Understanding Payday Loan APR Calculation is essential for anyone considering this type of loan. It reveals the true cost of borrowing money quickly and helps you avoid unexpected financial surprises. Knowing the APR, or Annual Percentage Rate, is key to making informed decisions.

What is APR?

APR stands for Annual Percentage Rate, indicating how much interest you’ll pay over a year. For payday loans, this rate can be quite high, making it vital to understand its calculation.

How is Payday Loan APR Calculated?

The calculation involves a few simple steps:

- Loan Amount: The total money you borrow.

- Interest Rate: The percentage charged for borrowing.

- Loan Term: The repayment duration, usually a few weeks.

- Total Interest Paid: The interest paid over the loan term.

Understanding these factors allows you to compare loans effectively. The higher the APR, the more you’ll pay!

Why Does It Matter?

Grasping Payday Loan APR Calculation enables you to choose a loan that fits your budget. Always read the fine print and ask questions to ensure clarity. This knowledge empowers you to borrow wisely!

Need cash fast? AdvanceCash offers quick payday loans to help you cover your expenses!

Why is APR Important in Payday Loans?

Understanding the Payday Loan APR Calculation is crucial for anyone considering a payday loan. APR, or Annual Percentage Rate, reflects the total cost of borrowing, including interest and fees. Knowing how it works can help you make informed decisions and avoid unexpected costs.

Clarity on Costs

When you see a payday loan’s APR, it gives you a clear picture of what you’ll pay over time. This is essential because payday loan interest rates can be quite high. By understanding the APR, you can compare different loans and choose the best option for your situation.

Budgeting Better

Knowing the APR helps you budget effectively. If you understand how much you’ll owe, you can plan your repayments better. This way, you can avoid falling into a cycle of debt, which is a common issue with payday loans. Remember, knowledge is power!

How to Calculate Your Payday Loan APR: A Step-by-Step Guide

Understanding how to calculate your Payday Loan APR is crucial for making informed financial decisions. It helps you see the true cost of borrowing and ensures you don’t get caught off guard by high interest rates. Let’s break it down step-by-step!

Step 1: Know Your Loan Amount and Fees

Start by identifying the total amount you plan to borrow. Next, add any fees associated with the loan. This total will be essential for your APR calculation.

Step 2: Calculate the Interest

Payday Loan interest rates can be steep. To find the interest, multiply your loan amount by the interest rate (expressed as a decimal). For example, if you borrow $500 at a 15% interest rate, your interest would be $75.

Step 3: Find the APR

To find the APR, use this formula: (Total Interest + Fees) / Loan Amount x 100. This gives you a percentage that reflects the annual cost of your loan. Remember, understanding Payday Loan Interest Rates Explained can help you avoid costly mistakes!

If you’re facing unexpected bills, AdvanceCash can provide you with the funds you need instantly!

Common Misconceptions About Payday Loan APR Calculation

Understanding Payday Loan APR Calculation is essential for anyone considering a payday loan. Many borrowers overlook how the Annual Percentage Rate (APR) affects their finances. Knowing the APR enables informed decisions and helps avoid unexpected costs.

1. APR is Just a Number

APR is not just a number; it represents the total cost of borrowing, including interest and fees. This means the APR provides a clearer picture of what you’ll ultimately pay back.

2. All Payday Loans Have the Same APR

It’s a misconception that all payday loans have similar interest rates. In fact, Payday Loan Interest Rates Explained indicates that rates can vary widely among lenders. Always compare options to find the best deal.

3. APR is the Only Factor to Consider

Some borrowers focus only on APR, but it’s crucial to consider repayment terms and fees as well. A lower APR doesn’t always mean a better deal if fees are high. Always evaluate the complete picture before making a decision.

Also Read: What Is the Payday Loan Application Process?

What Factors Influence Your Payday Loan APR?

Understanding the factors that influence your Payday Loan APR Calculation is essential for making informed borrowing decisions. Knowing how interest rates work helps you avoid surprises and select the best loan for your needs.

1. Loan Amount

The amount you borrow significantly impacts your Payday Loan Interest Rates Explained. Larger loans often come with higher APRs due to increased lender risk, so consider how much you truly need!

2. Loan Term

The repayment period also affects your APR. Shorter terms typically result in higher rates, as lenders prefer quick returns on their money, leading to steeper interest rates.

3. Your Credit Score

Your credit score acts as a report card for your borrowing habits. A higher score usually means lower APRs, while a lower score can lead to higher rates. Always check your score before applying!

4. Lender Policies

Lender policies vary, with some offering competitive rates and others charging more. It’s crucial to shop around and compare offers to secure the best deal for your situation.

Comparing Payday Loan APRs: What You Need to Know

Calculating the APR on payday loans is essential for anyone considering this type of borrowing. The Payday Loan APR Calculation reveals the true cost of borrowing, often hidden in fine print. Understanding this can save you money and prevent unexpected financial issues.

