When considering a loan, it’s crucial to understand the Hidden Loan Costs to Watch For. These costs can sneak up on you, turning what seemed like a manageable loan into a financial burden. Knowing what to look for can save you from unexpected fees and stress down the line.

Common Hidden Costs

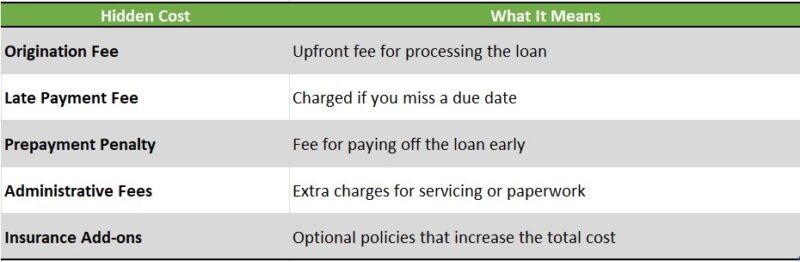

- Origination Fees: Some lenders charge a fee just for processing your loan application. This can be a percentage of the loan amount, so always ask about it upfront.

- Prepayment Penalties: If you pay off your loan early, some lenders might charge you a fee. This can be surprising, especially if you’re trying to save on interest!

- Late Fees: Missing a payment can lead to hefty late fees. Make sure you understand the terms regarding payment deadlines.

Payday Loan Interest Rates Explained

Payday loans often come with high-interest rates. It’s essential to read the fine print. These rates can make it hard to pay back the loan on time, leading to a cycle of debt. Always calculate the total cost before signing any agreement.

Need cash fast? AdvanceCash offers quick payday loans to help you cover your expenses!

What Are the Most Common Hidden Fees?

When considering a loan, it’s crucial to be aware of Hidden Loan Costs to Watch For. These sneaky fees can turn a seemingly good deal into a financial burden. Understanding these costs helps you make informed decisions and avoid unexpected surprises down the road.

Application Fees

Some lenders charge an application fee just for processing your loan request. This fee can vary, so always ask upfront if there are any costs associated with applying.

Origination Fees

Origination fees are charged for setting up your loan. They can be a percentage of the loan amount, so it’s essential to factor this into your total cost.

Prepayment Penalties

Did you know that paying off your loan early can sometimes cost you? Some lenders impose prepayment penalties, which can negate the benefits of paying off debt sooner.

Late Payment Fees

If you miss a payment, late fees can add up quickly. These fees can be hefty, so it’s vital to stay on top of your payment schedule to avoid them.

How to Identify Hidden Loan Costs Before Signing

When considering a loan, it’s crucial to understand the Hidden Loan Costs to Watch For. These costs can sneak up on you, turning what seemed like a good deal into a financial burden. Knowing how to spot these fees can save you from unexpected surprises down the road.

Read the Fine Print

Always read the loan agreement carefully. Look for any mention of fees that aren’t immediately obvious. This includes application fees, late payment penalties, and even prepayment penalties that could catch you off guard.

Ask Questions

Don’t hesitate to ask the lender about any unclear terms. A reputable lender will be happy to explain the payday loan interest rates explained and any other fees involved. If they seem evasive, it’s a red flag!

Compare Offers

Take the time to compare different loan offers. Some lenders may advertise low interest rates but have higher hidden fees. By comparing, you can find the best deal that truly meets your needs.

If you’re facing unexpected bills, AdvanceCash can provide you with the funds you need instantly!

The Impact of Hidden Costs on Your Loan Repayment

When considering a loan, many people focus solely on the interest rate, but there are Hidden Loan Costs to Watch For that can sneak up on you. These unexpected fees can significantly impact your overall repayment amount, making your loan much more expensive than you initially thought. Understanding these costs is crucial to avoid financial surprises down the road.

Common Hidden Costs

- Origination Fees: This is a fee charged by lenders for processing your loan application. It can be a percentage of the loan amount, adding to your total cost.

- Prepayment Penalties: Some loans charge you if you pay them off early. This can be frustrating if you want to save on interest by paying off your loan sooner.

- Late Payment Fees: Missing a payment can lead to hefty fees, increasing your total debt.

Why It Matters

Understanding these hidden costs is essential. For instance, if you’re looking at payday loan interest rates explained, knowing about these fees can help you make a more informed decision. By being aware, you can budget better and avoid falling into a debt trap. Remember, knowledge is power when it comes to loans!

Also Read: Payday Loan Interest Rates Explained: What to Know

Are You Paying for Unnecessary Services?

When considering a loan, many people focus solely on the interest rate. However, there are Hidden Loan Costs to Watch For that can sneak up on you. These unexpected fees can turn a seemingly good deal into a financial burden. Understanding these costs is crucial to avoid paying more than you bargained for.

