Understanding how Check N Go verifies checks before approval is crucial for anyone considering their services. This process ensures that the checks are legitimate and helps prevent fraud, making it safer for both the lender and the borrower. So, how does Check N Go verify checks? Let’s dive into the details!

The Verification Steps at Check N Go

Check N Go follows a systematic approach to verify checks. Here are the key steps involved:

- Check Information: They start by examining the check’s details, including the account number and routing number.

- Bank Verification: Next, they contact the issuing bank to confirm that the account is active and has sufficient funds.

- Fraud Detection: They also use advanced technology to detect any signs of fraud, ensuring that the check is not counterfeit.

These steps help Check N Go maintain a secure lending environment, which is essential for meeting their payday loan requirements.

Why Verification Matters

Understanding the verification process is important for borrowers. It not only protects you but also ensures that you meet the Check N Go payday loan requirements. By verifying checks, Check N Go can offer loans responsibly, making sure that borrowers can repay them without falling into financial trouble. This process ultimately builds trust between the lender and the borrower.

Need cash fast? AdvanceCash offers quick payday loans to help you cover your expenses!

What Methods Does Check N Go Use to Verify Checks?

When you’re in a pinch and need quick cash, understanding how Check N Go verifies checks before approval is crucial. This process helps ensure that the checks are legitimate, protecting both the lender and the borrower. Knowing what to expect can make your experience smoother and more transparent.

Check N Go employs several methods to verify checks, ensuring they meet their payday loan requirements. Here are some key techniques they use:

- Check Verification Services: They utilize specialized services that confirm the authenticity of the check. This includes checking the issuing bank’s details and the account status.

- Bank Account Validation: Check N Go verifies that the account linked to the check is active and has sufficient funds. This step is vital to prevent bounced checks.

- Fraud Detection Tools: Advanced technology helps identify any signs of fraud. This includes analyzing patterns and red flags that may indicate a problem with the check.

By understanding how Check N Go verifies checks, you can feel more confident in the process. This knowledge not only helps you meet the check n go payday loan requirements but also ensures a smoother transaction overall.

How Does Check N Go Verify Checks for Fraud Prevention?

When you think about getting a payday loan, you might wonder, “How does Check N Go verify checks before approval?” This process is crucial for preventing fraud and ensuring that both the lender and borrower are protected. Understanding this can help you feel more confident when applying for a loan.

Check N Go uses several methods to verify checks. Here are some key steps they take:

- Check Verification Services: They utilize third-party services that specialize in verifying the authenticity of checks. This helps them confirm that the check is valid and not stolen or forged.

- Bank Account Verification: Check N Go may also verify the bank account associated with the check. This ensures that the account has sufficient funds and is in good standing.

- Fraud Detection Technology: They employ advanced technology to detect patterns of fraud. This helps them identify any suspicious activity related to the check being presented.

By understanding how Check N Go verifies checks, you can better navigate the check n go payday loan requirements. This knowledge empowers you to make informed decisions and enhances your overall experience with the loan process.

If you’re facing unexpected bills, AdvanceCash can provide you with the funds you need instantly!

The Role of Technology in Check N Go’s Verification System

When you need quick cash, understanding how does Check N Go verify checks before approval is crucial. This process ensures that the checks are legitimate, protecting both the lender and the borrower. Let’s dive into the technology behind this verification system and how it impacts your experience.

Advanced Verification Techniques

Check N Go uses sophisticated technology to verify checks. They employ:

- Check Scanning: This captures the check’s details for analysis.

- Database Checks: They cross-reference information with banking databases to confirm validity.

Real-Time Processing

The system processes checks in real-time, which means you get quick feedback. This speed is essential, especially when you’re meeting check n go payday loan requirements. If everything checks out, you can receive your funds faster! In conclusion, understanding how Check N Go verifies checks can ease your mind when applying for a payday loan. Their advanced technology not only speeds up the process but also ensures that you’re getting a safe and secure transaction. This way, you can focus on what really matters—getting the cash you need!

What Information is Required for Check Verification at Check N Go?

Understanding how Check N Go verifies checks before approval is essential for anyone considering a payday loan. This verification process ensures that checks are legitimate, protecting both the lender and the borrower. Knowing the required information can help you prepare and improve your chances of approval.

