Salary advance loans provide a quick financial boost when unexpected expenses arise before your next paycheck. They function by allowing you to borrow a portion of your future salary, which you repay on your next payday. The process is straightforward: apply with your employment details, receive the cash if approved, and repay automatically when your paycheck arrives.

To qualify for a salary advance loan, you typically need steady employment with a consistent income, a checking account for transactions, and sometimes meet a minimum income requirement. These loans can be a lifesaver if used wisely, but it’s crucial to understand the terms and ensure timely repayment. Before deciding, compare them with other Cash Advances & Alternative Loans to determine the best option for your financial situation.

Who Can Benefit from Salary Advance Loans?

Salary advance loans are a quick financial fix for unexpected expenses like emergency car repairs or medical bills. These short-term loans allow you to borrow against your next paycheck, offering a fast solution without the hassle of traditional loans. They are perfect for those who need quick cash advances and alternative loans to manage sudden financial hiccups.

To qualify, you generally need to be employed with a steady income and have a bank account for salary deposits. The application process is straightforward, with less paperwork and faster approval times compared to traditional loans.

Benefits of Salary Advance Loans:

- Quick Access to Funds: Receive money swiftly, often within the same day.

- Simple Application Process: Minimal paperwork involved.

- Flexible Repayment Options: Repay when your next paycheck arrives.

In essence, salary advance loans are a valuable tool for anyone facing urgent financial needs, providing a convenient and efficient way to access necessary funds.

Need cash fast? AdvanceCash offers quick payday loans to help you cover your expenses!

How Do Salary Advance Loans Work?

Salary advance loans offer a quick financial boost when unexpected expenses arise before payday. These loans help manage cash flow by providing a portion of your upcoming paycheck in advance, reducing the stress of waiting for your next salary. Understanding how they work and who qualifies is essential for making informed decisions.

Salary advance loans, also known as cash advances or alternative loans, are short-term solutions to financial hiccups. You apply online or in-person, providing proof of employment and income. If approved, the lender advances a portion of your paycheck, which is typically repaid on your next payday through automatic deductions or manual payments.

Who Qualifies for Salary Advance Loans?

To qualify for a salary advance loan, you generally need steady employment, a bank account for deposit and repayment, and meet certain income requirements to ensure repayment capability. These loans are convenient for quick cash needs without the hassle of traditional loans. Always read the terms carefully and consider your repayment ability before borrowing.

Exploring the Eligibility Criteria for Salary Advance Loans

Salary advance loans are a convenient solution for managing unexpected expenses before payday, offering a quick financial boost to ease cash flow concerns. These loans, also known as cash advances or alternative loans, allow you to access a portion of your upcoming paycheck in advance, typically within a day or two. The process is simple: apply, get approved, and receive the funds directly into your bank account.

To qualify for a salary advance loan, you generally need to meet a few basic criteria:

- Steady Income: Lenders prefer applicants with a regular paycheck.

- Employment Verification: Proof of employment is often required.

- Bank Account: A valid bank account is necessary for fund transfers.

Understanding these requirements can help you determine if a salary advance loan is suitable for your financial needs, ensuring you can manage your expenses effectively without stress.

If you’re facing unexpected bills, AdvanceCash can provide you with the funds you need instantly!

The Pros and Cons of Salary Advance Loans

Salary advance loans provide a quick solution when you need cash before your next paycheck. They allow you to borrow from your future earnings, with the loan amount deducted on payday. This can be a lifesaver for unexpected expenses, but planning is crucial to avoid financial strain later.

To qualify, you generally need a steady job and regular income. Some employers offer these loans as a benefit, while others require application through a lender. Always review the terms before proceeding.

Pros include quick access to cash, no credit check, and convenience, especially if offered by your employer. However, there are cons: high fees can make them costly, there’s a risk of falling into a debt cycle, and you can only borrow a limited amount, which might not cover all expenses.

In summary, while salary advance loans and other cash advances & alternative loans can be helpful in emergencies, it’s vital to weigh their pros and cons carefully and consider your financial situation to avoid potential pitfalls.

How to Apply for a Salary Advance Loan: A Step-by-Step Guide

Salary advance loans, also known as Cash Advances & Alternative Loans, provide a quick financial boost when you need cash fast. To apply, first ensure you meet the basic eligibility criteria, such as having a steady income. Some lenders might check your credit score, but many focus on your repayment ability.

