When unexpected expenses arise, knowing how to get a cash advance in NC can be crucial. Whether it’s for a medical bill or car repair, having access to same-day money can relieve stress. Here’s how to secure that cash quickly and efficiently.

What is a Cash Advance?

A cash advance is a short-term loan that lets you borrow against your future paycheck. It’s a fast solution for urgent financial needs in North Carolina, often with quick approval processes.

Steps to Get Your Cash Advance

- Research Lenders: Find reputable lenders in NC and review their terms and fees.

- Gather Documents: Prepare proof of income, identification, and a bank account.

- Apply Online or In-Person: Many lenders offer online applications for convenience.

- Receive Your Funds: Once approved, you can usually access your cash the same day!

Alternatives to Cash Advances

If a cash advance isn’t suitable, consider alternative loans. These may provide lower interest rates and longer repayment terms, making them a better option for larger expenses. Always compare your choices to find the best financial solution.

Need cash fast? AdvanceCash offers quick payday loans to help you cover your expenses!

How to Qualify for a Cash Advance in NC: Essential Criteria

When unexpected expenses pop up, knowing how to get a cash advance in NC can be a lifesaver. Whether it’s a car repair or a medical bill, having access to same-day money can ease your stress. But how do you qualify for these quick funds? Let’s break it down!

Essential Criteria for Cash Advances in NC

To qualify for a cash advance in NC, you typically need to meet a few basic requirements. Here’s what lenders usually look for:

- Age: You must be at least 18 years old.

- Income: A steady income source is crucial. This can be from a job, benefits, or other reliable payments.

- Bank Account: Most lenders require you to have an active checking account for fund transfers.

Steps to Apply

Once you know the criteria, applying for cash advances & alternative loans is straightforward. Here’s how:

- Gather Documents: Prepare your ID, proof of income, and bank details.

- Choose a Lender: Research local lenders or online options that offer cash advances in NC.

- Submit Application: Fill out the application form, providing accurate information.

- Receive Funds: If approved, you could get your money the same day!

The Application Process: Steps to Secure Your Cash Advance Today

When unexpected expenses pop up, knowing how to get a cash advance in NC can be a lifesaver. This quick solution helps you access funds when you need them most, allowing you to tackle bills or emergencies without delay. Let’s explore the simple steps to secure your cash advance today!

- Research Your Options: Start by looking for lenders that offer cash advances & alternative loans in NC. Compare interest rates and terms to find the best fit for your needs.

- Gather Necessary Documents: Most lenders will require proof of income, identification, and possibly a bank statement. Having these ready speeds up the process.

- Fill Out the Application: Complete the application form online or in-person. Be honest and accurate to avoid delays in approval.

- Review and Submit: Double-check your application for any errors. Once you’re sure everything is correct, submit it to the lender.

- Receive Your Funds: If approved, you could receive your cash advance the same day! This quick turnaround can help you manage your financial needs effectively.

If you’re facing unexpected bills, AdvanceCash can provide you with the funds you need instantly!

Same-Day Cash Advances: What to Expect and How They Work

When unexpected expenses arise, a cash advance in NC can be a real lifesaver. Knowing how to access same-day money can help you manage urgent bills effectively. Let’s explore what cash advances are and how they work!

Understanding Cash Advances in NC

Cash advances are short-term loans designed to provide quick cash when you need it most. They are generally easier to obtain than traditional loans, making them a popular option. Here’s how to get started:

Steps to Get Your Cash Advance

- Research Lenders: Find reputable lenders in NC and compare their terms and interest rates.

- Gather Your Documents: Prepare proof of income, identification, and a bank account.

- Apply Online or In-Person: Complete an application form, with many lenders offering quick online options.

- Receive Approval: If approved, you can often access your cash the same day!

Benefits of Cash Advances & Alternative Loans

- Quick Access: Get funds without lengthy waiting periods.

- Flexible Use: Use the money for urgent expenses like medical bills or car repairs.

- Simple Process: The application is straightforward and typically doesn’t require a credit check.

Also Read: What Are Cash Advances & Alternative Loans Used For?

Comparing Cash Advance Options in NC: Which is Right for You?

Unexpected expenses can arise at any time, making a cash advance in NC a valuable option for quick financial relief. Whether it’s for a medical bill or car repair, same-day money can alleviate stress. However, with multiple choices available, selecting the right one is crucial.

Understanding Cash Advances

Cash advances allow you to borrow against your future paycheck, providing quick access to funds. They are simple to apply for and can often be processed the same day. However, be cautious of high fees and interest rates that can accumulate quickly!

Alternative Loans

If cash advances seem risky, consider alternative loans like personal loans or credit union options. These typically offer lower interest rates and longer repayment terms, making them a safer choice. Here’s a quick comparison:

- Cash Advances: Fast access, but high fees.

- Alternative Loans: Slower processing, but more affordable.

