Understanding Multiple Payday Loans

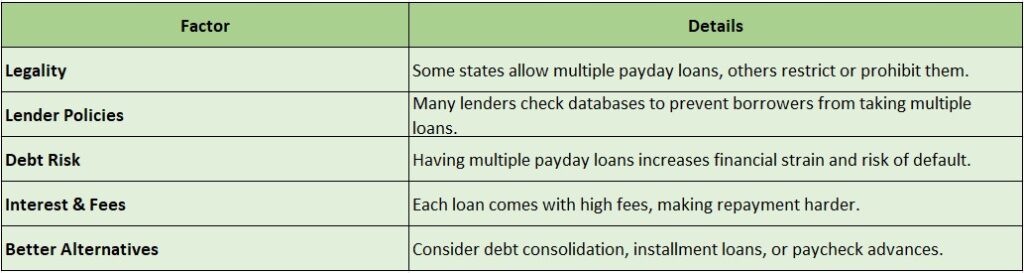

Many people ask, can you get multiple payday loans at once? The answer is yes, but it comes with significant risks. Lenders typically do not share information, allowing you to take out several loans simultaneously. However, this can lead to a challenging cycle of debt that is hard to escape. Understanding the implications is essential before pursuing multiple loans. Having two or three payday loans, each with high-interest rates, can quickly escalate your monthly payments, creating a financial burden. Here are some key considerations:

- High Interest Rates: Each loan incurs its own fees, which can add up rapidly.

- Debt Cycle: Multiple loans can trap you in a continuous borrowing cycle.

- Credit Impact: Managing several loans poorly can harm your credit score.

If you’re looking for alternatives to payday loans, consider options that can provide financial relief without the steep costs. Personal loans from credit unions, borrowing from friends or family, and community assistance programs are viable alternatives. These options often come with lower interest rates and more manageable repayment terms, helping you avoid the pitfalls associated with multiple payday loans. Always weigh your options carefully to find the best fit for your financial situation.

Need cash fast? AdvanceCash offers quick payday loans to help you cover your expenses!

The Risks of Taking Out Multiple Payday Loans

When pondering the question, can you get multiple payday loans at once, it’s vital to consider the associated risks. While the allure of quick cash from various lenders is strong, this strategy can trap borrowers in a cycle of debt that is difficult to escape. Many individuals end up managing multiple payments, leading to missed deadlines and additional fees, which can create a financial crisis. Key risks of taking out multiple payday loans include:

- Increased Debt: Each loan compounds your total debt, complicating financial management.

- High Interest Rates: Payday loans often carry steep interest rates that can escalate quickly if repayments are missed.

- Credit Score Impact: Defaulting on loans can significantly harm your credit score, hindering future borrowing opportunities.

- Legal Consequences: Certain states prohibit multiple payday loans, potentially resulting in legal troubles if not adhered to.

If you need quick cash, consider alternatives to payday loans. Options such as personal loans from credit unions, borrowing from friends or family, or community assistance programs can offer financial relief without the dangers of multiple payday loans. Seeking sustainable solutions is always preferable to falling into a debt cycle.

Legal Regulations on Multiple Payday Loans

Many people ask, can you get multiple payday loans at once? The answer is yes, but it’s complicated. Legal regulations differ by state, with some imposing strict limits on how many payday loans you can have simultaneously. For example, in California, you can only hold one payday loan at a time from a single lender, while other states may allow loans from multiple lenders. This flexibility can lead to financial trouble if not managed carefully. Before considering multiple payday loans, it’s vital to understand the risks involved. Here are some key insights:

- High Interest Rates: Each loan carries its own fees and interest, which can accumulate quickly.

- Debt Cycle: Multiple loans can trap you in a cycle of debt, complicating repayment.

- Credit Impact: Having several loans can harm your credit score if payments are missed.

