Understanding how loan interest is charged daily is crucial for borrowers. It can significantly impact your finances, especially if you’re considering a payday loan. Knowing the ins and outs of daily interest can help you make informed decisions and avoid surprises down the road.

When you take out a loan, the lender charges interest on the amount borrowed. But did you know that this interest can be calculated daily? This means that every day you owe money, the interest adds up, making it essential to understand how loan interest is charged daily.

How It Works

- Daily Interest Calculation: Lenders often divide the annual interest rate by 365 days. For example, if your loan has a 12% annual interest rate, the daily rate would be 0.03288%. This small percentage can add up quickly!

- Payday Loan Interest Rates Explained: Payday loans typically have higher interest rates. If you borrow $500 with a 15% daily interest rate, you could owe $75 in just five days!

Understanding these calculations helps you see how quickly your debt can grow. Always read the fine print before signing any loan agreement.

Need cash fast? AdvanceCash offers quick payday loans to help you cover your expenses!

How Loan Interest Is Charged Daily: The Basics Explained

Understanding how loan interest is charged daily is crucial for borrowers. It can significantly impact how much you end up paying over time. Knowing the basics helps you make informed decisions and avoid surprises when it comes to your finances.

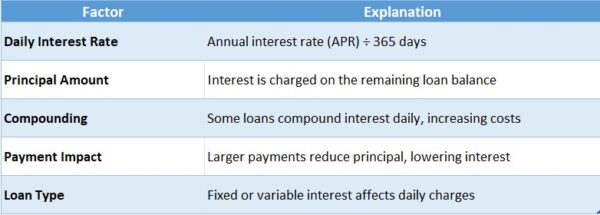

When you take out a loan, the lender typically charges interest on the amount you borrow. This interest can be calculated daily, which means it can add up quickly. Here’s what you need to know:

Daily Interest Calculation

- Daily Rate: Lenders often divide the annual interest rate by 365 to find the daily interest rate.

- Accrual: Each day, interest is added to your loan balance, which can increase the total amount you owe if not paid promptly.

Why It Matters

- Payday Loan Interest Rates Explained: These loans often have higher daily interest rates, making it essential to repay them quickly.

- Budgeting: Knowing how interest accumulates helps you plan your payments and avoid falling into debt traps.

Why Daily Interest Calculation Matters for Your Finances

Understanding how loan interest is charged daily is crucial for managing your finances effectively. Many borrowers overlook this detail, but it can significantly impact the total amount you repay. Knowing the ins and outs of daily interest calculations can help you make informed decisions about loans, especially when it comes to payday loans.

The Basics of Daily Interest

Daily interest means that your loan’s interest is calculated every single day. This can lead to higher costs over time, especially if you don’t pay off your loan quickly. For example, if you take out a payday loan, the interest accumulates daily, which can make it feel like you’re always playing catch-up.

Key Insights to Remember

- Short-Term Loans: Payday loans often have higher interest rates, and daily calculations can make them even more expensive.

- Budgeting: Knowing how interest accrues daily helps you budget better and avoid surprises.

- Paying Early: If you can pay off your loan early, you can save on interest costs. Every day counts!

By understanding how loan interest is charged daily, you can take control of your financial future. Remember, knowledge is power, and being aware of payday loan interest rates explained can help you avoid costly mistakes.

If you’re facing unexpected bills, AdvanceCash can provide you with the funds you need instantly!

The Impact of Daily Interest on Your Loan Repayment

Understanding how loan interest is charged daily is crucial for borrowers. It can significantly affect your repayment amount and overall financial health. Knowing the ins and outs of daily interest can help you make informed decisions and avoid surprises down the road.

When you take out a loan, the interest isn’t just a one-time fee. Instead, it accumulates daily. This means that every day, your loan balance grows slightly due to interest. Here’s what you should know:

How It Works

- Daily Calculation: Lenders calculate interest based on your outstanding balance each day.

- Payday Loan Interest Rates Explained: These loans often have higher daily rates, which can lead to quick accumulation of debt if not managed properly.

Why It Matters

- Total Cost: Daily interest can increase the total amount you owe faster than you might expect.

- Repayment Strategy: Understanding this can help you plan your repayments better, ensuring you pay off your loan sooner and save on interest costs.

By being aware of how loan interest is charged daily, you can take control of your finances. Make sure to read the fine print and ask questions before signing any loan agreement. This knowledge empowers you to make smarter financial choices and avoid unnecessary debt.

Also Read: Payday Loan Interest Rates Explained: What to Know

Are You Paying More? The Truth About Daily Loan Interest

When it comes to loans, understanding how interest is charged can save you a lot of money. Many borrowers are surprised to learn that interest is often calculated daily. This means that the amount you owe can grow faster than you might expect. Let’s dive into the details of how loan interest is charged daily and what it means for your wallet.

What Does Daily Interest Mean?

