Understanding loan rates is crucial for bad credit borrowers. If you find yourself in this situation, knowing your options can help you make informed decisions. Loan rates for bad credit borrowers can be higher, but there are still pathways to secure the funds you need.

Types of Loans Available

- Personal Loans: These can be harder to get, but some lenders specialize in bad credit.

- Payday Loans: Often have high interest rates. Payday loan interest rates explained show that these loans can be costly, so use them wisely.

- Secured Loans: If you have collateral, these loans might offer better rates.

Factors Influencing Loan Rates

- Credit Score: A lower score typically means higher rates.

- Loan Amount: Larger loans may come with different rates.

- Repayment Terms: Shorter terms can sometimes mean lower rates.

Understanding these options can empower you to choose the best loan for your situation, even with bad credit. Always compare rates and terms before making a decision!

Need cash fast? AdvanceCash offers quick payday loans to help you cover your expenses!

What Factors Influence Loan Rates for Bad Credit?

Understanding loan rates is vital for borrowers, particularly those with bad credit. These rates are often higher than average, making it essential to grasp the factors that influence them. Being informed about your options can lead to better financial decisions and more favorable deals.

Several key factors can affect the loan rates available to you:

- Credit Score: A lower credit score usually results in higher interest rates, as lenders perceive you as a higher risk.

- Loan Amount: The size of the loan can also influence your rate; larger loans may have different rates than smaller ones.

- Loan Type: Various loans, such as payday loans, have different interest rates. Payday loan interest rates explained show that these can be particularly high for bad credit borrowers.

- Lender Policies: Each lender has unique criteria for setting rates, so it’s wise to shop around for the best options.

Exploring Your Options: Types of Loans Available

When it comes to borrowing money, understanding your options is crucial, especially for those with bad credit. Loan rates for bad credit borrowers can be higher, but there are still paths to financial support. Knowing what types of loans are available can help you make informed decisions and find the right fit for your needs.

Personal Loans

Personal loans are a popular choice for bad credit borrowers. They can provide a lump sum of cash that you repay in installments. While the interest rates may be higher, they often come with flexible terms and can be used for various purposes, from consolidating debt to covering unexpected expenses.

Payday Loans

Payday loans are another option, but they come with risks. These loans are short-term and typically have high interest rates. Payday loan interest rates explained often reveal that borrowers can end up paying back much more than they borrowed. It’s essential to read the fine print and understand the repayment terms before committing.

If you’re facing unexpected bills, AdvanceCash can provide you with the funds you need instantly!

How to Improve Your Chances of Getting Approved

When it comes to securing a loan, understanding Loan Rates for Bad Credit Borrowers is crucial. Many people with less-than-perfect credit feel stuck, but there are options available. Knowing how to improve your chances of getting approved can make a big difference in your financial journey.

Understand Your Credit Score

First, check your credit score. Knowing where you stand helps you understand what lenders see. If your score is low, consider taking steps to improve it before applying for a loan.

Shop Around for Lenders

Not all lenders are the same. Research different lenders and their terms. Some may offer better rates than others, especially for bad credit borrowers. Look for those who specialize in helping individuals like you.

Consider Alternatives

If traditional loans seem out of reach, explore alternatives like payday loans. However, be cautious! Payday Loan Interest Rates Explained can reveal high costs, so read the fine print before committing.

Also Read: What Is the Payday Loan Application Process?

Comparing Loan Rates: Where to Find the Best Deals

Understanding Loan Rates for Bad Credit Borrowers is essential for securing a loan that fits your budget. If your credit score is low, finding affordable options can be daunting, but there are solutions available to help you access funds without falling into debt.

Explore Different Lenders

- Credit Unions: Typically offer lower rates than banks.

- Online Lenders: Provide competitive rates and fast approvals.

- Peer-to-Peer Lending: Connects you with investors who may offer favorable terms.

Understand Payday Loan Interest Rates Explained

While payday loans might seem appealing, they often come with exorbitant interest rates that can lead to a debt cycle. Always compare these rates with other lending options before making a decision. Not all loans are the same! To find the best loan rates, do your research and compare offers from various lenders, especially those catering to bad credit borrowers. You may discover more options than you expected. Just be sure to read the fine print and understand all terms before signing any agreements.

Loan Rates for Bad Credit Borrowers

The Role of Credit Unions in Bad Credit Lending

When borrowing money, especially with bad credit, knowing your options is essential. Loan rates for bad credit borrowers can be intimidating, but credit unions often offer a more hopeful alternative. They provide personalized services and flexible lending criteria compared to traditional banks.

Credit unions are not-for-profit organizations focused on their members, which allows them to offer lower loan rates for bad credit borrowers. Here’s why they are a great choice:

Benefits of Choosing a Credit Union

- Lower Interest Rates: Credit unions usually charge lower interest rates than payday loans.

- Flexible Terms: They may have more lenient repayment terms, making payments easier to manage.

- Personalized Service: Credit unions take the time to understand your financial situation, leading to better loan options.

In conclusion, if you have bad credit, consider contacting a credit union for better loan rates and insights. Understanding payday loan interest rates explained can also aid in making informed decisions.

