Understanding the Risks of Payday Loans: What You Need to Know

Understanding the risks of payday loans is essential for anyone considering this quick cash option. While they may seem like a lifeline during tough times, they can lead to serious financial trouble if you’re not careful. Here’s what you need to know before applying for one.

One major risk is the incredibly high-interest rates, often exceeding 400% APR. For instance, borrowing $500 could mean paying back significantly more, trapping you in a cycle of debt.

Short Repayment Terms

Another concern is the short repayment terms, typically requiring repayment within two weeks. This can be tough if you’re already struggling financially, leading to the temptation of taking out another loan.

Hidden Fees

Many payday loans also come with hidden fees that can catch borrowers off guard, increasing the total amount owed. Always read the fine print to avoid surprises later.

Impact on Credit Score

While payday loans may not directly affect your credit score, failing to repay them can lead to collections, harming your credit and limiting future financial options.

Emotional Stress

Lastly, managing payday loans can cause significant emotional stress. Worrying about repayments can lead to anxiety and sleepless nights, making it crucial to consider both financial and emotional impacts.

Need cash fast? AdvanceCash offers quick payday loans to help you cover your expenses!

Are Payday Loans a Trap? Exploring the Hidden Dangers

When people find themselves in a financial pinch, payday loans can seem like a quick fix. However, understanding the

risks of payday loans is crucial before diving into the payday loan application process. These loans can lead to more trouble than they solve, often trapping borrowers in a cycle of debt.

Hidden Dangers of Payday Loans

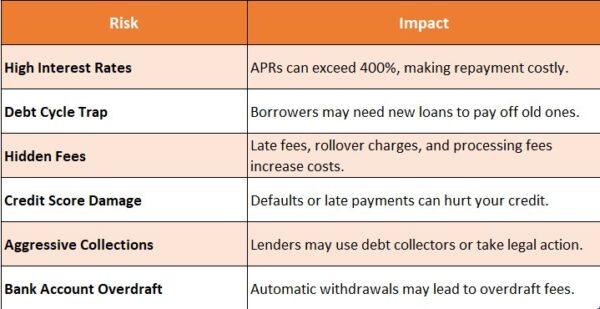

Payday loans may appear convenient, but they come with significant risks. Here are some key dangers to consider:

- High Interest Rates: The interest rates on payday loans can be shockingly high, often exceeding 400%. This means you could end up paying back much more than you borrowed.

- Short Repayment Terms: Most payday loans require repayment within two weeks. If you can’t pay it back on time, you may need to take out another loan, leading to a cycle of debt.

The Cycle of Debt

Many borrowers find themselves stuck in a loop. They take out a payday loan, struggle to repay it, and then borrow again. This cycle can lead to:

- Increased Financial Stress: Constantly worrying about repayments can take a toll on your mental health.

- Damage to Credit Score: Missing payments can hurt your credit score, making it harder to get loans in the future. Understanding these risks can help you make better financial choices.

If you’re facing unexpected bills, AdvanceCash can provide you with the funds you need instantly!

The Financial Burden: How Payday Loans Can Lead to Debt Cycles

When considering a quick financial fix, many people wonder, “What are the

risks of payday loans?” Understanding these risks is crucial because while payday loans can provide immediate cash, they often lead to long-term financial struggles. Let’s dive into how these loans can create a cycle of debt that’s hard to escape.

High-Interest Rates

One of the biggest risks of payday loans is their high-interest rates. Borrowers often face fees that can turn a small loan into a massive debt. For example, a $300 loan might cost you $75 in fees, making it hard to pay back without borrowing again.

Short Repayment Terms

The payday loan application process is usually quick, but the repayment terms are short—often just two weeks. This means that if you can’t pay back the loan on time, you might need to take out another loan, leading to a cycle of borrowing that can spiral out of control.

Consequences of Defaulting

If you miss a payment, the lender may charge additional fees or even send your account to collections. This can damage your credit score, making it harder to get loans in the future. It’s a tough situation that many find themselves in after taking out a payday loan.

Also Read: What Is the Payday Loan Application Process?

Impact on Credit Scores: What Are the Risks of Payday Loans?

When considering a payday loan, understanding the potential risks is crucial. Many seek these loans for quick cash but often overlook their impact on financial health. Let’s explore the risks of payday loans and why they matter.

High-Interest Rates

One major risk is the incredibly high-interest rates, which can reach up to 400%. For instance, borrowing $500 could mean paying back much more, trapping you in debt.

Short Repayment Terms

Payday loans usually have short repayment terms, often just two weeks. This can create a cycle of borrowing, leading to missed payments and damaging your credit score during the payday loan application process.

Potential for Default

If you can’t repay on time, you risk defaulting, resulting in additional fees and negative marks on your credit report that can linger for years.

Limited Regulation

Payday loans are often less regulated than traditional loans, allowing lenders to impose high fees and interest rates. Always read the fine print before signing any agreement.

Emotional Stress

Finally, managing payday loans can cause significant emotional stress, leading to anxiety and sleepless nights. It’s vital to consider both the financial and emotional impacts.

