When unexpected expenses arise, many people ask, “Can you get an online payday loan no credit check?” This is especially important for those with poor or no credit history. Knowing how these loans work can help you make better financial choices and avoid issues.

What is an Online Payday Loan?

An online payday loan is a quick, short-term borrowing option designed for urgent financial needs. However, it’s essential to understand the specific terms and conditions associated with these loans.

Loan Approval & Credit Requirements

- No Credit Check: Many lenders provide online payday loans without checking your credit score, which is helpful for those with low or no credit.

- Income Verification: Lenders usually require proof of income to ensure repayment capability instead of focusing on credit scores.

- Quick Approval: The application process is typically fast, with funds often deposited within a day.

Be cautious, though, as these loans can come with high fees and interest rates.

Need cash fast? AdvanceCash offers quick payday loans to help you cover your expenses!

Can You Really Get an Online Payday Loan No Credit Check?

When unexpected expenses arise, many people ask, “Can you really get an online payday loan no credit check?” This question is vital for those with poor credit histories seeking financial relief without the usual loan stress.

Although appealing, obtaining an online payday loan no credit check can be complicated. Many lenders still evaluate your income and other factors, even without checking your credit score. Here are some key insights:

Key Insights:

- Loan Approval & Credit Requirements: Lenders often prioritize your repayment ability over your credit score.

- Income Verification: Proof of income is typically required for approval.

- Interest Rates: Expect higher interest rates on loans without credit checks, so always read the fine print!

In summary, while online payday loans without credit checks are available, it’s crucial to understand the terms and ensure you can manage repayments to avoid debt cycles.

The Pros and Cons of No Credit Check Payday Loans

When unexpected expenses arise, many ask, “Can you get an online payday loan no credit check?” This question is vital for those with imperfect credit histories. Knowing the pros and cons helps you make better financial choices.

The Pros of No Credit Check Payday Loans

- Quick Access to Cash: These loans usually offer fast approval, helping you manage urgent bills or emergencies.

- Less Impact on Credit: With no credit check, your credit score remains unaffected, which is reassuring for those concerned about their credit history.

The Cons of No Credit Check Payday Loans

- Higher Interest Rates: These loans often come with high fees, making them costly over time.

- Debt Cycle Risk: Without careful planning, you may need another loan to cover the first, creating a cycle of debt.

In conclusion, while an online payday loan no credit check can provide quick relief, it’s crucial to consider the Loan Approval & Credit Requirements and the potential financial risks involved.

If you’re facing unexpected bills, AdvanceCash can provide you with the funds you need instantly!

How to Apply for an Online Payday Loan Without a Credit Check

An online payday loan no credit check can be a lifesaver during unexpected financial emergencies. Many individuals stress over their credit scores, but there are options that don’t require extensive credit history checks. Knowing how to apply for these loans can simplify your financial challenges.

1. Find a Reputable Lender

Begin by researching lenders that provide online payday loans without credit checks. Check reviews and ratings to ensure they are reliable, which is essential to avoid scams and secure fair terms.

2. Gather Your Information

Before applying, prepare necessary documents such as proof of income, identification, and bank details. Lenders typically prioritize your income over your credit history, so having this information ready can expedite the process.

3. Complete the Application

Fill out the lender’s online application form honestly regarding your financial situation. Many lenders will evaluate your Loan Approval & Credit Requirements based on your income and repayment ability, rather than your credit score.

Also Read: Loan Approval & Credit Requirements for Payday Loans

What to Expect During the Application Process

When facing financial difficulties, an online payday loan no credit check can feel like a quick solution. Knowing the application process can ease your worries about borrowing money.

Simple Steps to Apply

- Fill Out the Application: Provide basic details like your name, address, and income online in just a few minutes.

- Submit Your Documents: Be ready to show proof of income or ID; this is a normal requirement.

- Loan Approval & Credit Requirements: These loans skip the credit check, allowing for faster approval, though lenders will assess your income to ensure repayment capability.

Quick Approval Times

After submitting your application, many lenders respond within hours. If approved, funds can be in your account by the next business day, making online payday loans no credit check a speedy option!

Are No Credit Check Payday Loans Safe and Legitimate?

When considering financial options, many people wonder, “Can you get an online payday loan no credit check?” This question is crucial because it opens doors for those who might struggle with traditional loan requirements. Understanding the safety and legitimacy of these loans can help you make informed decisions.

What to Know About Safety

While online payday loans no credit check can be convenient, it’s essential to research lenders. Some may charge high fees or have hidden terms. Always check reviews and ensure the lender is licensed in your state.

