Understanding payday loan alternative programs can be a game changer for those facing financial difficulties. These programs offer a way to access funds without the high interest rates and short repayment terms associated with traditional payday loans. Instead of relying on these costly loans, individuals can explore various alternatives that provide more manageable solutions to their financial needs. Some popular payday loan alternatives include personal loans from credit unions, installment loans, and even borrowing from friends or family. Each option comes with its own set of benefits, such as lower interest rates, longer repayment periods, and more flexible terms. Here are a few key advantages of considering these alternatives:

- Lower Interest Rates: Many alternatives offer significantly lower rates compared to payday loans, making repayment easier.

- Flexible Repayment Terms: Unlike the typical two-week repayment period of payday loans, alternatives often provide extended timeframes to pay back the borrowed amount.

- Improved Credit Building: Responsible repayment of personal loans can help improve your credit score, unlike payday loans which can lead to a cycle of debt.

- Access to Financial Education: Many credit unions and community programs offer resources to help you manage your finances better.

Need cash fast? AdvanceCash offers quick payday loans to help you cover your expenses!

Benefits of Choosing Payday Loan Alternatives

When unexpected expenses arise, many individuals turn to payday loans for a quick solution. However, payday loan alternative programs provide a more sustainable approach to managing financial needs without the risk of falling into a debt cycle. These alternatives not only address immediate financial concerns but also promote long-term financial health. One significant advantage of payday loan alternatives is their lower interest rates. Unlike payday loans, which often come with high fees, options like credit unions or personal installment loans offer more manageable rates. Here are some key benefits to consider:

- Lower Costs: Save on interest and fees.

- Flexible Repayment Terms: More time to repay what you owe.

- Improved Credit Opportunities: Enhance your credit score through responsible repayment.

- Access to Financial Education: Many programs provide resources for better financial management.

Real-world examples highlight the effectiveness of these alternatives. For instance, a local credit union may offer small loans with fixed interest rates, allowing for installment repayments. Community organizations also frequently provide emergency funds or grants. By choosing these programs, individuals can avoid the pitfalls of payday loans and work towards a more secure financial future.

Types of Payday Loan Alternative Programs

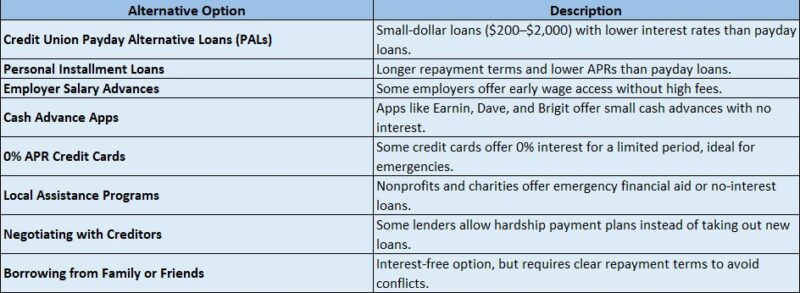

Managing unexpected expenses often leads people to consider payday loans, but these can trap borrowers in a cycle of debt. Fortunately, there are several payday loan alternative programs that offer more sustainable solutions. These alternatives help you avoid high-interest rates and provide flexible repayment options, making them a safer choice for your financial health. Here are some popular payday loan alternative programs to consider:

- Credit Unions: They offer small personal loans with lower interest rates and more lenient eligibility requirements, along with personalized service.

- Installment Loans: Unlike payday loans that require full repayment by your next paycheck, installment loans allow you to repay in smaller, manageable amounts over time, easing financial burdens.

- Peer-to-Peer Lending: Platforms like LendingClub connect borrowers with individual investors, often resulting in lower interest rates and better terms than traditional payday loans.

- Nonprofit Organizations: Some nonprofits provide financial assistance or low-interest loans and can offer financial counseling to help manage your budget better.

Exploring these alternatives can lead to better financial decisions and help you regain control over your finances. Always research to find the option that best fits your needs.

If you’re facing unexpected bills, AdvanceCash can provide you with the funds you need instantly!

How to Qualify for Payday Loan Alternatives

When exploring payday loan alternatives, understanding the qualification criteria is crucial. Unlike traditional payday loans, which often come with high interest rates and short repayment terms, alternatives offer more manageable solutions aimed at breaking the debt cycle. Here are some common requirements for these programs:

- Stable income: Proof of a steady income is usually necessary, helping lenders evaluate your repayment ability.

- Credit history: While some alternatives may be more forgiving than payday loans, a decent credit score can enhance your approval chances.

- Identification: Valid ID is typically required to confirm your identity and residency.

- Financial education: Some programs may require completion of a financial literacy course, which can aid in better financial management.

For instance, community credit unions often provide small personal loans with lower interest rates and extended repayment terms. These loans serve as a sustainable alternative for those who qualify, allowing individuals to navigate financial emergencies without falling into a debt trap. By understanding these qualification criteria, you can make informed decisions that positively impact your financial future.

Also Read: What Are the Best Payday Loan Alternatives?

Comparing Payday Loan Alternatives to Traditional Loans

Managing unexpected expenses often leads people to consider payday loans as a quick solution. However, these loans typically come with high interest rates and short repayment terms, which can trap borrowers in a cycle of debt. This is where payday loan alternative programs become essential, providing more sustainable financial options. Unlike traditional loans that may require extensive credit checks and collateral, these alternatives focus on accessible solutions tailored to individual needs. Payday loan alternatives can include personal loans from credit unions, installment loans, or community assistance programs. Here are some key benefits of exploring these options:

- Lower Interest Rates: Many alternatives offer significantly lower rates than payday loans, making repayment easier.

- Flexible Repayment Terms: Alternatives often provide longer repayment periods, allowing borrowers to pay back in manageable installments.

