Understanding your loan interest rates is essential for effective financial management. Our Loan Interest Rate Adjustment Guide will help you discover ways to lower your costs and make loans more manageable. Knowing how interest rates function can save you money and empower your decisions.

What Are Loan Interest Rates?

Loan interest rates are fees charged by lenders for borrowing money. These rates vary based on factors like your credit score and loan type. For instance, payday loan interest rates explained indicate that these loans typically have higher rates due to their short repayment periods and associated risks.

Why Do Rates Change?

Interest rates fluctuate for several reasons:

- Economic conditions: Strong economies may lead to higher rates.

- Credit score: Better scores can result in lower rates.

- Loan type: Different loans carry different rates.

Understanding these factors helps you navigate your options and find ways to reduce costs.

How to Lower Your Loan Interest Rates

To save money, consider these steps:

- Improve your credit score: Pay bills on time and reduce debt.

- Shop around: Compare rates from various lenders.

- Consider refinancing: This can secure a lower rate.

The Importance of Timing

Timing is crucial; applying when rates are low can lead to significant savings. Stay informed about market trends and be ready to act.

Conclusion

In summary, grasping loan interest rates is vital for financial management. By following our guide, you can lower costs and make loans more affordable. Remember, knowledge is power!

Need cash fast? AdvanceCash offers quick payday loans to help you cover your expenses!

What Triggers a Loan Interest Rate Adjustment?

Understanding what triggers a loan interest rate adjustment is crucial for anyone looking to save money. In our Loan Interest Rate Adjustment Guide, we’ll explore how these changes can impact your finances. Knowing the factors at play can help you make informed decisions and potentially lower your costs.

Several factors can lead to a loan interest rate adjustment. Here are some key triggers to keep in mind:

Economic Changes

- Inflation Rates: When inflation rises, lenders may increase interest rates to maintain their profit margins. This can affect your payday loan interest rates, making it essential to stay informed.

- Market Conditions: Changes in the economy, such as a recession or growth, can influence how lenders set their rates. Keeping an eye on these trends can help you anticipate adjustments.

Personal Financial Factors

- Credit Score Changes: If your credit score improves, you might qualify for lower rates. Conversely, a drop in your score could lead to higher rates.

- Payment History: Consistently making payments on time can positively impact your interest rates. Lenders reward reliability with better terms.

By understanding these triggers, you can better navigate your loan agreements and potentially save money in the long run.

If you’re facing unexpected bills, AdvanceCash can provide you with the funds you need instantly!

How to Assess Your Current Loan Terms Effectively

Understanding your loan terms is crucial for managing your finances effectively. In our Loan Interest Rate Adjustment Guide, we’ll explore how to assess your current loan terms. This knowledge can help you lower costs and make informed decisions, especially when it comes to payday loan interest rates explained.

Review Your Loan Agreement

Start by pulling out your loan agreement. Look for key details like the interest rate, repayment period, and any fees. Understanding these terms is the first step in figuring out if you can lower your costs.

Check for Variable Rates

If you have a variable interest rate, it can change over time. Keep an eye on market trends and see if rates are dropping. If they are, it might be time to consider refinancing your loan to secure a better rate.

Compare with Current Rates

Research current loan interest rates. Compare them with your existing rate. If you find a significantly lower rate, it could save you money. Don’t forget to check payday loan interest rates explained to see how they stack up against your current loan.

Also Read: Payday Loan Interest Rates Explained: What to Know

Steps to Negotiate Lower Interest Rates with Lenders

When it comes to managing loans, understanding how to negotiate lower interest rates can save you a lot of money. This is where our Loan Interest Rate Adjustment Guide comes in handy. By following these steps, you can potentially lower your costs and make your payments more manageable.

Do Your Homework

Before you approach your lender, research current payday loan interest rates explained. Knowing the average rates gives you leverage in negotiations. If you find better offers from other lenders, you can use this information to your advantage.

Build Your Case

Gather your financial documents, including your credit score and payment history. A strong credit score can help you argue for a lower rate. Be ready to explain why you deserve a better deal, like consistent payments or a long-standing relationship with the lender.

Ask for a Lower Rate

Once you’re prepared, reach out to your lender. Politely ask if they can lower your interest rate. Be clear about your reasons and mention any competitive offers you’ve found. Sometimes, simply asking can lead to a better deal!

Be Open to Alternatives

If your lender can’t lower your rate, ask about other options. They might offer a different loan product with better terms. Being flexible can lead to a solution that works for both you and your lender.

The Role of Credit Scores in Interest Rate Adjustments

Understanding your credit score’s impact on loan interest rates is essential. In our Loan Interest Rate Adjustment Guide, we highlight that a better credit score can lead to lower costs, putting more money in your pocket!

The Importance of Credit Scores

Your credit score serves as a report card for your financial behavior. Lenders assess it to gauge the risk of lending to you. A higher score often results in lower payday loan interest rates, making borrowing more affordable.

