High-interest payday loans can seem like a quick fix when you’re in a financial bind. However, understanding the risks associated with these loans is crucial. Many people jump in without realizing how much they might end up paying back. Let’s break down the high-interest payday loans risks and why they matter.

What Are High-Interest Payday Loans?

These loans are short-term and often come with very high-interest rates. They can be tempting because they promise quick cash. But, payday loan interest rates explained show that you might pay back much more than you borrowed!

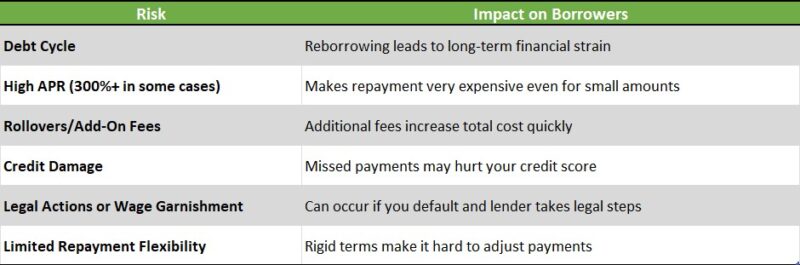

Key Risks to Consider:

- High Costs: The interest can pile up quickly, making it hard to pay back.

- Debt Cycle: Many borrowers find themselves needing another loan to pay off the first, leading to a cycle of debt.

- Credit Impact: Missing payments can hurt your credit score, making future loans harder to get.

Before taking a payday loan, weigh these risks carefully. It’s essential to explore other options that might be safer and more affordable.

Need cash fast? AdvanceCash offers quick payday loans to help you cover your expenses!

What Makes High-Interest Payday Loans So Risky?

High-interest payday loans can seem like a quick fix when you’re in a financial pinch. However, understanding the High-Interest Payday Loans Risks is crucial. These loans often come with high fees and interest rates that can trap borrowers in a cycle of debt. Knowing what you’re getting into can save you from future headaches.

Sky-High Interest Rates

Payday loan interest rates explained can be shocking. Some lenders charge rates that can exceed 400%! This means if you borrow $500, you could end up paying back much more than you borrowed. It’s like running on a hamster wheel—you’re always trying to catch up but never quite getting ahead.

Short Repayment Terms

Another risk is the short repayment terms. Most payday loans are due in just two weeks. If you can’t pay it back on time, you might have to take out another loan, leading to even more debt. It’s a slippery slope that can be hard to escape.

The Hidden Costs of High-Interest Payday Loans: Are You Aware?

Borrowing money can be challenging, especially when considering high-interest payday loans. While they may appear to offer quick relief, it’s essential to grasp the High-Interest Payday Loans Risks involved. These loans often hide costs that can lead to a debt cycle.

What You Might Not Know

Many borrowers miss the payday loan interest rates explained in the fine print, which can lead to unexpectedly high payments. Key hidden costs include:

- Fees and Charges: Additional fees can accumulate quickly with payday loans.

- Loan Rollovers: If repayment isn’t possible on time, rolling over the loan can result in even higher interest payments.

- Impact on Credit Score: Late payments can damage your credit score, making future loans more costly.

By understanding these risks, you can make informed financial choices and steer clear of debt traps. Always read the terms thoroughly before signing any loan agreement.

If you’re facing unexpected bills, AdvanceCash can provide you with the funds you need instantly!

How High-Interest Payday Loans Can Impact Your Credit Score

Before taking out a payday loan, it’s vital to grasp the High-Interest Payday Loans Risks involved. While these loans may seem like a quick solution for financial issues, they can lead to significant problems, particularly regarding your credit score. Understanding how these loans operate can empower you to make informed decisions.

Understanding the Basics

Payday loan interest rates can be shocking, often exceeding 400%! For instance, borrowing $500 could mean paying back much more than that, creating a debt cycle that negatively impacts your credit score.

The Ripple Effect on Your Credit

Taking out a payday loan can affect your credit score in several ways:

- Missed Payments: Late repayments can harm your score.

- Debt-to-Income Ratio: High-interest loans increase your debt burden.

- Collections: Defaulting may lead to collections, severely damaging your credit.

Being aware of these risks is crucial to prevent long-term financial problems.

Also Read: Payday Loan Interest Rates Explained: What to Know

Are High-Interest Payday Loans a Short-Term Solution or a Long-Term Trap?

When considering a quick cash fix, understanding the High-Interest Payday Loans Risks is crucial. Many people view these loans as a lifeline during financial emergencies. However, they can quickly turn into a long-term trap if not handled wisely. Let’s dive into why this matters.

The Allure of Quick Cash

Payday loans promise fast cash, but the Payday Loan Interest Rates Explained reveal a different story. These loans often come with sky-high interest rates, making it easy to fall into a cycle of debt. One missed payment can lead to more fees, trapping you in a financial nightmare.

Key Risks to Consider:

- High Interest Rates: Rates can exceed 400%, making repayment tough.

- Debt Cycle: Many borrowers find themselves needing another loan to pay off the first.

- Credit Impact: Late payments can hurt your credit score, affecting future loans.

In summary, while payday loans may seem like a quick fix, they often lead to more problems than solutions. Always weigh the risks before diving in!

