Understanding how online money lending apps work is crucial for anyone considering borrowing money. These apps provide a convenient way to access funds quickly, often serving as viable payday loan alternatives. By simplifying the borrowing process, they cater to those in need of immediate financial assistance.

Need cash fast? AdvanceCash offers quick payday loans to help you cover your expenses!

How Online Money Lending Apps Operate

Online money lending apps typically operate through a straightforward process. Users start by downloading the app and creating an account. After that, they can apply for a loan by providing necessary information such as income, credit score, and loan amount. Once submitted, the app uses algorithms to assess the application and determine eligibility.

Key Features of Online Money Lending Apps

- Speedy Approval: Many apps offer instant approval, allowing users to receive funds within hours.

- User-Friendly Interface: Most apps are designed for easy navigation, making the borrowing process seamless.

- Flexible Repayment Options: Borrowers can often choose repayment terms that suit their financial situation, making it easier to manage payments.

Overall, online money lending apps have revolutionized the borrowing landscape, providing accessible and efficient solutions for those in need.

How Do Online Money Lending Apps Assess Your Creditworthiness?

Understanding how online money lending apps work is crucial for anyone considering borrowing money. These platforms have revolutionized the lending process, making it faster and more accessible. But how do they determine if you’re a good candidate for a loan? Let’s dive into the assessment of your creditworthiness.

Online money lending apps typically evaluate your creditworthiness through several key factors:

Credit Score

- Credit History: They check your credit report to see your borrowing history. A higher score often leads to better loan terms.

- Payment History: Consistent on-time payments can positively influence your score, while missed payments can be detrimental.

Income Verification

- Employment Status: Lenders may require proof of income to ensure you can repay the loan. This can include pay stubs or bank statements.

- Debt-to-Income Ratio: They assess your existing debts compared to your income to gauge your financial health.

Alternative Data

- Social Media Activity: Some apps analyze your online presence as a non-traditional indicator of reliability.

- Banking Behavior: Your transaction history can also provide insights into your spending habits and financial stability.

The Application Process: What to Expect When Using Online Money Lending Apps

Understanding how online money lending apps work is crucial for anyone considering quick financial solutions. These apps offer a convenient way to access funds, often serving as payday loan alternatives. Knowing the application process can help you navigate these platforms with ease and confidence.

Step-by-Step Overview

- Download the App: Start by downloading the online money lending app from your device’s app store.

- Create an Account: Sign up by providing personal information, including your name, address, and income details.

- Submit Your Application: Fill out the application form, specifying the amount you wish to borrow and the purpose of the loan.

- Verification Process: The app will verify your information, which may include checking your credit score and income.

- Receive Approval: If approved, you’ll receive a loan offer detailing the terms, including interest rates and repayment schedules.

- Funds Disbursement: Once you accept the terms, the funds are typically deposited into your bank account within a few hours or the next business day.

Benefits of Using Online Money Lending Apps

- Convenience: Apply anytime, anywhere, without visiting a physical location.

- Speed: Quick approval and funding processes.

- Accessibility: Options for those with less-than-perfect credit, making them viable payday loan alternatives.

If you’re facing unexpected bills, AdvanceCash can provide you with the funds you need instantly!

Comparing Online Money Lending Apps: Which One is Right for You?

Understanding how online money lending apps work is crucial for anyone considering borrowing money. These platforms offer quick access to funds, often with fewer requirements than traditional banks. However, knowing the ins and outs can help you choose the right app for your needs.

How They Operate

Online money lending apps typically operate by connecting borrowers with lenders through a streamlined digital platform. Users fill out an application, which is then assessed using algorithms that evaluate creditworthiness and other factors. This process is usually faster than traditional lending methods, making it an appealing option for those seeking payday loan alternatives.

Key Features to Consider

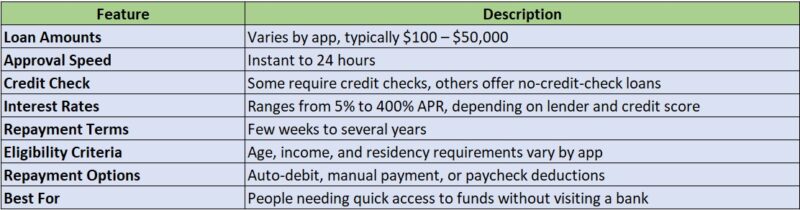

When comparing different online money lending apps, consider the following features:

- Interest Rates: Check the rates offered by various apps, as they can vary significantly.

