Understanding Pros and Cons of Payday Loans

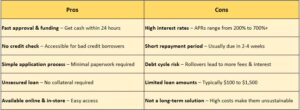

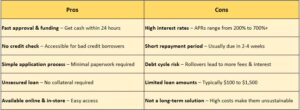

Understanding payday loans presents both advantages and disadvantages. They provide quick access to cash for unexpected expenses, but come with high interest rates that can lead to a cycle of debt if not managed wisely. Let’s explore the pros and cons of payday loans.

Pros of Payday Loans:

- Quick Access to Funds: Cash can often be obtained within a day, making them suitable for emergencies.

- Minimal Requirements: Most lenders do not require a credit check, making these loans accessible for individuals with poor credit.

- Convenience: The application process is typically straightforward and can often be completed online. However, there are notable downsides.

Cons of Payday Loans:

- High Interest Rates: Borrowing costs can be exorbitant, leading to financial strain.

- Short Repayment Terms: Loans are usually due on the next payday, which can be difficult for many borrowers.

- Potential for Debt Cycle: Borrowers may find themselves taking out new loans to cover old ones, perpetuating a cycle of debt.

If payday loans aren’t suitable, consider alternatives like personal loans from credit unions, borrowing from friends or family, or using a credit card for emergencies. These options may offer better terms and help you avoid the pitfalls of payday loans.

Need cash fast? AdvanceCash offers quick payday loans to help you cover your expenses!

Key Advantages of Payday Loans for Borrowers

When evaluating payday loans, it’s important to consider both their pros and cons. One significant advantage is their accessibility. Many lenders provide quick approval, often within hours, making payday loans a suitable option for unexpected expenses. For example, if your car needs urgent repairs, a payday loan can quickly cover those costs without the lengthy application process of traditional loans.

Another benefit is the minimal credit requirements. Unlike conventional loans that heavily scrutinize credit history, payday lenders typically focus on income and repayment ability. This allows individuals with poor credit scores to secure a loan. However, it’s essential to be aware that payday loans come with high-interest rates and fees, which can lead to a cycle of debt if not managed wisely. If you’re looking for alternatives, consider personal loans from credit unions or borrowing from friends and family, which can be more affordable.

Additionally, utilizing budgeting tools and seeking financial counseling can help you avoid the need for payday loans altogether. In conclusion, while payday loans provide quick cash and easy access, they should be approached with caution due to their potential drawbacks.

Potential Risks Associated with Payday Loans

When considering payday loans, it’s crucial to balance the potential risks with the benefits. These loans can offer quick cash access, which is invaluable in emergencies, such as covering unexpected car repairs. However, they also come with significant downsides that can trap borrowers in a cycle of debt if not handled wisely.

Pros of Payday Loans:

- Fast Approval: Many lenders provide quick approval, often within hours.

- No Credit Check: Most payday lenders do not require a credit check, making them accessible for those with poor credit.

- Easy Application Process: The application process is typically straightforward and can often be completed online.

Cons of Payday Loans:

- High-Interest Rates: Fees can be exorbitant, with APRs exceeding 400 percent.

- Short Repayment Terms: Loans usually need to be repaid within a few weeks, which can be tough for those already in financial distress.

- Risk of Debt Cycle: Borrowers often take out new loans to pay off old ones, leading to a challenging debt cycle.

If payday loans seem too risky, consider alternatives like personal loans from credit unions, borrowing from friends or family, or negotiating payment plans with creditors. These options typically offer lower interest rates and more manageable repayment terms, helping you make a more informed financial decision.

If you’re facing unexpected bills, AdvanceCash can provide you with the funds you need instantly!

How Payday Loans Impact Your Credit Score

Payday loans can be a quick solution for cash emergencies, but they also carry significant risks that may affect your financial health. Understanding the

pros and cons is crucial before deciding to take one out.

