessible for individuals with poor credit scores. You can get the funds you need without worrying about your credit history, which is a huge relief for many.

Simple Application Process

The payday loan application process is designed to be simple. Most lenders only require basic information, such as proof of income and identification. This ease of access can be a lifesaver when you’re in a tight spot.

FAQs

⭐ What are the main benefits of payday loans?

Payday loans offer fast approval, quick access to cash, and minimal credit requirements, making them useful for emergency expenses when traditional loans aren’t an option.

⭐ How fast can I get money from a payday loan?

Many payday lenders offer same-day or next-day funding, making it one of the fastest borrowing options available.

⭐ Do payday loans require good credit?

No, most payday lenders do not require a good credit score. They focus on income verification rather than credit history.

⭐ Can payday loans help with short-term financial emergencies?

Yes, payday loans are designed for urgent needs like medical bills, car repairs, or rent payments, providing quick financial relief.

⭐ Are payday loans easy to qualify for?

Yes, the requirements are simple—you usually need proof of income, an active bank account, and a valid ID to qualify.

Don’t let financial stress hold you back. AdvanceCash is here to help you secure your payday loan today!

🔗At

ExpressCash, we’re here to help guide you through the process and find the right financial solution for your specific situation.