What to Expect from High-Interest Loans

When you’re a borrower with bad credit, understanding loan rates is crucial. High-interest loans can feel overwhelming, but knowing your options can help you make informed decisions. Let’s dive into what to expect from high-interest loans and how they can impact your financial journey.

High-interest loans often come with higher monthly payments. Here’s what you should keep in mind:

- Loan Rates for Bad Credit Borrowers: These rates can be significantly higher than average, sometimes exceeding 30%.

- Payday Loan Interest Rates Explained: Payday loans, a common option for those with bad credit, can have interest rates that seem low at first but can lead to a cycle of debt if not managed properly.

Before you commit, consider the total cost of the loan. Always read the fine print and ask questions. Remember, understanding your loan options can empower you to make better financial choices.

Can You Refinance a Bad Credit Loan?

When you’re dealing with bad credit, understanding your options for loan rates is crucial. Many borrowers wonder if they can refinance a bad credit loan. Refinancing can potentially lower your monthly payments and make your loan more manageable. Let’s explore how this works!

Refinancing a bad credit loan is possible, but it comes with some considerations. Here are a few key points to keep in mind:

- Check Your Credit Score: Before refinancing, know your current credit score. This helps you understand what loan rates for bad credit borrowers you might qualify for.

- Shop Around: Different lenders offer various rates. Researching can help you find the best deal, even with bad credit.

- Consider Payday Loan Interest Rates Explained: Sometimes, payday loans can be a quick fix, but they often come with high-interest rates.

Refinancing might help you escape that cycle. In conclusion, refinancing a bad credit loan can be a smart move if done carefully. It’s all about finding the right lender and understanding your financial situation.

How AdvanceCash Can Help You Navigate Your Options

When it comes to borrowing money, understanding your options is crucial, especially for those with bad credit. Loan rates for bad credit borrowers can be higher, but that doesn’t mean you don’t have choices. Knowing where to look can make a big difference in your financial journey.

Understanding Your Choices

At AdvanceCash, we simplify the process of finding the right loan for you. We break down payday loan interest rates explained, so you can see what to expect. This way, you can make informed decisions without feeling overwhelmed.

Key Insights to Consider

- Research Different Lenders: Not all lenders offer the same rates. Shop around to find the best deal.

- Check Your Credit Report: Knowing your credit score can help you understand your loan options better.

- Consider Alternatives: Sometimes, personal loans or credit unions may offer better rates than payday loans.

By exploring these options, you can find a loan that fits your needs and budget, even with bad credit.

Tips for Managing Loans with Bad Credit

Managing loans with bad credit can feel overwhelming, but understanding your options is key. Loan rates for bad credit borrowers can be higher, making it essential to explore all available avenues. Knowing how to navigate these waters can save you money and stress in the long run.

- Shop Around: Don’t settle for the first offer. Different lenders have varying loan rates for bad credit borrowers. Compare options to find the best deal.

- Consider Secured Loans: If possible, look into secured loans. These often have lower interest rates because they are backed by collateral, reducing risk for lenders.

- Understand Payday Loan Interest Rates Explained: Payday loans can be tempting, but their interest rates are often sky-high.

Make sure to read the fine print and understand the total cost before committing. Staying informed is crucial. Always read the terms and conditions of any loan. If you’re unsure, ask questions. Remember, managing loans with bad credit is about making smart choices that lead to better financial health.

FAQs

⭐ What are typical interest rates for bad credit loans?

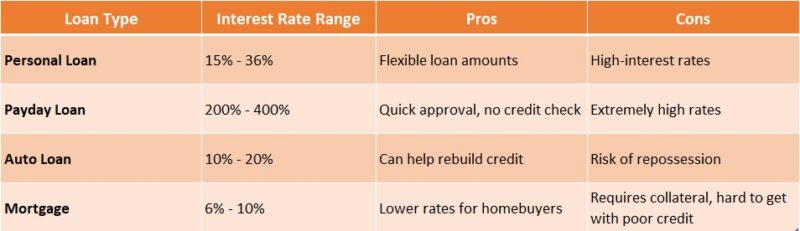

Bad credit loans often have higher interest rates, typically ranging from 15% to 400% APR, depending on the lender and loan type.

⭐ Why do bad credit borrowers get higher interest rates?

Lenders charge higher rates because bad credit borrowers are considered higher-risk, meaning they are more likely to default on the loan.

⭐ Which loan types offer lower rates for bad credit borrowers?

-

Secured loans (using collateral like a car or savings account)

-

Credit union personal loans (often capped at 18% APR)

-

Co-signed loans (where a creditworthy co-signer helps reduce risk)

⭐ How can I lower my loan interest rate with bad credit?

-

Improve your credit score by paying down debt

-

Choose a shorter repayment term

-

Compare multiple lenders before applying

⭐ Are payday loans a good option for bad credit borrowers?

Payday loans are not recommended due to extremely high APRs (often 300% – 700%). Alternatives include installment loans, credit builder loans, and secured credit cards.

Don’t let financial stress hold you back. AdvanceCash is here to help you secure your payday loan today!

🔗At ExpressCash, we’re here to help guide you through the process and find the right financial solution for your specific situation.