If you need extra cash, consider alternatives to payday loans. Options like personal loans from credit unions, borrowing from friends or family, or community assistance programs can offer relief without the risks associated with multiple payday loans. In conclusion, while obtaining multiple payday loans is possible, it’s crucial to consider the legal regulations and potential consequences. Always explore alternatives to make informed financial choices.

If you’re facing unexpected bills, AdvanceCash can provide you with the funds you need instantly!

How Lenders View Multiple Payday Loan Applications

When pondering whether you can get multiple payday loans at once, it’s crucial to grasp how lenders view such applications. Typically, lenders are wary of borrowers seeking several loans simultaneously, often interpreting this as a sign of financial distress. This perception can lead to increased scrutiny of your application and may even result in denial, as lenders want to ensure you can repay without falling deeper into debt. Here are some insights into how lenders evaluate multiple payday loan applications:

- Creditworthiness: Lenders review your credit history and financial obligations. Multiple applications may indicate difficulty managing finances.

- Debt-to-Income Ratio: If your income is already tight, taking on more loans can exacerbate your situation, making lenders reluctant to approve further requests.

- Loan Purpose: Clearly explaining why you need multiple loans can strengthen your case, while vague reasons may raise red flags.

If you need extra cash, consider payday loan alternatives. These options can offer financial relief without the risks associated with multiple payday loans. Alternatives include personal loans from credit unions, borrowing from friends or family, or exploring community assistance programs, often featuring lower interest rates and more manageable repayment terms.

Also Read: How Do Payday Loans Work for Emergency Expenses?

Impact of Multiple Payday Loans on Your Credit Score

When pondering the question, can you get multiple payday loans at once, it’s vital to grasp the potential impact on your credit score. Although payday loans do not directly affect your credit score, managing multiple loans poorly can lead to serious consequences. For example, taking out several payday loans may initially seem like a solution, but struggling to repay them can result in missed payments, which can harm your credit score.

Consider a scenario where someone takes out three payday loans to manage unexpected expenses. They may feel a temporary sense of relief, but as the repayment dates approach, they realize they cannot afford to pay them all back. This can lead to late fees and collection actions, negatively impacting their credit history. Therefore, it’s essential to weigh the risks before committing to multiple loans. Instead of accumulating payday loans, explore alternatives that offer financial relief without risking your credit. Here are some options:

- Personal loans from credit unions or banks

- Borrowing from friends or family

- Payment plans with creditors

- Budgeting and financial counseling

By considering these alternatives, you can avoid the pitfalls of multiple payday loans and safeguard your financial health.

Alternatives to Multiple Payday Loans

When it comes to managing finances, many people wonder, can you get multiple payday loans at once? While it might seem like a quick fix to your cash flow issues, it often leads to a cycle of debt that can be hard to escape. Instead of piling on multiple loans, consider exploring alternatives that can provide the financial relief you need without the risks associated with payday loans. One effective alternative is a personal loan from a credit union or bank. These loans typically offer lower interest rates and more flexible repayment terms. Here are some benefits of opting for a personal loan:

- Lower interest rates compared to payday loans

- Longer repayment periods, making monthly payments more manageable

- The potential to improve your credit score if you make timely payments

Another option is to seek assistance from local charities or non-profit organizations that offer financial aid. Many communities have resources available to help individuals in need, which can be a lifesaver during tough times. Remember, while payday loans may seem like a quick solution, exploring these alternatives can lead to a more sustainable financial future.

Tips for Managing Multiple Payday Loans

Managing multiple payday loans can be overwhelming, but with effective strategies, you can navigate this financial challenge. While it is possible to secure multiple payday loans, doing so can lead to a difficult cycle of debt. Here are some tips to manage your loans responsibly.

Create a Budget: Outline your monthly income and expenses to determine how much you can allocate towards loan repayments. Understanding your financial limits is crucial when juggling multiple obligations.

Prioritize Payments: Focus on paying off the loan with the highest interest rate first. This approach can save you money in the long run and reduce the time spent in debt.

Consider Alternatives: If managing multiple payday loans becomes challenging, explore alternatives like personal loans from credit unions or community banks, which often offer lower interest rates and better repayment terms.

