Understanding loan interest rates is crucial for anyone looking to save money. When you borrow money, the interest rate determines how much extra you’ll pay back. Learning how to lower loan interest rates can significantly reduce your overall costs, making it easier to manage your finances.

What Affects Loan Interest Rates?

Several factors influence loan interest rates, including your credit score, loan amount, and repayment term. A higher credit score often leads to lower rates, while larger loans or longer terms can increase them. Understanding these factors helps you make informed decisions.

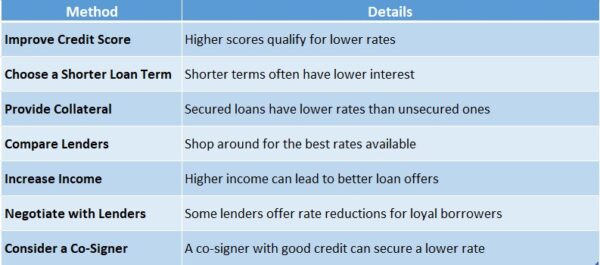

Tips to Lower Your Loan Interest Rates

- Improve Your Credit Score: Pay bills on time and reduce debt.

- Shop Around: Compare offers from different lenders.

- Consider a Co-Signer: A co-signer with good credit can help secure a lower rate.

- Negotiate: Don’t hesitate to ask lenders for better terms.

By following these tips, you can effectively lower payday loan interest rates and save money in the long run.

Need cash fast? AdvanceCash offers quick payday loans to help you cover your expenses!

How to Lower Loan Interest Rates: Proven Strategies

Lowering loan interest rates is essential for saving money over time, whether it’s a mortgage, car loan, or payday loan. By reducing these rates, you can keep more cash in your pocket and ease financial stress.

Improve Your Credit Score

A higher credit score often results in lower interest rates. To boost your score, pay bills on time, reduce debt, and check your credit report for errors. These actions can make lenders more inclined to offer better rates.

Shop Around for Better Offers

Don’t just accept the first loan you find. Compare rates from different lenders. A little research can uncover lower payday loan interest rates, helping you save money. Also, look for special promotions or discounts that lenders may provide!

Consider Refinancing

If you have an existing loan, refinancing could be beneficial. This involves taking out a new loan to pay off the old one, ideally at a lower interest rate. It can reduce your monthly payments and save you money in the long run, but be mindful of any associated fees!

Is Your Credit Score Impacting Your Loan Rates?

Understanding how to lower loan interest rates is crucial for saving money when borrowing. A lower interest rate means you pay less over time, which greatly benefits your financial health. Your credit score significantly impacts these rates, acting as a report card for your financial behavior. Lenders assess your score to determine the risk of lending to you. Higher scores typically lead to lower interest rates. Here’s what affects your credit score:

Key Factors That Affect Your Credit Score:

- Payment History: Timely bill payments boost your score.

- Credit Utilization: Keeping credit card balances low is beneficial.

- Length of Credit History: A longer history is advantageous.

- Types of Credit: A diverse mix can enhance your score.

- New Credit Inquiries: Excessive inquiries may lower your score.

Improving your credit score takes time, but it’s worthwhile. A better score can lead to lower loan interest rates, helping you save money in the long run. Keep in mind that payday loan interest rates can be quite high, making it even more important to focus on your credit score!

If you’re facing unexpected bills, AdvanceCash can provide you with the funds you need instantly!

The Role of Loan Type in Interest Rates: Which is Best for You?

Understanding how to lower loan interest rates is crucial for anyone looking to save money. Different types of loans come with varying interest rates, and knowing which one suits your needs can make a big difference in your finances. Let’s explore how the type of loan you choose can impact your interest rates.

When considering loans, here are some common types and their typical interest rates:

- Personal Loans: Usually have moderate interest rates, depending on your credit score.

- Payday Loans: Often come with high interest rates. Payday loan interest rates explained show that these can be extremely costly if not paid back quickly.

- Mortgages: Generally have lower rates, especially if you have good credit. They can be a great option for long-term borrowing.

Choosing the right loan type can help you lower your interest rates. Always compare options and read the fine print. Remember, a little research can lead to significant savings!

Also Read: Payday Loan Interest Rates Explained: What to Know

Negotiating with Lenders: Tips for Securing Better Rates

When it comes to loans, understanding how to lower loan interest rates can save you a lot of money. Lower rates mean smaller monthly payments, which can help you budget better and reduce financial stress. So, how do you negotiate with lenders to get the best deal? Let’s dive in!

Know Your Credit Score

Before you start negotiating, check your credit score. A higher score can give you leverage when discussing rates. If your score has improved since you took out the loan, mention it! This can help you secure better terms.

Be Prepared to Shop Around

Don’t settle for the first offer. Research different lenders and compare their rates. You can even use online tools to see what others are offering. This knowledge will empower you during negotiations, showing lenders that you have options.

Ask for Discounts

Sometimes, lenders offer discounts for things like setting up automatic payments or being a loyal customer. Don’t hesitate to ask! It’s a simple way to potentially lower your payday loan interest rates, explained in a way that’s easy to understand.