Alternatives to Payday Loans: Safer Options for Quick Cash

When people find themselves in a tight spot financially, they often consider payday loans. However, understanding the risks of payday loans is crucial before diving into the payday loan application process. These loans can seem like a quick fix, but they come with hidden dangers that can lead to bigger problems down the road.

The Hidden Costs of Payday Loans

Payday loans typically have high-interest rates, which can make repayment difficult. If you can’t pay back the loan on time, you might end up in a cycle of debt. This means borrowing more money just to pay off the first loan, leading to even more fees and stress.

Safer Alternatives to Consider

Instead of payday loans, consider these safer options for quick cash:

- Credit Unions: They often offer small loans with lower interest rates.

- Personal Loans: Banks and online lenders may provide better terms.

- Payment Plans: Talk to your service providers about flexible payment options.

By exploring these alternatives, you can avoid the risks of payday loans and find a more manageable solution to your financial needs.

How to Recognize Predatory Lending Practices in Payday Loans

Understanding the risks of payday loans is crucial for anyone considering this quick cash option. While they may seem like a lifeline during financial emergencies, they often come with hidden dangers that can trap borrowers in a cycle of debt. Let’s explore how to recognize predatory lending practices in payday loans.

Warning Signs of Predatory Lending

When you start the payday loan application process, keep an eye out for these red flags:

- High Fees: If the fees seem excessive, it’s a warning sign.

- Lack of Transparency: If the lender isn’t clear about the terms, be cautious.

- Pressure Tactics: If you feel rushed to sign, it’s time to walk away.

The Cycle of Debt

Many borrowers find themselves caught in a cycle of debt due to the risks of payday loans. They may take out a loan to cover one expense, only to need another loan to pay off the first. This can lead to a never-ending cycle of borrowing and repaying, often with high interest rates that make it hard to escape.

Can Payday Loans Affect Your Mental Health? The Psychological Risks

Payday loans are often viewed through a financial lens, but the risks of payday loans also include significant psychological impacts. These loans can deeply affect your mental health, leading to various emotional challenges. Let’s delve into how they can influence your well-being.

The Stress of Debt

While payday loans may seem like a quick solution, they often trap borrowers in a cycle of debt. The payday loan application process can be stressful, and the pressure to repay can cause anxiety and sleepless nights, making it hard to cope.

Feelings of Shame and Isolation

Borrowers frequently experience shame about needing a payday loan, which can lead to feelings of isolation. It’s important to remember that many people face similar challenges, and seeking support can help alleviate this burden.

Impact on Relationships

The stress associated with payday loans can strain relationships, often resulting in arguments with loved ones. Open communication is essential; discussing your financial situation can ease tensions and foster understanding.

Coping Strategies

If you find yourself struggling, consider reaching out for help. A financial advisor or counselor can provide valuable guidance, helping you manage both your finances and mental health effectively.

How AdvanceCash Can Help You Navigate the Risks of Payday Loans

When considering a payday loan, understanding the risks is essential. Many people seek these loans during financial emergencies, but they can trap you in a cycle of debt that’s hard to escape. Recognizing the risks of payday loans empowers you to make informed decisions and avoid potential pitfalls.

Understanding the Risks

Payday loans typically come with high interest rates and fees, making timely repayment challenging. Missing a payment can lead to borrowing more money just to cover the previous loan, creating a dangerous cycle of debt.

The Payday Loan Application Process

The payday loan application process is often quick and straightforward, but it can be misleading. You may think you’re receiving help, yet the terms can ensnare you in debt. That’s where AdvanceCash steps in. We offer resources and guidance to help you understand what you’re signing up for, ensuring you are aware of all the risks before applying. By educating yourself about these risks, you can make better choices. At AdvanceCash, we’re dedicated to helping you navigate these challenges and find safer alternatives to payday loans. Always remember, being informed is better than rushing into a decision that could affect your financial future.

FAQs

⭐ What are the main risks of payday loans?

The biggest risks include high interest rates, short repayment terms, and the potential for a debt cycle if borrowers take out new loans to pay off old ones.

⭐ Can payday loans hurt my credit score?

Most payday lenders don’t report to major credit bureaus, but if you default and your debt goes to collections, it can negatively impact your credit score.

⭐ Why do payday loans have high fees?

Payday loans are high-risk loans for lenders, so they charge high fees and APRs (often 300% or more) to offset the risk of non-payment.

⭐ What happens if I can’t repay my payday loan on time?

You may face late fees, collection calls, and even legal action. Some lenders automatically withdraw payments, leading to overdraft fees in your bank account.

⭐ Are payday loans a trap?

They can be if used frequently. Many borrowers roll over their loans, getting stuck in a cycle of debt where they continually borrow to cover previous loans.

Don’t let financial stress hold you back. AdvanceCash is here to help you secure your payday loan today!

🔗At

ExpressCash, we’re here to help guide you through the process and find the right financial solution for your specific situation.