Sometimes, lenders offer additional services that you may not need. These can include things like payment protection plans or credit insurance. While they sound helpful, they often come with extra fees that can add up quickly. Before agreeing to any service, ask yourself: Do I really need this?

Key Points to Consider:

- Read the Fine Print: Always check the loan agreement for any hidden fees.

- Ask Questions: Don’t hesitate to ask your lender about any charges you don’t understand.

- Compare Offers: Look at different lenders to see who offers the best deal without unnecessary extras.

By being aware of these potential costs, you can make a more informed decision and avoid falling into a trap of high payday loan interest rates explained in the fine print.

Tips for Negotiating Loan Terms to Avoid Hidden Fees

When seeking a loan, being aware of Hidden Loan Costs to Watch For is essential. These unexpected fees can transform a seemingly good deal into a financial burden. By understanding these costs, you can make informed choices and steer clear of surprises later on.

Ask About All Fees

Before signing, ensure you ask the lender to clarify all potential fees, including application and processing fees. Knowing these details upfront can save you money in the long run.

Compare Different Lenders

Not all lenders are the same. Take time to compare payday loan interest rates explained by various companies. This helps you identify lenders with lower fees and better terms, allowing you to make the best choice for your situation.

Read the Fine Print

Always read the fine print in your loan agreement. This document contains crucial information about hidden fees, such as ‘origination fees’ or ‘prepayment penalties’ that could lead to unexpected costs.

Negotiate Terms

Don’t hesitate to negotiate! If you encounter high fees, ask the lender if they can reduce them. Many are open to negotiation, especially if you have a good credit score.

Seek Recommendations

Consult friends or family who have taken out loans. Their experiences can guide you to lenders who are upfront about their fees, helping you avoid hidden costs.

How AdvanceCash Can Help You Navigate Loan Costs

When considering a loan, it’s crucial to understand that the advertised rate isn’t the only cost involved. Hidden loan costs can sneak up on you, leading to unexpected fees that can strain your budget. Knowing what to look for can save you from financial surprises down the road.

At AdvanceCash, we believe in transparency. We help you identify hidden loan costs to watch for, ensuring you make informed decisions. Here’s how we simplify the process:

Key Insights to Consider:

- Read the Fine Print: Always check the terms and conditions for any additional fees.

- Ask Questions: Don’t hesitate to ask lenders about potential hidden costs.

- Compare Offers: Look at different lenders to see who provides the best overall deal, including payday loan interest rates explained.

By being proactive and informed, you can avoid the pitfalls of hidden fees. At AdvanceCash, we guide you through the loan process, making it easier to spot these costs and secure a loan that fits your needs without breaking the bank.

The Importance of Reading the Fine Print in Loan Agreements

When it comes to loans, many people focus on the big numbers, like the total amount borrowed or the interest rate. However, Hidden Loan Costs to Watch For can sneak up on you and turn a manageable loan into a financial burden. That’s why it’s crucial to read the fine print in loan agreements before signing anything.

Understanding the details of your loan can save you from unexpected fees. For instance, some lenders may charge processing fees, late payment penalties, or even prepayment penalties. These costs can add up quickly, so knowing what to expect is key.

Key Hidden Costs to Look Out For:

- Processing Fees: These are charges for handling your loan application.

- Late Payment Fees: Missing a payment can lead to extra charges.

- Prepayment Penalties: Some loans penalize you for paying off your loan early.

By being aware of these hidden costs, you can make informed decisions. Additionally, if you’re considering a payday loan, it’s essential to understand how Payday Loan Interest Rates Explained can impact your repayment. Always ask questions and clarify any terms you don’t understand.

FAQs

🔍 What hidden fees might be included in a payday loan?

Some lenders charge origination fees, late payment penalties, rollover fees, and even processing or verification charges that aren’t always clear upfront.

📄 Are loan processing fees always disclosed?

Not always—some lenders may bury them in fine print. Always read the full loan agreement and ask for a fee breakdown before signing.

💳 Can I be charged for early repayment?

Yes, certain lenders impose prepayment penalties if you pay off your loan before the due date. Check this clause in your contract.

🔄 What is a rollover fee and how does it work?

A rollover fee is charged when you extend your loan instead of paying it on time. This can stack up quickly, leading to a debt cycle.

⚠️ How can I avoid surprise loan costs?

Choose licensed, transparent lenders and read every part of your loan terms. Avoid deals that seem too good to be true or lack detailed fee disclosures.

Don’t let financial stress hold you back. AdvanceCash is here to help you secure your payday loan today!

🔗At ExpressCash, we’re here to help guide you through the process and find the right financial solution for your specific situation.