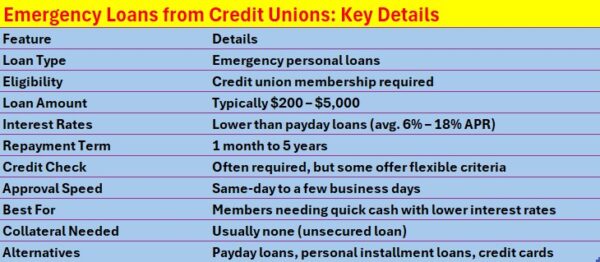

When unexpected expenses arise, many people seek quick financial solutions, and emergency loans from credit unions are a great option. Unlike traditional banks, credit unions are member-owned and typically offer more favorable terms, making them a better alternative to payday loans, which often come with high interest rates and fees. To find these emergency loans, start by checking with your local credit union, as many have specific programs for urgent situations that allow members to borrow small amounts quickly. Here are some benefits of choosing credit unions for emergency loans:

- Lower Interest Rates: Credit unions generally provide lower rates than payday lenders, making repayment easier.

- Flexible Terms: Many credit unions offer repayment options tailored to your financial situation.

- Personalized Service: Being member-focused, credit unions provide personalized assistance to help you navigate your options effectively.

To apply for an emergency loan, follow these steps:

- Become a Member: If you are not already a member, you will need to join the credit union, usually for a small fee.

- Gather Documentation: Prepare necessary documents like proof of income and identification.

- Submit Your Application: Fill out the loan application online or in person and provide required documentation.

- Receive Funds: Once approved, funds can often be disbursed quickly, sometimes within the same day.

Need cash fast? AdvanceCash offers quick payday loans to help you cover your expenses!

When unexpected financial challenges arise, securing a reliable source for emergency loans becomes essential. Credit unions are often a preferred choice due to their member-owned structure, which prioritizes members’ needs over profits. This allows them to provide favorable terms and personalized service, making them ideal for emergency loans. Here are some key benefits of choosing credit unions for your emergency loan needs:

- Lower Interest Rates: Credit unions generally offer lower interest rates than payday loans, helping you save money.

- Flexible Repayment Options: Many credit unions provide repayment plans that can be tailored to fit your financial situation.

- Personalized Service: With a community-oriented approach, credit unions offer personalized assistance to help you understand your options.

- Quick Access to Funds: Credit unions often process loans rapidly, ensuring you have access to funds when needed most.

To apply for an emergency loan from a credit union, follow these steps:

- Research Local Credit Unions: Identify credit unions in your area that offer emergency loans.

- Check Membership Requirements: Confirm that you meet the eligibility criteria for membership.

- Gather Necessary Documentation: Prepare your financial documents to facilitate the application process.

- Apply for the Loan: Submit your application and wait for approval, which is typically quicker than with traditional lenders.

How to Qualify for Emergency Loans from Credit Unions

When you find yourself in need of quick cash, emergency loans from credit unions can be a real lifesaver. These loans typically offer lower interest rates and more flexible terms than traditional payday loans. Qualifying for one is easier than you might think. Credit unions generally consider your membership status, credit history, and income level. If you’re already a member, you’re ahead of the game. If not, joining a credit union is usually a straightforward process that can be completed online or in person. To qualify for an emergency loan, follow these steps:

- Check Membership Requirements: Make sure you meet the criteria to join the credit union, which may include living in a specific area or working for certain employers.

- Gather Financial Documents: Prepare proof of income, identification, and possibly your credit report to help the credit union assess your financial situation.

- Apply for the Loan: Complete the application online or at a branch, clearly stating that you need an emergency loan to expedite the process.

Choosing emergency loans from credit unions over payday loans has significant benefits. Credit unions usually offer lower interest rates, reducing the risk of falling into debt. They also provide personalized service and financial education, empowering you to make informed decisions. While these loans can help in emergencies, it’s crucial to borrow responsibly and ensure timely repayment to maintain your financial health.

If you’re facing unexpected bills, AdvanceCash can provide you with the funds you need instantly!

Top Credit Unions Offering Emergency Loans

When unexpected financial challenges arise, credit unions can be a smart choice for emergency loans. Unlike traditional banks, they often provide more favorable terms and lower interest rates, making them a better alternative to payday loans. Here are some top credit unions known for their emergency loan offerings:

- Navy Federal Credit Union: This member-focused institution offers personal loans with competitive rates and flexible repayment options. Their quick application process can deliver funds in as little as one business day, ideal for urgent needs.

- Alliant Credit Union: Alliant provides personal loans with no origination fees and terms up to five years. Their straightforward online application often leads to quick approvals, perfect for emergencies.

- PenFed Credit Union: Renowned for low rates, PenFed offers personal loans for various purposes, including emergencies. Their efficient application process allows members to access funds swiftly, reducing financial stress.

When considering an emergency loan from a credit union, remember these benefits:

- Lower Interest Rates: Typically lower than payday lenders, saving you money.

- Flexible Terms: Various repayment options to fit your budget.

- Member Support: Personalized service and financial education to help you make informed decisions.

Explore these options to find a reliable source for emergency funds that won’t trap you in debt. Always read the terms carefully to ensure the loan suits your financial situation.

Also Read: What Are the Best Payday Loan Alternatives?