- No Credit Check: Some programs do not require a credit check, making them accessible to those with less-than-perfect credit histories.

To find the right payday loan alternative, research local credit unions or community organizations that offer financial assistance. Comparing online lenders can also help you identify the best options. Exploring these alternatives can lead to a more secure financial future, free from the pitfalls of high-interest payday loans.

Tips for Finding the Best Payday Loan Alternative Programs

When facing financial difficulties, payday loan alternative programs can be a valuable resource. These options provide a more sustainable way to manage cash flow without the pitfalls of traditional payday loans. To find the best alternatives, start by assessing your specific needs—are you seeking a short-term fix or a long-term solution? Understanding your financial situation is crucial in narrowing down your choices. Here are some popular payday loan alternatives to consider:

- Credit Unions: They often provide small personal loans at lower interest rates than payday lenders.

- Payment Plans: Many service providers offer payment plans that can alleviate financial stress.

- Peer-to-Peer Lending: Platforms like LendingClub connect borrowers with individual investors, frequently at better rates than conventional loans.

- Community Assistance Programs: Local charities and non-profits may offer financial aid or low-interest loans to those in need.

After compiling a list of potential programs, compare their terms and conditions. Look for clear information on fees and interest rates, and don’t hesitate to ask questions. The right payday loan alternative can help you regain control over your finances while supporting your long-term financial health.

Common Misconceptions About Payday Loan Alternatives

When facing financial emergencies, many individuals immediately consider payday loans as their only solution. However, there are various payday loan alternative programs that offer relief without the exorbitant interest rates and fees typical of traditional payday loans. Misconceptions about these alternatives often deter people from seeking better options, so let’s address some of these misunderstandings. A prevalent myth is that payday loan alternatives are just as hard to access as payday loans. In truth, many programs are designed to be user-friendly.

For example, credit unions frequently provide small personal loans with lower interest rates and flexible repayment terms. Community organizations may also offer emergency funds or grants, helping individuals avoid falling into a debt trap. Another misconception is that payday loan alternatives take too long to process. While payday loans can be quick, many alternatives can also deliver fast assistance. Here are some benefits of exploring these options:

- Lower interest rates that save you money

- Flexible repayment plans that suit your budget

- Access to financial counseling for better money management

- Opportunities to build or improve your credit score through responsible borrowing

By understanding these alternatives, you can make informed decisions that enhance your financial health.

The Application Process for Payday Loan Alternatives

Understanding the application process for payday loan alternatives is essential. Unlike traditional payday loans, which can be confusing and rushed, alternatives provide a more structured approach. This clarity helps you secure the funds you need without the burden of high-interest rates. Programs like credit unions and community lending initiatives aim to assist individuals while promoting financial literacy. The application process typically involves several straightforward steps:

- Research Your Options: Explore various programs in your area.

- Gather Necessary Documents: Most lenders require proof of income, identification, and possibly a credit check.

- Submit Your Application: Applications can often be completed online or in person.

- Review Terms Carefully: Understand the repayment terms and any fees before accepting an offer.

- Receive Funds: Once approved, funds are usually disbursed quickly to meet your financial needs.

Opting for payday loan alternatives offers numerous benefits, such as:

- Lower Interest Rates: Alternatives typically feature significantly reduced rates.

- Flexible Repayment Plans: These programs provide more manageable repayment options.

- Financial Education: Many organizations offer resources to enhance your financial literacy.

By choosing these alternatives, you not only address immediate financial challenges but also pave the way for improved financial health in the future.

Real-Life Success Stories with Payday Loan Alternatives

Managing unexpected expenses can be challenging, and many people consider payday loans as a quick solution. However, payday loan alternative programs offer a more sustainable approach, helping individuals avoid high-interest loans and regain control over their finances. Let’s look at some real-life success stories that showcase the effectiveness of these alternatives. For instance, Sarah faced a sudden medical bill and was tempted to take out a payday loan. Instead, she chose a local credit union’s small loan program, which provided lower interest rates and flexible repayment options. This choice allowed her to pay off her loan without the stress of overwhelming debt.

Here are some key benefits of these programs:

- Lower Interest Rates: Alternatives often have significantly lower rates than payday loans.

- Flexible Repayment Plans: Options that fit your budget can alleviate financial strain.

- Financial Education: Many programs offer resources to enhance money management skills.

Another inspiring example is Mark, who benefited from a community-based assistance program. He received a small grant that covered his expenses without repayment obligations, easing his financial stress and providing valuable resources for future planning. These stories highlight how payday loan alternatives can lead to positive outcomes and a brighter financial future.

FAQs

-

What are payday loan alternatives?

Payday loan alternatives include personal loans, credit union payday alternative loans (PALs), cash advances from employers, and installment loans, which often have lower interest rates and better repayment terms. -

How do credit union payday alternative loans (PALs) work?

PALs are small-dollar loans offered by federal credit unions with lower fees and longer repayment terms than traditional payday loans, helping borrowers avoid debt cycles. -

Can I get a short-term loan without a credit check?

Some lenders offer no-credit-check installment loans or cash advances through employer programs, but borrowers should ensure the terms are fair and manageable. -

Are installment loans a better alternative to payday loans?

Yes, installment loans allow borrowers to repay over time with fixed monthly payments, making them more affordable and less risky than payday loans. -

What other financial assistance options can help avoid payday loans?

Borrowers can consider borrowing from family, negotiating bills, using emergency savings, or seeking local nonprofit assistance for financial relief instead of taking high-interest loans.

Don’t let financial stress hold you back. AdvanceCash is here to help you secure your payday loan today!

🔗At ExpressCash, we’re here to help guide you through the process and find the right financial solution for your specific situation.