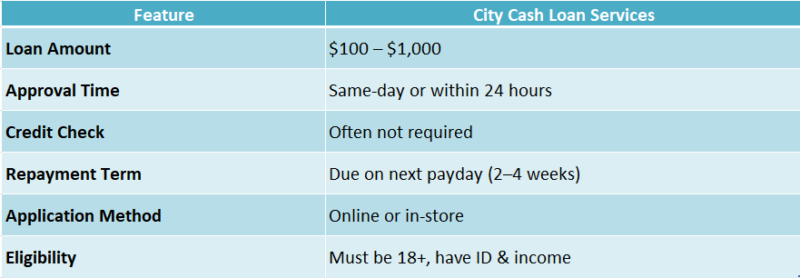

Unexpected expenses can be challenging, but understanding the City Cash Loan can make a significant difference. This guide will help you know what to expect and how to apply effectively.

What is a City Cash Loan?

A city cash loan is a short-term borrowing option designed for urgent financial needs. It’s quick and easy, making it a go-to choice for those needing cash fast.

How to Apply for a City Cash Loan

Applying is simple. Follow these steps:

- Research: Find payday loan lenders & locations nearby.

- Gather Documents: Prepare proof of income and ID.

- Fill Out the Application: You can apply online or in-person.

- Receive Your Funds: Approved loans typically provide quick access to cash!

Benefits of a City Cash Loan

- Quick Access to Cash: Ideal for emergencies.

- Flexible Terms: Various repayment options available.

- Easy Application Process: Requires minimal paperwork.

In conclusion, a city cash loan can be a valuable financial resource when needed, but always borrow responsibly!

Need cash fast? AdvanceCash offers quick payday loans to help you cover your expenses!

What Are the Eligibility Requirements for a City Cash Loan?

Understanding the eligibility requirements for a city cash loan is essential for a smooth application process. This knowledge not only prepares you but also boosts your chances of approval, especially when working with payday loan lenders and locations.

Basic Eligibility Criteria

To qualify for a city cash loan, you generally need to meet these basic requirements:

- Age: At least 18 years old.

- Income: A steady source of income is necessary.

- Residency: You must reside in the city where you apply.

Additional Considerations

Lenders may also review your credit history. While a good credit score can enhance your chances, many payday loan lenders are flexible and prioritize your ability to repay the loan. By knowing these requirements, you can confidently approach your application. Keep in mind that each lender may have different criteria, so it’s beneficial to check with specific payday loan lenders and locations.

How to Apply for a City Cash Loan: Step-by-Step Guide

Applying for a City Cash Loan can be a straightforward process, especially if you know what to expect. Whether you need quick cash for an emergency or unexpected expenses, understanding the application steps can make it easier. Let’s dive into how you can secure your funds without the hassle!

Step-by-Step Guide to Applying for a City Cash Loan

- Research Lenders: Start by looking for payday loan lenders and locations in your area. This will help you find the best options available.

- Gather Your Documents: You’ll typically need proof of income, identification, and a bank account. Having these ready speeds up the process.

- Fill Out the Application: Most lenders offer online applications. Just provide your details and submit!

What to Expect After Applying

- Quick Approval: Many lenders will review your application quickly, often within minutes.

- Receive Your Funds: If approved, you can expect to receive your cash in your bank account shortly after. Just remember to read the terms carefully before signing!

If you’re facing unexpected bills, AdvanceCash can provide you with the funds you need instantly!

What Documents Do You Need for a City Cash Loan Application?

When applying for a city cash loan, knowing the required documents is essential. This preparation can streamline your application process, making you feel more confident whether you’re dealing with unexpected expenses or planning a significant purchase.

Required Documents

To apply for a city cash loan, you generally need the following:

- Identification: A government-issued ID, such as a driver’s license or passport.

- Proof of Income: Recent pay stubs or bank statements to verify your earnings.

- Social Security Number: Necessary for identity verification.

- Residency Proof: A utility bill or lease agreement can suffice.

Having these documents ready can expedite your application with payday loan lenders & locations, making it easier to access the funds you need.

Importance of Preparation

Collecting the right documents not only speeds up the application process but also boosts your chances of approval. Being organized demonstrates to lenders that you are responsible and trustworthy. So, before visiting a payday loan lender, ensure you have everything in order.

Also Read: Payday Loan Lenders & Locations: Where to Apply Near You

The Benefits of Choosing a City Cash Loan Over Traditional Loans

When considering a loan, many people explore their options. Understanding City Cash Loan: What to Expect and How to Apply is essential for accessing fast cash. Unlike traditional loans, City Cash Loans provide quick access to funds, making them ideal for immediate financial needs.

Quick Approval Process

- Fast Access: City Cash Loans often offer same-day approval, while traditional loans can take days or weeks.

- Less Paperwork: The application process is simpler, requiring fewer documents.

Flexible Terms

- Tailored Repayment: City Cash Loans can be customized to fit your budget, easing repayment.

- Local Payday Loan Lenders & Locations: With many lenders nearby, you can find convenient support.

In summary, opting for a City Cash Loan is a smart choice for quick cash. With a straightforward application and flexible terms, obtaining funds is hassle-free compared to traditional loans. If you’re in need, consider visiting local payday loan lenders for assistance.

