When seeking quick cash solutions, it’s vital to understand the differences between cash advance VS payday loan. Both can provide immediate relief, but knowing which option suits your needs can save you money and stress. Let’s explore these two financial tools to determine which is better for you.

What is a Cash Advance?

A cash advance allows you to borrow against your credit card limit. It’s a fast and easy option, but it often comes with high fees and interest rates. While it may seem appealing for urgent cash needs, proceed with caution!

What is a Payday Loan?

Conversely, a payday loan is a small, short-term loan due on your next payday. These loans are generally easier to obtain than cash advances but can also carry high fees. It’s important to consider the pros and cons of cash advance vs payday loan before making a choice.

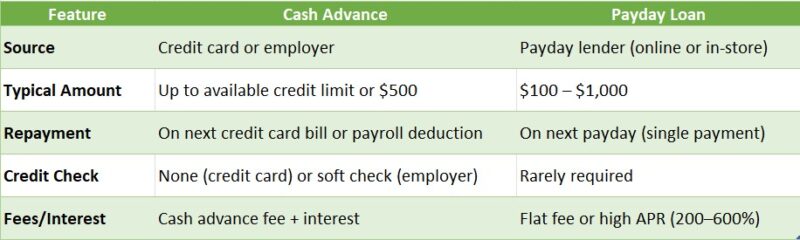

Key Differences

- Repayment Terms: Cash advances are charged to your credit card, while payday loans require cash repayment.

- Interest Rates: Cash advances usually have higher interest rates compared to payday loans.

- Accessibility: Payday loans may be easier to get without a credit check.

In summary, understanding your options between cash advances and alternative loans can lead to better financial decisions.

Need cash fast? AdvanceCash offers quick payday loans to help you cover your expenses!

Payday Loans Explained: Are They Right for You?

When you find yourself in a tight spot financially, you might wonder about your options. Two popular choices are cash advances and payday loans. But which one is better for you? Understanding the differences between cash advance vs payday loan can help you make an informed decision that suits your needs.

What is a Payday Loan?

A payday loan is a short-term loan designed to cover expenses until your next paycheck. Typically, you borrow a small amount and repay it quickly, often within two weeks. However, be cautious! The interest rates can be quite high, making it a costly option if not managed well.

Pros and Cons of Payday Loans

- Pros: Quick access to cash, minimal paperwork, and no credit check required.

- Cons: High-interest rates, potential for debt cycles, and short repayment terms.

Cash Advances & Alternative Loans

On the other hand, cash advances are often linked to credit cards. You can withdraw cash up to a certain limit, but watch out for fees and interest rates! Alternative loans may offer better terms, so explore all your options before deciding.

If you’re facing unexpected bills, AdvanceCash can provide you with the funds you need instantly!

Cash Advance vs Payday Loan: Key Differences Uncovered

When you’re in a financial pinch, you might wonder about the best way to get quick cash. This brings us to the debate of cash advance vs payday loan: Which option is better? Understanding these two choices can help you make an informed decision and avoid unnecessary stress.

What is a Cash Advance?

A cash advance is a short-term loan that allows you to borrow money against your credit card limit. It’s quick and easy, but it often comes with high fees and interest rates. You can access cash from ATMs or directly through your credit card issuer.

What is a Payday Loan?

On the other hand, a payday loan is a small, short-term loan typically due on your next payday. These loans are usually easier to obtain but can trap you in a cycle of debt due to high-interest rates. It’s crucial to weigh the pros and cons of Cash Advances & Alternative Loans before deciding.

Key Takeaways

- Cash advances are linked to credit cards, while payday loans are standalone loans.

- Cash advances may have lower fees if you pay them back quickly, but payday loans can lead to higher costs if not managed properly.

Also Read: What Are Cash Advances & Alternative Loans Used For?

The Pros and Cons of Cash Advances: Is It Worth It?

When it comes to quick cash solutions, many people wonder about cash advance vs payday loan: which option is better? Understanding the differences can help you make an informed choice. Both options provide fast access to money, but they come with their own sets of pros and cons.

The Pros of Cash Advances

- Quick Access: Cash advances can be obtained almost instantly, making them ideal for emergencies.

- Flexible Repayment: You can often repay cash advances over a longer period compared to payday loans.

- No Credit Check: Many cash advances don’t require a credit check, making them accessible to more people.

The Cons of Cash Advances

- High Fees: Cash advances often come with steep fees that can add up quickly.

- Debt Cycle Risk: If not managed properly, you could find yourself in a cycle of debt, needing more cash to pay off previous advances.

- Interest Rates: The interest rates can be higher than traditional loans, making it costly in the long run.

In contrast, payday loans also offer quick cash but typically require repayment by your next paycheck. They can be easier to obtain, but they often come with even higher fees. So, when considering Cash Advances & Alternative Loans, weigh your options carefully. Ultimately, the best choice depends on your financial situation and ability to repay.

Payday Loans: Benefits and Drawbacks to Consider

When it comes to quick cash solutions, understanding the differences between cash advances and payday loans is crucial. Both options can help you bridge the gap until your next paycheck, but they come with their own sets of benefits and drawbacks. So, which option is better for you? Let’s dive into the details!

