Understanding loan interest rates is essential when borrowing money. A Loan Interest Rate Comparison Guide helps you explore various options to find the best rates, ultimately saving you money and easing your financial journey.

What Are Loan Interest Rates?

Loan interest rates represent the cost of borrowing money and can vary based on the loan type and your creditworthiness. Grasping how these rates function is vital for making informed choices.

Why Compare Rates?

Comparing rates can lead to significant savings, including:

- Lower Monthly Payments: A reduced interest rate means lower monthly payments.

- Reduced Total Cost: Over time, lower rates can save you hundreds or thousands of dollars.

- Better Loan Terms: You may discover loans with more favorable terms, such as flexible repayment options.

In summary, a thorough comparison empowers you to make wise decisions, particularly regarding payday loans. Understanding payday loan interest rates explained can help clarify potential costs.

Need cash fast? AdvanceCash offers quick payday loans to help you cover your expenses!

Why Comparing Loan Interest Rates is Crucial for Borrowers

When it comes to borrowing money, understanding interest rates is key. That’s where our Loan Interest Rate Comparison Guide comes in. By comparing rates, you can save money and make smarter financial decisions. After all, a lower interest rate means less money paid back over time!

Why Compare Loan Interest Rates?

Comparing loan interest rates is crucial for several reasons:

- Save Money: Even a small difference in rates can lead to significant savings.

- Understand Your Options: Different lenders offer various terms and conditions.

- Avoid Surprises: Knowing the rates helps you avoid unexpected costs later on.

Payday Loan Interest Rates Explained

Payday loans often come with high-interest rates. Understanding these rates can help you make informed choices. Here are some tips:

- Research: Look for lenders with transparent rates.

- Ask Questions: Don’t hesitate to inquire about fees and terms.

- Read Reviews: See what other borrowers have experienced.

By following these steps, you can navigate the world of loans with confidence!

How to Use Our Loan Interest Rate Comparison Guide Effectively

Understanding interest rates is essential when borrowing money. Our Loan Interest Rate Comparison Guide is designed to help you explore various options and find the best rates tailored to your needs. This guide simplifies complex terms, enabling you to make informed decisions.

To maximize the benefits of our guide, start by collecting your financial details. Knowing your credit score and the amount you wish to borrow will aid in accurate rate comparisons. Follow these steps:

- Identify Your Needs: Decide on the type of loan you require, such as a personal loan or a payday loan.

- Compare Rates: Utilize our guide to view different lenders and their rates side by side.

- Understand Terms: Check our section on Payday Loan Interest Rates Explained to understand the consequences of high rates.

- Make a Decision: Select the loan that aligns with your budget and repayment capacity.

If you’re facing unexpected bills, AdvanceCash can provide you with the funds you need instantly!

Top Factors That Influence Loan Interest Rates

Finding the best loan requires a solid understanding of interest rates. A Loan Interest Rate Comparison Guide is essential for navigating your options and securing the most favorable rates. By knowing what influences these rates, you can save both money and stress over time.

Credit Score

Your credit score plays a crucial role in determining your interest rate. Lenders use it to assess your repayment likelihood. Generally, a higher score results in lower rates, while a lower score can increase costs.

Loan Type

Interest rates vary by loan type. For instance, payday loans typically have higher rates due to their short repayment periods. Understanding the specific loan you need can lead to better financial decisions.

Economic Conditions

The economy also affects interest rates. Rates may rise during strong economic periods and fall during downturns. Monitoring economic trends can help you choose the right time to apply for a loan, ensuring you get the best rates.

Also Read: What Is the Payday Loan Application Process?

Fixed vs. Variable Interest Rates: Which is Right for You?

When it comes to borrowing money, understanding interest rates is crucial. Our Loan Interest Rate Comparison Guide: Find the Best Rates helps you navigate the options available. One of the biggest decisions you’ll face is choosing between fixed and variable interest rates. Each has its pros and cons, so let’s break it down!

Fixed Interest Rates: Stability You Can Count On

With a fixed interest rate, your payments stay the same throughout the loan term. This predictability can be comforting, especially if you’re on a tight budget. You won’t have to worry about sudden increases in your monthly payments, making it easier to plan your finances.

Variable Interest Rates: Flexibility with Risks

On the other hand, variable interest rates can change over time. They often start lower than fixed rates, which can save you money initially. However, they can also rise, leading to higher payments later on. If you’re considering payday loan interest rates explained, remember that variable rates can be a gamble. Choose wisely!

