Understanding how Loan APR affects monthly payments is essential for anyone considering borrowing money. The Annual Percentage Rate (APR) represents the cost of borrowing over a year. A higher APR means you’ll pay more in interest, significantly impacting your monthly payments.

What is Loan APR?

Loan APR combines the interest rate and any fees into one percentage, making it easier to compare loans. For instance, understanding payday loan interest rates can help you see how much you’ll owe each month.

How Loan APR Affects Monthly Payments

- Higher APR = Higher Payments: A higher APR increases your monthly payment.

- Lower APR = Lower Payments: A lower APR means you’ll pay less each month.

- Loan Amount Matters: The total amount you borrow also influences your payments.

Knowing how Loan APR affects monthly payments allows you to make smarter borrowing decisions. Always shop around for the best rates to save money!

Why Understanding APR is Important

Understanding Loan APR helps you budget better. A high APR can lead to financial stress if you struggle to make payments, so it’s crucial to know what you’re getting into.

Tips for Managing Loan Payments

- Compare Rates: Look at different lenders to find the best APR.

- Consider Your Budget: Ensure your monthly payment fits within your budget.

- Ask Questions: Don’t hesitate to inquire about fees and rates.

By following these tips, you can make informed choices and avoid surprises later on!

The Impact of Loan Terms

The length of your loan also affects monthly payments. A longer loan term usually means lower monthly payments, but you’ll pay more in interest overall. Balancing the loan term and APR is key to effective financial management.

Need cash fast? AdvanceCash offers quick payday loans to help you cover your expenses!

How Loan APR Affects Monthly Payments: The Basics Explained

Understanding how Loan APR affects monthly payments is crucial for anyone considering borrowing money. The Annual Percentage Rate (APR) is not just a number; it represents the cost of borrowing over a year. Knowing this can help you make informed decisions about loans, especially when comparing different options.

When you take out a loan, the APR determines how much interest you’ll pay. Higher APRs mean higher monthly payments. Here’s how it works:

Key Insights:

- Monthly Payment Calculation: The APR is used to calculate your monthly payment. A higher APR increases your payment, while a lower APR decreases it.

- Loan Amount Matters: The total amount you borrow also affects your payments. For instance, a $10,000 loan at 5% APR will cost less monthly than a $10,000 loan at 15% APR.

- Loan Term: The length of your loan impacts payments too. Shorter terms usually mean higher monthly payments but less interest paid overall.

Payday Loan Interest Rates Explained

Payday loans often come with high APRs. This can lead to hefty monthly payments that are hard to manage. Understanding these rates can help you avoid financial pitfalls and choose better loan options. Remember, a lower APR can save you money in the long run!

If you’re facing unexpected bills, AdvanceCash can provide you with the funds you need instantly!

The Relationship Between Loan Amount and APR: A Deep Dive

Understanding how Loan APR affects monthly payments is crucial for anyone considering borrowing money. The Annual Percentage Rate (APR) is more than just a number; it represents the cost of borrowing over a year. A higher APR means you’ll pay more in interest, which can significantly impact your monthly payments. Let’s dive deeper into this relationship!

How APR Influences Your Payments

When you take out a loan, the APR determines how much interest you’ll pay on top of the principal. For instance, if you borrow $10,000 at a 5% APR, your monthly payments will be lower than if you borrowed the same amount at a 15% APR. This difference can mean hundreds of dollars over the life of the loan!

Key Insights on Loan APR and Payments

- Higher APR = Higher Payments: As APR increases, so do your monthly payments.

- Loan Amount Matters: A larger loan amount with a high APR can lead to overwhelming payments.

- Payday Loan Interest Rates Explained: These loans often have extremely high APRs, making them costly options for quick cash.

In summary, understanding how Loan APR affects monthly payments can help you make informed decisions about borrowing. Always compare rates and consider the total cost before committing to a loan!

Also Read: Payday Loan Interest Rates Explained: What to Know

Fixed vs. Variable APR: Which One Affects Your Payments More?

Understanding how loan APR affects monthly payments is crucial for anyone considering borrowing money. Whether you’re looking for a mortgage, a personal loan, or even a payday loan, knowing the difference between fixed and variable APR can help you make informed decisions. Let’s dive into this topic!

When it comes to loan APR, there are two main types: fixed and variable. Here’s a quick breakdown of each:

- Fixed APR: This means your interest rate stays the same throughout the life of the loan. It provides stability, making it easier to budget your monthly payments. You know exactly what to expect!

- Variable APR: This type can change over time, often based on market conditions. While it might start lower than a fixed rate, it can increase, leading to higher monthly payments.

This unpredictability can make budgeting a bit tricky. So, how does this affect your monthly payments? With a fixed APR, you can plan ahead without worrying about sudden increases. On the other hand, variable APR might save you money initially, but it could lead to surprises down the road. Understanding payday loan interest rates explained can also shed light on how these rates impact your overall financial health.

Can You Lower Your Monthly Payments by Adjusting Your APR?

