Unexpected expenses can make emergency loans feel like a necessary solution, especially for those with bad credit. The possibility of finding emergency loan bad credit guaranteed approval exists, but it comes with important considerations. Many lenders cater to individuals with poor credit, recognizing that financial challenges can happen to anyone.

Here are some key insights:

- Higher Interest Rates: Loans for bad credit typically carry higher interest rates due to the increased risk for lenders.

- Shorter Repayment Terms: These loans often require quick repayment, which can be tough if your financial situation doesn’t improve swiftly.

- Potential for Scams: Be wary of lenders promising guaranteed approval without evaluating your financial background. Always conduct thorough research and read reviews before making a commitment.

If you’re looking for alternatives, consider options like credit unions, peer-to-peer lending, or personal loans from family and friends. Each alternative has its advantages and disadvantages, but they may offer a more manageable way to address emergencies without excessive fees.

In summary, while emergency loans for bad credit can provide quick relief, it’s essential to carefully weigh the benefits against potential drawbacks and explore all available options for your financial well-being.

Need cash fast? AdvanceCash offers quick payday loans to help you cover your expenses!

Is Guaranteed Approval for Bad Credit Loans Realistic?

When considering emergency loans for bad credit, many wonder if guaranteed approval is realistic. While some lenders promote this appealing offer, it’s important to approach such claims cautiously. Guaranteed approval often comes with drawbacks, like high-interest rates or hidden fees, which can create more financial strain over time. So, what should you keep in mind before pursuing this option? Here are some key insights:

- Understand the Risks: Loans with guaranteed approval may not be as advantageous as they appear. They often target those in desperate situations, resulting in unfavorable terms.

- Explore Alternatives: Rather than jumping into a high-interest loan, consider payday loan alternatives. Options include personal loans from credit unions, borrowing from friends or family, or negotiating payment plans with creditors.

- Check Your Credit Report: Before applying for any loan, review your credit report. Understanding your credit standing can help you negotiate better terms or find more accommodating lenders.

In summary, while emergency loans for bad credit with guaranteed approval may seem like a quick solution, it’s vital to carefully evaluate your options. By exploring alternatives and recognizing the risks, you can make a more informed decision that avoids further financial difficulties.

The Pros and Cons of Emergency Loans with Bad Credit

When unexpected expenses arise, many wonder if emergency loans with bad credit and guaranteed approval are a good choice. While these loans can provide quick cash, they come with pros and cons that are important to understand. One major advantage is the speed of approval; some lenders offer same-day funding, which can be crucial in a crisis. Additionally, these loans typically require minimal documentation, making them accessible for those with poor credit histories. However, there are significant downsides to consider. Emergency loans for bad credit often carry high-interest rates, which can lead to a cycle of debt if not managed carefully. Key points to keep in mind include:

- High Costs: Interest rates can be much higher than traditional loans.

- Short Repayment Terms: Many require repayment within weeks or months.

- Potential for Debt Cycle: Frequent reliance on these loans can lead to financial trouble.

For alternatives, consider personal loans from credit unions or borrowing from friends and family, which can provide necessary funds without the high costs associated with emergency loans. Ultimately, while these loans can be a quick fix, it’s essential to explore all options and choose wisely.

How to Find Lenders Offering Guaranteed Approval

Finding an emergency loan with bad credit and guaranteed approval can feel like a lifeline during financial distress. However, it is crucial to proceed with caution, as not all lenders offering guaranteed approval are trustworthy. Here are some tips to help you identify reliable lenders.

Research Lenders Thoroughly: Focus on lenders that specialize in bad credit loans. Check their reviews on platforms like the Better Business Bureau or Trustpilot to gauge their reputation.

Compare Loan Terms: After compiling a list of potential lenders, compare their interest rates, fees, and repayment terms to find the most affordable option.

Look for Alternatives: If guaranteed approval loans appear too risky, consider payday loan alternatives such as credit unions, peer-to-peer lending platforms, or personal loans from family and friends. These options often come with better terms and less stress than high-interest loans.

Understand the Risks: Be aware that lenders offering guaranteed approval may impose high fees and interest rates. Ensure you fully comprehend the terms before signing anything.

By conducting thorough research and exploring various options, you can find a solution that meets your needs without falling into a debt trap.

If you’re facing unexpected bills, AdvanceCash can provide you with the funds you need instantly!

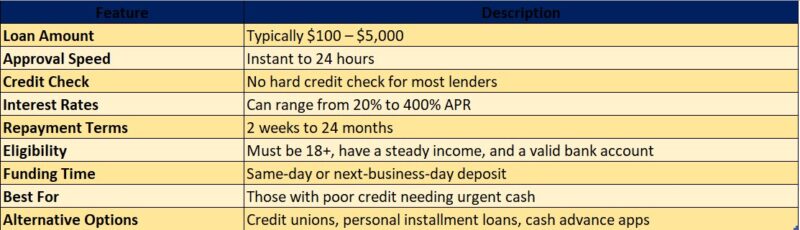

What to Expect from Emergency Loans for Bad Credit

When unexpected expenses arise, emergency loans for bad credit can feel like a lifeline. However, the promise of guaranteed approval should be approached with caution. Not all loans are the same, and understanding what to expect is crucial. Generally, these loans come with higher interest rates and fees, making it essential to read the fine print before signing anything. Here are some key insights to consider when exploring emergency loans for bad credit:

- Quick Access to Funds: Many lenders provide fast approval, allowing you to receive funds within a day or two, which is vital for urgent bills.

