Understanding how a payday loan based on income works is crucial for anyone facing unexpected expenses. These loans can provide quick cash without the hassle of a credit check, making them an appealing option for many. But how exactly do they function? Let’s break it down.

What is a Payday Loan Based on Income?

A payday loan based on income is a short-term loan that allows you to borrow money against your next paycheck. This means that lenders focus more on your income rather than your credit score. Here’s how it typically works:

- Application: You fill out a simple application, often online.

- Income Verification: Lenders check your income to determine how much you can borrow.

- Approval: If approved, you receive the funds quickly, sometimes within hours!

Benefits of Payday Loans Without a Credit Check

Choosing a payday loan based on income has several advantages:

- Quick Access to Cash: Perfect for emergencies!

- No Credit Check: This opens doors for those with poor credit.

- Flexible Locations: Many payday loan lenders & locations are available, making it easy to find help nearby.

In summary, payday loans based on income can be a lifeline when you need it most, offering a straightforward solution without the stress of credit checks.

Need cash fast? AdvanceCash offers quick payday loans to help you cover your expenses!

How Do Payday Loans Based on Income Work Without a Credit Check?

When unexpected expenses arise, many people turn to payday loans based on income. These loans are designed to help you bridge the gap until your next paycheck, especially when traditional credit checks can be a barrier. Understanding how these loans work without a credit check is essential for making informed financial decisions.

Payday loans based on income are straightforward. Here’s how they typically function:

- Application Process: You fill out a simple application, often online, providing details about your income and employment.

- Income Verification: Lenders verify your income rather than checking your credit score. This means if you have a steady job, you’re likely eligible.

- Loan Amount: The amount you can borrow usually depends on your income. Lenders want to ensure you can repay the loan by your next payday.

- Repayment: When your payday arrives, the lender deducts the loan amount plus fees directly from your bank account.

This makes repayment seamless and straightforward. Using payday loan lenders & locations that offer these services can be beneficial. They cater to those who may not have perfect credit but need quick cash. Just remember to borrow responsibly!

The Benefits of Choosing Payday Loans Based on Income

When unexpected expenses arise, many people find themselves in a tight spot. This is where a payday loan based on income can come to the rescue. Unlike traditional loans, these loans focus on your income rather than your credit score, making them accessible to more individuals. Let’s explore the benefits of this option.

Quick Access to Funds

One of the biggest advantages is the speed at which you can get cash. Many payday loan lenders & locations offer same-day approvals, allowing you to tackle urgent bills or emergencies without delay.

No Credit Check Required

Another significant benefit is that these loans don’t require a credit check. This means that even if you have a less-than-perfect credit history, you can still qualify. It’s a great way to get back on your feet without the stress of credit evaluations.

Flexible Repayment Options

Payday loans based on income often come with flexible repayment plans. You can choose a schedule that fits your budget, making it easier to manage your finances.

In summary, payday loans based on income provide a quick, accessible solution for those in need, helping you navigate financial challenges with ease.

If you’re facing unexpected bills, AdvanceCash can provide you with the funds you need instantly!

What Are the Risks Involved with Payday Loans Based on Income?

When considering a payday loan based on income, it’s crucial to understand the risks involved. While these loans can provide quick cash without a credit check, they often come with hidden dangers that can lead to financial trouble. Let’s explore what you need to know before diving in.

High-Interest Rates

One of the biggest risks of payday loans based on income is the high-interest rates. These loans can have APRs that soar into the triple digits! This means if you borrow $500, you could end up paying back much more than you expected. Always calculate the total repayment amount before agreeing to a loan.

Debt Cycle

Another risk is falling into a debt cycle. Many borrowers find themselves needing to take out another payday loan to pay off the first one. This can lead to a never-ending cycle of debt, making it hard to escape. It’s essential to have a plan for repayment before taking out a loan from payday loan lenders & locations.

Also Read: Payday Loan Lenders & Locations: Where to Apply Near You

Eligibility Criteria for Payday Loans Based on Income: What You Need to Know

When unexpected expenses arise, many people turn to a payday loan based on income. This type of loan is especially appealing because it often doesn’t require a credit check. Understanding how it works can help you make informed decisions when you need quick cash.

Basic Requirements

To qualify for a payday loan based on income, you typically need to meet a few basic criteria:

- Steady Income: You should have a reliable source of income, whether from a job, benefits, or other means.

- Age: Most lenders require you to be at least 18 years old.

- Bank Account: A checking account is usually necessary for loan deposits and repayments.