Daily interest means that the lender calculates the interest on your loan every single day. For example, if you take out a payday loan, the interest accumulates daily, not monthly. This can lead to higher costs if you don’t pay off the loan quickly.

Key Points to Remember:

- Daily Accrual: Interest builds up each day, increasing your total debt.

- Payday Loan Interest Rates Explained: These loans often have high daily rates, making it crucial to repay them promptly to avoid excessive charges.

Understanding how loan interest is charged daily can help you make informed decisions. If you’re considering a payday loan, be sure to read the fine print. Knowing the interest rates and how they accumulate can prevent unexpected surprises and keep your finances in check.

How Loan Interest Is Charged Daily: Key Factors to Consider

Understanding how loan interest is charged daily is crucial for borrowers. It can significantly impact the total amount you owe. When you take out a loan, interest isn’t just a one-time fee; it accumulates daily, which can lead to higher costs if you’re not careful. Let’s break this down!

Daily Accrual of Interest

Interest on loans, especially payday loans, is often calculated daily. This means that every day you have the loan, interest adds up. For example, if you borrow $1,000 at a daily interest rate of 0.5%, you’ll owe $5 in interest each day.

Understanding Payday Loan Interest Rates Explained

Payday loans typically have higher interest rates. Here’s what to keep in mind:

- Short-term nature: These loans are meant to be paid back quickly, often within two weeks.

- High costs: Because interest accumulates daily, the total can balloon quickly if you don’t pay it back on time.

- Budget wisely: Always plan your repayment to avoid extra charges!

By knowing how loan interest is charged daily, you can make smarter financial decisions. Remember, the sooner you pay off your loan, the less interest you’ll pay overall. Keep these factors in mind to avoid surprises and manage your finances effectively!

Tips for Managing Loans with Daily Interest Charges

Managing loans can be overwhelming, especially when you understand how loan interest is charged daily. This knowledge is crucial for borrowers, as it significantly impacts the total amount owed. By grasping how daily interest works, you can make smarter financial decisions and avoid unnecessary debt.

Understand Daily Interest Accrual

Daily interest means your loan balance increases every day. For instance, with a payday loan, interest can accumulate quickly. Knowing how loan interest is charged daily helps you realize how even small amounts can add up over time.

Make Payments Regularly

To keep your loan manageable, try to make payments more frequently. This approach can reduce the principal balance faster, lowering the daily interest charged. Even small extra payments can make a significant difference!

Keep Track of Your Loan Terms

Always read the fine print of your loan agreement. Understanding payday loan interest rates explained can help you avoid surprises. Look for details on how often interest is calculated and any applicable fees.

Create a Budget

Creating a budget can help you stay on top of your loan payments. By knowing your monthly expenses and income, you can allocate funds specifically for loan repayment, preventing you from falling behind and accumulating more interest.

How AdvanceCash Can Help You Navigate Daily Loan Interest

Understanding how loan interest is charged daily is crucial for borrowers. It can significantly impact the total amount you repay. When you know how loan interest is charged daily, you can make informed decisions about borrowing and managing your finances effectively.

Breaking Down Daily Interest Charges

Daily interest means that the interest on your loan accumulates every single day. This can lead to higher costs if you don’t pay off your loan quickly. For example, if you take out a payday loan, the interest can add up fast!

Key Insights on Payday Loan Interest Rates Explained

- Daily Accrual: Interest is calculated daily, not monthly.

- Quick Costs: The longer you hold the loan, the more interest you pay.

- Budget Wisely: Knowing this helps you plan your payments better.

By understanding these concepts, you can avoid surprises and manage your loans more effectively. AdvanceCash is here to guide you through these complexities, ensuring you make smart financial choices.

FAQs

-

How does daily interest work on a loan?

Daily interest is calculated based on the outstanding loan balance each day. The lender applies a daily interest rate to the remaining principal, which accumulates until payment is made. -

How do you calculate daily loan interest?

The formula is:

Daily Interest = (Loan Balance × Annual Interest Rate) ÷ 365

For example, if your loan balance is $10,000 with a 10% annual interest rate, the daily interest would be:

($10,000 × 10%) ÷ 365 = $2.74 per day. -

Does paying off a loan early reduce daily interest?

Yes, making extra payments or paying early lowers the principal balance, reducing the total interest accrued over time. -

Are daily interest loans more expensive than monthly interest loans?

It depends on how frequently you make payments. If you pay only once per month, daily interest can add up, making the loan more expensive. However, frequent payments can minimize interest costs. -

How can I reduce interest charges on a daily interest loan?

-

Make early or extra payments to lower the principal faster.

-

Choose a shorter loan term to reduce overall interest.

-

Consider refinancing if you qualify for a lower interest rate.

-

Don’t let financial stress hold you back. AdvanceCash is here to help you secure your payday loan today!

🔗At ExpressCash, we’re here to help guide you through the process and find the right financial solution for your specific situation.