Understanding Loan Amounts for Payday Loans: What You Need to Know

Understanding how much you can borrow with a payday loan is crucial for making informed financial decisions. Payday loans can provide quick cash for urgent needs, but knowing the loan amounts for payday loans is essential for responsible borrowing.

- Income Level: Your monthly income significantly impacts how much you can borrow.

- State Regulations: Laws vary by state, affecting the maximum loan amount available.

- Lender Policies: Different lenders have unique criteria, so it’s beneficial to compare options.

Typical Loan Amounts

Payday loans typically range from $100 to $1,000, depending on your financial situation and lender policies. During the payday loan application process, be ready to share details about your income and expenses to assess your eligibility. In summary, understanding payday loan amounts is vital for responsible borrowing. Always evaluate your ability to repay on time to avoid debt cycles. While payday loans can be useful, they should be approached with caution.

Need cash fast? AdvanceCash offers quick payday loans to help you cover your expenses!

How Much Can You Really Borrow with Payday Loans?

When considering a payday loan, a common question is, “How much can I really borrow?” Knowing the loan amounts for payday loans is essential for effective financial planning. These loans can provide quick cash for unexpected expenses, but understanding the limits can help you avoid pitfalls.

Typical Loan Amounts for Payday Loans

Payday loans typically range from $100 to $1,000. The specific amount you can borrow often depends on your income and the lender’s policies. While these loans are accessible, they come with high-interest rates, so it’s important to borrow wisely.

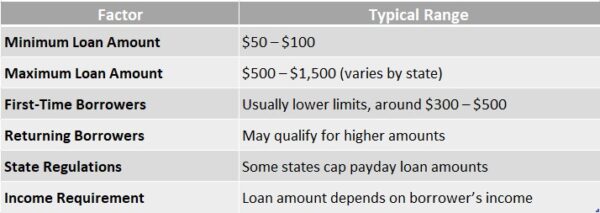

Factors Influencing Your Loan Amount

- Income Level: Lenders assess your income to determine your borrowing capacity.

- State Regulations: Laws vary by state, affecting the maximum loan amount.

- Credit History: Although many payday loans don’t require a credit check, your financial history can still impact your limit.

Understanding the payday loan application process is also beneficial. Always read the terms carefully before making a commitment!

Factors Influencing Your Payday Loan Amount

When considering a payday loan, understanding how much you can borrow is crucial. This amount can significantly impact your financial situation, especially if you’re facing an unexpected expense. Knowing the factors that influence loan amounts for payday loans can help you make informed decisions.

Your Income Level

Your income plays a big role in determining your loan amount. Lenders typically want to ensure you can repay the loan. Higher income often means you can borrow more, while lower income may limit your options.

State Regulations

Different states have various laws regarding payday loans. Some states cap the maximum loan amounts, which can affect how much you can borrow. Always check your local regulations before applying!

Lender Policies

Each lender has its own criteria. Some may offer higher loan amounts based on your credit history or repayment ability. During the payday loan application process, be prepared to provide information that can influence your loan amount.

If you’re facing unexpected bills, AdvanceCash can provide you with the funds you need instantly!

The Maximum Limits: What to Expect from Payday Loans

Understanding how much you can borrow with a payday loan is essential for effective financial planning. It helps you avoid taking on more debt than you can manage. Let’s look at the maximum limits and what to expect during the payday loan application process.

Typical Loan Amounts for Payday Loans

Payday loans typically range from $100 to $1,000. The exact amount you can borrow depends on your income and the lender’s policies. Here are some important points:

- Income-Based Limits: Lenders assess your income to determine your borrowing capacity. Higher earnings usually mean a higher loan amount.

- State Regulations: Maximum loan amounts can vary by state, so it’s important to check local laws before applying.

The Payday Loan Application Process

The application process for payday loans is generally simple. You complete a form, provide proof of income, and sometimes your credit history. This quick process can get you funds fast, but always remember to borrow responsibly!

Also Read: What Is the Payday Loan Application Process?

Comparing Loan Amounts for Payday Loans Across Different States

When considering how much you can borrow with payday loans, it’s essential to understand that the loan amounts can vary significantly from state to state. This variation can impact your financial decisions, especially if you’re in a tight spot and need quick cash. Knowing the limits can help you plan better and avoid surprises during the payday loan application process.

State Limits

- California: You can borrow up to $300.

- Texas: The maximum loan amount is $1,500.

- New York: Borrowers can access up to $600.

These differences can affect how much you can rely on payday loans in emergencies. It’s crucial to check your state’s regulations before applying.

Why It Matters

Understanding the loan amounts for payday loans helps you gauge your options. If you know your state’s limits, you can make informed choices and avoid falling into a cycle of debt. Always remember to read the terms carefully before signing any agreement!

Are Payday Loans Worth the Risk? Analyzing Loan Amounts and Costs

When considering a payday loan, understanding how much you can borrow is crucial. This knowledge helps you make informed decisions and avoid potential pitfalls. Payday loans can be tempting, especially when you’re in a financial bind, but knowing the loan amounts for payday loans can save you from future headaches.

