When life throws unexpected expenses your way, knowing where to find quick funds can be a lifesaver. In Rhode Island, a cash advance can provide the financial relief you need, helping you cover bills or emergencies without the long wait of traditional loans. Understanding cash advance RI is essential for anyone seeking immediate financial support.

What is a Cash Advance?

A cash advance is a short-term loan that allows you to borrow money against your credit card limit. It’s quick and easy, making it a popular choice for those in need of immediate cash. However, it’s important to know the terms and fees involved before diving in.

Where to Get Cash Advance RI

In Rhode Island, you have several options for obtaining a cash advance:

- Banks and Credit Unions: Many local banks offer cash advances through ATMs or in-person.

- Credit Card Issuers: Check with your credit card company for cash advance options.

- Payday Loan Shops: These can provide quick cash but often come with high fees.

- Online Lenders: Some online platforms specialize in fast cash advances, providing convenience at your fingertips.

Remember, while cash advances can be helpful, they should be used wisely to avoid falling into debt.

Need cash fast? AdvanceCash offers quick payday loans to help you cover your expenses!

Where to Find Reliable Cash Advance Services in Rhode Island

When unexpected expenses arise, knowing where to find cash advance RI services can be a lifesaver. Whether it’s a medical bill or car repair, quick funds can help you get back on track without stress. Let’s explore how to find reliable cash advance options in Rhode Island.

Local Banks and Credit Unions

Many local banks and credit unions in Rhode Island offer cash advance services. They often provide competitive rates and flexible terms. It’s a good idea to check with your bank first, as they may have special offers for existing customers.

Online Lenders

If you prefer convenience, online lenders are a great option. They allow you to apply for a cash advance from the comfort of your home. Just make sure to read reviews and check their legitimacy before proceeding.

Check Cashing Stores

Another option is check cashing stores, which can provide quick cash advances. However, be cautious of high fees. Always compare costs to ensure you’re making a wise choice.

The Benefits of Choosing Local Cash Advance Options

When life throws unexpected expenses your way, knowing where to find quick funds can be a lifesaver. In Rhode Island, cash advance options are available locally, making it easier for you to get the money you need without the hassle of long-distance transactions. Let’s explore why choosing local cash advance RI options is beneficial.

Convenience and Speed

Local cash advance services are often just around the corner. This means you can get cash quickly, sometimes within the same day. No waiting for checks to clear or long online processes. Just walk in, apply, and walk out with cash in hand!

Personalized Service

When you choose a local cash advance RI provider, you often receive personalized service. Staff members understand the community and can offer tailored advice. They can help you navigate your options and find the best solution for your financial needs. Plus, it feels good to support local businesses!

No Hidden Fees

Local cash advance options tend to be more transparent about their fees. You can ask questions and get clear answers right away. This helps you avoid surprises down the line, making it easier to manage your repayment plan. Knowing what to expect can ease your financial stress.

If you’re facing unexpected bills, AdvanceCash can provide you with the funds you need instantly!

How to Qualify for a Cash Advance in RI: A Step-by-Step Guide

When unexpected expenses arise, knowing how to access cash quickly can be a lifesaver. In Rhode Island, a cash advance can provide the funds you need to cover bills, emergencies, or other urgent costs. Understanding how to qualify for a cash advance RI is essential for anyone looking to secure quick financial help.

- Check Your Eligibility: Most lenders require you to be at least 18 years old and a resident of Rhode Island. Ensure you have a steady income source, whether from a job or other means.

- Gather Necessary Documents: Prepare your identification, proof of income, and bank statements. Having these ready can speed up the application process.

- Choose a Reputable Lender: Research local lenders that offer cash advances. Look for reviews and compare interest rates to find the best option for your needs.

By following these steps, you can simplify the process of obtaining a cash advance RI. Remember, it’s crucial to borrow responsibly and understand the terms of your loan. This way, you can manage your finances effectively and avoid falling into a cycle of debt.

Also Read: What Are Cash Advances & Alternative Loans Used For?

Cash Advance RI vs. Traditional Loans: Which is Right for You?

When you find yourself in a tight spot financially, knowing your options is crucial. In Rhode Island, cash advance services can provide quick funds to help you through unexpected expenses. But how do they stack up against traditional loans? Let’s explore this together!

