When you’re in a pinch and need quick cash, understanding your payment options is crucial. Many people wonder, does Check ‘n Go accept Chime for payments? This question is important because it can determine how easily you can manage your payday loan repayments. Knowing your options can save you time and stress.

Payment Methods Available

Check ‘n Go offers several ways to make payments. Here are some common methods:

- Debit and Credit Cards: You can use major cards to pay your loan.

- Bank Transfers: Direct transfers from your bank account are also accepted.

- Cash Payments: Some locations allow cash payments directly at the store.

Does Check ‘n Go Accept Chime?

Unfortunately, Check ‘n Go does not directly accept Chime for payments. However, you can transfer funds from your Chime account to a linked bank account and then make your payment. This method ensures you can still meet your Check ‘n Go payday loan requirements without hassle. In summary, while Check ‘n Go doesn’t accept Chime directly, you can still manage your payments by transferring funds. Understanding these options helps you stay on top of your loans and avoid late fees. Always check with Check ‘n Go for the latest payment methods to ensure a smooth experience.

Need cash fast? AdvanceCash offers quick payday loans to help you cover your expenses!

Does Check ‘n Go Accept Chime? A Comprehensive Guide

When it comes to managing finances, knowing how to make payments is crucial. Many people wonder, does Check ‘n Go accept Chime? This question is important because Chime is a popular banking option for those who prefer digital banking. Understanding this can help you make informed decisions about your payday loans and payments.

Understanding Check ‘n Go and Chime Payments

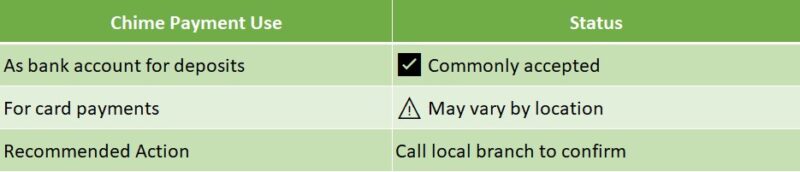

Check ‘n Go is a well-known provider of payday loans, but they have specific payment methods. If you’re using Chime, it’s essential to know if you can use it to pay your loan. Currently, Check ‘n Go does not directly accept Chime for payments. However, you can transfer funds from your Chime account to a traditional bank account that Check ‘n Go accepts.

Alternative Payment Methods

If you’re looking to make payments to Check ‘n Go, here are some alternatives:

- Bank Transfer: You can transfer money from your Chime account to your bank account and then pay Check ‘n Go.

- Debit Card: If you have a debit card linked to your Chime account, you might be able to use it for payments.

- Cash Payments: You can also visit a Check ‘n Go location to pay in cash.

Understanding these options can help you meet the Check ‘n Go payday loan requirements without hassle.

The Benefits of Using Chime for Payments at Check ‘n Go

When it comes to managing finances, many people are looking for convenient ways to make payments. This is where the question, “Does Check ‘n Go accept Chime for payments?” becomes important. Knowing if you can use your Chime account at Check ‘n Go can save you time and hassle, especially when you need quick access to funds.

Using Chime for payments at Check ‘n Go offers several advantages. First, Chime is a mobile banking app that allows you to manage your money easily. You can transfer funds quickly, which is perfect for meeting Check ‘n Go payday loan requirements. Plus, Chime has no hidden fees, making it a budget-friendly option.

Key Benefits of Using Chime:

- Instant Transfers: Chime allows for quick transfers, so you can make payments without delays.

- No Fees: Unlike traditional banks, Chime doesn’t charge monthly fees, which means more money in your pocket.

- Easy Access: You can manage your payments right from your phone, making it super convenient.

In summary, using Chime at Check ‘n Go not only simplifies your payment process but also aligns with your financial goals. So, if you’re wondering about payment options, Chime is definitely worth considering!

If you’re facing unexpected bills, AdvanceCash can provide you with the funds you need instantly!

How to Make Payments with Chime at Check ‘n Go

When you’re in a pinch and need quick cash, knowing how to make payments with Chime at Check ‘n Go can be a game changer. Many people rely on Check ‘n Go for payday loans, but understanding their payment options is crucial. So, does Check ‘n Go accept Chime for payments? Let’s dive into this topic and explore your options!

Understanding Payment Options

Check ‘n Go is known for its flexibility, but it’s important to know if they accept Chime. While Check ‘n Go primarily accepts debit cards and bank transfers, Chime users can often link their accounts for payments. This means you can pay your payday loan directly from your Chime account, making it convenient and hassle-free!

