When you’re relying on government income, understanding how payday lenders for benefits work can be crucial. Many people wonder if they can qualify for a payday loan when their income comes from sources like Social Security or disability benefits. This knowledge can help you make informed financial decisions during tough times.

Can You Qualify?

Yes, you can qualify for payday loan lenders & locations even if your income is from government benefits. Lenders often consider your total income, which includes benefits, when assessing your application. However, it’s essential to check with individual lenders, as requirements may vary.

Key Considerations

- Income Verification: Be prepared to show proof of your government income.

- Loan Amounts: Understand that the amount you can borrow may depend on your income level.

- Repayment Terms: Always read the terms carefully to avoid unexpected fees.

By knowing these factors, you can navigate the world of payday lenders for benefits more confidently.

Need cash fast? AdvanceCash offers quick payday loans to help you cover your expenses!

Can You Qualify for Payday Loans on Government Income?

When unexpected expenses arise, many people wonder if they can turn to payday lenders for benefits. This is especially true for those relying on government income. Understanding how payday loans work can help you make informed decisions during tough financial times.

Understanding Eligibility

Payday loan lenders often consider various sources of income, including government benefits. If you receive Social Security, disability payments, or unemployment benefits, you might still qualify for a payday loan. Here’s what to keep in mind:

- Proof of Income: You’ll need to show documentation of your government income. This could be a benefits statement or bank statements showing regular deposits.

- Loan Amounts: The amount you can borrow may depend on your income level. Lenders typically offer loans that are a percentage of your income.

Benefits of Using Payday Lenders for Benefits

Using payday lenders can provide quick cash when you need it most. Here are some benefits:

- Fast Approval: Many lenders offer quick approvals, sometimes within hours.

- No Credit Check: Most payday lenders don’t require a credit check, making it easier for those with low credit scores to qualify.

The Pros and Cons of Using Payday Lenders for Benefits

When facing financial difficulties, payday lenders for benefits may appear to be a quick solution. However, if you depend on government income, qualifying can be a concern. It’s vital to understand the pros and cons of payday loan lenders before proceeding.

The Pros of Using Payday Lenders for Benefits

- Quick Access to Cash: They offer fast cash, which can be crucial in emergencies.

- No Credit Check: Many lenders don’t check credit scores, making it easier for those on government income to qualify.

- Flexible Locations: Payday loan lenders & locations are widely available, providing convenient access to funds.

The Cons of Using Payday Lenders for Benefits

- High Interest Rates: Borrowing costs can be high, potentially leading to a debt cycle.

- Short Repayment Terms: Quick repayment can be challenging for those with limited income.

- Risk of Over-Borrowing: It’s easy to borrow more than you can repay, especially in tough times.

In summary, while payday lenders for benefits can offer immediate assistance, it’s crucial to carefully consider these advantages and disadvantages.

If you’re facing unexpected bills, AdvanceCash can provide you with the funds you need instantly!

Essential Criteria for Qualifying for Payday Loans

When unexpected expenses arise, many people turn to payday lenders for benefits. But can you qualify for a payday loan if you rely on government income? Understanding the essential criteria can help you navigate this financial option more effectively.

Income Verification

To qualify for payday loans, lenders typically require proof of income. If you receive government benefits, such as Social Security or unemployment, you can use these as your income source. Just be ready to provide documentation!

Age and Residency Requirements

Most payday loan lenders have specific age and residency requirements. Generally, you must be at least 18 years old and a resident of the state where you’re applying. Check local laws, as they can vary significantly!

Employment Status

While some payday lenders for benefits may not require a traditional job, having a steady source of government income can strengthen your application. It shows lenders that you have a reliable way to repay the loan.

Also Read: Payday Loan Lenders & Locations: Where to Apply Near You

How Government Benefits Impact Your Loan Eligibility

When life gets tough, many people consider payday lenders for benefits. But can you qualify for a loan if your income comes from government assistance? Understanding this is crucial for your financial decisions.

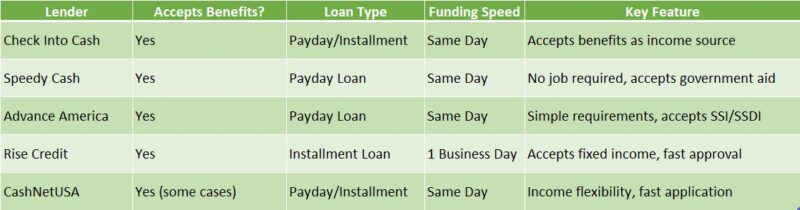

Many payday loan lenders & locations accept government benefits as valid income. If you receive Social Security, unemployment, or disability payments, you might qualify for a loan. Here’s what to know:

- Stable Income: Government benefits provide steady income, which lenders view positively.

- Documentation: Be ready to show proof of your benefits, like bank statements or award letters.

