When unexpected expenses hit, cash advance loans Michigan can provide a quick financial solution. These loans help cover urgent costs, such as medical bills or car repairs, without the lengthy process of traditional loans. Knowing how to apply can significantly impact your financial situation.

What Are Cash Advance Loans?

Cash advance loans are short-term loans that offer quick cash to borrowers. They are generally easier to obtain than traditional loans. Key points include:

- Quick Approval: Many lenders provide fast approval, sometimes within hours.

- Flexible Amounts: Borrow amounts typically range from $100 to $1,000.

- Short Repayment Terms: Loans usually need to be repaid within a few weeks to a month.

How to Apply for Cash Advance Loans in Michigan

Applying for cash advance loans Michigan is simple. Follow these steps:

- Research Lenders: Find reputable lenders offering cash advances & alternative loans.

- Gather Documents: Prepare proof of income and identification.

- Complete the Application: Apply online or in-person.

- Review Terms: Understand the interest rates and repayment terms before signing.

By following these steps, you can quickly secure the funds you need.

Need cash fast? AdvanceCash offers quick payday loans to help you cover your expenses!

Why Choose Cash Advance Loans in Michigan?

When unexpected expenses pop up, cash advance loans Michigan can be a lifesaver. These loans provide quick access to cash, helping you manage urgent bills or emergencies. Understanding how to apply today can make a big difference in your financial situation.

Quick Access to Funds

- Fast Approval: Cash advance loans often have a simple application process, allowing you to get funds quickly.

- Flexible Amounts: You can borrow what you need, whether it’s a small amount or a bit more for larger expenses.

Easy Application Process

Applying for cash advance loans Michigan is straightforward. You can often complete the application online, making it convenient. Just fill out your details, and you could have cash in your hands within a day!

Alternatives to Traditional Loans

Cash advances & alternative loans are great options if you don’t want to deal with lengthy bank procedures. They provide a quick solution without the hassle, making them ideal for those in urgent need.

How to Qualify for Cash Advance Loans in Michigan

When unexpected expenses arise, cash advance loans in Michigan can be a quick solution. Knowing how to qualify for these loans can make the process smoother and less stressful. Let’s dive into what you need to know to get started today!

Basic Requirements for Cash Advance Loans in Michigan

To qualify for cash advance loans in Michigan, you typically need to meet a few basic criteria:

- Age: You must be at least 18 years old.

- Income: A steady income source is essential.

- Identification: Valid ID and proof of residency are required.

These requirements help lenders ensure that you can repay the loan, making the process easier for everyone.

Steps to Apply

Applying for cash advances and alternative loans is straightforward. Here’s how you can do it:

- Research Lenders: Look for reputable lenders in Michigan.

- Gather Documents: Prepare your ID, proof of income, and bank statements.

- Fill Out an Application: Complete the application online or in-person.

- Review Terms: Carefully read the loan terms before signing.

If you’re facing unexpected bills, AdvanceCash can provide you with the funds you need instantly!

Step-by-Step Guide: Applying for Cash Advance Loans in Michigan

Cash advance loans in Michigan can be a lifesaver during unexpected financial emergencies. Knowing how to apply can significantly impact your situation. Here’s a quick guide to help you secure a cash advance efficiently.

1. Understand Your Needs

Before applying, determine how much money you need for emergencies like car repairs or medical bills. This helps you select the right loan amount.

2. Research Lenders

Find lenders that offer cash advance loans in Michigan. Compare their terms, interest rates, and customer reviews to choose a reliable option.

3. Gather Required Documents

Prepare the necessary documents, including:

- Proof of income

- Identification

- Bank account details

4. Fill Out the Application

Choose a lender and complete their application form, usually available online. Double-check your information before submitting it.

5. Review the Terms

After approval, carefully read the loan terms, including repayment schedules and fees, to avoid surprises.

6. Receive Your Funds

Once approved, you’ll receive your cash advance, often deposited directly into your bank account for convenience.

Also Read: What Are Cash Advances & Alternative Loans Used For?

What Documents Are Required for Cash Advance Loans in Michigan?

If you’re looking into cash advance loans in Michigan, knowing the required documents can streamline your application process. These loans offer quick solutions for unexpected expenses, but having the right paperwork is essential. Let’s explore what you need to apply today!

Essential Documents for Cash Advance Loans in Michigan

To apply for cash advances & alternative loans, you’ll typically need:

- Identification: A valid government-issued ID, like a driver’s license or passport.

- Proof of Income: Recent pay stubs or bank statements to verify your earnings.

- Social Security Number: This helps lenders confirm your identity.

- Contact Information: A phone number and address where you can be reached.

Gathering these documents in advance can expedite your application and help you secure funds more quickly!

Why Having Your Documents Ready Matters

Being prepared with your documents not only simplifies the application for cash advance loans in Michigan but also boosts your approval chances. Lenders want assurance that you can repay the loan, and having everything organized demonstrates your commitment. So, take a moment to gather these documents and be ready to meet your financial needs head-on!

Exploring the Benefits of Cash Advance Loans in Michigan

Cash advance loans in Michigan can be a lifesaver for unexpected expenses like medical bills or car repairs. Knowing how to apply for these loans can make a significant difference. Let’s explore the benefits and the simple steps to get started!

