When facing unexpected expenses, knowing if Check n Go offers same day funds can be crucial. Quick access to cash helps you manage urgent costs, like car repairs or medical bills, without the hassle of waiting for approval.

What Are Same Day Funds?

Same day funds allow you to receive money on the same day you apply, which is vital for those in urgent need of cash. Check n Go strives to provide this service, but there are important details to consider.

Check n Go Payday Loan Requirements

To qualify for check n go same day funds, you must meet specific payday loan requirements, including:

- Valid ID: A government-issued ID for identity verification.

- Proof of Income: Recent pay stubs or bank statements.

- Bank Account: A checking account for fund deposits.

Having these documents ready can expedite the process and improve your chances of getting funds the same day!

Need cash fast? AdvanceCash offers quick payday loans to help you cover your expenses!

How Does Check n Go Facilitate Same Day Funding?

When you find yourself in a tight spot financially, knowing whether Check n Go offers same day funds can be a game changer. This option can help you cover unexpected expenses quickly, making it a popular choice for many. But how does Check n Go make this possible?

Check n Go has streamlined its process to ensure you can access funds on the same day you apply. Here’s how:

- Quick Application Process: You can fill out an application online or in-store, making it easy to get started.

- Instant Approval: Once you meet the Check n Go payday loan requirements, you can receive approval almost immediately. This means less waiting and more time to handle your financial needs.

- Fast Funding Options: After approval, funds can be deposited directly into your bank account, often within hours. This is perfect for emergencies or urgent bills!

In summary, Check n Go’s efficient system allows for quick access to cash, making same day funds a reality for those in need.

Eligibility Criteria for Check n Go Same Day Funds

When you’re in a financial pinch, knowing if Check n Go offers same day funds can be a game changer. This service allows you to access cash quickly, which is crucial for unexpected expenses. But what does it take to qualify for these speedy funds? Let’s dive into the eligibility criteria.

Check n Go Same Day Funds Requirements

To qualify for Check n Go same day funds, you need to meet certain requirements. Here’s what you typically need:

- Age: You must be at least 18 years old.

- Income: A steady source of income is essential. This could be from a job, benefits, or other reliable sources.

- Bank Account: Having an active checking account is crucial for direct deposits.

Additional Considerations

While these are the basic check n go payday loan requirements, it’s also important to consider your credit history. A good credit score can improve your chances of approval. Remember, the quicker you provide the necessary documents, the faster you can get your funds!

If you’re facing unexpected bills, AdvanceCash can provide you with the funds you need instantly!

The Application Process for Same Day Funds at Check n Go

When you find yourself in a financial pinch, knowing if Check n Go offers same day funds can be a game changer. Quick access to cash can help you cover unexpected expenses, like car repairs or medical bills, without the stress of waiting days for approval.

Simple Steps to Apply

Applying for a Check n Go payday loan is straightforward. Here’s what you need to do:

- Visit the Website or Store: You can apply online or in person.

- Fill Out the Application: Provide your personal information and financial details.

- Meet the Requirements: Ensure you meet the check n go payday loan requirements, such as age and income verification.

Quick Approval

Once you submit your application, Check n Go reviews it quickly. If approved, you could receive your funds the same day! Just make sure to have all necessary documents ready to speed up the process. This way, you can tackle your financial needs without delay.

What to Expect After Applying for Check n Go Same Day Funds?

When you find yourself in a financial pinch, knowing whether Check n Go offers same day funds can be a game changer. This service can provide quick cash when you need it most, helping you cover unexpected expenses without the long wait. Let’s dive into what you can expect after applying for Check n Go same day funds.

The Application Process

After submitting your application, Check n Go reviews your information quickly. If you meet the Check n Go payday loan requirements, you could receive approval within minutes. This means you won’t be left hanging for days, which is a huge relief during emergencies!

What Happens Next?

Once approved, you can choose how to receive your funds. Here are your options:

- Direct Deposit: Funds can be sent straight to your bank account.

- Cash Pickup: You might be able to pick up cash at a nearby location.

This flexibility ensures you get the money when you need it, making the process smooth and stress-free.

Are There Any Fees Associated with Check n Go Same Day Funds?

When you need cash quickly, knowing if Check n Go offers same day funds can be crucial. This service helps you manage unexpected expenses without a long wait. However, it’s vital to understand any associated fees before proceeding.

Understanding the Costs

Check n Go does offer same day funds, but potential fees vary based on the loan amount and your state. Generally, they charge a percentage of the loan, which can accumulate quickly.

Key Points to Consider:

- Loan Amount: Higher loans may incur higher fees.

- State Regulations: Fees can vary by local laws.

- Repayment Terms: Knowing when and how to repay the loan is essential, as it impacts your total costs.

By familiarizing yourself with the Check n Go payday loan requirements and fees, you can make a more informed choice about whether this option suits your needs.