Making Your Choice

The best option depends on your financial situation. If you need cash urgently and can repay it quickly, a cash advance in NC may be suitable. For a more manageable repayment plan, look into alternative loans. Always read the fine print before deciding!

Common Myths About Cash Advances in NC: Debunking Misconceptions

When it comes to getting quick cash, many people in North Carolina turn to cash advances. However, there are several myths surrounding this financial option that can lead to confusion. Understanding the truth about cash advances in NC is crucial for making informed decisions and accessing same-day money when you need it most.

Myth 1: Cash Advances Are Only for Emergencies

Some believe cash advances are only for dire situations. In reality, they can be a flexible solution for various needs, from unexpected bills to planned expenses. They offer quick access to funds without the lengthy approval processes of traditional loans.

Myth 2: Cash Advances Are Always Expensive

While cash advances & alternative loans can have higher fees, they can also be more affordable than you think. Many lenders offer competitive rates, especially for short-term needs. Always compare options to find the best deal!

Myth 3: You Need Perfect Credit to Qualify

Another common misconception is that only those with excellent credit can get a cash advance. Many lenders consider other factors, making it possible for individuals with less-than-perfect credit to access funds.

How to Use Your Cash Advance Wisely: Tips for Financial Management

When life throws unexpected expenses your way, a cash advance in NC can be a quick solution. But it’s essential to use this financial tool wisely to avoid falling into a cycle of debt. Here’s how to manage your cash advance effectively and make the most of your funds.

Understand Your Needs

Before you apply for a cash advance, ask yourself: Do I really need this money? Make sure it’s for urgent expenses like medical bills or car repairs. Avoid using it for non-essential items, as this can lead to unnecessary debt.

Create a Repayment Plan

Once you receive your cash advance, plan how you’ll pay it back. Set aside a portion of your income each month to cover the repayment. This will help you avoid late fees and keep your finances on track. Remember, cash advances and alternative loans can have high-interest rates, so timely repayment is crucial.

Why Choose AdvanceCash.com for Your Cash Advance Needs?

When unexpected expenses arise, knowing how to access a cash advance in NC can be a lifesaver. Whether it’s a medical bill or a car repair, having quick access to funds can ease financial stress. That’s where AdvanceCash.com comes in, offering a straightforward way to get cash advances and alternative loans without the hassle.

At AdvanceCash.com, we understand that time is of the essence. Our process is designed to be quick and easy, ensuring you can get same-day money when you need it most. Here’s why we stand out:

- Fast Approval: Our online application is simple and takes just minutes.

- Flexible Options: We offer various cash advances and alternative loans tailored to your needs.

- Transparent Terms: No hidden fees or confusing jargon—just clear information to help you make informed decisions.

When you choose AdvanceCash.com, you’re not just getting a cash advance in NC; you’re gaining a partner in your financial journey. Our dedicated team is here to guide you every step of the way, ensuring you feel confident in your choices. So, why wait? Let’s tackle those unexpected expenses together!

Frequently Asked Questions About Cash Advances in NC

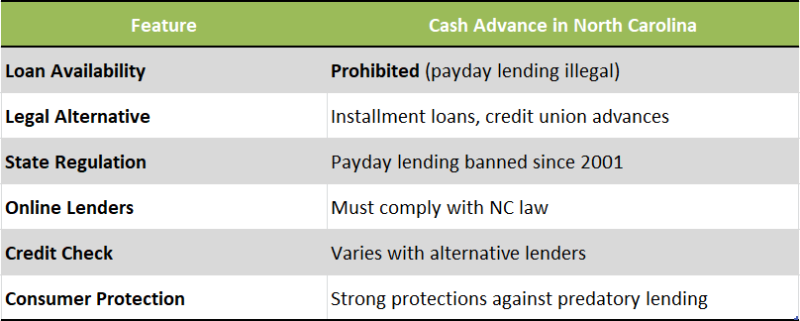

🚫 Are cash advances or payday loans legal in North Carolina?

No, payday loans and high-interest cash advances are illegal in NC. The state prohibits lenders from charging excessive interest rates and protects consumers from predatory lending.

🏦 What legal alternatives to cash advances are available in NC?

You can consider credit union salary advance loans, personal loans, or installment loans from licensed lenders. Some online platforms also connect NC residents to safe, regulated options.

🕒 How fast can I get emergency cash in North Carolina?

Many alternatives like credit union loans or licensed personal loans offer same-day or next-business-day funding, depending on the lender and your banking setup.

📋 What do I need to qualify for a legal loan in NC?

You typically need a valid ID, proof of income, and an active bank account. Credit requirements vary, but some options accept low or no credit scores.

🔍 How do I make sure a lender is legal in NC?

Always check that the lender is licensed in North Carolina. You can verify through the NC Department of Justice or the NC Commissioner of Banks website.

Don’t let financial stress hold you back. AdvanceCash is here to help you secure your payday loan today!

🔗At ExpressCash, we’re here to help guide you through the process and find the right financial solution for your specific situation.