When it comes to payday loans, understanding Loan Approval & Credit Requirements is crucial. These loans can be a quick solution for urgent cash needs, but knowing what lenders look for can help you navigate the process smoothly. Let’s break it down!

What Lenders Look For

Lenders typically focus on a few key factors when assessing your application. Here are the main points:

- Income Verification: You need a steady source of income.

- Employment Status: Being employed helps your chances.

- Bank Account: A valid checking account is usually required.

Credit Score Considerations

Unlike traditional loans, payday loans often have lenient credit requirements. However, a better credit score can still improve your chances of approval. Remember, even if your credit isn’t perfect, you might still qualify! In summary, understanding Loan Approval & Credit Requirements for payday loans can empower you to make informed decisions. By knowing what lenders seek, you can prepare your application better and increase your chances of getting the funds you need quickly.

Need cash fast? AdvanceCash offers quick payday loans to help you cover your expenses!

What Are the Minimum Credit Requirements for Payday Loans?

Understanding the Loan Approval & Credit Requirements for payday loans is essential for anyone seeking quick cash. Many people are unaware of what lenders look for, but knowing these details can help you navigate the process and boost your chances of approval.

Payday loans are generally easier to obtain than traditional loans, yet they do have some credit requirements:

- No Minimum Credit Score: Payday lenders usually do not require a specific credit score.

- Income Verification: Lenders need to confirm you have a reliable income to repay the loan.

- Identification: A valid ID and proof of residency are typically required.

These aspects make payday loans attractive, especially for those with poor credit histories.

Why Do These Requirements Matter?

Knowing these Loan Approval & Credit Requirements can save you time and reduce frustration. By understanding what to expect, you can prepare your documents effectively and enhance your chances of getting approved. Remember, while payday loans can be useful, they should be approached with caution!

How Does Your Credit Score Impact Loan Approval?

When it comes to payday loans, understanding Loan Approval & Credit Requirements is crucial. Your credit score plays a significant role in whether you get approved for a loan. Lenders use this score to gauge your reliability in repaying borrowed money. So, how does your credit score impact loan approval? Let’s dive in!

The Role of Your Credit Score

Your credit score is like a report card for your financial behavior. A higher score often means better chances of getting approved. Here’s how it breaks down:

- Excellent (750+): You’re likely to get approved with favorable terms.

- Good (700-749): You have a solid chance of approval.

- Fair (650-699): You might face higher interest rates.

- Poor (below 650): Approval could be challenging, but not impossible!

Why It Matters

Understanding these Loan Approval & Credit Requirements can help you prepare. If your score is low, consider improving it before applying. This way, you can secure better loan terms and save money in the long run. Remember, your credit score is a key player in your financial journey!

If you’re facing unexpected bills, AdvanceCash can provide you with the funds you need instantly!

The Role of Income Verification in Payday Loan Approval

When it comes to payday loans, understanding the Loan Approval & Credit Requirements is crucial. Many people find themselves in a tight spot financially and need quick cash. But how does income verification fit into the approval process? Let’s break it down!

Why Income Matters

Lenders want to ensure you can repay the loan. They check your income to see if you have a steady source of money coming in. This helps them decide if you qualify for the loan. Without proof of income, getting approved can be tough!

Key Points to Remember

- Steady Income: Lenders prefer borrowers with a reliable paycheck.

- Documentation: You may need to show pay stubs or bank statements.

- Loan Amount: Your income can affect how much you can borrow.

In short, income verification plays a big role in Loan Approval & Credit Requirements for payday loans. It helps lenders feel secure in their decision, and it can make your borrowing experience smoother!

Also Read: What Are Cash Advances & Alternative Loans Used For?

Common Myths About Loan Approval & Credit Requirements

When it comes to payday loans, many people have misconceptions about Loan Approval & Credit Requirements. Understanding these can help you navigate the borrowing process more smoothly. Let’s clear up some common myths that might be holding you back from getting the help you need.

Myth 1: You Need Perfect Credit

Many believe that only those with perfect credit can get approved for a payday loan. In reality, most lenders focus more on your current income and ability to repay rather than your credit score. This means even if your credit isn’t great, you still have a chance!

Myth 2: All Lenders Have the Same Requirements

Another common myth is that all payday lenders have the same Loan Approval & Credit Requirements. This isn’t true! Different lenders have varying criteria, so it’s wise to shop around. You might find one that fits your situation better than others.

What to Expect During the Payday Loan Application Process?

When you’re in a tight spot financially, understanding the Loan Approval & Credit Requirements for payday loans can make all the difference. Knowing what to expect during the application process helps you prepare and increases your chances of getting the funds you need quickly.

Understanding Loan Approval

First, lenders will look at your income and employment status. They want to ensure you can repay the loan. Unlike traditional loans, payday loans often have less strict credit requirements, which means even if your credit isn’t perfect, you might still qualify!

Key Credit Requirements

- Income Verification: You’ll need to show proof of income, like pay stubs or bank statements.

- Identification: A valid ID is essential to confirm your identity.

