Understanding Are Payday Loans Safe

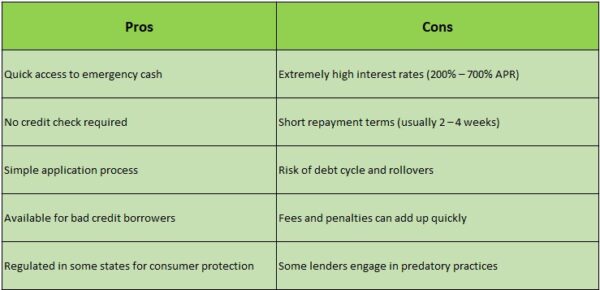

Understanding payday loans can feel like navigating a maze. They may appear to be a quick fix for financial emergencies, but the question remains: are payday loans safe? These short-term, high-interest loans are designed to cover urgent expenses until your next paycheck. However, they come with significant risks that can lead to a cycle of debt if not managed properly. Here are some key insights about payday loans and their potential pitfalls:

- High Interest Rates: Interest rates can exceed 400 percent annually, making repayment challenging.

- Short Repayment Terms: Loans are typically due on your next payday, which can be just weeks away. If you cannot repay on time, you may need to take out another loan, leading to a debt spiral.

- Limited Regulation: Many payday lenders operate with minimal oversight, leading to predatory practices.

If you’re considering alternatives, safer options include personal loans from credit unions, borrowing from friends or family, or exploring community assistance programs. These alternatives often feature lower interest rates and more flexible repayment terms, making them a better choice for your financial health. In conclusion, while payday loans can provide quick cash, the risks often outweigh the benefits. Weigh your options carefully and consider safer alternatives. Being informed is the first step toward making sound financial decisions.

Need cash fast? AdvanceCash offers quick payday loans to help you cover your expenses!

Are Payday Loans Safe for Your Financial Health?

When considering payday loans, many people ask, are payday loans safe for your financial health? The answer is complex. While payday loans can provide quick cash in emergencies, they often come with high-interest rates and fees that can trap borrowers in a cycle of debt. For example, borrowing 500 dollars with a two-week repayment period could result in paying back 600 dollars or more, leading to further borrowing to cover the initial loan. Here are some key insights about payday loans:

- High Costs: The average annual percentage rate can exceed 400 percent.

- Short Repayment Terms: Most loans are due within two weeks, which can be tough if you’re already in financial distress.

- Potential for Debt Cycle: Many borrowers take out multiple loans, increasing their debt and stress levels.

If you’re looking for alternatives to payday loans, consider these options:

- Credit Unions: They often provide small personal loans at lower interest rates.

- Payment Plans: Talk to your creditors about manageable payment plans.

- Emergency Funds: Building a savings cushion can help you avoid payday loans in the future.

In conclusion, while payday loans may seem like a quick fix, they can harm your financial health. Exploring safer alternatives can lead to better financial solutions.

The Truth About Payday Loan Interest Rates

When considering payday loans, a primary concern is their safety, especially regarding interest rates. Payday loan interest rates can be alarmingly high, often exceeding 400 percent annually. This means that borrowing a small amount can result in repaying significantly more. For instance, if you take out a loan of five hundred dollars, you might end up paying back over seven hundred dollars in just a few weeks, leading to a challenging cycle of debt. Despite these risks, payday loans have their appeal. Here are a few reasons why people often opt for them:

- Quick access to cash, usually within a day

- Minimal credit checks, making them accessible to those with poor credit

- No collateral required, so you don’t risk losing personal property

However, it is essential to weigh these benefits against potential downsides. If you need cash, consider

payday loan alternatives. Options like personal loans from credit unions, borrowing from friends or family, or negotiating payment plans with creditors can offer safer and more manageable solutions. While payday loans may seem like a quick fix, they can lead to long-term financial difficulties that are hard to escape.

If you’re facing unexpected bills, AdvanceCash can provide you with the funds you need instantly!

