Understanding Interest-Free Payday Loan Offers can be a game-changer for those in need of quick cash. These offers allow you to borrow money without the burden of interest, making repayment much easier. But where can you find these offers? Let’s dive in!

What Are Interest-Free Payday Loan Offers?

Interest-Free Payday Loan Offers are short-term loans that don’t charge interest. Instead, you pay back only what you borrowed. This can save you a lot of money compared to traditional payday loans, which often come with high interest rates.

Where to Find Them

- Online Lenders: Many online platforms specialize in interest-free loans. A quick search can lead you to several options.

- Credit Unions: Some credit unions offer interest-free loans to their members. It’s worth checking with your local credit union.

- Promotional Offers: Keep an eye out for special promotions from lenders that might offer interest-free loans for first-time borrowers.

Benefits of Interest-Free Loans

- No Extra Costs: You only repay what you borrowed.

- Easier Budgeting: Knowing you won’t pay interest helps you plan your finances better.

- Quick Access: These loans are often processed quickly, giving you the cash you need when you need it.

In conclusion, Interest-Free Payday Loan Offers can provide a lifeline when cash is tight. By understanding where to find them and how they work, you can make informed financial decisions.

Need cash fast? AdvanceCash offers quick payday loans to help you cover your expenses!

Where to Look for Interest-Free Payday Loan Offers: Top Resources

Finding Interest-Free Payday Loan Offers can feel like searching for a needle in a haystack. However, knowing where to look can make all the difference. These offers can help you avoid high payday loan interest rates, which can be overwhelming. Let’s explore some top resources to help you find these valuable offers.

Online Lenders and Comparison Websites

Many online lenders provide interest-free payday loans. Websites like NerdWallet and Bankrate allow you to compare different lenders. They often have sections dedicated to interest-free options. This way, you can see various offers side by side and choose the best one for your needs.

Credit Unions and Local Banks

Don’t overlook your local credit unions and banks. They sometimes offer special promotions for members, including interest-free loans. It’s worth visiting their websites or calling them directly to ask about any current offers. You might be surprised by what you find!

Community Resources

Lastly, check out community organizations. Some non-profits provide financial assistance or interest-free loans to those in need. They can guide you through the process and help you understand payday loan interest rates explained. Remember, you’re not alone in this journey!

If you’re facing unexpected bills, AdvanceCash can provide you with the funds you need instantly!

Are Interest-Free Payday Loan Offers Too Good to Be True?

Managing unexpected expenses can be challenging, and many people turn to Interest-Free Payday Loan Offers for help. While these offers sound appealing, it’s important to ask: are they too good to be true? Let’s dive into this topic!

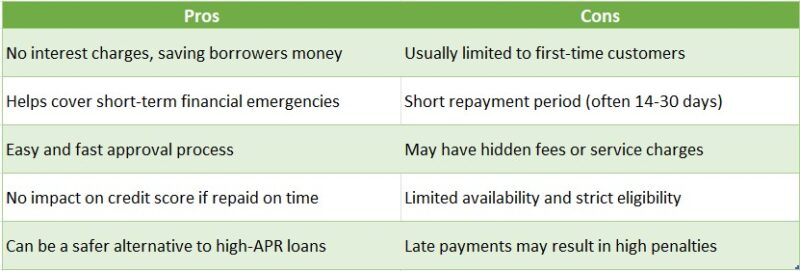

Interest-Free Payday Loan Offers may seem like a dream, but understanding the fine print is crucial. These loans often come with hidden fees or high-interest rates if not repaid on time. Here are some key points to consider:

Key Points to Consider:

- Read the Terms: Always check for hidden charges in the loan agreement.

- Understand the Repayment Schedule: Know when and how much you need to repay.

- Compare Offers: Look at different lenders to find the best deal.

While these loans can provide immediate relief, they are often only interest-free for a limited time. Missing a payment can lead to steep penalties. Therefore, staying on top of your payments is essential!

Benefits of Interest-Free Payday Loans:

- Immediate Relief: Quick cash for emergencies.

- No Interest for a Limited Time: Repay on time to avoid extra fees.

- Easier Budgeting: Knowing the exact repayment amount helps with planning.

Not all lenders are the same, so do your research and read reviews before making a commitment.

Also Read: Payday Loan Interest Rates Explained: What to Know

The Benefits of Choosing Interest-Free Payday Loans

Interest-Free Payday Loan Offers can be a lifesaver during unexpected financial emergencies. Whether it’s for a car repair or a medical bill, these loans allow you to borrow money without the burden of interest fees, making it easier to manage your finances.

No Extra Costs

One major advantage is that you won’t pay any interest, meaning you only repay what you borrowed. This simplifies budgeting and helps you avoid worrying about additional costs later.

Quick Access to Funds

Interest-Free Payday Loans are typically quick to obtain. Many lenders offer online applications, allowing you to receive cash in your account within a day. This speed is essential in emergencies, enabling you to address bills promptly.

Flexible Repayment Options

Many lenders also provide flexible repayment plans. You can choose a schedule that suits your financial situation, reducing the pressure to repay everything at once.

