Understanding the requirements for a payday loan is crucial, especially if you’re considering a Check N Go payday loan. Knowing what you need can help you prepare and avoid any surprises. Let’s dive into the essentials of check n go payday loan requirements so you can feel confident in your decision.

Basic Eligibility Criteria

To qualify for a Check N Go payday loan, you typically need to meet a few basic requirements. Here’s what you should have:

- Age: You must be at least 18 years old.

- Income: A steady source of income is essential, whether from a job or benefits.

- Bank Account: A valid checking account is necessary for loan disbursement and repayment.

Documentation Needed

When applying, you’ll need to provide some documents. Here’s a quick list:

- Identification: A government-issued ID like a driver’s license.

- Proof of Income: Recent pay stubs or bank statements.

- Social Security Number: This helps verify your identity.

By gathering these documents ahead of time, you can streamline the application process and increase your chances of approval. Understanding check n go payday loan requirements can make your financial journey smoother!

Need cash fast? AdvanceCash offers quick payday loans to help you cover your expenses!

What Documents Do You Need for a Check N Go Payday Loan?

When you’re in a financial pinch, knowing the check n go payday loan requirements can make all the difference. These loans are designed to help you cover unexpected expenses quickly. But before you apply, it’s important to gather the necessary documents to ensure a smooth process.

To get started with a Check N Go payday loan, you’ll need a few key documents. Here’s a simple list to help you prepare:

Required Documents:

- Valid ID: A government-issued ID, like a driver’s license or passport, to prove your identity.

- Proof of Income: Recent pay stubs or bank statements to show you have a steady income.

- Social Security Number: This helps verify your identity and eligibility.

- Bank Account Information: You’ll need your bank account number for direct deposit of the loan funds.

Having these documents ready can speed up your application process. It’s also a good idea to check if your state has any additional requirements. By understanding the check n go payday loan requirements, you can approach your financial needs with confidence and clarity.

Eligibility Criteria: Who Can Apply for Check N Go Payday Loans?

When considering a payday loan, understanding the check n go payday loan requirements is crucial. These requirements help determine if you qualify for a loan, ensuring you can meet your financial needs without unnecessary stress. Let’s dive into who can apply and what you need to get started!

Basic Eligibility Criteria

To apply for a Check N Go payday loan, you generally need to meet the following criteria:

- Age: You must be at least 18 years old.

- Income: A steady source of income is essential, whether from a job or other means.

- Residency: You should be a resident of the state where you are applying for the loan.

Additional Requirements

Besides the basics, there are a few more check n go payday loan requirements to keep in mind:

- Bank Account: A valid checking account is necessary for loan disbursement and repayment.

- Identification: You’ll need to provide a government-issued ID, like a driver’s license or passport.

- Contact Information: Valid phone number and email address are required for communication purposes.

Meeting these requirements can help streamline your application process, making it easier to access the funds you need.

If you’re facing unexpected bills, AdvanceCash can provide you with the funds you need instantly!

How to Apply for a Check N Go Payday Loan: A Step-by-Step Guide

When you’re in a tight spot financially, understanding the check n go payday loan requirements can make all the difference. These loans can provide quick cash to help you cover unexpected expenses, but knowing what you need to apply is crucial. Let’s break it down step-by-step!

Basic Requirements to Apply for a Check N Go Payday Loan

To get started, you need to meet some basic criteria. Here’s what you typically need:

- Age: You must be at least 18 years old.

- Income: A steady source of income is essential, whether from a job or benefits.

- Identification: A valid ID, like a driver’s license or state ID, is required.

- Bank Account: You’ll need an active checking account for the loan deposit and repayment.

The Application Process

Once you know the check n go payday loan requirements, applying is straightforward. Here’s how you can do it:

- Gather Your Documents: Collect your ID, proof of income, and bank details.

- Visit the Website or Store: You can apply online or in person at a Check N Go location.

- Fill Out the Application: Provide your information accurately to avoid delays.

- Review and Submit: Double-check everything before submitting your application.

- Receive Your Funds: If approved, you’ll get your cash quickly, often the same day!

Understanding the check n go payday loan requirements is key to navigating your financial needs effectively. By following these steps, you can secure the funds you need without unnecessary stress. Remember, always borrow responsibly!

Common Misconceptions About Check N Go Payday Loan Requirements

Understanding check n go payday loan requirements is essential for anyone considering this option. It helps you avoid surprises and makes the borrowing process smoother. Let’s address some common misconceptions about these requirements.

1. You Need Perfect Credit: Many believe only those with excellent credit qualify for payday loans. In reality, check n go payday loan requirements are flexible, focusing more on income than credit scores.