Common Misconceptions About City Cash Loans: Debunking the Myths

When considering a city cash loan, many people have questions and misconceptions. Understanding what to expect and how to apply can help you make informed decisions. Let’s clear up some common myths surrounding city cash loans so you can navigate the process with confidence.

Myth 1: City Cash Loans Are Only for Emergencies

Many believe city cash loans are solely for urgent situations. While they can assist in emergencies, they are also beneficial for planned expenses like home repairs or medical bills. This broader perspective can help you decide when to apply.

Myth 2: The Application Process is Complicated

Some think applying for a city cash loan is a lengthy ordeal. In reality, most payday loan lenders have streamlined processes. You can often apply online or visit local locations, making it quick and easy to access the funds you need.

Myth 3: You Need Perfect Credit

Another misconception is that only those with excellent credit can qualify. Many payday loan lenders consider various factors beyond your credit score, meaning you might still be eligible even if your credit isn’t perfect.

How Long Does It Take to Get Approved for a City Cash Loan?

When you’re in a tight spot financially, knowing how long it takes to get approved for a City Cash Loan can be a game changer. Understanding this process helps you plan your finances better and eases the stress of unexpected expenses. So, let’s dive into what you can expect!

Typically, the approval process for a City Cash Loan is quite fast. Most applicants receive a decision within minutes after submitting their application. However, some factors can influence this timeline, such as:

- Completeness of your application: Ensure all information is accurate and complete to avoid delays.

- Verification process: Lenders may need to verify your income and identity, which can take extra time.

- Loan amount: Larger loans might require more scrutiny, extending the approval time.

In general, if you apply during business hours, you could have cash in hand by the end of the day! Just remember, it’s always wise to check with local payday loan lenders & locations for specific timelines.

What to Expect After Applying for a City Cash Loan: The Approval Process

When you apply for a city cash loan, understanding what happens next can ease your mind. Knowing the approval process helps you prepare for the next steps and manage your expectations. Let’s dive into what you can expect after submitting your application!

The Approval Process

After applying, payday loan lenders typically review your application quickly. Here’s what happens:

- Application Review: Lenders check your information for accuracy.

- Credit Check: They may look at your credit history, but don’t worry; many city cash loan lenders are flexible!

- Decision Time: You’ll usually get a decision within hours, sometimes even minutes!

What Happens Next?

Once approved, you’ll receive details about your loan. Here’s what to keep in mind:

- Loan Amount: Know how much you can borrow.

- Repayment Terms: Understand when and how you’ll need to pay it back.

- Funds Disbursement: Most lenders will deposit the money directly into your bank account, making it easy to access your funds.

How AdvanceCash.com Can Simplify Your City Cash Loan Experience

When life throws unexpected expenses your way, understanding how to navigate a city cash loan can make all the difference. Knowing what to expect and how to apply can help you feel more confident and less stressed. This is where AdvanceCash.com comes in to simplify your experience!

Easy Application Process

Applying for a city cash loan doesn’t have to be complicated. With AdvanceCash.com, you can fill out a simple online form in just a few minutes. No long lines or endless paperwork!

Quick Approval

Once you submit your application, payday loan lenders will review it quickly. You could receive approval within hours, allowing you to tackle your financial needs without delay.

Local Lenders at Your Fingertips

AdvanceCash.com connects you with payday loan lenders and locations near you. This means you can find the best options available in your area, making it easier to get the cash you need when you need it.

Tips for Managing Your City Cash Loan Responsibly: Best Practices

When considering a city cash loan, it’s essential to understand what to expect and how to apply. These loans can provide quick financial relief, but managing them responsibly is crucial. Knowing how to navigate the process can make a significant difference in your financial health.

Understand Your Loan Terms

Before signing anything, read the loan agreement carefully. Know the interest rates, repayment terms, and any fees involved. This knowledge will help you avoid surprises later on.

Create a Repayment Plan

Plan how you’ll repay your city cash loan. Consider your monthly budget and set aside funds specifically for loan payments. This strategy ensures you stay on track and avoid late fees.

Communicate with Your Lender

If you face difficulties, reach out to your payday loan lenders. They may offer solutions like extended payment plans or other options to help you manage your loan effectively.

FAQs

🏙️ What is a City Cash Loan?

A City Cash Loan generally refers to a short-term loan or cash advance offered by lenders like Check City or Cash City Payday. These loans are designed to help with emergency expenses until your next payday.

💻 Can I apply for a City Cash Loan online?

Yes, many City Cash Loan providers offer a fully online application, allowing you to apply in minutes and, if approved, receive funds as soon as the same day.

🔍 Is City Cash Loan a direct lender or a loan matching service?

It depends on the provider. Some City Cash Loan sites act as direct lenders, while others function as loan brokers, connecting you with third-party lenders.

⚠️ Is City Cash Loan a scam?

There have been reports of scam warnings related to similarly named websites. Always verify that the site is secure, check reviews, and avoid lenders who ask for upfront fees or personal info without explanation.

📑 What do I need to qualify for a City Cash Loan?

You usually need to be 18 or older, have a steady source of income, a valid ID, and a checking account. Requirements may vary slightly depending on the lender.

Don’t let financial stress hold you back. AdvanceCash is here to help you secure your payday loan today!

🔗At ExpressCash, we’re here to help guide you through the process and find the right financial solution for your specific situation.