Understanding cash advances & alternative loans is crucial in today’s fast-paced world. Many people encounter situations requiring quick access to funds, whether for unexpected expenses or planned purchases. Knowing how these financial tools can assist is essential.

Common Uses for Cash Advances & Alternative Loans

Cash advances and alternative loans serve various purposes, including:

- Emergency Expenses: They provide quick relief for unexpected costs like car repairs or medical bills.

- Debt Consolidation: These loans can combine multiple debts into one manageable payment.

- Home Improvements: They can fund renovations, whether upgrading a kitchen or fixing a roof.

- Business Needs: Small business owners often use cash advances to cover operational costs or unexpected expenses.

Benefits of Cash Advances & Alternative Loans

These financial options offer several benefits:

- Quick Access to Funds: They typically provide money faster than traditional loans.

- Flexible Terms: Many lenders offer repayment plans that fit your budget.

- Less Strict Requirements: They may be easier to qualify for, even with a less-than-perfect credit score.

In summary, cash advances and alternative loans can be lifesavers in times of need, but it’s important to use them wisely.

Need cash fast? AdvanceCash offers quick payday loans to help you cover your expenses!

What Are the Common Uses for Cash Advances?

Cash advances and alternative loans can be lifesavers when you find yourself in a financial pinch. Understanding what these options are used for can help you make informed decisions. Whether it’s an unexpected bill or a sudden expense, knowing how to utilize these funds effectively is crucial.

Everyday Expenses

Many people turn to cash advances for everyday expenses. This can include groceries, utility bills, or even car repairs. When money is tight, these funds can help bridge the gap until your next paycheck arrives.

Medical Emergencies

Medical emergencies can happen at any time, and they often come with hefty bills. Cash advances and alternative loans can provide quick access to funds needed for urgent medical care, ensuring you or a loved one gets the help needed without delay.

Home Repairs

Home repairs can be costly and unexpected. Whether it’s a leaky roof or a broken furnace, cash advances can help you cover these urgent repairs without having to wait for savings to accumulate. This way, you keep your home safe and comfortable.

Exploring Alternative Loans: When Are They Necessary?

When unexpected expenses arise, many people wonder about their options. Cash advances and alternative loans can be lifesavers in tough situations. Understanding what these financial tools are used for can help you make informed decisions when you need quick cash.

What Are Cash Advances?

Cash advances are short-term loans that allow you to borrow money against your credit card limit. They are useful for emergencies, like car repairs or medical bills. However, they often come with high fees and interest rates, so it’s important to use them wisely.

Alternative Loans Explained

Alternative loans are non-traditional loans that can help when banks say no. They can be used for various purposes, including:

- Home improvements: Upgrading your living space can increase its value.

- Debt consolidation: Combining multiple debts into one payment can simplify your finances.

- Starting a business: If you have a great idea, alternative loans can provide the necessary funds to get started.

In conclusion, both cash advances and alternative loans serve important roles in personal finance. Knowing when to use them can help you navigate financial challenges more effectively.

If you’re facing unexpected bills, AdvanceCash can provide you with the funds you need instantly!

How Cash Advances Can Help During Financial Emergencies

When unexpected expenses arise, knowing about Cash Advances & Alternative Loans can be a lifesaver. These financial tools provide quick access to funds, helping you navigate through tough times. Understanding their uses can empower you to make informed decisions during financial emergencies.

Quick Access to Funds

Cash advances are designed for urgent situations. Whether it’s a medical bill, car repair, or a sudden job loss, these funds can help you cover immediate costs without lengthy approval processes.

Flexibility in Usage

Unlike traditional loans, cash advances offer flexibility. You can use them for various needs, such as:

- Paying off overdue bills

- Covering unexpected travel expenses

- Managing everyday costs until payday

Alternative Loans for Broader Needs

Alternative loans can also provide financial relief. They often come with different terms and conditions, making them suitable for various situations. You might consider them for:

- Home repairs

- Education expenses

- Starting a small business

In summary, understanding Cash Advances & Alternative Loans can equip you with the knowledge to tackle financial emergencies effectively. They can be your safety net when life throws unexpected challenges your way.

The Benefits of Choosing Alternative Loans Over Traditional Options

When unexpected expenses arise, many people wonder, “What are cash advances and alternative loans used for?” Understanding these financial tools can help you make informed decisions. Cash advances and alternative loans offer quick access to funds, making them appealing when traditional loans seem out of reach.

Quick Access to Funds

Alternative loans, like cash advances, provide fast cash when you need it most. Whether it’s for medical bills, car repairs, or urgent home repairs, these loans can help you cover costs without lengthy approval processes.

Flexible Terms

Unlike traditional loans, alternative loans often come with more flexible terms. This means you can choose repayment plans that fit your budget. Plus, many lenders consider your overall financial situation, not just your credit score, making it easier for more people to qualify.