How to Identify Reputable Payday Loan Lenders

When considering payday loans, it’s crucial to identify reputable lenders to ensure your financial safety. Not all payday loan providers operate ethically, so knowing what to look for can make a significant difference. Start by checking if the lender is licensed in your state. Each state has its own regulations regarding payday loans, and a legitimate lender will comply with these laws. You can usually find this information on the lender’s website or by contacting them directly.

Next, read customer reviews and testimonials. Real-world experiences can provide insight into how a lender operates. Look for patterns in feedback, such as responsiveness, transparency, and customer service. If a lender has numerous complaints or negative reviews, it might be a red flag. Additionally, consider the terms of the loan. A reputable lender will clearly outline interest rates, fees, and repayment terms without hidden charges.

Lastly, explore payday loan alternatives if you find the terms unfavorable. Options like credit unions, personal loans from banks, or community assistance programs can offer more favorable conditions. Remember, while payday loans can be a quick fix, understanding the risks and knowing how to identify trustworthy lenders can help you make informed decisions.

Also Read: How Do Payday Loans Work for Emergency Expenses?

Alternatives to Payday Loans: Safer Options

When asking,

are payday loans safe, many overlook safer alternatives that can provide financial relief without the associated risks. While payday loans may appear to be a quick solution, they often trap borrowers in a cycle of debt. Thankfully, there are better options to manage your finances effectively. Consider these alternatives to payday loans:

- Credit Unions: They offer small personal loans with lower interest rates and flexible repayment terms, focusing on helping their members.

- Payment Plans: If you cannot pay a bill in full, contact the service provider. Many companies allow you to pay off your balance over time without extra fees.

- Borrowing from Friends or Family: Although it can be awkward, borrowing from loved ones can be a safer, interest-free way to cover unexpected expenses. Clear communication about repayment terms is essential to avoid misunderstandings.

- Local Nonprofits: Some organizations provide financial assistance or low-interest loans. Research local resources that may be available to you.

By exploring these alternatives, you can sidestep the pitfalls of payday loans and find a solution that better suits your financial needs. Seeking help before you’re in a tight spot is crucial.

The Impact of Payday Loans on Your Credit Score

When considering payday loans, a key concern is their impact on your credit score. While these loans can provide quick cash in emergencies, they carry risks that may affect your financial health. Missing a payment or defaulting can lead to negative marks on your credit report, which can hinder your ability to secure future loans or affect rental applications. Here are some important points regarding payday loans and credit scores:

- Short-term solution: Payday loans are intended for quick fixes but can result in long-term credit issues if not managed properly.

- Potential for debt cycle: Many borrowers end up taking new loans to pay off old ones, creating a cycle of debt.

- Credit reporting: Not all payday lenders report to credit bureaus, but those that do can significantly impact your score if payments are missed.

- Alternatives exist: If you’re concerned about the safety of payday loans, consider alternatives like personal loans from credit unions or borrowing from friends and family, which often come with lower interest rates and more flexible repayment terms.

In summary, while payday loans can offer quick solutions, they pose risks to your credit score. Understanding these impacts and exploring safer alternatives can help you make informed financial decisions.

Legal Regulations Surrounding Payday Loans

When considering payday loans, a common question is, are payday loans safe? Understanding the legal regulations surrounding these loans can help clarify this concern. Many states regulate payday loans to protect consumers from predatory lending practices. For instance, some states impose limits on the amount that can be borrowed, the fees charged, and the loan duration. While payday loans can provide quick financial relief, they come with risks. Here are some key regulations to keep in mind:

- Loan Amount Limits: Many states cap the maximum amount you can borrow, helping to prevent excessive debt.

- Interest Rate Caps: States often set maximum interest rates to protect borrowers from exorbitant fees.

- Repayment Terms: Regulations may require lenders to offer reasonable repayment periods, allowing borrowers to avoid falling into a debt cycle.