Improved Financial Management

These loans can enhance your financial management skills. By borrowing only what you need and repaying without interest, you learn to budget effectively and avoid debt traps.

Building Trust with Lenders

Repaying on time helps build a positive relationship with lenders, potentially leading to better loan offers in the future.

Avoiding High Payday Loan Interest Rates

Understanding Payday Loan Interest Rates Explained is vital, as traditional loans often come with high rates. Interest-free options help you steer clear of this cycle of debt.

How to Qualify for Interest-Free Payday Loan Offers

Finding Interest-Free Payday Loan Offers can be a lifesaver during financial emergencies. These loans help cover unexpected expenses without the burden of high-interest rates. So, how do you qualify for these offers? Let’s explore!

Check Your Credit Score

Lenders typically check your credit score. A higher score increases your chances of qualifying for Interest-Free Payday Loan Offers. If your score is low, consider improving it before applying.

Proof of Income

You’ll also need to provide proof of income, such as pay stubs or bank statements. A steady income makes you a more appealing borrower!

Research Lenders

Research various lenders, as not all payday loan companies offer the same terms. Look for those with low or zero interest rates and read reviews to find trustworthy options. Understanding payday loan interest rates explained can guide your choices.

Compare Loan Offers

Once you identify potential lenders, compare their offers, including total loan costs and fees. This helps you find the best Interest-Free Payday Loan Offers.

Understand the Terms

Before signing, ensure you understand the loan terms, including repayment periods and penalties for late payments. Clear terms prevent unexpected surprises!

Ask Questions

Don’t hesitate to ask questions if something is unclear. A reliable lender will clarify their process and terms, helping you feel more comfortable with your decision.

Tips for Finding the Best Interest-Free Payday Loan Offers Online

Finding the right Interest-Free Payday Loan Offers can be challenging due to the vast number of options available online. These loans provide quick financial relief without high-interest rates, making them appealing to many.

Do Your Research

Begin by checking reputable payday loan websites. Look for reviews to identify trustworthy lenders that offer interest-free options.

Compare Offers

Not all payday loan interest rates are the same. Take time to compare offers, as some lenders may have hidden fees. Create a list of potential lenders to find the best deal.

Check for Promotions

Many lenders offer special promotions for interest-free payday loans, especially during holidays. Sign up for newsletters to stay informed about limited-time offers that can save you money.

Understand the Terms

Before you commit, read the fine print carefully. Knowing the repayment terms and any fees can prevent surprises and ensure a wise financial choice.

Use Online Comparison Tools

Utilize online comparison tools to view multiple offers side by side. This makes it easier to identify the best interest-free payday loan options available.

Seek Recommendations

Ask friends or family for recommendations. Their personal experiences can guide you to reliable lenders.

Stay Informed

Keep up with financial news, as lenders may change their offers. Being informed allows you to act quickly when a great interest-free payday loan opportunity arises.

How AdvanceCash Can Help You Secure Interest-Free Payday Loan Offers

Finding the right financial help can be challenging, especially when you need cash quickly. Interest-Free Payday Loan Offers are an excellent choice for avoiding high-interest rates. Knowing where to find these offers can save you both money and stress, and that’s where AdvanceCash comes in!

Easy Access to Information

At AdvanceCash, we simplify your search for Interest-Free Payday Loan Offers. Our platform lists lenders who provide these loans, allowing you to easily compare options without sifting through endless websites.

Understanding Payday Loan Interest Rates Explained

We break down payday loan interest rates, helping you make informed decisions. With our guidance, you can select the best loan for your needs without worrying about hidden fees or high costs.

Personalized Recommendations

Recognizing that every financial situation is unique, we offer personalized recommendations. By answering a few simple questions, you can receive tailored options for Interest-Free Payday Loan Offers that fit your circumstances perfectly.

User-Friendly Tools

Our website features user-friendly tools to make the loan application process straightforward. With just a few clicks, you can access calculators and comparison charts to visualize your options and see how much you can save with interest-free loans.

Support and Guidance

Need help navigating the loan landscape? Our team is here for you! We provide support and guidance throughout your journey, whether you have questions about the application process or need clarity on payday loan interest rates.

FAQs

-

Do interest-free payday loans really exist?

Some lenders offer interest-free payday loans as promotional offers for new customers, but they may still have processing fees or other charges. Always check the terms before applying. -

Who qualifies for an interest-free payday loan?

Eligibility varies by lender but usually requires steady income, a valid ID, an active bank account, and meeting the lender’s minimum credit requirements. -

Are there hidden fees in interest-free payday loans?

Some lenders charge processing fees, late fees, or rollover fees, even if the loan is marketed as “interest-free.” Always read the terms carefully. -

Where can I find interest-free payday loans?

Some online lenders, credit unions, and employer-sponsored loan programs may offer zero-interest short-term loans for first-time borrowers or under special conditions. -

What happens if I can’t repay an interest-free payday loan on time?

Missing payments can result in late fees, penalties, or losing the interest-free benefit, turning the loan into a high-interest payday loan.

Don’t let financial stress hold you back. AdvanceCash is here to help you secure your payday loan today!

🔗At ExpressCash, we’re here to help guide you through the process and find the right financial solution for your specific situation.