- Loan Amounts: Determine the range of loan amounts available to ensure they meet your needs.

- Repayment Terms: Look for flexible repayment options that fit your financial situation.

- Customer Support: Reliable customer service can make a big difference in your experience.

Also Read: What Are the Best Payday Loan Alternatives?

The Pros and Cons of Using Online Money Lending Apps

Understanding how online money lending apps work is crucial for anyone considering their use. These platforms offer quick access to funds, often with minimal requirements. However, it’s essential to weigh the pros and cons before diving in, especially when exploring payday loan alternatives.

Pros

- Convenience: Access funds anytime, anywhere, right from your smartphone.

- Speed: Get approved and receive money within hours, unlike traditional loans that can take days.

- Flexible Options: Many apps offer various loan amounts and repayment terms to suit your needs.

Cons

- High Interest Rates: Many online money lending apps charge higher rates compared to traditional lenders, which can lead to debt cycles.

- Potential for Over-Borrowing: The ease of access might tempt users to borrow more than they can afford to repay.

- Lack of Regulation: Some apps may not be fully regulated, leading to predatory lending practices.

In summary, while online money lending apps provide a quick solution for financial needs, they come with significant risks. It’s vital to consider these factors carefully and explore payday loan alternatives that may offer better terms and protections.

How Online Money Lending Apps Ensure Your Data Security

In today’s digital age, understanding how online money lending apps work is crucial for anyone considering financial assistance. These platforms offer quick access to funds, making them popular payday loan alternatives. However, with convenience comes the responsibility of ensuring your data security.

Encryption Technology

Most online money lending apps utilize advanced encryption technology to protect your personal and financial information. This means that your data is scrambled and unreadable to unauthorized users, ensuring that your sensitive information remains confidential.

Secure Transactions

When you apply for a loan through these apps, secure transaction protocols are in place. This includes secure payment gateways that safeguard your bank details during transfers, minimizing the risk of fraud or identity theft.

Privacy Policies

Reputable online money lending apps have clear privacy policies that outline how your data is used and stored. They comply with regulations to ensure that your information is not shared with third parties without your consent, giving you peace of mind as you explore payday loan alternatives.

How AdvanceCash Can Help You Navigate Online Money Lending Options

Understanding how online money lending apps work is crucial for anyone considering borrowing money. These platforms offer quick access to funds, often with fewer requirements than traditional banks. However, knowing the ins and outs can help you make informed decisions and avoid pitfalls.

The Process of Online Money Lending

- Application: Users fill out a simple online form, providing personal and financial information.

- Approval: The app uses algorithms to assess creditworthiness, often providing instant decisions.

- Funding: Once approved, funds are typically deposited directly into the user’s bank account within a short timeframe.

Benefits of Using Online Money Lending Apps

- Convenience: Apply anytime, anywhere, without the need for in-person visits.

- Speed: Quick processing times mean you can access cash when you need it most.

- Payday Loan Alternatives: Many apps offer flexible repayment options, making them a viable alternative to traditional payday loans.

By leveraging AdvanceCash, you can easily compare different online money lending apps, ensuring you choose the best option for your financial needs. Our platform provides insights into fees, interest rates, and user reviews, empowering you to make a confident choice.

FAQs

-

What are online money lending apps?

Online lending apps provide quick access to loans without visiting a bank. They offer personal loans, payday advances, and installment loans through a mobile platform. -

Are online lending apps safe to use?

Reputable apps with strong encryption, clear terms, and positive user reviews are generally safe. Avoid apps that ask for upfront fees or have unclear policies. -

How fast can I receive money from a lending app?

Many lending apps provide same-day or next-day funding, depending on your bank and verification process. Some offer instant transfers for a fee. -

What credit score is needed for online lending apps?

Some apps require good credit, but many offer loans to bad credit borrowers with alternative eligibility checks, such as income verification. -

Do online lending apps report to credit bureaus?

Some apps report loan activity to major credit bureaus, which can help build or harm your credit score based on your repayment behavior.

Don’t let financial stress hold you back. AdvanceCash is here to help you secure your payday loan today!

🔗At ExpressCash, we’re here to help guide you through the process and find the right financial solution for your specific situation.