Additional Considerations

While these are the main requirements, some payday loan lenders & locations may have additional stipulations. It’s wise to check with your chosen lender to ensure you meet all their criteria. Remember, the goal is to ensure you can repay the loan without falling into a cycle of debt.

Comparing Payday Loans Based on Income to Traditional Loans

When you’re in a tight spot financially, understanding how a payday loan based on income works can be a game changer. Unlike traditional loans, these loans focus on your income rather than your credit score, making them accessible to many who might otherwise struggle to get help. Let’s dive into how this works!

Traditional loans often require a good credit score, which can be a barrier for many. In contrast, payday loan lenders & locations offer options that prioritize your income. This means if you have a steady paycheck, you can qualify for a loan even if your credit isn’t perfect.

Key Differences:

- Credit Check: Traditional loans usually require a credit check, while payday loans based on income do not.

- Approval Speed: Payday loans are often approved quickly, sometimes within hours, compared to the longer process of traditional loans.

- Loan Amounts: Payday loans are typically smaller, designed to cover immediate expenses, while traditional loans can be larger and used for various purposes.

In summary, if you need quick cash and have a reliable income, a payday loan based on income might be the right choice for you!

How ‘AdvanceCash’ Can Help You Secure a Payday Loan Based on Income

When unexpected expenses arise, many people find themselves in need of quick cash. This is where a payday loan based on income can be a lifesaver. It allows you to secure funds without the hassle of a credit check, making it accessible for those who might have a less-than-perfect credit history. Understanding how this works can empower you to make informed financial decisions.

Simple Application Process

Applying for a payday loan based on income is straightforward. At ‘AdvanceCash’, we offer an easy online application that you can complete in minutes. Just provide your income details, and you’re on your way to securing the funds you need.

Quick Approval and Access to Funds

Once you submit your application, our payday loan lenders review it quickly. Many times, you can receive approval within hours! This means you can get cash in hand to cover those urgent expenses, whether it’s a medical bill or a car repair. Plus, our locations make it easy to find help nearby.

Tips for Responsible Borrowing: Making the Most of Your Payday Loan Based on Income

When unexpected expenses arise, a payday loan based on income can be a helpful solution. This type of loan allows you to borrow based on your income, making it accessible even if your credit score isn’t perfect. Understanding how it works without a credit check is essential for informed decisions.

Know Your Budget

Before taking out a payday loan, assess your budget. Calculate your monthly income and expenses to determine how much you can afford to borrow and repay without straining your finances.

Choose Reputable Payday Loan Lenders & Locations

Not all payday loan lenders are created equal. Research and find reputable lenders in your area. Look for reviews and ratings to ensure you’re working with a trustworthy provider, helping you avoid hidden fees and unfair terms.

Understand the Terms

Before signing any agreement, read the terms carefully. Pay attention to interest rates and repayment schedules to avoid surprises later on, ensuring you can manage your loan responsibly.

Plan for Repayment

Create a repayment plan before you borrow. Decide when you will pay back the loan and how much you can afford each payday to prevent falling into a cycle of debt.

Use the Loan Wisely

Only use a payday loan based on income for essential expenses, like medical bills or car repairs, to maximize benefits while minimizing financial strain.

FAQs

✅ Can I get a payday loan based solely on my income?

Yes, many payday lenders approve loans based on your regular income rather than credit score.

✅ What type of income qualifies for a payday loan?

Income from employment, government benefits, freelance work, or pensions may qualify if it meets the lender’s minimum requirement.

✅ How do lenders verify my income for payday loans?

Lenders typically ask for recent pay stubs, bank statements, or proof of benefit payments.

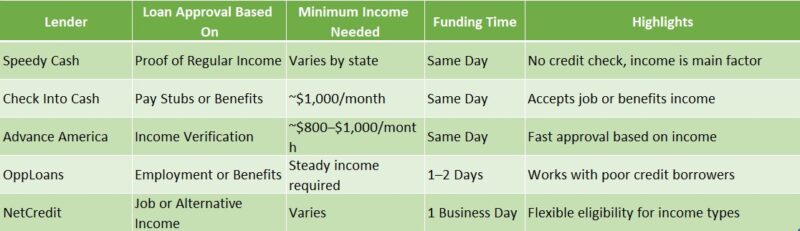

✅ Is there a minimum income needed to qualify?

Yes, most lenders require a minimum monthly income, often around $800–$1,000, but it varies by lender.

✅ Will my loan amount be based on my income level?

Yes, payday loan amounts are usually capped based on your monthly income to ensure you can repay it.

Don’t let financial stress hold you back. AdvanceCash is here to help you secure your payday loan today!

🔗At ExpressCash, we’re here to help guide you through the process and find the right financial solution for your specific situation.