2. You Must Have a Bank Account: While having a bank account can simplify the process, it’s not always necessary. Some locations may allow funds to be received through other means, like prepaid cards.

3. You Need Extensive Documentation: Some think applying requires piles of paperwork. However, check n go payday loan requirements usually involve just a few key documents, such as proof of income and ID, making it appealing to many borrowers.

4. You Can Only Borrow a Small Amount: Many assume payday loans are limited to small sums. However, check n go payday loan requirements can allow for larger amounts based on income and state regulations.

5. All Locations Have the Same Rules: It’s a common belief that every Check N Go location follows the same guidelines. In truth, requirements can vary by state due to different laws, so checking local regulations is crucial.

6. The Process is Complicated: Some think applying for a payday loan is lengthy and complex. In fact, the application process is usually quick and straightforward, often taking just a few minutes.

How Check N Go Can Help You Navigate Loan Requirements

When unexpected expenses arise, understanding the check n go payday loan requirements can be a lifesaver. These loans can help bridge the gap until your next paycheck, but knowing what you need to qualify is crucial. Let’s dive into how Check N Go can guide you through this process.

Check N Go makes it easy to understand what you need to apply for a payday loan. Here are the basic requirements you should keep in mind:

- Age: You must be at least 18 years old.

- Income: A steady source of income is essential, whether from a job or benefits.

- Identification: Valid ID, like a driver’s license or state ID, is required.

- Bank Account: A checking account is necessary for loan disbursement and repayment.

By meeting these check n go payday loan requirements, you can quickly access the funds you need. Plus, Check N Go offers a friendly team ready to assist you with any questions you may have. Understanding the check n go payday loan requirements is the first step towards financial relief. With the right information and support, you can confidently navigate the loan process. Remember, Check N Go is here to help you every step of the way!

Tips for Meeting Check N Go Payday Loan Requirements Successfully

When considering a payday loan, understanding the check n go payday loan requirements is crucial. These requirements help ensure that you can repay the loan on time and avoid falling into a cycle of debt. Knowing what to expect can make the process smoother and less stressful.

Basic Requirements for Check N Go Payday Loans

To qualify for a check n go payday loan, you typically need to meet a few basic criteria. Here’s what you should have ready:

- Proof of Identity: A government-issued ID, like a driver’s license.

- Income Verification: Recent pay stubs or bank statements to show you can repay the loan.

- Age Requirement: You must be at least 18 years old.

Tips for Success

Meeting the check n go payday loan requirements can be easier with these tips:

- Organize Your Documents: Keep your ID and income proof handy to speed up the application process.

- Check Your Credit: While payday loans often don’t require a credit check, knowing your score can help you understand your options.

- Read the Fine Print: Understand the terms and fees associated with the loan to avoid surprises later.

By preparing ahead, you can navigate the check n go payday loan requirements successfully and secure the funds you need.

FAQs

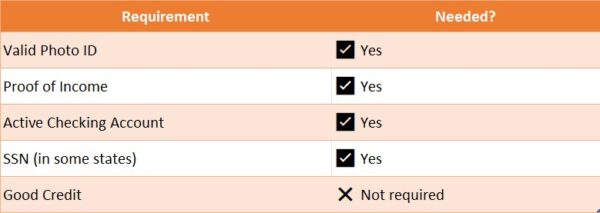

🧾 What documents do I need to apply for a Check ‘n Go payday loan?

To apply, you’ll need a valid U.S. government-issued photo ID or driver’s license, proof of your most recent income, a valid and working phone number, and proof of routing and account number from an open and active checking account that’s been active for at least 30 days. In some states like Alabama, Indiana, and Oklahoma, official documentation of your Social Security Number is also required.

📅 How quickly can I receive funds after approval?

If your application is approved and originated by 8:00 PM ET on a business day, online loans are typically funded no later than the following business day. All times and dates are based on Eastern Time (ET).

🔄 Can I renew or roll over my payday loan?

No, rollovers are not permitted. However, borrowers may elect once every 12 months to repay a payday loan through an extended payment plan.

💳 Do I need a good credit score to qualify?

Check ‘n Go and third-party lenders may, at their discretion, verify application information using national databases that may provide information from one or more national credit bureaus. However, a good credit score is not necessarily required for approval.

🏦 Can I apply for a payday loan if I don’t have a checking account?

No, a checking account is required. You must provide proof of routing and account number from an open and active checking account that’s been active for at least 30 days.

Don’t let financial stress hold you back. AdvanceCash is here to help you secure your payday loan today!

🔗At ExpressCash, we’re here to help guide you through the process and find the right financial solution for your specific situation.