Refinancing Your Loan: When and How to Do It

Refinancing your loan can be a smart move if you’re looking to lower loan interest rates and save money. It’s like getting a fresh start on your finances! By refinancing, you can replace your current loan with a new one that has better terms, which can lead to significant savings over time.

When Should You Refinance?

Refinancing is best when:

- Interest Rates Drop: If rates have decreased since you took out your loan, it’s a great time to consider refinancing.

- Improved Credit Score: If your credit score has improved, you might qualify for lower rates.

- Change in Financial Situation: If your income has increased, refinancing can help you pay off your loan faster with lower rates.

How to Refinance Your Loan

- Research Lenders: Look for lenders that offer competitive rates.

- Check Your Credit: Make sure your credit score is in good shape.

- Gather Documentation: Prepare your financial documents for the application.

- Apply for a New Loan: Submit your application and wait for approval.

- Close the Loan: Once approved, close the loan and start enjoying lower payments!

By understanding payday loan interest rates explained, you can make informed decisions about refinancing and saving money.

Exploring Government Programs to Lower Interest Rates

When it comes to managing your finances, knowing how to lower loan interest rates can be a game changer. Lower interest rates mean you pay less over time, which can save you a significant amount of money. Fortunately, there are government programs designed to help you achieve just that!

Federal Housing Administration (FHA) Loans

FHA loans are a great option for first-time homebuyers. They often come with lower interest rates and require smaller down payments. This can make homeownership more accessible and affordable!

Income-Driven Repayment Plans

If you have student loans, consider income-driven repayment plans. These plans can lower your monthly payments based on your income, which may also reduce your interest rate over time.

VA Loans

For veterans, VA loans offer competitive interest rates without the need for private mortgage insurance. This can significantly lower your monthly payments, making it easier to manage your finances.

By exploring these government programs, you can effectively lower your loan interest rates and save money in the long run. Remember, understanding payday loan interest rates explained can also help you avoid high-interest loans that can trap you in debt.

How to Lower Loan Interest Rates with ‘AdvanceCash’

Lowering loan interest rates can lead to substantial savings over time, making it essential for anyone looking to manage their finances effectively. Whether you’re dealing with a mortgage, personal loan, or payday loans, understanding how to lower loan interest rates can significantly impact your budget.

Shop Around for Better Rates

Comparing rates from different lenders is one of the best strategies to lower your loan interest rates. You might discover a deal that saves you hundreds or even thousands of dollars!

Improve Your Credit Score

A higher credit score often results in lower interest rates. To boost your score, pay your bills on time, reduce your debt, and check your credit report for errors. This makes you a more appealing borrower to lenders.

Consider a Co-Signer

If your credit isn’t strong, consider asking someone with better credit to co-sign your loan. This can help you secure a lower interest rate, as lenders view it as a lower risk. Just remember, your co-signer is responsible if you can’t make payments!

Negotiate with Your Lender

Don’t hesitate to negotiate! If you have a solid payment history, your lender may be willing to lower your interest rate. A simple conversation can lead to significant savings.

The Long-Term Benefits of Lower Interest Rates on Your Finances

Managing your finances effectively involves understanding how to lower loan interest rates, which can significantly impact your savings. Lower interest rates mean reduced payments over time, allowing you to allocate funds for important goals like vacations or education. Let’s delve into the long-term benefits of lower interest rates on your finances.

More Money in Your Pocket

Lower interest rates lead to smaller monthly payments, freeing up cash for savings or investments. With this extra money, you could explore new hobbies, save for a car, or invest in your education.

Building Better Credit

Reducing your loan interest rates can also enhance your credit score. Paying less interest allows you to pay off loans more quickly, which improves your credit standing. A better credit score can lead to more financial opportunities, including lower rates on future loans.

Understanding Payday Loan Interest Rates Explained

Payday loans typically carry high-interest rates. By learning how to lower loan interest rates, you can avoid these costly options. Instead, focus on budgeting and finding better loan alternatives to maintain healthy finances and reduce stress.

FAQs

💰 How can I negotiate a lower loan interest rate?

You can negotiate by improving your credit score, providing collateral, or comparing multiple lenders for better rates.

💰 Does a higher credit score help lower interest rates?

Yes! A better credit score shows lenders that you’re a low-risk borrower, which can result in lower interest rates.

💰 Can refinancing help reduce loan interest rates?

Absolutely! Refinancing your loan with a lower-interest option can reduce monthly payments and save money over time.

💰 Are there government programs that offer lower loan rates?

Yes, government-backed loans like FHA, VA, and USDA loans often come with lower interest rates than private lenders.

💰 Does making a larger down payment reduce interest rates?

Yes! A larger down payment lowers the amount you need to borrow, making lenders more likely to offer a lower rate.

Don’t let financial stress hold you back. AdvanceCash is here to help you secure your payday loan today!

🔗At ExpressCash, we’re here to help guide you through the process and find the right financial solution for your specific situation.