The Cycle of Debt: How High-Interest Payday Loans Keep You Borrowing

High-interest payday loans may appear to be a quick solution for financial issues, but they carry significant risks. It’s vital to understand these risks before borrowing. When you take out a loan at such high rates, it can trap you in a cycle of debt that’s difficult to escape.

What Happens Next?

- You borrow money to cover an unexpected expense.

- The payday loan interest rates explained indicate that you’ll owe much more than you initially borrowed.

- When the repayment date arrives, you might not have enough funds to pay it back.

The Trap

- To avoid defaulting, you may take out another loan.

- This creates a continuous cycle of borrowing to pay off previous loans.

- Each new loan incurs additional fees and interest, making it increasingly challenging to escape.

In conclusion, high-interest payday loans can ensnare you in a debt cycle. It’s crucial to assess the risks and explore alternatives before borrowing. Understanding payday loan interest rates is essential for making informed financial choices.

Alternatives to High-Interest Payday Loans: What Are Your Options?

When it comes to managing money, understanding the High-Interest Payday Loans Risks is crucial. Many people turn to payday loans in times of need, but these loans can lead to a cycle of debt that’s hard to escape. So, what are the alternatives? Let’s explore some options that can help you avoid the pitfalls of high-interest loans.

- Credit Unions: These often offer lower interest rates and flexible repayment plans. They’re a great option if you need a small loan without the hefty fees.

- Personal Loans: Banks and online lenders provide personal loans with better terms. Always check the payday loan interest rates explained to compare them with payday loans.

- Payment Plans: If you owe money, ask your creditor for a payment plan. Many are willing to work with you to avoid losing a customer.

- Borrowing from Friends or Family: This can be a more affordable option, but make sure to communicate clearly to avoid misunderstandings.

How to Recognize the Warning Signs of High-Interest Payday Loan Scams

High-interest payday loans can seem like a quick fix for financial troubles, but they come with significant risks. Understanding these risks is crucial to protect yourself from falling into a cycle of debt. Knowing how to recognize warning signs can save you from making a costly mistake.

Look for Unclear Terms

- If the payday loan interest rates are not clearly explained, be cautious. Legitimate lenders should provide straightforward information about fees and repayment terms.

Pressure Tactics

- Beware of lenders who rush you into signing a contract. If they pressure you to act quickly, it’s a red flag. Take your time to read everything carefully.

Check for Licensing

- Always verify if the lender is licensed in your state. Unlicensed lenders often operate outside the law and may charge exorbitant fees.

By being aware of these warning signs, you can avoid the high-interest payday loans risks that could lead to serious financial trouble. Remember, it’s always better to explore other options before taking on a payday loan.

How AdvanceCash Can Help You Navigate High-Interest Payday Loan Risks

High-interest payday loans can seem like a quick fix for financial troubles, but they come with significant risks. Understanding these risks is crucial for anyone considering this option. At AdvanceCash, we aim to guide you through the maze of payday loan interest rates explained, ensuring you make informed decisions.

Navigating high-interest payday loans can be tricky. Here’s how we can assist you:

- Clear Information: We break down complex terms into simple language, making it easier to understand the risks involved.

- Comparative Analysis: We provide comparisons of different lenders, helping you find the best rates available.

By using our resources, you can avoid common pitfalls associated with high-interest payday loans. Remember, knowledge is power! With the right information, you can make choices that protect your financial future. Let’s work together to ensure you’re not caught off guard by unexpected costs.

Making Informed Decisions: Tips for Avoiding High-Interest Payday Loans Risks

When it comes to borrowing money, understanding the risks is crucial. High-interest payday loans can seem like a quick fix, but they often come with hidden dangers. Knowing about these risks can help you make informed decisions and avoid financial pitfalls.

Understand the Costs

- Payday Loan Interest Rates Explained: These loans can have interest rates that skyrocket, sometimes exceeding 400%! This means you could end up paying back much more than you borrowed.

- Read the Fine Print: Always check the terms and conditions. Look for any hidden fees that could increase your total repayment amount.

Explore Alternatives

- Consider Other Options: Before jumping into a payday loan, explore alternatives like personal loans from banks or credit unions. They often have lower interest rates.

- Create a Budget: Planning your expenses can help you avoid the need for a payday loan in the first place. Stick to your budget to keep your finances on track.

FAQs

🔥 Why are payday loans considered high-risk?

Payday loans have extremely high interest rates, often exceeding 300% APR, leading to rapid debt accumulation.

🔥 What happens if I can’t repay a payday loan on time?

Missed payments result in late fees, rollover charges, and higher debt, making repayment even harder.

🔥 Can a payday loan affect my credit score?

Yes! Some lenders report defaults to credit bureaus, which can lower your credit score.

🔥 Are payday loan debt cycles common?

Yes! Many borrowers take new payday loans to repay old ones, creating a dangerous cycle of debt.

🔥 What are safer alternatives to payday loans?

Consider personal loans, credit unions, paycheck advances, or installment loans with lower interest rates.

Don’t let financial stress hold you back. AdvanceCash is here to help you secure your payday loan today!

🔗At ExpressCash, we’re here to help guide you through the process and find the right financial solution for your specific situation.