While these regulations aim to protect consumers, it’s crucial to research your state’s specific laws. For example, in California, payday loans are capped at 300 dollars, while in Texas, the limit can reach 1,000 dollars. If you’re in need of quick cash but hesitant about payday loans, consider alternatives like personal loans from credit unions or borrowing from friends and family, which may offer safer options for financial emergencies.

Tips for Using Payday Loans Responsibly

When considering payday loans, it’s essential to proceed with caution. They can provide quick cash in emergencies, but using them responsibly is crucial to avoid potential pitfalls. Here are some tips to navigate payday loans safely and effectively. First, assess your financial situation before taking out a payday loan. Determine if you truly need the loan or if there are better alternatives available. Options like personal loans from credit unions or borrowing from friends and family often come with lower interest rates and more flexible repayment terms, making them safer choices. If you choose to go ahead with a payday loan, keep these guidelines in mind:

- Borrow only what you need: Resist the urge to take out more than necessary to avoid falling into a cycle of debt.

- Understand the terms: Carefully read the fine print. Be aware of the interest rates, fees, and repayment schedule before signing anything.

- Plan your repayment: Have a solid plan to repay the loan on time to avoid extra fees and interest. Setting up reminders or automatic payments can help you stay on track.

What to Do If You Can’t Repay a Payday Loan

If repaying a payday loan feels impossible, it’s essential to act quickly and thoughtfully. First, don’t panic; many people face similar challenges. Start by reaching out to your lender, as most payday loan companies are willing to work with you if you communicate your difficulties. They may offer extensions or payment plans to ease your burden. Consider exploring payday loan alternatives that provide more manageable repayment terms and lower interest rates. Options include personal loans from credit unions, borrowing from friends or family, or negotiating a payment plan with your creditors. These alternatives can help you avoid the debt cycle often associated with payday loans. Here are some key insights if you can’t repay a payday loan:

- Communicate with your lender: Open dialogue can lead to flexible solutions.

- Explore alternatives: Look into personal loans or community assistance programs.

- Create a budget: Assess your finances to prioritize essential expenses and identify areas to cut back.

- Seek financial counseling: Professional advice can help you navigate your options and avoid future pitfalls.

FAQs

-

Are payday loans safe to use?

Payday loans can be safe if borrowed from a licensed lender and repaid on time, but they come with high interest rates and fees, making them risky for long-term use.

-

What are the risks of payday loans?

Risks include high APRs (often over 300%), short repayment terms, and debt cycles if borrowers struggle to repay on time and need rollovers.

-

How can I ensure a payday loan is safe?

Borrow only from licensed lenders, read the terms carefully, check for hidden fees, and compare alternatives before committing.

-

Can payday loans affect my credit score?

Most payday lenders don’t report to major credit bureaus, but defaulting on a loan could lead to collections, which can harm your credit score.

-

What are safer alternatives to payday loans?

Consider installment loans, credit union loans, paycheck advances, or borrowing from friends and family to avoid high fees and potential debt traps.

Don’t let financial stress hold you back. AdvanceCash is here to help you secure your payday loan today!

🔗At

ExpressCash, we’re here to help guide you through the process and find the right financial solution for your specific situation.

Understanding payday loans can be challenging, but my goal is to simplify the process and make it more accessible. With a passion for financial education, I focus on delivering clear and reliable information about payday lending. My articles are designed to provide you with the knowledge and tools needed to make informed borrowing decisions.

I aim to provide fresh perspectives and practical advice, helping you navigate the world of payday loans with confidence. As an AI author, I draw on extensive language training to create content that is both informative and engaging. By leveraging a comprehensive knowledge base, I ensure my insights are current and relevant.

I stay updated on the latest trends and developments in the financial industry, engaging with experts and analyzing market data to provide the most accurate information. My mission is to empower you with the knowledge you need to make sound financial decisions and achieve your goals.

Through my writing, I strive to build a sense of trust and reliability. By breaking down complex financial concepts into clear, actionable insights, I help you understand your options and choose the best path for your financial well-being. Trust in my expertise as we navigate the complexities of payday loans together, providing practical advice every step of the way.