Tips to Improve Your Credit Score

- Pay Bills on Time: Late payments can negatively affect your score.

- Keep Balances Low: Aim to use less than 30% of your credit limit.

- Check Your Credit Report: Identify and correct any errors that may lower your score.

By following these tips, you can enhance your credit score and potentially lower your loan interest rates. Every little bit helps!

The Benefits of a Good Credit Score

- Lower Interest Rates: Save money on loans.

- Better Loan Terms: Enjoy more favorable repayment options.

- Increased Approval Chances: Easier access to loans.

Improving your credit score not only benefits your interest rates but also opens doors to better financial opportunities. It’s a win-win!

Take Action Today

Begin monitoring your credit score and implement steps to improve it. Even small changes can significantly impact your loan interest rates. Remember, every point counts!

How AdvanceCash Can Help You Navigate Loan Adjustments

Adjusting your loan interest rates can lead to significant savings and reduced financial stress. Our Loan Interest Rate Adjustment Guide is designed to help you navigate the complexities of loans and find effective ways to lower your costs.

At AdvanceCash, we believe everyone deserves clear financial guidance. Here’s how we assist with loan adjustments:

Personalized Advice

- Tailored Solutions: We provide personalized advice based on your unique financial situation.

- Expert Insights: Our team simplifies payday loan interest rates, making it easier for you to understand your options.

Step-by-Step Guidance

- Easy Steps: Our guide breaks down the adjustment process into manageable steps.

- Supportive Resources: We offer resources to help you make informed decisions about your loans, boosting your confidence.

Tools and Calculators

- Interactive Tools: Use our online calculators to estimate potential savings from interest rate adjustments.

- Visual Aids: Our guides clarify complex terms and processes, ensuring you know what to expect.

Ongoing Support

- Customer Service: Our dedicated team is always available to answer your questions.

- Regular Updates: We keep you informed about changes in interest rates and market trends, enabling timely decisions.

With AdvanceCash’s resources, you can confidently navigate loan adjustments and take control of your financial future!

Tips for Future-Proofing Your Loan Against Rate Increases

When it comes to managing loans, understanding how to protect yourself from rising costs is crucial. This is where our Loan Interest Rate Adjustment Guide comes in handy. By taking proactive steps, you can future-proof your loan against unexpected rate increases, ensuring that your financial health remains intact.

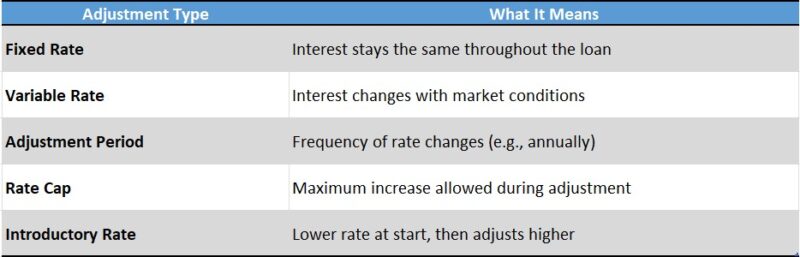

Understand Your Loan Terms

Before signing any loan agreement, make sure you fully understand the terms. Look for details about how interest rates can change. This knowledge is key to avoiding surprises later on.

Consider Fixed-Rate Loans

If you want stability, consider opting for a fixed-rate loan. Unlike variable rates, fixed rates remain the same throughout the loan term. This means you won’t have to worry about sudden spikes in your monthly payments, making budgeting easier.

Keep an Eye on Market Trends

Stay informed about the economy and interest rates. By knowing when rates are likely to rise, you can make better decisions about refinancing or adjusting your loan. Remember, payday loan interest rates explained can help you understand short-term borrowing costs, too!

Refinance When Possible

If you notice that rates are lower than your current loan, consider refinancing. This can save you money in the long run. Just make sure to weigh the costs of refinancing against the potential savings to ensure it’s worth it.

FAQs

🔁 Can I request a lower interest rate on my existing loan?

Yes, some lenders may reduce your interest rate if you’ve consistently made on-time payments or improved your credit score.

📝 What factors influence loan interest rate adjustments?

Lenders consider your credit score, income, payment history, and loan type before approving any rate changes.

💳 Does refinancing help in lowering interest rates?

Absolutely. Refinancing replaces your current loan with a new one—often with better terms and lower rates.

📊 Are interest rates on payday loans adjustable?

Typically no. Payday loans usually have fixed, high-interest rates set by state regulations and are not adjustable.

📅 How often can I adjust my loan interest rate?

It depends on the lender. Some offer annual reviews, while others may allow a one-time adjustment after a set period.

Don’t let financial stress hold you back. AdvanceCash is here to help you secure your payday loan today!

🔗At ExpressCash, we’re here to help guide you through the process and find the right financial solution for your specific situation.