Key Points to Consider:

- Loan Approval & Credit Requirements: Many lenders focus on your income rather than your credit score. This can be a relief for those with poor credit history.

- Transparency: Legitimate lenders will provide clear information about fees and repayment terms. If something seems off, trust your instincts and look elsewhere.

Alternatives to Online Payday Loans with No Credit Check

Many people ask, “Can you get an online payday loan no credit check?” This question is important as it reveals the difficulties faced by those needing quick cash with poor credit. Fortunately, there are alternatives that can provide help without the hassle of credit checks.

Personal Installment Loans

- Flexible Payments: These loans allow repayment over time, unlike payday loans.

- Lower Interest Rates: They typically offer better rates, making them more affordable.

Credit Unions

- Member Benefits: Members may qualify for small loans with fewer requirements.

- Community Focused: They often consider your overall financial situation, not just your credit score.

Peer-to-Peer Lending

- Direct Borrowing: Borrow from individuals instead of banks.

- Varied Terms: Terms can be more flexible, and some lenders may overlook bad credit.

Exploring these options can lead to better financial choices without the burden of high-interest payday loans. Understanding loan approval & credit requirements is essential for finding the right solution.

How AdvanceCash.com Can Help You Find the Right Loan

When you’re in a tight spot financially, the question often arises: Can you get an online payday loan no credit check? This is crucial because many people worry that their credit history will hold them back. Understanding your options can make a big difference in your financial journey.

At AdvanceCash.com, we simplify the process of finding the right loan for you. We connect you with lenders who offer online payday loans with no credit check, making it easier to get the funds you need. Here’s how we can assist you:

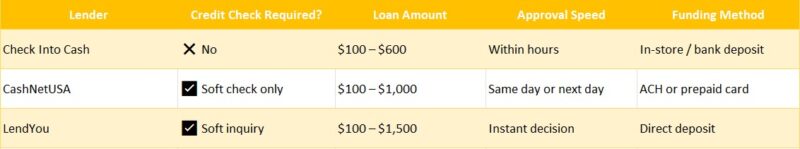

- Quick Comparisons: We provide a list of lenders, so you can easily compare rates and terms.

- Simple Application Process: Our platform guides you through the application, ensuring you meet loan approval & credit requirements without hassle.

- Expert Guidance: Our team is here to answer your questions and help you understand your options.

Tips for Managing Your Finances After Taking a Payday Loan

When considering an online payday loan no credit check, it’s essential to plan how to manage your finances afterward. These loans can be appealing in emergencies, but handling your money wisely post-loan is vital for your financial health.

- Create a Budget: List your income and expenses to understand where your money goes and how much you can allocate for loan repayment.

- Prioritize Loan Repayment: Focus on paying off your payday loan first to avoid accumulating extra fees and interest.

- Avoid New Debt: Steer clear of taking on additional loans while repaying your payday loan. Concentrate on managing your current debt to prevent a borrowing cycle.

By following these strategies, you can effectively manage the challenges of an online payday loan no credit check. Additionally, being aware of loan approval & credit requirements will help you make better financial decisions in the future. Stay proactive and keep your finances on track!

Frequently Asked Questions About Online Payday Loans No Credit Check

💻 Can I really get an online payday loan with no credit check?

Yes. Some lenders offer no traditional credit check payday loans, meaning they don’t pull reports from major bureaus like Experian or TransUnion. Instead, they verify your income and banking history to approve you.

🧾 What do I need to qualify for a no credit check payday loan?

Typically, you’ll need:

-

Proof of income (job, benefits, or gig work)

-

An active checking or savings account

-

A valid ID and U.S. residency

-

Be 18 years or older

📆 How fast can I get the money?

Most online payday lenders offer same-day or next-business-day deposits, especially if you apply early in the day and your bank supports fast transfers.

⚠️ Are no credit check payday loans safe?

They can be safe if you use a licensed, reputable lender. Avoid unverified sites or lenders who ask for upfront fees. Always check the terms, fees, and repayment schedule before accepting an offer.

📉 Do no credit check loans affect my credit score?

Not usually. Since many lenders don’t report to credit bureaus, these loans won’t build your credit—but if you default and go to collections, that will appear on your credit report and hurt your score.

Don’t let financial stress hold you back. AdvanceCash is here to help you secure your payday loan today!

🔗At ExpressCash, we’re here to help guide you through the process and find the right financial solution for your specific situation.