When unexpected expenses arise, many people in New Jersey turn to cash advances for quick financial relief. Understanding cash advance New Jersey options can help you make informed decisions. These fast cash solutions can be a lifesaver, but it’s essential to know how they work and what alternatives are available.

What is a Cash Advance?

A cash advance is a short-term loan that allows you to borrow money quickly. It’s often available through credit cards or specialized lenders. This can be helpful for emergencies like car repairs or medical bills. However, be cautious—interest rates can be high!

Cash Advances & Alternative Loans

- Quick Access: Cash advances provide fast access to funds, often within a day.

- Flexible Options: Alternative loans may offer different terms and lower rates.

- Consider Your Needs: Always assess your financial situation before choosing a cash advance or an alternative loan.

In New Jersey, knowing your options can empower you to handle financial challenges effectively. Always read the fine print and ensure you understand the repayment terms before committing to any loan.

Need cash fast? AdvanceCash offers quick payday loans to help you cover your expenses!

How to Qualify for a Cash Advance in New Jersey?

When life throws unexpected expenses your way, understanding how to qualify for a cash advance in New Jersey can be a game-changer. Cash advances offer quick access to funds, making them a popular choice for those in need of fast cash options. Let’s explore how you can qualify for these helpful financial tools.

Basic Requirements for Cash Advances

To qualify for a cash advance in New Jersey, you typically need to meet a few basic requirements. Here’s what lenders usually look for:

- Age: You must be at least 18 years old.

- Income: A steady source of income is essential.

- Bank Account: Most lenders require an active checking account.

Steps to Qualify

- Check Your Credit Score: While cash advances often have lenient credit requirements, knowing your score can help.

- Gather Documentation: Prepare your ID, proof of income, and bank statements.

- Choose a Lender: Research cash advances & alternative loans to find the best fit for your needs.

By following these steps, you can increase your chances of qualifying for a cash advance in New Jersey. Remember, these fast cash options can provide relief during tough times, but it’s important to borrow responsibly. Always read the terms and conditions before signing any agreement.

The Pros and Cons of Cash Advances: Is It Right for You?

When unexpected expenses arise, many people in New Jersey turn to cash advances for quick financial relief. Understanding the pros and cons of cash advances is crucial before deciding if it’s the right option for you. Let’s dive into what cash advance New Jersey offers and how it compares to other cash options.

The Pros of Cash Advances

- Quick Access to Funds: Cash advances provide fast cash options, often available within hours.

- No Credit Check: Many cash advance services don’t require a credit check, making them accessible to those with poor credit.

- Flexible Use: You can use the funds for any purpose, whether it’s a medical bill or car repair.

The Cons of Cash Advances

- High Fees: Cash advances often come with high fees and interest rates, which can lead to debt if not managed properly.

- Short Repayment Terms: You typically need to repay the amount quickly, which can be challenging if your financial situation doesn’t improve.

- Potential for Debt Cycle: Relying on cash advances may lead to a cycle of borrowing that’s hard to escape.

In summary, while cash advances can provide immediate relief, it’s essential to weigh these pros and cons carefully. If you’re considering cash advances & alternative loans, make sure to explore all your options.

If you’re facing unexpected bills, AdvanceCash can provide you with the funds you need instantly!

Exploring Fast Cash Options: What Are Your Choices?

When unexpected expenses arise, knowing your options for quick cash can be a lifesaver. In New Jersey, cash advances and alternative loans provide fast solutions to help you bridge financial gaps. Understanding these options is crucial for making informed decisions that suit your needs.

Cash Advances

Cash advances in New Jersey are a popular choice for those needing immediate funds. They allow you to borrow against your credit card limit, providing quick access to cash. However, it’s important to remember that these advances often come with high-interest rates, so use them wisely!

Alternative Loans

If cash advances aren’t the right fit, consider alternative loans. These loans can be obtained from various lenders and often have more flexible terms. They may include personal loans, payday loans, or even peer-to-peer lending. Each option has its pros and cons, so weigh them carefully before deciding.

Key Benefits of Fast Cash Options

- Quick Access: Get funds in as little as one business day.

- Flexible Terms: Choose a repayment plan that works for you.

- Variety of Lenders: Explore different options to find the best rates.

In conclusion, whether you opt for a cash advance New Jersey or an alternative loan, understanding your choices can help you navigate financial challenges with confidence.

Also Read: What Are Cash Advances & Alternative Loans Used For?

Cash Advance New Jersey: Fees and Interest Rates Explained

When unexpected expenses arise, many people in New Jersey turn to cash advances. Understanding the fees and interest rates associated with cash advance New Jersey options is crucial. It helps you make informed decisions and avoid surprises down the line. Let’s dive into what you need to know!

What Are the Fees?

Cash advances often come with various fees. These can include:

- Transaction Fees: A percentage of the amount you borrow, typically ranging from 2% to 5%.

- Service Fees: A flat fee charged for processing your cash advance, which can vary by lender.

Interest Rates to Consider

Interest rates on cash advances can be quite high. They usually range from 15% to 30% or more, depending on the lender. Here’s why it matters:

- Short-Term Burden: High rates mean you’ll pay more if you don’t repay quickly.