- Flexible Loan Amounts: Depending on the lender, you can often borrow various amounts tailored to your needs.

- Potential for Higher Interest Rates: Be ready for higher costs due to your credit history, a common trade-off for quick cash.

- Alternatives to Payday Loans: If high-interest rates concern you, consider options like credit unions or peer-to-peer lending platforms, which may offer better terms.

In conclusion, while emergency loans for bad credit can offer immediate relief, it is essential to evaluate your options carefully. Compare lenders, read reviews, and understand the terms before committing to ensure you find a suitable solution.

Also Read: What Are the Best Payday Loan Alternatives?

Tips for Applying for Emergency Loans with Bad Credit

When unexpected expenses arise, you may consider emergency loans with bad credit and guaranteed approval. While this option seems attractive, the reality is more nuanced. Many lenders promote quick approvals, but it is vital to approach these offers cautiously. Understanding the terms is essential to avoid falling into a debt trap. Here are some helpful tips to navigate the process effectively.

Research Your Options: Take time to explore various lenders before applying. Not all emergency loans are equal, and some may offer better terms. Look for lenders specializing in bad credit loans and read reviews to assess their reliability.

Check Your Credit Report: Knowing your credit score can help set realistic expectations. Even with less-than-perfect credit, some lenders may provide reasonable terms.

Consider Alternatives: If emergency loans feel overwhelming, explore payday loan alternatives. Options include borrowing from friends or family, negotiating payment plans with creditors, or seeking help from local charities or community programs.

By following these steps, you can enhance your chances of securing a loan that meets your needs while protecting your financial future. The goal is to find a solution that addresses your emergency without adding unnecessary stress.

Alternatives to Emergency Loans for Bad Credit

When unexpected expenses arise, many people consider emergency loans for bad credit with guaranteed approval. However, these loans often come with high interest rates and unfavorable terms. Thankfully, there are several alternatives that can help you manage your financial needs without falling into the traps of high-cost loans. Here are some alternatives to consider:

- Credit Unions: Many credit unions provide small personal loans at lower interest rates than traditional lenders. Membership may allow you to qualify even with bad credit.

- Peer-to-Peer Lending: Platforms like LendingClub and Prosper connect borrowers with individual investors, offering a way to secure funds without the strict requirements of banks.

- Payment Plans: If your emergency involves medical bills or utility payments, inquire about payment plans from service providers. This can help ease your financial burden without accumulating debt.

- Community Assistance Programs: Local charities and non-profits often offer financial assistance for those in need. Research organizations in your area that may provide support during difficult times.

By exploring these options, you can find a solution that meets your needs while avoiding the potential pitfalls of emergency loans for bad credit. Always read the fine print and understand the terms before committing to any financial product.

The Impact of Bad Credit on Loan Approval Rates

Securing an emergency loan can be challenging for individuals with bad credit, leading many to question the feasibility of guaranteed approval. While some lenders promote this option, the reality is more complex. Bad credit significantly impacts loan approval rates, as lenders evaluate your credit score, income, and financial history to determine eligibility. Even if you find a willing lender, the terms may not be favorable. Here are key insights on how bad credit affects loan approval rates:

- Higher Interest Rates: Lenders typically charge higher rates to offset the risk of lending to those with bad credit.

- Lower Loan Amounts: You might receive a smaller loan than expected, which can limit your emergency options.

- Shorter Repayment Terms: Some lenders may offer shorter terms, resulting in higher monthly payments.

- Increased Fees: Be cautious of additional fees that can accompany loans for bad credit, as they can increase your financial burden. If you need quick cash but worry about your credit score, consider payday loan alternatives like credit unions, peer-to-peer lending, or borrowing from friends and family. Each option has benefits, such as lower interest rates or flexible repayment terms. While emergency loans with guaranteed approval may seem attractive, it is essential to evaluate all options carefully.

Frequently Asked Questions About Emergency Loans and Bad Credit

-

Can I get an emergency loan with bad credit?

Yes, some lenders offer emergency loans for bad credit borrowers, but approval is not always guaranteed. Income, employment, and ability to repay are key factors. -

What are my options for emergency loans with bad credit?

Options include payday loans, installment loans, credit union loans, and cash advance apps. Some lenders specialize in bad credit personal loans. -

Are there loans with guaranteed approval for bad credit?

No lender can offer 100% guaranteed approval, but some lenders have high approval rates and consider alternative factors like income and banking history. -

How fast can I get an emergency loan?

Some lenders offer same-day or next-day funding, while others may take a few business days depending on verification and banking processes. -

Do emergency loans for bad credit have high interest rates?

Yes, loans for bad credit often come with higher interest rates and fees. It’s important to compare offers and ensure repayment terms are manageable.

Don’t let financial stress hold you back. AdvanceCash is here to help you secure your payday loan today!

🔗At ExpressCash, we’re here to help guide you through the process and find the right financial solution for your specific situation.