What Can You Expect to Borrow?

Typically, payday loans range from $100 to $1,000, depending on your income and state regulations. Lenders assess your financial situation during the payday loan application process, which influences the amount you can receive. Remember, borrowing more means higher repayment costs!

Key Considerations

- Loan Amounts for Payday Loans: Most lenders cap the amount based on your income.

- Repayment Terms: Be aware of the repayment period, usually two to four weeks.

- Interest Rates: These can be steep, so calculate the total cost before borrowing.

In conclusion, while payday loans can provide quick cash, understanding the loan amounts and associated costs is essential for making a wise choice.

How to Determine the Right Loan Amount for Your Needs

When considering a payday loan, understanding how much you can borrow is crucial. This knowledge helps you make informed decisions and avoid financial pitfalls. The right loan amount can ease your financial stress, but borrowing too much can lead to more trouble. Let’s explore how to determine the right loan amount for your needs.

Assess Your Financial Situation

Start by evaluating your current financial situation. Ask yourself:

- What expenses do I need to cover?

- How much can I repay by my next payday?

This self-assessment will guide you in choosing appropriate loan amounts for payday loans that fit your budget.

Understand the Payday Loan Application Process

Next, familiarize yourself with the payday loan application process. Lenders typically offer amounts ranging from $100 to $1,000. However, your income and repayment ability will influence the final amount. Be honest about your financial capabilities to avoid borrowing more than you can handle.

The Role of Income in Deciding Your Payday Loan Amount

When determining how much you can borrow with payday loans, your income plays a vital role. Lenders evaluate your earnings to decide the loan amounts for payday loans you qualify for, making your paycheck a key factor in the payday loan application process.

How Income Affects Your Loan Amount

Your income significantly impacts your borrowing capacity. Consider these points:

- Stable Income: Lenders favor borrowers with consistent income, indicating reliability.

- Income Level: Higher earnings can lead to larger loan amounts, while lower income may restrict options.

- Employment Status: Full-time employment often results in better loan terms than part-time or temporary jobs.

Other Factors to Consider

In addition to income, other factors are important:

- Credit History: A strong credit score can improve your borrowing potential.

- Existing Debts: Lenders assess your current financial obligations to ensure you can handle more debt.

- Loan Purpose: The reason for the loan can also affect the amount you can borrow.

Understanding these factors will help you navigate the payday loan process more effectively.

Exploring Alternatives: Other Loan Options Beyond Payday Loans

When considering payday loans, it’s crucial to understand their limits and explore alternatives. These loans typically come with high interest rates and short repayment terms, which can trap borrowers in a cycle of debt. Knowing your options can lead to better financial choices.

Other Loan Options

- Personal Loans: These often provide higher amounts and longer repayment terms, making them a better choice for those needing more time.

- Credit Unions: Many offer small loans with lower interest rates, making them more affordable than payday loans.

- Installment Loans: These allow repayment in smaller, manageable installments over time, unlike payday loans.

Understanding the Payday Loan Application Process

The payday loan application process is quick and straightforward. You fill out a form, provide proof of income, and usually receive funds within a day. However, payday loans typically range from $100 to $1,000. Always consider other options before committing!

How AdvanceCash Can Help You Navigate Payday Loan Amounts

Understanding how much you can borrow with payday loans is crucial. It helps you plan your finances better and avoid surprises. Knowing the loan amounts for payday loans can empower you to make informed decisions when you need quick cash.

Key Insights on Loan Amounts

- Typical Ranges: Most payday loans range from $100 to $1,000, depending on your income and state regulations.

- Factors Influencing Amounts: Your income, credit history, and the lender’s policies play a big role in determining how much you can borrow.

The Payday Loan Application Process

Applying for a payday loan is straightforward. You fill out a simple application, providing details like your income and bank information. This process helps lenders assess your eligibility and decide on the loan amount you can receive. With AdvanceCash, you can easily navigate this process and find the best options for your needs.

FAQs

⭐ What is the typical loan amount for a payday loan?

Payday loans typically range from $100 to $1,500, depending on state regulations and lender policies.

⭐ Can I borrow more than the standard payday loan limit?

Some states allow higher loan amounts, but lenders often cap loans based on income and repayment ability.

⭐ How is my payday loan amount determined?

Lenders consider your income, employment status, state regulations, and repayment ability to determine the approved amount.

⭐ Are there limits on payday loan amounts by state?

Yes, each state sets legal maximum loan amounts. Some states restrict payday loans entirely, while others impose caps.

⭐ Can I increase my payday loan amount after approval?

Most lenders do not allow increases after approval, but you may be able to apply for a new loan after repaying the first one.

Don’t let financial stress hold you back. AdvanceCash is here to help you secure your payday loan today!

🔗At ExpressCash, we’re here to help guide you through the process and find the right financial solution for your specific situation.