When considering a payday loan, many people focus solely on the interest rates. However, understanding Fees and Charges Beyond Interest Rates is crucial. These hidden costs can sneak up on you and significantly impact your overall repayment amount. Let’s dive into what you need to know!

Common Hidden Fees to Watch Out For

- Application Fees: Some lenders charge a fee just to process your application.

- Late Payment Fees: Missing a payment can lead to hefty penalties.

- Prepayment Penalties: Believe it or not, some loans charge you for paying off your debt early!

Why It Matters

Being aware of these extra costs can save you money and stress. By understanding Payday Loan Interest Rates Explained, you can make informed decisions. Always read the fine print and ask questions to avoid surprises later on. Remember, knowledge is power when it comes to managing your finances!

Need cash fast? AdvanceCash offers quick payday loans to help you cover your expenses!

Are You Aware of These Hidden Costs in Your Loan Agreement?

When considering a loan, many people focus solely on the interest rates. However, it’s crucial to understand that there are fees and charges beyond interest rates that can significantly impact your total repayment amount. These hidden costs can sneak up on you, making your loan more expensive than you initially thought.

Common Hidden Fees

- Origination Fees: Some lenders charge a fee for processing your loan application. This can be a percentage of the loan amount, adding to your overall cost.

- Late Payment Fees: Missing a payment can lead to hefty penalties. Always check how much these fees are, as they can accumulate quickly.

- Prepayment Penalties: If you decide to pay off your loan early, some lenders might charge you a fee. This can be surprising for many borrowers! Understanding these hidden costs is essential.

By being aware of payday loan interest rates explained, you can make informed decisions and avoid unexpected financial burdens. Always read your loan agreement carefully to spot these fees before signing.

The Impact of Fees and Charges Beyond Interest Rates on Your Finances

When considering a loan, many people focus solely on the interest rates. However, fees and charges beyond interest rates can sneak up on you, turning a seemingly good deal into a financial burden. Understanding these hidden costs is crucial for making informed decisions about your finances.

Common Hidden Costs to Watch Out For

- Origination Fees: These are charged for processing your loan application and can vary significantly.

- Late Payment Fees: Missing a payment can lead to hefty penalties that add up quickly.

- Prepayment Penalties: Some loans charge you if you pay them off early, which can be surprising.

Why It Matters

Being aware of these fees helps you budget better. For instance, when looking at payday loan interest rates explained, remember that the total cost includes more than just the interest. By factoring in all potential fees, you can avoid unexpected financial strain and make smarter borrowing choices.

If you’re facing unexpected bills, AdvanceCash can provide you with the funds you need instantly!

Decoding the Fine Print: Common Fees and Charges to Look Out For

When considering a payday loan, many people focus solely on the interest rates. However, understanding Fees and Charges Beyond Interest Rates is crucial. These hidden costs can sneak up on you, turning a seemingly manageable loan into a financial burden. Let’s dive into what to watch for!

Common Fees to Watch Out For

- Application Fees: Some lenders charge a fee just to process your application. This can add up quickly!

- Late Payment Fees: Missing a payment? Expect a hefty fee that can increase your total debt.

- Prepayment Penalties: If you want to pay off your loan early, some lenders may charge you for that privilege.

Understanding these fees is essential. By being aware of the Payday Loan Interest Rates Explained, you can make informed decisions. Always read the fine print and ask questions. Remember, knowledge is power when it comes to managing your finances!

Also Read: Payday Loan Interest Rates Explained: What to Know

How Fees and Charges Beyond Interest Rates Can Affect Your Loan Choices

When considering a loan, many people focus solely on the interest rates. However, fees and charges beyond interest rates can sneak up on you, turning a seemingly good deal into a costly mistake. Understanding these hidden costs is crucial for making informed financial decisions.

Types of Hidden Costs to Watch Out For

- Origination Fees: These are fees charged by lenders for processing your loan application. They can vary widely and add to your overall cost.

- Late Payment Fees: Missing a payment can lead to hefty penalties, making your loan more expensive over time.

- Prepayment Penalties: Some loans charge you if you pay them off early, which can be a surprise if you’re trying to save on interest.

Why It Matters

Knowing about these fees and charges beyond interest rates helps you compare loans more effectively. For instance, while payday loan interest rates might seem low, the additional fees can make them much more expensive. Always read the fine print to avoid unexpected costs!

The Role of Origination Fees: Are They Worth It?

When considering a payday loan, many people focus solely on the interest rates. However, it’s crucial to look at Fees and Charges Beyond Interest Rates. These hidden costs can sneak up on you and affect your overall repayment amount. Understanding these fees helps you make informed financial decisions.

Origination fees are common in payday loans. They are charged for processing your loan application and can vary widely. Here’s what you should know:

- Cost Impact: Origination fees can add a significant amount to your total loan cost. Always ask for this fee upfront!

- Value Assessment: Consider if the service provided justifies the fee. Are you getting quick access to cash?

- Comparison Shopping: Don’t settle for the first offer. Compare different lenders to find the best deal, including origination fees.

Remember, payday loan interest rates explained often include these fees, so be sure to factor them in!