Comparing Interest Rates on Emergency Loans from Credit Unions

Credit unions are a reliable option for securing emergency loans, often offering lower interest rates than traditional banks and payday loan alternatives. This makes them an attractive choice for those needing quick cash. To effectively compare rates, it’s crucial to shop around and understand the terms. Many credit unions provide online calculators to help estimate monthly payments based on various interest rates and loan amounts. Here are some key benefits of choosing emergency loans from credit unions:

- Lower Interest Rates: Being member-owned, credit unions typically offer lower rates than for-profit lenders.

- Flexible Terms: They often provide customizable repayment plans to fit your budget.

- Personalized Service: Smaller institutions like credit unions can offer a more personalized experience, guiding you through your options.

To compare interest rates effectively, follow these steps:

- Research Local Credit Unions: Look for credit unions in your area that offer emergency loans.

- Check Membership Requirements: Ensure you qualify for membership before applying.

- Request Quotes: Reach out to multiple credit unions for quotes to find the best deal.

- Read the Fine Print: Be aware of any fees or penalties that could impact the overall loan cost. By following these steps, you can make an informed decision and secure an emergency loan that suits your needs.

The Application Process for Emergency Loans from Credit Unions

When facing a financial emergency, credit unions can provide a much-needed lifeline through their emergency loans. Compared to traditional banks, credit unions typically offer more favorable terms and lower interest rates. The application process is generally straightforward, allowing you to access funds quickly. First, ensure you meet the eligibility criteria, which usually requires membership in the credit union. If you are not a member, many credit unions allow you to join easily, often for a small fee. Once you are a member, gather the necessary documentation, including proof of income and identification. Many credit unions also offer online applications, saving you time. Here’s a quick overview of the application steps:

- Check your credit score: A higher score can lead to better terms.

- Gather your documents: Prepare your income proof and ID.

- Fill out the application: This can often be done online.

- Wait for approval: Many credit unions respond quickly, sometimes within a day.

- Receive your funds: Approved loans can be deposited directly into your account.

Choosing emergency loans from credit unions over payday loan alternatives offers benefits like lower interest rates and flexible repayment options. Credit unions prioritize your financial well-being and often provide financial counseling services to help you manage your loans effectively. If you find yourself in a tight spot, consider reaching out to your local credit union for assistance.

Tips for Getting Approved for Emergency Loans from Credit Unions

When you find yourself in a financial bind and need quick cash, credit unions can be an excellent source for emergency loans. They often offer more flexible lending criteria and lower interest rates compared to traditional banks. To improve your chances of approval, consider these helpful tips.

Understand Your Credit Score: Check your credit score before applying, as many credit unions take your credit history into account. If your score is lower than desired, work on improving it beforehand.

Gather Necessary Documentation: Be prepared with proof of income, identification, and other financial documents, as these are typically required by credit unions. Having everything ready can expedite the approval process.

Build a Relationship: If you are not yet a member, think about joining the credit union. Establishing a relationship can make them more willing to lend to you. Participate in community events or engage with them online to demonstrate your commitment.

Consider Loan Alternatives: If credit union loans are not an option, explore payday loan alternatives, such as personal loans from online lenders or borrowing from friends and family. Assess the pros and cons of each choice to determine the best fit for your needs.

By following these strategies, you can boost your chances of obtaining an emergency loan from a credit union, helping you navigate financial challenges more effectively.

Common Uses for Emergency Loans from Credit Unions

When unexpected financial challenges arise, emergency loans from credit unions can be a true lifesaver. These loans help cover urgent expenses without the high interest rates associated with payday loans. Credit unions generally offer lower rates and more flexible terms, making them an excellent alternative for quick cash needs. Whether it’s a medical bill, car repair, or home maintenance, these loans provide necessary relief without financial strain. Common uses for emergency loans from credit unions include:

- Medical Expenses: An unexpected trip to the emergency room can lead to hefty bills, and an emergency loan can help manage these costs promptly.

- Car Repairs: If your vehicle breaks down, getting it fixed quickly is crucial. Emergency loans can cover urgent repair costs, getting you back on the road.

- Home Repairs: From leaky roofs to broken furnaces, home repairs can’t wait. An emergency loan can provide the funds needed to keep your home safe and comfortable.

- Unexpected Travel: Sometimes, you may need to travel for family emergencies. An emergency loan can help cover those travel expenses. To apply for an emergency loan from a credit union, follow these steps: Research local credit unions, check membership requirements, gather necessary documents, submit your application, and receive your funds quickly, often within a day or two.

Frequently Asked Questions About Emergency Loans from Credit Unions

-

What are emergency loans from credit unions?

These are short-term personal loans offered by credit unions to help members cover urgent expenses, often with lower interest rates than payday loans. -

How do I qualify for an emergency loan from a credit union?

You typically need to be a credit union member, show proof of income, and meet basic credit or financial requirements. -

Do credit unions check credit scores for emergency loans?

Some do, but they may have more flexible requirements than banks, focusing on income and membership history instead of just credit scores. -

How quickly can I get an emergency loan from a credit union?

Funding can take anywhere from a few hours to a few days, depending on the credit union’s processing time and your membership status. -

Are credit union emergency loans better than payday loans?

Yes, they usually have lower interest rates, better repayment terms, and fewer fees compared to payday loans.

Don’t let financial stress hold you back. AdvanceCash is here to help you secure your payday loan today!

🔗At ExpressCash, we’re here to help guide you through the process and find the right financial solution for your specific situation.