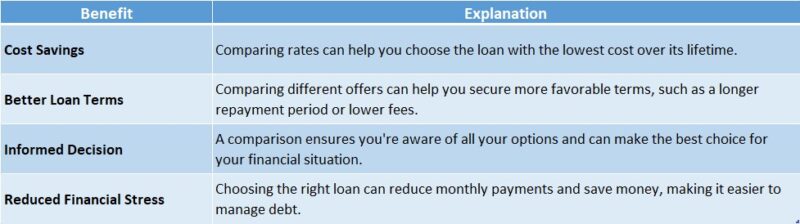

Benefits of Comparing Loan Interest Rates

The Impact of Your Credit Score on Loan Interest Rates

When it comes to borrowing money, understanding how your credit score affects loan interest rates is crucial. This is where our Loan Interest Rate Comparison Guide comes into play. By comparing rates, you can save money and make informed decisions about your financial future.

The Role of Your Credit Score

Your credit score is like a report card for how well you manage money. Lenders use it to decide if they can trust you to pay back a loan. A higher score often means lower interest rates, which can save you a lot of cash over time.

Why It Matters

- Lower Payments: A better credit score can lead to lower monthly payments.

- More Options: With a good score, you can access more loan types, including favorable terms.

- Payday Loan Interest Rates Explained: If you have a low score, payday loans might seem tempting, but they often come with high interest rates. Always compare before deciding!

How to Spot the Best Loan Interest Rates in the Market

When searching for the best loan interest rates, a Loan Interest Rate Comparison Guide can be your best friend. Understanding how to compare rates helps you save money and make informed decisions. With so many options available, knowing where to look is crucial.

Understand the Basics

Start by learning about different types of loans. For instance, payday loan interest rates explained can help you see how short-term loans work. Knowing the terms can prevent surprises later on.

Compare Multiple Lenders

Don’t settle for the first offer you see. Instead, check rates from various lenders. Use online comparison tools to see who offers the best deal. This way, you can find a rate that fits your budget perfectly.

Look for Hidden Fees

Sometimes, the lowest interest rate isn’t the best deal. Always read the fine print for hidden fees. These can add up quickly and affect your overall cost. Remember, a good loan is not just about the interest rate!

Common Mistakes to Avoid When Comparing Loan Interest Rates

Understanding interest rates is essential when borrowing money. A Loan Interest Rate Comparison Guide can help you find the best rates, ultimately saving you money. However, many borrowers make common mistakes that can lead to poor financial choices. Let’s look at these pitfalls!

Ignoring the Fine Print

One major mistake is not reading the fine print in loan agreements. Hidden fees or penalties can significantly affect your overall cost, so understanding these details is crucial for making informed decisions.

Focusing Solely on the Interest Rate

While comparing rates is important, don’t overlook other factors. For instance, payday loan interest rates explained often come with additional costs. Always consider the total cost of the loan, not just the interest rate, for a clearer understanding.

Not Considering Your Credit Score

Your credit score greatly influences your interest rate. Many borrowers neglect to check their score before applying. A higher score typically results in lower rates, making it wise to know your credit standing before comparing loans.

How AdvanceCash Can Help You Find the Best Loan Rates

Finding the best loan rates can feel like searching for a needle in a haystack. That’s where our Loan Interest Rate Comparison Guide comes in! We simplify the process, helping you understand the different rates available and ensuring you make informed decisions. After all, a good rate can save you money!

At AdvanceCash, we believe in empowering you with knowledge. Our guide breaks down everything you need to know about loan interest rates, including the often confusing payday loan interest rates explained. We make it easy to compare options and find what suits you best.

Key Benefits of Using Our Guide:

- Easy Comparisons: Quickly see how different lenders stack up.

- Clear Explanations: Understand terms and conditions without the jargon.

- Save Money: Finding the best rates can lead to significant savings over time.

With our help, navigating the world of loans becomes a breeze!

Frequently Asked Questions About Loan Interest Rate Comparisons

⭐ What factors affect loan interest rates?

Loan rates depend on credit score, loan type, lender policies, loan term, and market conditions.

⭐ How can I compare loan interest rates effectively?

Look at the APR (Annual Percentage Rate), which includes the interest rate plus fees, to get the true cost of borrowing.

⭐ Do fixed or variable interest rates offer better terms?

-

Fixed rates stay the same, providing predictable payments.

-

Variable rates may start lower but can increase over time.

⭐ How can I get a lower interest rate on a loan?

Improve your credit score, choose a shorter loan term, or apply with a co-signer for better rates.

⭐ Where can I compare loan rates online?

Many websites offer loan comparison tools, including bank websites, credit unions, and financial marketplaces.

Don’t let financial stress hold you back. AdvanceCash is here to help you secure your payday loan today!

🔗At ExpressCash, we’re here to help guide you through the process and find the right financial solution for your specific situation.