Next, gather necessary documents like recent pay stubs and identification to expedite the process. Research various lenders to find favorable terms, comparing interest rates and fees to make an informed choice. Most applications are online, requiring accurate information and document submission. Approval can be instant or take a few days.

Once approved, funds are usually deposited directly into your bank account within hours or days, ready for immediate use. While convenient, it’s important to use salary advance loans responsibly to avoid financial strain.

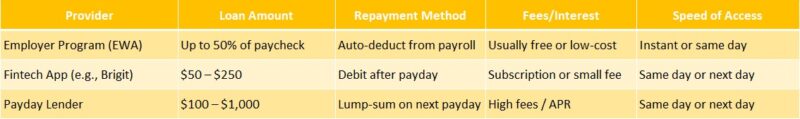

Comparing Salary Advance Loans with Traditional Payday Loans

When you need extra cash before payday, salary advance loans might be a smarter choice than traditional payday loans. These loans allow you to borrow from your future paycheck, providing quick access to funds for unexpected expenses. Unlike payday loans, salary advances often come with lower fees and more flexible terms, making them a popular option for cash advances & alternative loans.

To qualify for a salary advance loan, you typically need to be employed with a steady income. Some employers even offer these loans as a benefit, simplifying the approval process and making it easier to access the funds you need.

Benefits Over Traditional Payday Loans

- Lower Fees: Generally, salary advance loans have lower fees compared to payday loans.

- Flexible Terms: They offer more flexible repayment options.

- Employer Support: Some employers provide these loans, enhancing accessibility.

In summary, salary advance loans present a more affordable and convenient alternative to payday loans, helping you manage your finances effectively when unexpected expenses arise.

What to Consider Before Taking a Salary Advance Loan

Salary advance loans, also known as Cash Advances & Alternative Loans, can be a quick fix for unexpected expenses, offering immediate funds by borrowing against your next paycheck. However, they come with important considerations. These loans are typically short-term and must be repaid by your next payday, often carrying higher interest rates than traditional loans. To qualify, you generally need steady employment and income, though some lenders may overlook a less-than-perfect credit score.

Understanding the eligibility criteria is crucial before applying. Weighing the pros and cons is essential: while they provide quick cash without collateral and have a simple application process, they also involve high interest rates, short repayment periods, and the risk of falling into a debt cycle. Carefully evaluating these factors will help determine if a salary advance loan is suitable for your financial situation.

How AdvanceCash.com Can Help You Secure a Salary Advance Loan

Salary advance loans are a handy solution for unexpected expenses before payday, providing a quick financial boost without the wait for your next paycheck. These short-term loans allow you to borrow against your upcoming salary, offering immediate cash relief. AdvanceCash.com makes this process easy by connecting you with lenders who provide flexible terms and swift approvals.

To qualify for a salary advance loan, you typically need steady employment and a bank account. While credit history might be considered, lenders often prioritize your repayment ability through your salary. AdvanceCash.com assists by matching you with lenders who cater to your specific needs.

The benefits of cash advances and alternative loans include quick access to funds, a simple online application process, and flexible repayment options tailored to your budget. By choosing AdvanceCash.com, you can confidently navigate salary advance loans, ensuring you secure the right financial solution for your situation.

Frequently Asked Questions About Salary Advance Loans

💼 What is a salary advance loan?

A salary advance loan is a short-term loan that lets you borrow a portion of your upcoming paycheck in advance. It’s designed to help with unexpected expenses before payday.

📆 When do I repay a salary advance loan?

Repayment is usually due on your next payday, though some lenders may allow split payments or short-term installments depending on the agreement.

📊 How much can I borrow with a salary advance loan?

The loan amount typically ranges from $100 to $1,000, depending on your monthly income and the lender’s terms.

🧾 Do I need good credit to get a salary advance loan?

Not necessarily. Many salary advance lenders focus more on your employment status and income stability rather than your credit score, making them accessible to people with poor or no credit history.

🔐 Is a salary advance loan safe?

Yes—if you use a trusted lender or a workplace-sponsored program. Look for transparent terms, no hidden fees, and avoid lenders that don’t follow state lending regulations or charge excessive interest.

Don’t let financial stress hold you back. AdvanceCash is here to help you secure your payday loan today!

🔗At ExpressCash, we’re here to help guide you through the process and find the right financial solution for your specific situation.