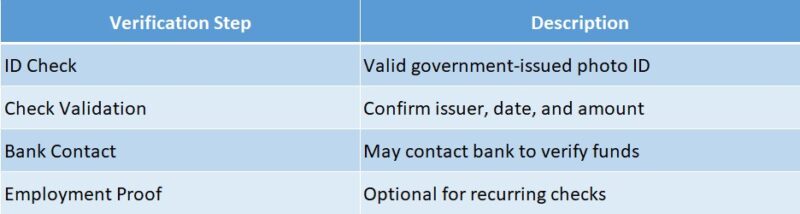

When visiting Check N Go, you’ll need to provide specific details for check verification:

- Personal Identification: A government-issued ID, like a driver’s license or passport, is necessary to confirm your identity.

- Check Details: Present the check, including the check number, amount, and issuing bank’s information.

- Bank Account Information: Your bank account number and routing number are crucial for verifying fund availability.

Gathering this information in advance can streamline the process. Additionally, Check N Go may conduct a quick background check on the check issuer to assess the risk involved in approving your loan.

Why is Check Verification Important?

Check verification is vital as it prevents fraud, ensuring that Check N Go protects itself and its customers from potential losses.

Tips for a Smooth Verification Process

To ease the verification process, consider these tips:

- Bring all necessary documents: Being prepared can speed up your visit.

- Ensure your check is valid: Double-check the details to avoid issues.

- Ask questions: Don’t hesitate to seek clarification from the staff if needed.

How Does Check N Go Verify Checks Before Approval?

When you need quick cash, understanding how Check N Go verifies checks before approval is crucial. This process ensures that checks are legitimate, protecting both lenders and borrowers. Knowing this can boost your confidence when applying for a payday loan.

Check N Go employs several methods to verify checks. Here’s a quick overview of their process:

Verification Steps

- Check Authenticity: They first check for signs of forgery to confirm the check is real.

- Bank Verification: They contact the issuing bank to ensure that funds are available.

- Check History: They review the check’s history to see if it has bounced before.

By following these steps, Check N Go ensures that the checks they accept are valid. This verification process is part of their payday loan requirements, helping to prevent fraud and ensuring smooth transactions for everyone involved.

Why Verification Matters

Verifying checks is essential for both lenders and borrowers. It helps prevent fraud and builds trust, allowing Check N Go to offer loans safely and responsibly.

Benefits of Check Verification

- Security: Protects against fraudulent checks.

- Confidence: Gives borrowers peace of mind knowing their loan is based on valid funds.

- Efficiency: Speeds up the approval process by filtering out bad checks early.

In summary, understanding how Check N Go verifies checks before approval can help you navigate the payday loan process with ease, reassuring you that your financial transactions are secure.

How Can Customers Benefit from Check N Go’s Verification Services?

When you need quick cash, understanding how Check N Go verifies checks before approval is crucial. This process ensures that the checks are legitimate, protecting both the customer and the company. Knowing this can help you feel more secure when applying for a payday loan.

Peace of Mind

Check N Go uses a thorough verification process to confirm the authenticity of checks. This means that customers can trust that their checks are valid, reducing the risk of fraud. It’s a safety net that helps you feel confident in your financial decisions.

Faster Approval Times

By verifying checks efficiently, Check N Go can speed up the approval process for payday loans. This means you get your money faster, which is often what you need in a pinch. Understanding the check N Go payday loan requirements can also help you prepare for a smooth application.

Easy to Understand Process

The verification process is straightforward. Check N Go checks the check’s details against banking records. If everything matches up, you’re good to go! This clarity makes it easier for customers to navigate their financial needs without confusion.

FAQs

🧾 What does Check `n Go require to verify a check?

They typically require a valid government-issued ID and may ask for additional personal or banking information.

🔍 How does Check `n Go confirm a check is legitimate?

They review the check for proper formatting, verify account details, and may contact the issuing bank to confirm available funds.

🚫 Does Check `n Go accept all types of checks?

No, they may decline postdated, altered, or third-party checks due to risk of fraud or insufficient verification.

💼 Does Check `n Go check my employment when verifying a check?

They may ask for proof of income or employment, especially for payday loan applications tied to the check.

🔐 What fraud checks does Check `n Go use?

Check `n Go uses national databases, internal security systems, and bank verification to screen for fraudulent activity.

Don’t let financial stress hold you back. AdvanceCash is here to help you secure your payday loan today!

🔗At ExpressCash, we’re here to help guide you through the process and find the right financial solution for your specific situation.