- Comparison is Key: Always compare rates between cash advances and alternative loans to find the best deal.

In conclusion, knowing the fees and interest rates for cash advance New Jersey options can save you money and stress. Make sure to read the fine print and ask questions before committing!

When to Consider a Cash Advance: Timing is Everything

When life throws unexpected expenses your way, knowing when to consider a cash advance can be a game changer. In New Jersey, cash advance options can provide quick relief when you need it most. Understanding the right timing can help you make the best financial decisions.

Urgent Expenses

Sometimes, emergencies arise, like car repairs or medical bills. If you find yourself in a pinch, a cash advance New Jersey can help you cover these urgent costs without delay.

Short-Term Needs

If you’re waiting for your paycheck but need to pay bills now, cash advances & alternative loans can bridge that gap. They offer quick access to funds, so you don’t have to stress about late fees or service interruptions.

Weighing Your Options

Before jumping into a cash advance, consider your options. Here are a few things to think about:

- Interest Rates: Compare rates to find the best deal.

- Repayment Terms: Understand how and when you’ll need to pay it back.

- Alternatives: Look into other loans or financial assistance programs that might suit your needs better.

In conclusion, knowing when to consider a cash advance can help you navigate financial challenges with confidence. Timing is everything, so be sure to weigh your options carefully!

How AdvanceCash.com Can Help You Secure a Cash Advance

When unexpected expenses arise, many people in New Jersey find themselves searching for quick financial solutions. Understanding cash advance New Jersey options can be a game-changer. With the right information, you can navigate through various Cash Advances & Alternative Loans to find the best fit for your needs.

At AdvanceCash.com, we specialize in guiding you through the cash advance process. Our team is dedicated to making your experience smooth and straightforward. Here’s how we can assist you:

Personalized Guidance

- Expert Advice: Our knowledgeable staff will help you understand your options.

- Tailored Solutions: We consider your unique financial situation to recommend the best cash advance New Jersey options.

Quick Application Process

- Easy Online Forms: Fill out our simple application from the comfort of your home.

- Fast Approval: Get quick responses so you can access funds when you need them most.

With AdvanceCash.com, securing a cash advance is not just a possibility; it’s a reality. We’re here to support you every step of the way, ensuring you find the right financial solution for your immediate needs.

Alternatives to Cash Advances: What Other Options Are Available?

When you find yourself in a tight spot financially, cash advance New Jersey: Fast Cash Options Explained can be a lifesaver. However, it’s essential to know that there are alternatives to cash advances that might suit your needs better. Let’s explore these options together!

Personal Loans

Personal loans are a great alternative to cash advances. They usually have lower interest rates and longer repayment terms. You can borrow a larger amount, making it easier to manage your finances without the stress of high fees.

Credit Union Loans

Credit unions often offer loans with better terms than traditional banks. They focus on helping their members, so you might find lower interest rates and more flexible repayment plans. Plus, they’re usually more understanding if you have a less-than-perfect credit score.

Peer-to-Peer Lending

Peer-to-peer lending connects borrowers with individual lenders. This option can provide competitive rates and terms. It’s like borrowing from a friend but with a formal agreement. Just be sure to read the terms carefully!

Emergency Funds

Building an emergency fund is a smart way to avoid cash advances in the future. Even saving a little each month can help you cover unexpected expenses without relying on loans. Start small, and watch your savings grow!

FAQs

-

Are payday loans legal in New Jersey?

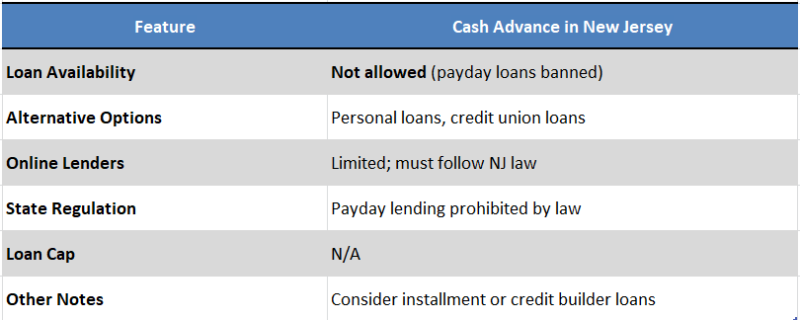

No, payday loans are prohibited in New Jersey. The state has strict interest rate caps (30% APR), making traditional payday lending illegal. -

What are legal alternatives to payday loans in New Jersey?

You can explore installment loans, personal loans, or cash advance apps that comply with state laws and offer more affordable repayment options. -

Can I get a cash advance in New Jersey with bad credit?

Yes, many installment loan providers and cash advance apps accept applicants with poor credit, focusing more on income and repayment ability. -

How quickly can I get a cash advance in New Jersey?

If approved, many lenders and apps can deposit funds within 1–2 business days, with some offering instant funding for a small fee. -

Is it safe to use online lenders for cash advances in New Jersey?

Yes, as long as the lender is licensed to operate in New Jersey. Always check for secure websites, transparent terms, and state compliance.

Don’t let financial stress hold you back. AdvanceCash is here to help you secure your payday loan today!

🔗At ExpressCash, we’re here to help guide you through the process and find the right financial solution for your specific situation.