- Bank Account: Most lenders require a checking account for direct deposit of funds.

By knowing these Loan Approval & Credit Requirements, you can approach the application process with confidence. Remember, payday loans are designed to be quick and accessible, so don’t hesitate to ask questions if you’re unsure about anything!

How to Improve Your Chances of Loan Approval

When it comes to payday loans, understanding Loan Approval & Credit Requirements is crucial. These loans can be a quick fix for financial emergencies, but knowing how to improve your chances of getting approved can save you time and stress. Let’s dive into some simple strategies that can help you secure that much-needed cash!

Know Your Credit Score

Your credit score plays a big role in Loan Approval & Credit Requirements. A higher score often means better chances of approval. Check your score before applying, and if it’s low, consider taking steps to improve it, like paying off small debts or correcting errors on your report.

Provide Accurate Information

When applying for a payday loan, ensure all your information is accurate. Lenders check your details closely. Missing or incorrect information can lead to delays or denials. Always double-check your application before submitting it to boost your chances of approval.

Exploring Alternatives to Payday Loans: Are They Worth It?

When considering payday loans, understanding the Loan Approval & Credit Requirements is crucial. These loans often promise quick cash, but they come with strings attached. Knowing what lenders look for can help you make informed decisions and avoid pitfalls.

What Lenders Look For

- Credit Score: While payday loans may not require perfect credit, a higher score can improve your chances.

- Income Verification: Lenders want to see proof of steady income to ensure you can repay the loan.

- Employment Status: Being employed full-time can boost your approval odds.

Alternatives to Consider

Instead of rushing into payday loans, explore alternatives like personal loans or credit unions. These options often have better Loan Approval & Credit Requirements and lower interest rates. Plus, they can help build your credit over time, making them a smarter choice for your financial future.

How AdvanceCash.com Can Help You Navigate Loan Approval & Credit Requirements

Understanding Loan Approval & Credit Requirements is crucial when considering payday loans. These requirements can determine whether you get the funds you need quickly. At AdvanceCash.com, we simplify this process, helping you understand what lenders look for and how to improve your chances of approval.

What You Need to Know

When applying for a payday loan, lenders typically check your credit history. However, many payday lenders focus more on your income and ability to repay rather than your credit score. This means even if your credit isn’t perfect, you still have options!

How AdvanceCash.com Can Assist You

- Guidance on Requirements: We provide clear information on what documents you need.

- Tips for Approval: Learn how to present your financial situation positively.

- Understanding Terms: We break down loan terms so you know what to expect. With our help, navigating Loan Approval & Credit Requirements becomes easier, ensuring you make informed decisions.

Tips for Responsible Borrowing: Managing Payday Loans Effectively

When considering a payday loan, understanding the Loan Approval & Credit Requirements is crucial. These loans can be a quick fix for financial emergencies, but they come with responsibilities. Knowing what lenders look for can help you borrow wisely and avoid pitfalls.

Know Your Credit Score

Your credit score plays a significant role in loan approval. While payday lenders often have lenient requirements, a higher score can lead to better terms. Check your score before applying to know where you stand.

Borrow Only What You Need

It’s tempting to borrow more, but sticking to your budget is essential. Only take what you can repay on your next payday. This approach helps you manage your finances and avoid falling into a cycle of debt.

Read the Fine Print

Always review the loan agreement carefully. Understand the fees, interest rates, and repayment terms. Being informed about the Loan Approval & Credit Requirements can save you from unexpected surprises later on.

FAQs

📝 What credit score is needed to get approved for a loan?

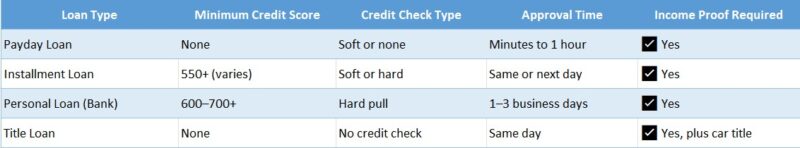

It depends on the loan type. Traditional personal loans usually require a credit score of 600+, while payday and installment loans may approve applicants with poor or no credit at all.

🔍 Do lenders check credit for all loans?

Not always. No-credit-check payday loans and some alternative lenders focus more on your income and repayment ability than your credit score. However, traditional lenders usually perform a hard credit check.

💼 What factors affect loan approval besides credit score?

Lenders also look at:

-

Income and employment status

-

Debt-to-income ratio

-

Bank account history

-

Past defaults or bankruptcies

⚖️ Can I get a loan with bad credit?

Yes, many lenders offer bad credit loans or cash advances, but you may face higher interest rates and fees. Make sure the lender is licensed and transparent with terms.

💳 Will applying for a loan hurt my credit?

A soft inquiry won’t affect your score, but a hard inquiry (common during approval) can lower your score slightly. Applying with multiple lenders in a short time may have a bigger impact.

Don’t let financial stress hold you back. AdvanceCash is here to help you secure your payday loan today!

🔗At ExpressCash, we’re here to help guide you through the process and find the right financial solution for your specific situation.