What is APR?

APR, or Annual Percentage Rate, indicates the total cost of borrowing over a year, including interest and fees. This makes it easier to compare payday loan options effectively.

Why It Matters

- Transparency: Knowing the APR clarifies what you’re actually paying.

- Comparison: Different lenders may have varying APRs, so it’s crucial to shop around.

- Budgeting: Understanding your loan’s APR aids in planning repayments better.

When examining payday loan interest rates, remember that a higher APR results in more interest paid. Always read the terms carefully and calculate the total cost before signing any agreement. This approach helps you make informed decisions and avoid falling into a debt trap.

The Impact of APR on Your Overall Loan Cost

Understanding the impact of APR on your payday loan is crucial. The Payday Loan APR Calculation determines how much you’ll ultimately pay back. This number can significantly affect your finances, especially if you’re already in a tight spot. Knowing how it works can help you make better decisions.

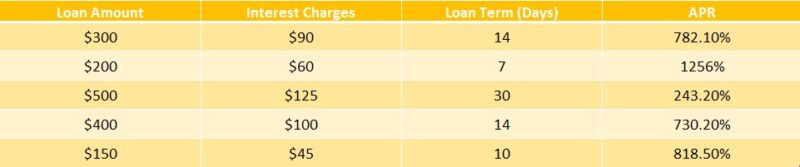

When you borrow money through a payday loan, the payday loan interest rates explained often come with high APRs. This means that for every dollar you borrow, you might end up paying back much more. Here’s how it breaks down:

Key Points to Remember:

- High Costs: A higher APR means more money out of your pocket.

- Short-Term Loans: Payday loans are usually short-term, but the APR can still be steep.

- Budget Wisely: Always calculate the total cost before borrowing.

Understanding these factors can help you avoid financial pitfalls and choose the right loan for your needs.

How AdvanceCash Can Help You Navigate Payday Loan APRs

Understanding how payday loan APR calculation works is crucial for anyone considering this type of loan. It can help you make informed decisions and avoid unexpected costs. At AdvanceCash, we simplify the complex world of payday loan interest rates, ensuring you know exactly what you’re getting into.

When you visit AdvanceCash, you’ll find resources that break down payday loan interest rates explained. We provide clear examples and easy-to-follow guides that demystify APR calculations. Here’s how we can assist you:

- Simple Calculators: Use our online tools to estimate your potential costs.

- Clear Definitions: We explain terms like APR and interest rates in plain language.

- Helpful Articles: Our blog features tips on managing loans and understanding repayment terms.

By using AdvanceCash, you gain access to valuable insights that can save you money. We believe that knowledge is power, especially when it comes to financial decisions. With our help, you can confidently navigate payday loans and make choices that suit your needs.

Tips for Finding the Best Payday Loan APR

Understanding how to calculate the APR on payday loans is crucial for making informed financial decisions. The Payday Loan APR Calculation helps you see the true cost of borrowing, including interest and fees. This knowledge empowers you to choose the best loan option for your needs.

Compare Different Lenders

- Research multiple lenders: Not all payday loan providers offer the same interest rates. Take time to compare their APRs.

- Read reviews: Customer feedback can reveal a lot about a lender’s reliability and transparency.

Understand the Terms

- Ask about fees: Some lenders may have hidden fees that can increase your overall cost.

- Clarify repayment terms: Knowing when and how you need to repay the loan can help you avoid additional charges.

By following these tips, you can navigate the world of payday loans more effectively. Remember, understanding Payday Loan Interest Rates Explained is key to finding a loan that won’t break the bank.

Frequently Asked Questions About Payday Loan APR Calculation

-

How is the APR for a payday loan calculated?

The Annual Percentage Rate (APR) is calculated by converting the loan’s fees into an annualized rate using the formula:

APR = (Loan Fee / Loan Amount) × 365 / Loan Term in Days × 100 -

Why is the APR for payday loans so high?

Payday loans have short repayment periods (typically two weeks), so when their fees are annualized, the APR appears extremely high—often 200% to 600% or more. -

What is an example of a payday loan APR calculation?

If you borrow $300 with a $45 fee for 14 days, the APR would be:

APR = (45 / 300) × (365 / 14) × 100 = 391.07% -

Does a high APR mean I’m paying that much interest?

No, the APR reflects the cost of borrowing on an annual basis. Since payday loans are short-term, the actual dollar amount paid may be lower, but the effective cost is still high. -

How can I lower the APR on a payday loan?

Alternatives like installment loans, credit union loans, or negotiating better terms with lenders can help reduce borrowing costs.

Don’t let financial stress hold you back. AdvanceCash is here to help you secure your payday loan today!

🔗At ExpressCash, we’re here to help guide you through the process and find the right financial solution for your specific situation.