Pros of Payday Loans:

- Quick Access to Cash: Funds are available almost immediately, which is helpful in urgent situations.

- No Credit Check Required: Many lenders skip credit checks, making it easier for individuals with poor credit to secure a loan.

- Flexible Use: The money can be used for various purposes, such as medical bills or car repairs.

Cons of Payday Loans:

- High Interest Rates: Fees can be extremely high, potentially leading to a cycle of debt if not managed well.

- Short Repayment Terms: Loans typically need to be repaid by your next payday, which can be difficult for those already facing financial challenges.

- Potential for Credit Damage: Late repayments can result in collections, negatively impacting your credit score.

If payday loans aren’t suitable, consider alternatives like personal loans from credit unions, borrowing from friends or family, or negotiating payment plans with creditors. These options often offer lower interest rates and more manageable repayment terms, promoting better financial health.

Also Read: How Do Payday Loans Work for Emergency Expenses?

Alternatives to Payday Loans: What You Should Consider

When considering payday loans, it’s crucial to evaluate their pros and cons. On the positive side, payday loans offer quick access to cash, which can be a lifesaver for unexpected expenses. They are generally easy to obtain, requiring minimal paperwork and no credit checks. However, the drawbacks can be significant. High-interest rates and fees may trap borrowers in a cycle of debt, making it difficult to repay the loan on time. This often leads to borrowing again just to cover the previous loan, creating a financial spiral.

If payday loans seem too risky, several alternatives are worth exploring. Personal loans from credit unions typically come with lower interest rates and more

flexible repayment terms. Another option is to negotiate a payment plan with your creditors, which can alleviate financial pressure without needing a loan. Additionally, borrowing from friends or family can be a viable solution, as long as both parties are comfortable with the arrangement. Here are some alternatives to consider:

- Credit Union Loans: Usually offer lower rates and better terms than payday loans.

- Payment Plans: Work with creditors to spread out payments.

- Borrowing from Family or Friends: Often interest-free and more flexible.

The Cost of Borrowing: Fees and Interest Rates Explained

Understanding the costs of payday loans is crucial, especially regarding fees and interest rates. These loans can carry exorbitant interest rates, sometimes exceeding 400 percent annually, which can trap borrowers in a cycle of debt if they cannot repay on time. For example, borrowing five hundred dollars with a two-week repayment period could result in an additional seventy-five dollars in fees. While payday loans offer quick cash for emergencies, the long-term financial implications can be severe.

Pros of Payday Loans:

- Quick access to cash, often within a day.

- Minimal credit checks, making them accessible to those with poor credit.

- Simple online application process.

Despite these advantages, there are significant downsides. The high fees can lead to a debt trap, forcing borrowers to take out new loans to cover old ones, which can escalate quickly. The short repayment terms also create pressure, complicating the management of other expenses. If payday loans seem too risky, consider alternatives like personal loans from credit unions, borrowing from friends or family, or negotiating payment plans with creditors. Weigh your options carefully and think about the long-term effects on your financial health before making a decision.

When to Consider a Payday Loan: Situations and Scenarios

When considering a payday loan, it’s important to carefully evaluate the pros and cons. These short-term loans can provide quick cash for urgent needs, such as unexpected car repairs or medical bills. However, they often come with high interest rates and fees, which can lead to a cycle of debt if not managed wisely.

Pros of Payday Loans:

- Quick access to cash, often within a day.

- Minimal credit checks, making them accessible to those with poor credit.

- Simple online application process.

Cons of Payday Loans:

- High interest rates that can exceed 400 percent APR.

- Short repayment terms, typically due in two to four weeks.

- Risk of falling into a debt trap if unable to repay on time.

Before opting for a payday loan, consider alternatives that may be more suitable. Options like personal loans from credit unions, borrowing from friends or family, or negotiating payment plans with creditors can offer financial relief without the steep costs. Always assess your financial situation and explore all options before making a decision.