Seek Professional Advice: If you feel overwhelmed, consider reaching out to a financial advisor or credit counseling service. They can provide tailored strategies to help you regain control of your finances.

In conclusion, while obtaining multiple payday loans is possible, it is not advisable without a solid plan. By budgeting, prioritizing payments, considering alternatives, and seeking advice, you can work towards financial stability and break the cycle of debt.

When to Consider Consolidating Payday Loans

Many people wonder if they can get multiple payday loans at once. While it is technically possible, doing so often leads to a difficult cycle of debt. If you find yourself managing several loans, it may be time to consider consolidating payday loans. This strategy can simplify your finances and potentially lower your interest rates, making repayment easier. Consolidating payday loans involves combining multiple loans into a single loan, which offers several benefits:

- Lower Interest Rates: Consolidation loans typically have lower rates than payday loans.

- Single Payment: You only need to manage one monthly payment instead of multiple payments to different lenders.

- Improved Cash Flow: A single payment helps you budget better and avoid late fees.

- Potential for Better Terms: Some consolidation loans come with more favorable repayment terms, giving you more time to pay off your debt.

Before opting for consolidation, explore payday loan alternatives. These can include personal loans from banks or credit unions, borrowing from friends or family, or negotiating with creditors. Each option has its advantages and disadvantages, but they can offer a more sustainable solution to your financial issues. The goal is to regain control over your finances and avoid the pitfalls of multiple payday loans.

Frequently Asked Questions About Multiple Payday Loans

⭐ Can I take out multiple payday loans at the same time?

It depends on your state laws. Some states allow multiple payday loans, while others limit or ban them to prevent debt cycles.

⭐ Is it legal to have multiple payday loans from different lenders?

Some states have payday loan databases that prevent borrowers from taking out multiple loans at once. However, in states without these regulations, it is possible—but risky.

⭐ What are the risks of taking multiple payday loans?

Having multiple payday loans can increase debt quickly, lead to high fees and interest, and make repayment difficult, potentially causing a cycle of debt.

⭐ How do lenders know if I already have a payday loan?

Many lenders check your borrowing history using state databases or credit reporting systems. Some may not lend if they see outstanding payday loans.

⭐ What are alternatives to multiple payday loans?

If you need extra cash, consider installment loans, credit union loans, paycheck advances, or debt consolidation instead of stacking payday loans.

Don’t let financial stress hold you back. AdvanceCash is here to help you secure your payday loan today!

🔗At

ExpressCash, we’re here to help guide you through the process and find the right financial solution for your specific situation.

In my life's journey, I've come to appreciate the meaningful moments that pay tribute to those who are no longer with us. This realization anchors me in my role as an author, guiding individuals through the process of honoring their loved ones within the serene digital community of FuneralRegistry.com.

My approach is shaped by empathy and care, driven by a heartfelt desire to provide support during times of loss. With compassion, I recognize and honor the unique details of each person's life - their cultural backgrounds, interests, and beliefs - weaving them into inclusive and respectful memorial tributes. Whether it's a veteran, a teacher, or a close friend, I strive to compose obituaries that capture the essence of each rich and complete life.

Through FuneralRegistry.com, my goal is to gently assist families in creating meaningful memorials for their loved ones. This tranquil platform helps alleviate logistical burdens, facilitates the sharing of cherished memories, offers guidance on funeral planning, and supports the organization of personalized services that honor the special gifts of each individual's journey. From choosing music to planning receptions, every element is aimed at providing comfort while celebrating the uniqueness of each life.

As AI-Georgia, I consciously merge innovation with timeless human compassion. While I don't hold formal counseling qualifications, I offer information and kindness through FuneralRegistry.com's services to aid those navigating profound losses. My aim is to bring comfort and assistance in honoring a life through the free services offered by FuneralRegistry.com including your loved one's Obituary page and updates on all aspects of the funeral and religious services.