- Loan Amounts: The amount you can borrow may depend on your benefit amount, so know your numbers.

Understanding Your Options

If you rely on government benefits, payday lenders can be a viable option. They aim to help you through financial challenges.

Key Considerations

Before applying, consider these points:

- Interest Rates: Payday loans can have high-interest rates, so read the fine print.

- Repayment Terms: Understand repayment timelines and consequences for missed payments.

- Alternatives: Look into credit unions or community assistance programs for potentially better terms.

Exploring Alternatives to Payday Lenders for Benefits

When facing financial challenges, many people consider payday lenders for benefits. But can you qualify if you rely on government income? Understanding your options is crucial, especially when unexpected expenses arise. Let’s explore some alternatives that might be more suitable for your situation.

Understanding Your Options

If you’re on government assistance, payday loan lenders may not be your best choice. These lenders often charge high fees and interest rates. Instead, consider these alternatives:

- Credit Unions: Many credit unions offer small loans with lower interest rates. They often have programs specifically for those on government benefits.

- Community Assistance Programs: Local charities or non-profits may provide financial help or emergency funds.

- Payment Plans: Some service providers allow you to set up payment plans, easing the burden of immediate costs.

By exploring these options, you can find a solution that better fits your financial situation without the risks associated with payday loans.

Tips for Responsible Borrowing from Payday Lenders

When considering payday lenders for benefits, it’s essential to understand how government income can play a role in your eligibility. Many people rely on government assistance, and knowing your options can help you make informed financial decisions. Let’s explore how you can responsibly borrow from payday loan lenders and what to keep in mind.

Understand Your Eligibility

Before applying, check if payday loan lenders accept government income. Many do, but requirements can vary. Make sure to have your documentation ready, such as proof of income and identification. This will help streamline the process and increase your chances of approval.

Tips for Responsible Borrowing

- Borrow only what you need: Avoid taking out more than necessary to minimize repayment stress.

- Read the fine print: Understand the terms and conditions, including interest rates and repayment schedules.

- Plan your repayment: Ensure you have a strategy to pay back the loan on time to avoid additional fees.

By following these tips, you can navigate the world of payday lenders for benefits more effectively and make choices that support your financial well-being.

How AdvanceCash Can Help You Navigate Payday Lending

Navigating the world of payday lenders can be tricky, especially if you’re relying on government income. Understanding how payday lenders for benefits work is crucial for those who need quick cash but are unsure if they qualify. This is where AdvanceCash comes in, helping you find the right options tailored to your situation.

At AdvanceCash, we simplify the process of finding payday loan lenders & locations that cater specifically to individuals on government assistance. We provide resources and guidance to help you understand your eligibility and the steps to take.

Key Insights:

- Eligibility: Many payday lenders accept government income, making it easier for you to qualify.

- Quick Access: You can often get funds quickly, which is essential during emergencies.

- Local Options: We help you find payday loan lenders & locations near you, ensuring convenience and accessibility.

With our user-friendly platform, you can explore various payday lenders for benefits without the stress. We aim to empower you with the knowledge you need to make informed decisions about your financial future. Remember, you’re not alone in this journey!

Common Misconceptions About Payday Loans and Government Income

When it comes to payday lenders for benefits, many people have questions about whether they can qualify for a loan if they rely on government income. Understanding this topic is crucial, especially for those who may need quick cash to cover unexpected expenses. Let’s clear up some common misconceptions surrounding payday loans and government income.

Misconception 1: You Can’t Qualify with Government Income

Many believe that payday loan lenders won’t accept government income as a valid source for loan qualification. However, this isn’t entirely true. Many payday lenders for benefits do consider government assistance, such as Social Security or disability payments, as a reliable income source.

Misconception 2: All Payday Loan Lenders Are the Same

It’s important to note that not all payday loan lenders have the same criteria. Some may be more flexible and willing to work with individuals on government income. Researching different payday loan lenders & locations can help you find one that suits your needs.

FAQs

🔹 Can I get a payday loan if I’m on government benefits?

Yes, some payday lenders accept benefits as a form of income, such as Social Security, disability, or unemployment.

🔹 Do lenders treat benefits the same as employment income?

Many lenders consider regular benefit payments as stable income, but you may need to meet a minimum monthly amount.

🔹 Are there special payday loans for people on benefits?

Some lenders specialize in offering loans to benefit recipients, often with lower loan amounts and flexible terms.

🔹 Will receiving benefits affect my loan approval?

Not necessarily—approval depends on your ability to repay, not the source of your income.

🔹 What should I watch out for when borrowing on benefits?

Avoid lenders with high fees or misleading terms. Always compare offers and check for hidden costs.

Don’t let financial stress hold you back. AdvanceCash is here to help you secure your payday loan today!

🔗At ExpressCash, we’re here to help guide you through the process and find the right financial solution for your specific situation.