Less Stress

With cash advances and alternative loans, you can avoid the stress of waiting for traditional loan approvals. This quick access to funds can help you tackle emergencies head-on, allowing you to focus on what really matters—getting back on track.

Are Cash Advances & Alternative Loans Right for You? Key Considerations

When unexpected expenses arise, many people wonder about their options. Cash advances and alternative loans can provide quick financial relief, but understanding what they are used for is crucial. Knowing their purpose helps you make informed decisions about your financial future.

Common Uses for Cash Advances & Alternative Loans

- Emergency Expenses: These loans can cover urgent costs like medical bills or car repairs.

- Debt Consolidation: They can help combine multiple debts into one manageable payment.

- Home Improvements: Many use these funds to upgrade their living spaces, increasing home value.

Benefits to Consider

- Quick Access to Funds: Cash advances often provide money faster than traditional loans.

- Flexible Use: You can use the money for various purposes, making them versatile options.

- Less Strict Requirements: Alternative loans may have fewer eligibility criteria than bank loans.

If you’re considering cash advances and alternative loans, weigh the pros and cons. They can be helpful in a pinch, but it’s essential to understand the terms and potential costs. Always ask yourself if this is the best choice for your situation. Making informed decisions can lead to better financial health.

How to Apply for Cash Advances & Alternative Loans Effectively

Understanding what cash advances and alternative loans are used for is crucial for anyone considering these financial options. They can provide quick access to funds in times of need, making them a popular choice for many. But what exactly are they used for? Let’s dive in!

Common Uses for Cash Advances & Alternative Loans

- Emergency Expenses: Unexpected bills or urgent repairs can arise at any moment. Cash advances and alternative loans can help cover these costs quickly.

- Medical Bills: Health emergencies can be financially draining. These loans can help you manage medical expenses when insurance falls short.

- Debt Consolidation: If you have multiple debts, using a cash advance to consolidate them into one payment can simplify your finances.

Benefits of Cash Advances & Alternative Loans

- Quick Access to Funds: Unlike traditional loans, cash advances and alternative loans often have faster approval times.

- Flexible Use: You can use the money for various purposes, from personal needs to business expenses.

- Less Strict Requirements: These loans may have more lenient eligibility criteria, making them accessible to more people.

Discover How AdvanceCash.com Can Support Your Financial Needs

When unexpected expenses arise, knowing your options can make all the difference. Cash advances and alternative loans are two financial tools that can help you bridge the gap when you need quick cash. Understanding how these options work is essential for making informed decisions about your finances.

What Are Cash Advances?

Cash advances are short-term loans that allow you to borrow money against your credit card limit. They can be useful for emergencies, like car repairs or medical bills. However, they often come with high fees and interest rates, so it’s important to use them wisely.

Alternative Loans Explained

Alternative loans are non-traditional lending options that can provide funds when banks may not. These loans can be used for various purposes, including:

- Home improvements

- Debt consolidation

- Starting a small business

Both cash advances and alternative loans can be valuable resources. They offer quick access to funds, helping you manage your financial needs effectively. However, always consider the terms and ensure you can repay the borrowed amount to avoid falling into a cycle of debt.

FAQs

💵 What is a cash advance?

A cash advance is a short-term loan, typically for a small amount, meant to cover urgent expenses until your next paycheck. They often come with high fees and interest rates.

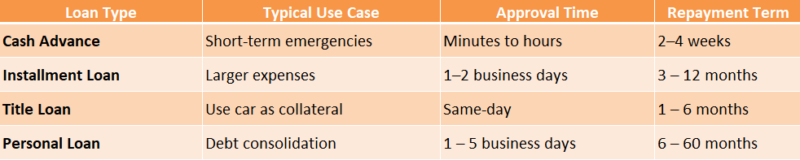

🔁 What are alternative loans?

Alternative loans are financing options that offer similar convenience to cash advances but with more flexible terms, lower rates, or longer repayment periods. Examples include installment loans, credit union loans, and buy-now-pay-later services.

⚠️ Are cash advances risky?

Yes. While fast and easy, they can be expensive and lead to debt cycles if not repaid quickly. Many carry APRs over 300%, especially payday-style loans.

🏦 What are safer alternatives to payday cash advances?

Look into personal loans from credit unions, installment loans, or employer paycheck advances. Some apps (like Earnin or Dave) also offer small cash advances with no interest or low fees.

📋 How do I qualify for an alternative loan?

Requirements vary, but most alternative lenders ask for proof of income, a valid ID, and a bank account. Some check your credit, but many focus on your ability to repay instead.

Don’t let financial stress hold you back. AdvanceCash is here to help you secure your payday loan today!

🔗At ExpressCash, we’re here to help guide you through the process and find the right financial solution for your specific situation.