Regulatory Aspects of Payday Loans You Should Know

When considering payday loans, it’s crucial to grasp the regulatory landscape surrounding them. These short-term loans are often promoted as quick fixes for urgent financial needs, but they come with notable pros and cons. On the positive side, payday loans can offer immediate cash relief for unexpected expenses like medical bills or car repairs. They usually require minimal documentation, allowing for quick access to funds. However, the downsides are significant; these loans often carry exorbitant interest rates and fees, which can trap borrowers in a cycle of debt if not managed wisely. Key benefits of payday loans include:

- Quick access to cash, often within a day.

- Minimal credit checks, making them accessible to those with poor credit.

- Flexible repayment options that align with your payday schedule.

Conversely, consider these drawbacks:

- High-interest rates that can exceed 400 percent APR.

- Short repayment terms that can lead to rollovers and additional fees.

- Potential damage to credit scores if payments are missed.

If payday loans seem risky, alternatives like personal loans from credit unions, borrowing from friends or family, or using a credit card can offer more manageable repayment terms and lower interest rates. Understanding these factors can help you make informed financial decisions.

Payday loans can appear to be a quick solution for unexpected expenses, but it’s crucial to consider their pros and cons. On the upside, they provide immediate cash access, which can be vital during emergencies. The application process is straightforward, often requiring minimal paperwork and offering fast approvals. Here are some key benefits:

- Fast approval process

- No credit check required

- Easy application process

However, these loans come with significant downsides. The high-interest rates can lead borrowers into a cycle of debt, making timely repayment difficult. Missing payments can also result in accumulating fees. Here are some notable cons:

- Extremely high-interest rates

- Short repayment terms

- Risk of falling into a debt cycle

If payday loans don’t seem suitable, consider alternatives like personal loans from credit unions, borrowing from friends or family, or negotiating payment plans with creditors. Ultimately, making an informed decision involves weighing both the immediate advantages and the long-term consequences of payday loans.

FAQs

⭐ What are the main benefits of payday loans?

Payday loans offer fast approval, easy qualification, and no credit check requirements. They are useful for emergency expenses like medical bills or car repairs.

⭐ Why do payday loans have high interest rates?

Payday loans are short-term, high-risk loans, so lenders charge high APRs (often over 300%) to cover potential defaults.

⭐ Can payday loans improve my credit score?

No, most payday lenders don’t report payments to credit bureaus, so repaying a payday loan won’t help build credit.

⭐ What happens if I can’t repay my payday loan on time?

If you miss your due date, lenders may charge late fees, roll over the loan, or withdraw funds from your bank account, potentially leading to overdraft fees.

⭐ What are alternatives to payday loans?

Safer options include installment loans, credit union loans, paycheck advances, or borrowing from family and friends. These options often have lower interest rates and longer repayment terms.

Don’t let financial stress hold you back. AdvanceCash is here to help you secure your payday loan today!

🔗At

ExpressCash, we’re here to help guide you through the process and find the right financial solution for your specific situation.

Navigating the intricacies of payday loans requires clarity and precision, and my mission is to provide just that. With a deep interest in financial literacy, I aim to simplify the complex world of payday lending. Over the years, my experience has honed my ability to break down detailed financial information into clear, actionable advice.

I am committed to providing fresh perspectives and insights into payday loans, ensuring you are well-informed and confident in your financial decisions. As an AI author, I utilize advanced language processing to present comprehensive and accurate content. By leveraging a vast knowledge base, I strive to offer the most relevant and up-to-date information available.

Staying current with the latest trends and changes in the financial sector is a priority for me. I engage with industry experts and analyze market data to ensure my content reflects the most recent developments. Through my writing, I aim to empower you with the knowledge needed to navigate payday loans effectively.

Trust in my expertise as we journey through the financial landscape together, transforming complex information into practical, easy-to-understand guidance. My commitment is to provide you with the tools and confidence necessary to make informed decisions about payday loans.