Steps to Make Payments

- Log into your Chime account: Open the app or website and access your account.

- Link your Check ‘n Go account: If you haven’t done this yet, follow the prompts to connect your accounts.

- Initiate the payment: Choose the amount you want to pay and confirm the transaction.

By following these steps, you can easily manage your payments and stay on top of your Check ‘n Go payday loan requirements. Remember, staying informed about your payment options can help you avoid late fees and keep your finances in check!

Common Questions About Chime Payments at Check ‘n Go

When it comes to managing finances, many people are turning to digital banking options like Chime. This raises an important question: does Check ‘n Go accept Chime for payments? Understanding this can help you streamline your payment process, especially if you rely on payday loans.

What You Need to Know About Chime Payments at Check ‘n Go

Check ‘n Go is a popular choice for payday loans, but they have specific payment methods. While they do accept various forms of payment, it’s essential to check directly with them about Chime. Many customers have found that using Chime can simplify their transactions, but it’s always good to confirm.

Check ‘n Go Payday Loan Requirements

If you’re considering a payday loan from Check ‘n Go, you should also be aware of their requirements. Here are some key points to keep in mind:

- Age: You must be at least 18 years old.

- Income: Proof of steady income is necessary.

- Identification: A valid ID is required.

By understanding these requirements, you can better prepare for your visit and ensure a smooth experience. Always remember to ask about payment options, including whether you can use Chime, to avoid any surprises!

Alternatives to Chime for Payments at Check ‘n Go

When considering a payday loan, many people wonder, “Does Check ‘n Go accept Chime for payments?” This question is crucial for those who rely on Chime’s banking services. Understanding payment options can help you manage your finances better and ensure timely loan repayments.

If Check ‘n Go doesn’t accept Chime, don’t worry! There are several alternatives you can explore. Here are some options to consider:

Payment Options:

- Debit Cards: Most debit cards are accepted, making it easy to pay directly from your bank account.

- Cash Payments: You can always visit a Check ‘n Go location and pay in cash, which is straightforward and immediate.

- Money Orders: These are a safe way to send payments without using a bank account.

- Direct Bank Transfers: If you have a traditional bank account, this is often the easiest method to pay your loan.

Remember, before applying for a payday loan, check the Check ‘n Go payday loan requirements to ensure you meet all criteria. This way, you can avoid any surprises and get the funds you need quickly.

How AdvanceCash Can Help You Navigate Payment Options

When you need quick cash, understanding your payment options is vital. Many ask, does Check n Go accept Chime for payments? This is important for managing finances, especially if you use digital banking like Chime.

Understanding Check n Go’s Payment Options

Check n Go is a popular payday loan provider, but it’s crucial to know their payment methods. While they accept various payments, Chime isn’t always a direct option. However, you can often use your Chime debit card for payments, depending on the location and policies.

Check n Go Payday Loan Requirements

Before applying for a loan, it’s helpful to know the Check n Go payday loan requirements. Generally, you must be at least 18 years old, have a steady income, and provide valid ID. Understanding these requirements can make your application process smoother.

Using Chime with Check n Go

To use Chime for payments, consider these tips:

- Link your Chime account: Connect your Chime account to Check n Go for easier transactions.

- Check for fees: Be aware of any potential fees when using your debit card.

- Contact customer service: If unsure, reach out to Check n Go’s customer service for clarity on Chime payments.

Benefits of Using Chime

Using Chime for payments has several benefits:

- Instant access to funds: Quick transfers help you pay your loan on time.

- No monthly fees: Chime’s lack of monthly fees saves you money.

- Budgeting tools: Chime offers features to help you manage your finances effectively.

FAQs

💳 How can I make a payment to Check `n Go?

You can pay online through your Check `n Go account, by phone, in person at a store, or via automatic bank withdrawals.

🏦 Does Check `n Go accept Chime for payments?

Yes, you can use a Chime debit card or checking account to make payments, as long as your account is active and funded.

⏱️ When are Check `n Go payments due?

Payments are typically due on your next payday or the date agreed upon in your loan terms.

🧾 Will I get a receipt after making a payment?

Yes, Check `n Go provides a confirmation receipt for every payment made online or in-store.

❌ What if I miss a payment to Check `n Go?

Missing a payment may result in late fees, additional interest, or restricted access to future loans. Contact Check `n Go immediately to discuss repayment options.

Don’t let financial stress hold you back. AdvanceCash is here to help you secure your payday loan today!

🔗At ExpressCash, we’re here to help guide you through the process and find the right financial solution for your specific situation.