Cash Advance RI: Quick and Easy Access

Cash advances in RI are designed for speed. You can often get funds within a day, making them ideal for emergencies. Traditional loans, on the other hand, can take days or even weeks to process. If you need money fast, cash advance RI might be your best bet!

Pros and Cons of Each Option

- Cash Advance RI:

- Quick access to funds

- Less paperwork

- Higher interest rates

- Traditional Loans:

- Lower interest rates

- Longer approval times

- More paperwork involved

In summary, if you need cash quickly and can handle higher interest, cash advance RI is a solid choice. But if you can wait and want to save on interest, consider a traditional loan instead.

What to Watch Out for When Seeking Cash Advances in Rhode Island

When you’re in a tight spot and need quick cash, knowing where to find a cash advance in RI can be a lifesaver. However, it’s essential to tread carefully. Understanding what to watch out for can help you make informed decisions and avoid pitfalls.

Hidden Fees and Interest Rates

One of the first things to check is the fees and interest rates. Some lenders might advertise low rates but have hidden charges. Always read the fine print! This way, you won’t be surprised by extra costs later on.

Loan Terms and Repayment

Make sure you understand the loan terms. How long do you have to repay the cash advance? If the repayment period is too short, you might find yourself in a cycle of debt. It’s crucial to choose a loan that fits your budget.

Research Local Lenders

Take time to research local lenders in Rhode Island. Look for reviews and ask friends or family for recommendations. A reputable lender will be transparent about their terms and will help you feel comfortable with your decision.

How AdvanceCash.com Can Help You Secure Quick Funds

When unexpected expenses pop up, knowing where to find quick cash can be a lifesaver. In Rhode Island, cash advance options are available to help you bridge the gap until your next paycheck. Understanding how to access these funds can make a big difference in your financial situation.

At AdvanceCash.com, we simplify the process of obtaining a cash advance RI. Our user-friendly platform connects you with local lenders who understand your needs. You can apply online in just a few minutes, making it easier than ever to get the cash you need.

Benefits of Using AdvanceCash.com

- Fast Approval: Most applications are processed quickly, often within hours.

- Local Lenders: We work with lenders right here in Rhode Island, ensuring you get personalized service.

- Flexible Options: Choose the amount and repayment terms that work best for you.

With AdvanceCash.com, securing a cash advance RI is straightforward. We guide you through each step, ensuring you feel confident in your decision. Don’t let financial stress hold you back; let us help you find the quick funds you need today!

Frequently Asked Questions About Cash Advances in RI

-

Are payday loans legal in Rhode Island?

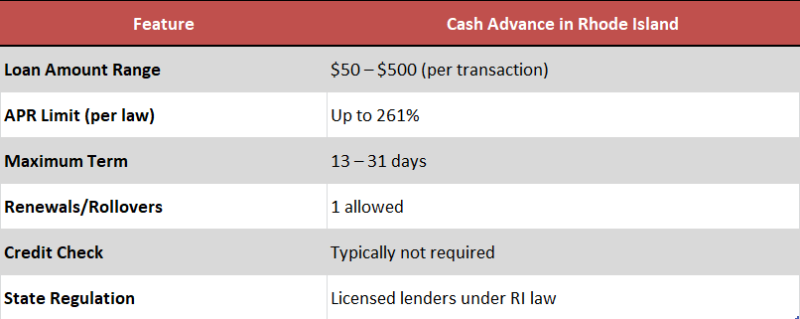

Yes, payday loans and cash advances are legal in Rhode Island, but lenders must be state-licensed and follow regulations on loan amounts and fees. -

What is the maximum amount I can borrow in RI?

Most licensed lenders in Rhode Island offer payday loans up to $450, but the amount may vary based on your income and financial history. -

Can I get a cash advance in RI with bad credit?

Yes, many lenders consider applications from those with bad credit as long as they have a steady income and meet basic eligibility requirements. -

How fast can I receive a cash advance in Rhode Island?

Some lenders offer same-day funding if you apply early, while others provide next-business-day deposits for online applications. -

What should I check before applying for a cash advance in RI?

Always verify the lender’s state license, read the loan terms, understand the fees, and make sure you have a clear repayment plan.

Don’t let financial stress hold you back. AdvanceCash is here to help you secure your payday loan today!

🔗At ExpressCash, we’re here to help guide you through the process and find the right financial solution for your specific situation.