Why Choose Cash Advance Loans?

Cash advance loans in Michigan provide quick access to funds, making them a popular choice. Benefits include:

- Fast Approval: Get approved within hours.

- Flexible Amounts: Borrow what you need, whether small or large.

- No Credit Worries: Many lenders overlook your credit score.

How to Apply for Cash Advances

Applying is straightforward:

- Research Lenders: Find reputable lenders in Michigan.

- Gather Documents: Prepare proof of income and ID.

- Fill Out an Application: Often available online.

- Receive Funds: Approved funds can be deposited quickly!

Cash advances and alternative loans provide options to bridge gaps until your next paycheck or cover emergencies. Always read the terms carefully and ensure you can repay the loan on time to enjoy the benefits without stress!

Common Misconceptions About Cash Advance Loans in Michigan

When exploring cash advance loans Michigan: How to Apply Today, it’s essential to address common misconceptions that can mislead borrowers. Understanding these myths helps in making informed financial choices.

Misconception 1: Cash Advances Are Only for Emergencies

Many think cash advances are solely for emergencies, but they can also assist with everyday expenses like car repairs or unexpected bills.

Misconception 2: High Interest Rates Are Unavoidable

Another myth is that cash advance loans come with exorbitant interest rates. While some lenders may charge higher rates, many offer competitive terms, so it’s wise to shop around.

Misconception 3: You Need Perfect Credit

Some believe only those with perfect credit qualify for cash advances. However, many lenders consider various factors, making options available even for those with less-than-perfect credit.

Misconception 4: Cash Advances Are Always a Bad Idea

While cash advances can lead to debt if misused, responsible borrowing can improve your financial situation.

Misconception 5: The Application Process is Complicated

Lastly, applying for cash advance loans is often straightforward and quick, with many lenders offering online applications that take just minutes.

How AdvanceCash.com Can Help You Secure a Cash Advance Loan

When unexpected expenses arise, cash advance loans Michigan can be a quick solution. These loans provide immediate cash to help you cover bills, medical emergencies, or other urgent needs. Understanding how to apply for these loans can make all the difference in your financial situation.

At AdvanceCash.com, we simplify the process of obtaining cash advances & alternative loans. Our user-friendly platform guides you through each step, ensuring you understand your options. Here’s how we can assist you:

Easy Application Process

- Quick Online Form: Fill out a simple application in minutes.

- Instant Approval: Get a decision fast, often within the same day.

- Flexible Options: Choose from various loan amounts that fit your needs.

With our support, securing cash advance loans Michigan becomes a breeze. We’re here to help you navigate your financial journey with confidence.

Tips for Managing Your Cash Advance Loan Responsibly

When you find yourself in a financial pinch, understanding how to manage cash advance loans Michigan: How to Apply Today can make a big difference. These loans can provide quick cash, but it’s essential to use them wisely to avoid falling into a cycle of debt.

Create a Repayment Plan

Before you even apply for cash advances & alternative loans, think about how you will pay them back. Set a budget that includes your loan repayment to ensure you can meet your obligations without stress.

Borrow Only What You Need

It’s tempting to take out a larger amount, but borrowing only what you need can help you manage your finances better. This way, you won’t be overwhelmed by high repayments later on.

Stay Informed

Keep track of your loan terms and interest rates. Understanding these details can help you avoid surprises and make informed decisions about your cash advance loans Michigan.

FAQs

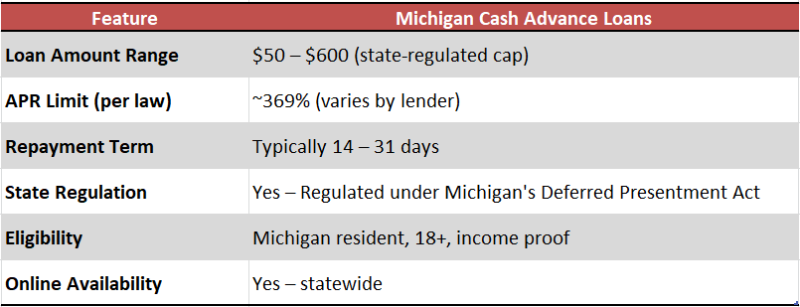

📍 Are cash advance loans legal in Michigan?

Yes, payday loans (cash advance loans) are legal and regulated in Michigan under the Deferred Presentment Service Transactions Act. Lenders must follow specific rules on loan limits, fees, and terms.

💰 How much can I borrow with a cash advance loan in Michigan?

You can borrow up to $600 per loan. You’re allowed to have two active loans at once, but only one loan per lender.

📆 What’s the maximum loan term in Michigan?

The loan must be repaid in 31 days or less. It’s designed to be a short-term solution, not a long-term borrowing option.

💸 How much does a payday loan cost in Michigan?

Lenders can charge tiered service fees (e.g., 15% for the first $100, 14% for the next, and so on). This can result in a high APR, making these loans very expensive if not repaid on time.

🚫 Are there alternatives to payday loans in Michigan?

Yes. You can consider credit union loans, installment loans, or employer paycheck advances—which usually offer lower rates and more manageable terms.

Don’t let financial stress hold you back. AdvanceCash is here to help you secure your payday loan today!

🔗At ExpressCash, we’re here to help guide you through the process and find the right financial solution for your specific situation.