Customer Experiences: Success Stories with Check n Go Same Day Funds

When unexpected expenses arise, knowing if Check n Go offers same day funds can be crucial. Many customers find themselves needing quick cash for bills or emergencies, and Check n Go’s same day funds provide timely relief.

Real-Life Success Stories

Customers have shared their positive experiences with Check n Go:

- Quick Access: Sarah, a single mom, needed funds for car repairs and received her check the same day, getting her back on the road quickly.

- Simple Process: John found it easy to meet the Check n Go payday loan requirements. He applied online and had cash in hand within hours!

Benefits of Same Day Funds

Check n Go’s same day funds offer key advantages:

- Immediate Relief: Ideal for urgent expenses.

- Convenience: Fast application process online or in-store.

- Flexibility: Helps manage unexpected financial challenges effectively.

These stories highlight how Check n Go can be a reliable option for those in need of quick financial support.

Comparing Check n Go Same Day Funds with Other Lenders

When you need cash quickly, knowing whether a lender offers same day funds can make a big difference. For many, Check n Go is a popular choice. But does Check n Go offer same day funds? Understanding this can help you decide if it’s the right option for your financial needs.

Quick Access to Cash

Check n Go does provide same day funds for eligible borrowers. This means if you meet their Check n Go payday loan requirements, you could have cash in hand by the end of the day. This is especially helpful for emergencies or unexpected expenses.

Why Choose Check n Go?

- Fast Approval: Many customers appreciate the quick approval process.

- Convenient Locations: With numerous branches, getting help is easy.

- Flexible Options: They offer various loan amounts to fit your needs.

While other lenders may also offer same day funds, Check n Go stands out for its straightforward requirements and customer service. Always compare your options to find the best fit!

Tips for Maximizing Your Chances of Receiving Same Day Funds

When you find yourself in a financial pinch, knowing whether Check n Go offers same day funds can be a game changer. Quick access to cash can help you cover unexpected expenses and avoid late fees. But how can you ensure you get those funds on the same day?

Understand Check n Go Payday Loan Requirements

To maximize your chances of receiving same day funds, it’s crucial to understand the Check n Go payday loan requirements. Make sure you have the necessary documents ready, such as:

- A valid ID

- Proof of income

- A checking account

This preparation can speed up the application process significantly!

Apply Early in the Day

Timing is everything! To increase your chances of getting same day funds, apply early in the day. The sooner you submit your application, the more likely it is to be processed quickly. Plus, don’t forget to double-check your application for any errors before hitting submit!

How AdvanceCash Can Help You Navigate Check n Go Same Day Funds Options

When you find yourself in a financial pinch, knowing whether Check n Go offers same day funds can be a game changer. Quick access to cash can help you cover unexpected expenses, like car repairs or medical bills, without the stress of waiting days for approval.

Understanding Same Day Funds

Check n Go provides same day funds for eligible applicants. This means if you meet their requirements, you could receive your payday loan on the same day you apply. It’s a relief for many who need immediate cash!

Check n Go Payday Loan Requirements

To qualify for check n go same day funds, you typically need to meet these requirements:

- Be at least 18 years old

- Have a steady income

- Provide a valid ID

- Have an active checking account

By understanding these requirements, you can prepare your application and increase your chances of getting funds quickly.

FAQs

💸 Can I receive same-day funding from Check ‘n Go?

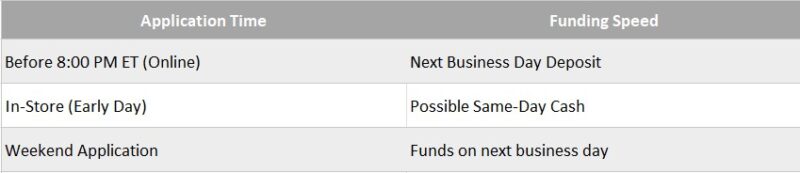

Yes, Check ‘n Go offers same-day funding for payday loans. If your application is approved and finalized by 8:00 PM ET on a business day, funds are typically deposited into your bank account by the next business day.

📝 What are the requirements to qualify for same-day funding?

To be eligible, you must be at least 18 years old, provide a valid government-issued photo ID, have proof of income, an active checking account, and a valid phone number. In some states, additional documentation like your Social Security Number may be required.

⏱️ How quickly can I complete the application process?

The online application process is designed to be quick and straightforward, often taking just a few minutes to complete. Approval decisions are typically made promptly, allowing for expedited funding.

🔄 Are there any restrictions on loan renewals or rollovers?

No, rollovers are not permitted. However, borrowers may elect once every 12 months to repay a payday loan through an extended payment plan.

🏦 Do I need a checking account to receive same-day funds?

Yes, an active checking account is required to receive funds. This account must have been active for at least 30 days prior to your application.

Don’t let financial stress hold you back. AdvanceCash is here to help you secure your payday loan today!

🔗At ExpressCash, we’re here to help guide you through the process and find the right financial solution for your specific situation.