Benefits of Payday Loans

- Quick Access to Cash: Payday loans are designed for immediate needs, often providing funds within a day.

- No Credit Check: Many lenders don’t require a credit check, making it easier for those with poor credit to qualify.

Drawbacks of Payday Loans

- High Interest Rates: The cost of borrowing can be steep, leading to a cycle of debt if not managed properly.

- Short Repayment Period: Typically, you must repay the loan by your next payday, which can be challenging for some borrowers.

In summary, when comparing cash advance vs payday loan options, it’s essential to weigh the pros and cons. While payday loans offer quick cash without credit checks, their high interest rates and short repayment terms can lead to financial strain. Always consider your situation carefully before deciding on Cash Advances & Alternative Loans.

Which Option Is More Cost-Effective: Cash Advance or Payday Loan?

When you’re in a financial pinch, understanding the differences between cash advance vs payday loan can help you make a smarter choice. Both options offer quick cash, but they come with different costs and terms. Knowing which option is more cost-effective can save you money and stress in the long run.

Understanding Cash Advances

A cash advance allows you to borrow against your credit card limit. While it’s convenient, it often comes with high fees and interest rates. If you can’t pay it back quickly, those costs can add up fast!

Exploring Payday Loans

On the other hand, payday loans are short-term loans that you repay on your next payday. They usually have higher interest rates than cash advances. If you miss a payment, the fees can spiral out of control, making them quite expensive.

Key Takeaways

- Cash Advances: Quick access to funds but high fees and interest.

- Payday Loans: Easy to get but can lead to debt if not managed carefully.

- Consider Alternatives: Look into Cash Advances & Alternative Loans for potentially better rates.

In conclusion, weigh the costs and benefits of cash advance vs payday loan carefully. Choose wisely to avoid falling into a cycle of debt!

How AdvanceCash.com Can Help You Choose the Right Financial Option

When you’re in a tight spot financially, understanding the difference between cash advance vs payday loan can be crucial. Both options offer quick cash, but they come with different terms and conditions. Knowing which one suits your needs can save you money and stress in the long run.

Understanding Your Needs

At AdvanceCash.com, we break down the differences between cash advances and payday loans. A cash advance is often linked to your credit card, allowing you to borrow against your credit limit. In contrast, payday loans are short-term loans that require repayment by your next paycheck. Understanding these differences helps you make informed choices.

Key Considerations

- Interest Rates: Cash advances typically have higher interest rates than payday loans.

- Repayment Terms: Payday loans usually require repayment within a few weeks, while cash advances can be paid back over a longer period.

- Fees: Both options may have fees, but they can vary significantly.

By exploring these factors, AdvanceCash.com guides you in choosing between cash advances & alternative loans, ensuring you find the best fit for your financial situation.

Making an Informed Decision: Cash Advance vs Payday Loan

When faced with unexpected expenses, many people wonder about their options. This brings us to the question: cash advance vs payday loan: Which option is better? Understanding these two financial tools can help you make a more informed decision and avoid unnecessary pitfalls.

What is a Cash Advance?

A cash advance allows you to borrow money against your credit card limit. It’s quick and easy, but it often comes with high fees and interest rates. If you need cash fast, this might seem appealing, but be cautious!

What is a Payday Loan?

On the other hand, a payday loan is a short-term loan meant to cover expenses until your next paycheck. While it can provide immediate relief, the costs can add up quickly. Many borrowers find themselves in a cycle of debt, making it crucial to weigh your options carefully.

Key Considerations

- Interest Rates: Cash advances usually have higher rates than payday loans.

- Repayment Terms: Payday loans often require repayment within a few weeks, while cash advances can be paid back over time.

- Impact on Credit: Cash advances can affect your credit score differently than payday loans.

In conclusion, when considering cash advances & alternative loans, think about your financial situation and choose wisely!

FAQs

🔍 What is the difference between a cash advance and a payday loan?

A cash advance is typically a short-term loan from a credit card or bank, while a payday loan is a small, high-interest loan borrowed against your next paycheck, often from a lender or online service.

💳 Is a cash advance safer than a payday loan?

Yes, in most cases. Cash advances from credit cards or banks are regulated, while payday loans often come with higher fees, shorter repayment periods, and a higher risk of debt traps.

📅 How quickly do I have to repay a payday loan vs a cash advance?

-

Payday loans: Usually due in 2–4 weeks, on your next payday.

-

Cash advances: Repayment terms vary based on credit card billing cycles or lender agreements—often more flexible.

📈 Which one charges more in fees or interest?

Payday loans usually have much higher APRs (up to 400% or more), while cash advances from credit cards charge interest (typically around 20–30% APR) plus a transaction fee (like 3–5%).

✅ Which option is better if I need quick cash?

If you have a credit card or bank line of credit, a cash advance is usually safer. Only consider a payday loan if there are no other options, and you’re sure you can repay it on time.

Don’t let financial stress hold you back. AdvanceCash is here to help you secure your payday loan today!

🔗At ExpressCash, we’re here to help guide you through the process and find the right financial solution for your specific situation.