Unpacking Prepayment Penalties: What Borrowers Should Consider

When borrowing money, many people focus solely on interest rates. However, fees and charges beyond interest rates can sneak up on you, making your loan more expensive than expected. One of the most significant hidden costs is the prepayment penalty, which can catch borrowers off guard.

What Are Prepayment Penalties?

Prepayment penalties are fees lenders charge if you pay off your loan early. While it might seem odd to penalize someone for paying off debt, lenders want to ensure they earn enough from your interest payments.

Why Do They Matter?

- Costly Surprise: If you plan to pay off your loan early, a prepayment penalty can add hundreds of dollars to your total cost.

- Loan Flexibility: Understanding these fees helps you choose loans that offer more flexibility, especially if your financial situation changes.

Before signing any loan agreement, always ask about fees and charges beyond interest rates. Knowing about prepayment penalties can save you money and stress in the long run. Remember, being informed is your best defense against unexpected costs!

How Late Payment Fees Can Sneak Up on You: A Cautionary Tale

When you think about borrowing money, you often focus on the interest rates. However, fees and charges beyond interest rates can sneak up on you and make your loan much more expensive. Understanding these hidden costs is crucial to avoid financial surprises later on.

Imagine you’ve taken out a payday loan, thinking you can easily pay it back. But life happens, and you miss a payment. Suddenly, you’re hit with a late payment fee. These fees can add up quickly, making your loan much more costly than you anticipated.

Key Points to Remember

- Late Payment Fees: Often charged after just one missed payment.

- Impact on Total Cost: These fees can significantly increase the total amount you owe.

- Payday Loan Interest Rates Explained: While interest rates are important, late fees can sometimes overshadow them. Always read the fine print!

Exploring Additional Charges: Insurance, Maintenance, and More

When considering a loan, many people focus solely on the interest rates. However, understanding Fees and Charges Beyond Interest Rates is crucial. These hidden costs can sneak up on you, making your loan more expensive than you initially thought. Let’s dive into some of these additional charges that can impact your finances.

Insurance Costs

One common hidden cost is insurance. Some lenders require you to purchase insurance to protect the loan. This can add up quickly, so be sure to ask about it upfront.

Maintenance Fees

Another charge to watch for is maintenance fees. These are often associated with managing your loan and can vary widely. Always read the fine print to avoid surprises later on!

Other Charges

Don’t forget about other potential charges like late fees or processing fees. These can add to your overall cost, making it essential to understand the total picture. Remember, knowing about these Payday Loan Interest Rates Explained can help you make better financial decisions.

How AdvanceCash Can Help You Navigate Fees and Charges Beyond Interest Rates

When considering a payday loan, many focus only on interest rates. However, Fees and Charges Beyond Interest Rates can greatly affect the total borrowing cost. Understanding these hidden costs is essential for making informed financial decisions and avoiding surprises.

At AdvanceCash, we empower users with knowledge by breaking down various fees associated with payday loans, including:

- Origination Fees: Charged for processing your loan application.

- Late Payment Fees: Additional charges for missed payments.

- Prepayment Penalties: Fees for paying off your loan early.

By clarifying these charges, we help you see the bigger picture beyond just payday loan interest rates explained. Our aim is to ensure you fully understand what you’re signing up for, enabling you to make the best financial choices. Additionally, AdvanceCash provides tools to compare different lenders, helping you find the most transparent options with minimal hidden fees. Remember, being informed is your best defense against unexpected costs!

FAQs

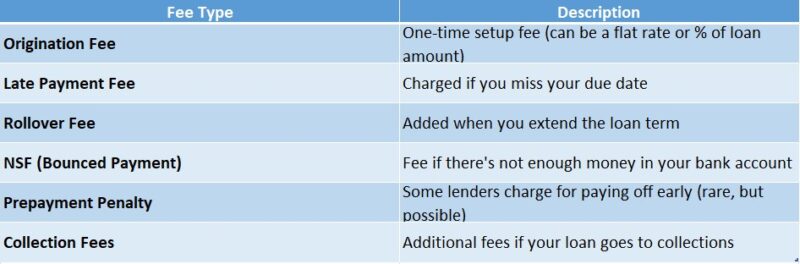

⚠️ What extra fees do payday loans have?

Beyond interest, payday loans may include origination fees, rollover charges, late fees, and insufficient funds (NSF) fees.

⚠️ What is a rollover fee in payday loans?

If you extend your loan, lenders charge a rollover fee, which adds to your total repayment amount.

⚠️ Can payday lenders charge prepayment penalties?

Most payday lenders don’t charge prepayment fees, but it’s best to check your loan agreement to be sure.

⚠️ What happens if I miss a payday loan payment?

You may face late fees, penalty interest, and collection costs, and it could hurt your credit score.

⚠️ Are payday loan fees regulated?

Yes, state laws limit payday loan fees, but costs can still be high, so always review loan terms carefully.

Don’t let financial stress hold you back. AdvanceCash is here to help you secure your payday loan today!

🔗At ExpressCash, we’re here to help guide you through the process and find the right financial solution for your specific situation.