Understanding how loan APR affects monthly payments is crucial for anyone considering borrowing money. The Annual Percentage Rate (APR) is not just a number; it directly influences how much you pay each month. By grasping this concept, you can make informed decisions that save you money in the long run.

When you adjust your APR, you can indeed lower your monthly payments. Here’s how:

- Lower APR Means Lower Payments: A lower APR reduces the interest you pay, which can significantly decrease your monthly payment. For example, if your loan amount is $10,000 with a 5% APR, your monthly payment will be lower than if it were 10%.

- Longer Loan Terms: Sometimes, extending the loan term can also help lower monthly payments. However, this may increase the total interest paid over time. It’s a balancing act!

- Payday Loan Interest Rates Explained: If you’re considering a payday loan, be cautious. These loans often come with high APRs, leading to hefty monthly payments.

Always compare options to find the best rate. In summary, adjusting your APR can be a smart move to lower monthly payments. Just remember to weigh the pros and cons carefully, and you’ll be on your way to making better financial choices!

Real-Life Examples: How Loan APR Affects Monthly Payments

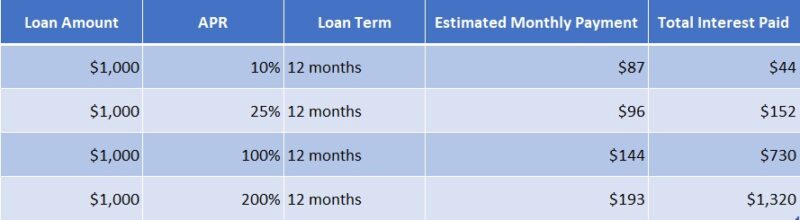

Understanding how Loan APR affects monthly payments is essential for anyone considering borrowing money. The Annual Percentage Rate (APR) reflects the cost of borrowing, including interest and fees. A higher APR results in higher monthly payments, which can significantly impact your budget. Let’s look at some real-life examples.

Real-Life Example: Car Loan

For instance, if you take out a $20,000 car loan at a 3% APR, your monthly payment could be around $600. However, if the APR increases to 6%, your payment might rise to about $700, adding an extra $100 each month. This clearly illustrates how Loan APR affects monthly payments.

Understanding Payday Loan Interest Rates Explained

Payday loans often come with steep interest rates. If you borrow $500 at a staggering 400% APR, you could end up repaying $650 in just two weeks. This example shows how payday loan interest rates can lead to substantial monthly payments, complicating financial management.

The Impact of Loan Duration

The loan duration also influences monthly payments. A shorter loan term typically results in higher monthly payments but less total interest paid. For example, a 5-year loan at 5% APR costs more monthly than a 10-year loan at the same rate, but you’ll pay less interest overall.

Conclusion: Make Informed Decisions

In summary, understanding how Loan APR affects monthly payments is crucial for making informed borrowing decisions. Always compare rates and terms to find the best deal that suits your financial situation.

How AdvanceCash Can Help You Navigate Loan APR and Monthly Payments

Understanding how Loan APR affects monthly payments is crucial for anyone considering borrowing money. The Annual Percentage Rate (APR) is more than just a number; it represents the cost of borrowing over a year. A higher APR means higher monthly payments, which can impact your budget significantly. That’s why knowing how to navigate these numbers is essential.

Key Insights on Loan APR

- APR Explained: The APR includes not just the interest rate but also any fees associated with the loan. This gives you a clearer picture of what you’ll pay each month.

- Monthly Payments: A higher APR leads to higher monthly payments. For example, a loan of $10,000 at 5% APR will cost less monthly than the same loan at 10% APR.

- Budgeting: Understanding these payments helps you budget effectively. You can plan your finances better when you know how much to set aside each month.

Payday Loan Interest Rates Explained

- Short-Term Loans: Payday loans often come with high APRs, which can lead to steep monthly payments. It’s vital to understand these rates before borrowing.

- Avoiding Pitfalls: By using AdvanceCash, you can compare different loan options and find the best APR for your needs, helping you avoid costly mistakes.

In conclusion, knowing how Loan APR affects monthly payments empowers you to make informed financial decisions. With the right tools and insights, you can navigate the loan landscape confidently.

FAQs

✅ What is APR, and how does it affect my loan?

APR (Annual Percentage Rate) represents the total cost of borrowing, including interest and fees. A higher APR means higher monthly payments.

✅ How does a lower APR reduce my monthly payment?

A lower APR reduces the total interest charged, making each monthly installment more affordable.

✅ Does a longer loan term affect my APR?

Yes! Longer terms may have higher APRs, but they spread payments over more months, reducing the monthly amount but increasing overall costs.

✅ How can I lower my APR to reduce monthly payments?

Improve your credit score, shop for better rates, opt for secured loans, or negotiate with lenders to secure a lower APR.

✅ Can APR change over time?

If you have a fixed-rate loan, APR stays the same. For variable-rate loans, APR can increase or decrease, impacting your monthly payments.

Don’t let financial stress hold you back. AdvanceCash is here to help you secure your payday loan today!

🔗At ExpressCash, we’re here to help guide you through the process and find the right financial solution for your specific situation.